Tobacco Taxation in India: Cigarettes vs. Bidis & Public Health - Social Issues | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Tobacco Taxation in India: Cigarettes vs. Bidis & Public Health

Medium⏱️ 7 min read

social issues

📖 Introduction

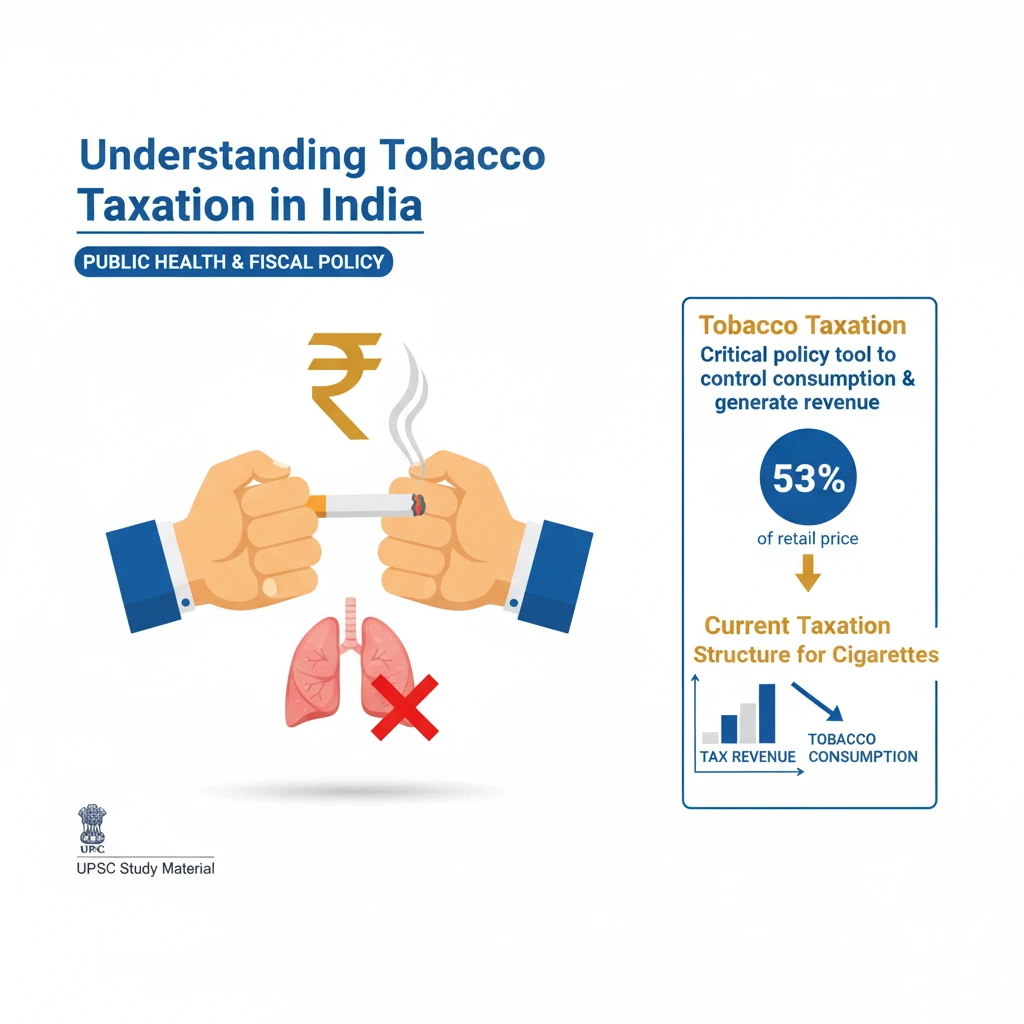

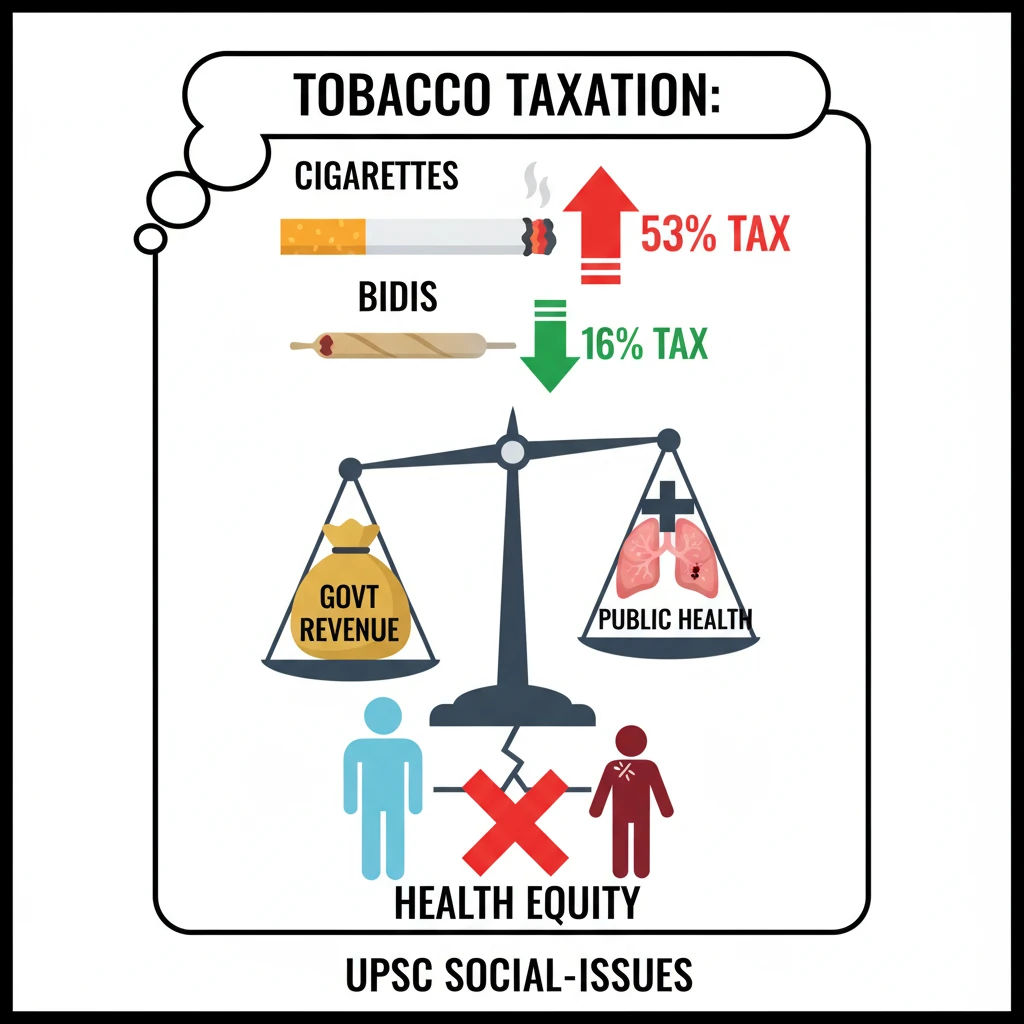

<h4>Understanding Tobacco Taxation in India</h4><p><strong>Tobacco taxation</strong> is a critical policy tool used by governments worldwide to control tobacco consumption and generate revenue. In India, it plays a significant role in public health initiatives and fiscal policy.</p><h4>Current Taxation Structure for Cigarettes</h4><p>India implements a substantial tax on <strong>cigarettes</strong>. Currently, the tax burden on cigarettes amounts to approximately <strong>53% of their retail price</strong>. This high taxation aims to make cigarettes less affordable and deter usage.</p><div class='info-box'><p><strong>Cigarette Tax Burden:</strong> Approximately <strong>53%</strong> of retail price.</p></div><h4>Bidi Taxation: A Significant Disparity</h4><p>In stark contrast to cigarettes, <strong>bidis</strong>, a traditional and cheaper form of tobacco consumption, are taxed at a much lower rate. Their tax burden stands at around <strong>16% of the retail price</strong>.</p><p>This significant difference in taxation makes bidis considerably more affordable, especially for lower-income groups, impacting public health outcomes.</p><div class='info-box'><p><strong>Bidi Tax Burden:</strong> Approximately <strong>16%</strong> of retail price.</p></div><h4>Rationale for Increasing Bidi Taxes</h4><p><strong>Public health experts</strong> consistently advocate for a substantial increase in bidi taxes. The primary objective is to make bidis less accessible and affordable, thereby <strong>discouraging their use</strong>.</p><p>Higher taxes on bidis are expected to lead to a reduction in consumption, contributing positively to public health indicators and reducing the burden of tobacco-related diseases.</p><div class='key-point-box'><p><strong>Dual Objectives of Higher Bidi Taxes:</strong><ul><li><strong>Public Health:</strong> To deter bidi consumption and reduce associated health risks.</li><li><strong>Government Revenue:</strong> To generate additional funds for public services and health programs.</li></ul></p></div><h4>Revenue Generation Potential</h4><p>Beyond public health, increasing bidi taxes presents a significant opportunity for the government to <strong>raise substantial revenue</strong>. This additional income can be channelled into various development projects or health initiatives.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Questions on tobacco taxation often link to <strong>public health (GS-II)</strong>, <strong>fiscal policy (GS-III)</strong>, and <strong>social welfare (GS-II)</strong>. Be prepared to discuss both health and economic dimensions.</p></div>

💡 Key Takeaways

- •India taxes cigarettes heavily (53% of retail price) but bidis significantly lower (16%).

- •Public health experts advocate for higher bidi taxes to reduce consumption and raise government revenue.

- •Tobacco taxation serves dual goals: public health improvement and fiscal revenue generation.

- •The current tax disparity makes bidis more accessible, impacting health equity and exacerbating health disparities.

- •Increasing bidi taxes aligns with global best practices and WHO FCTC recommendations for effective tobacco control.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Ministry of Finance, Government of India (GST Council documents)

•World Health Organization (WHO) Framework Convention on Tobacco Control (FCTC) reports

•Public Health Foundation of India (PHFI) research and policy briefs