National Tobacco Control Program (NTCP) 2007 - Social Issues | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

National Tobacco Control Program (NTCP) 2007

Medium⏱️ 7 min read

social issues

📖 Introduction

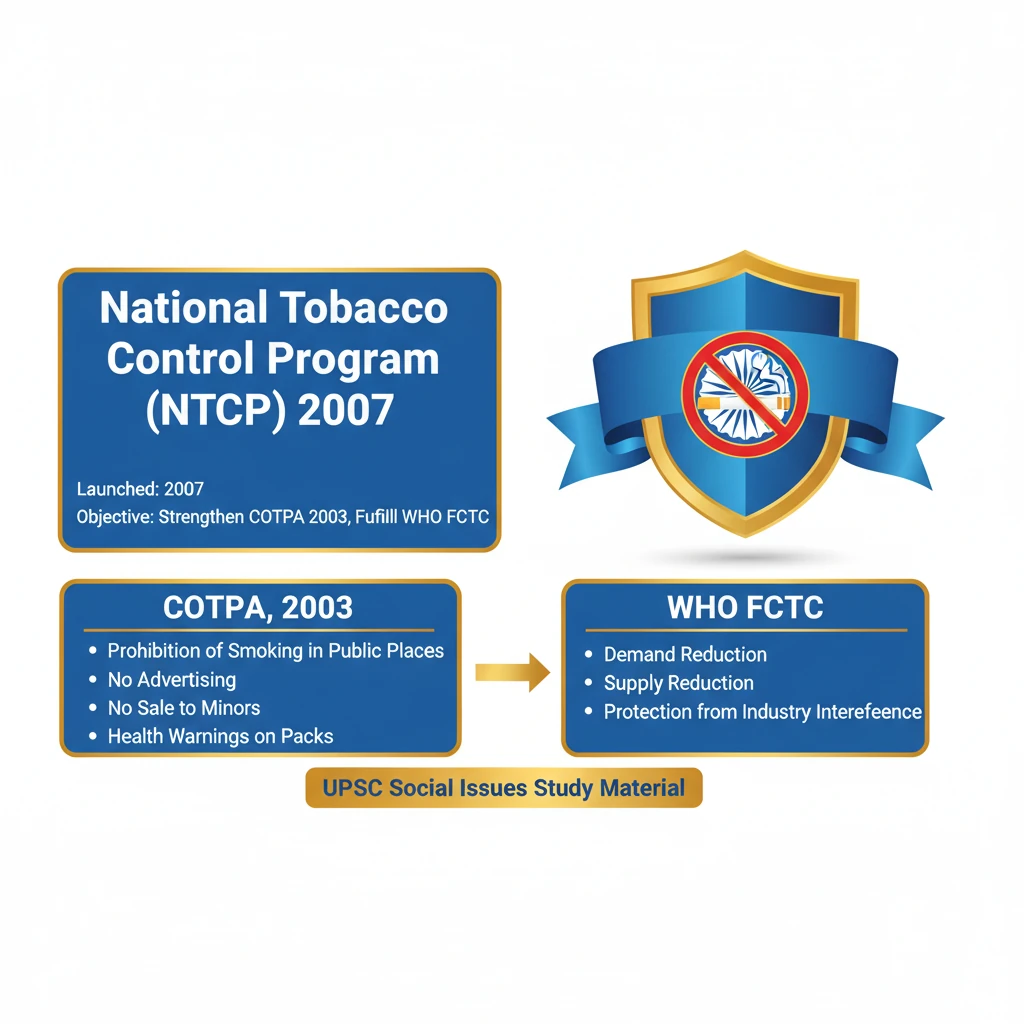

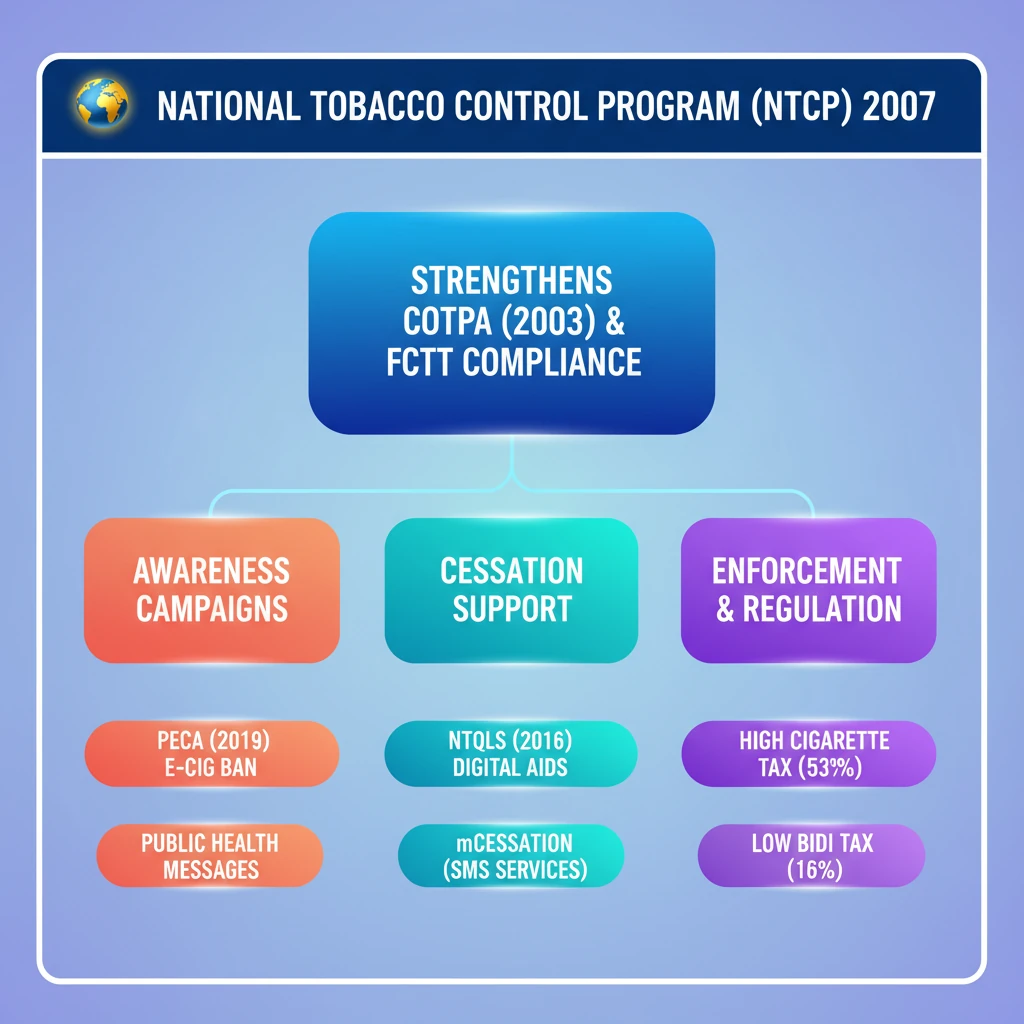

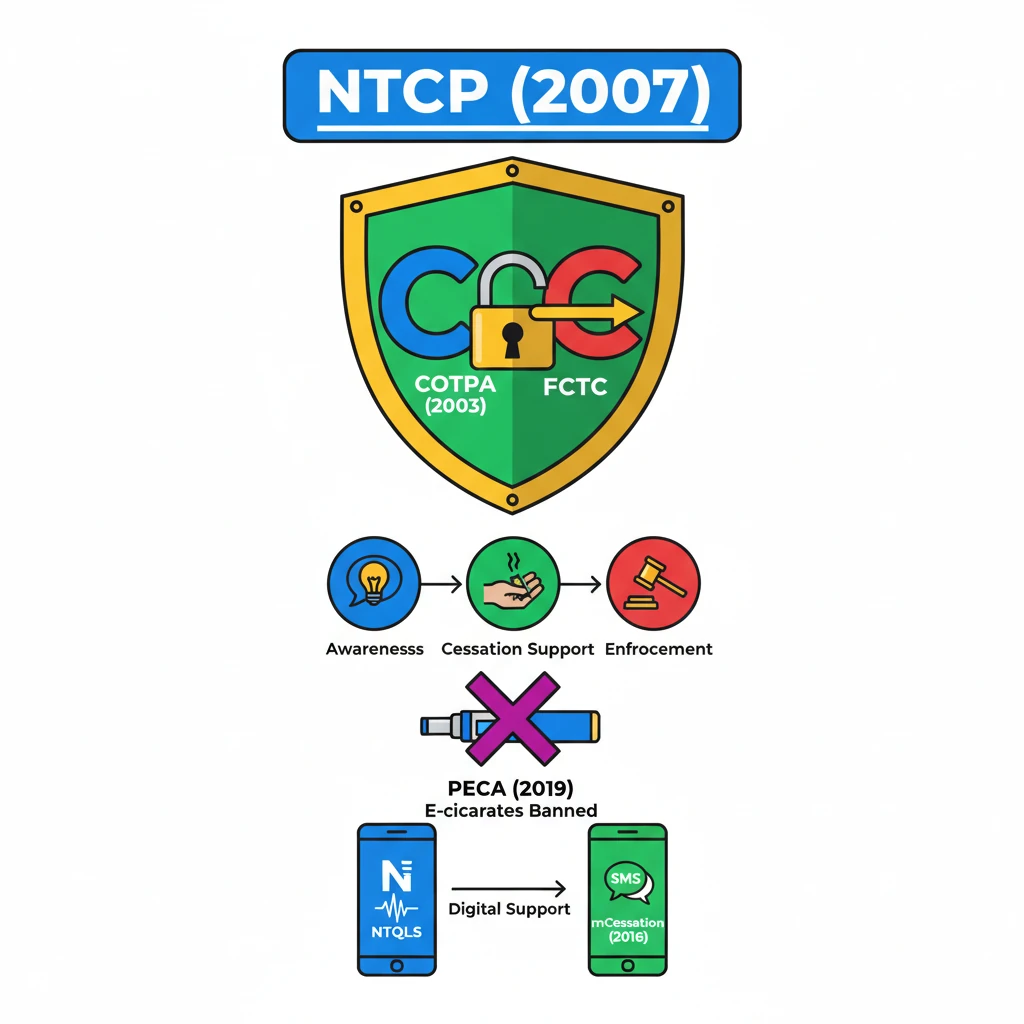

<h4>Introduction to National Tobacco Control Program (NTCP)</h4><p>The <strong>National Tobacco Control Program (NTCP)</strong> was launched in <strong>2007</strong> with a crucial mandate. Its primary objective is to strengthen the implementation of the <strong>Cigarettes and Other Tobacco Products Act (COTPA), 2003</strong>, and ensure India's compliance with the <strong>WHO Framework Convention on Tobacco Control (FCTC)</strong>.</p><div class='info-box'><p><strong>COTPA, 2003</strong> addresses various aspects of tobacco control, including <strong>production and supply</strong>, <strong>advertising and promotion</strong>, <strong>distribution and sale</strong>, as well as <strong>packaging and labeling</strong> of tobacco products.</p></div><h4>Key Functions of NTCP</h4><p>The <strong>NTCP</strong> operates through several key functions designed to curb tobacco consumption and mitigate its health impacts across the nation.</p><ul><li><strong>Public Awareness Campaigns:</strong> These involve extensive <strong>mass media campaigns</strong> aimed at educating the general public about the severe <strong>health risks</strong> associated with tobacco use.</li><li><strong>Smoking Cessation Initiatives:</strong> The program facilitates various initiatives to help individuals quit tobacco. These include dedicated <strong>quitlines</strong>, comprehensive <strong>counselling services</strong>, and effective <strong>behavioural interventions</strong>.</li><li><strong>Enforcement Mechanisms:</strong> A critical function is the rigorous enforcement of <strong>COTPA provisions</strong>. This is carried out with the active involvement and support of <strong>designated authorities</strong> at various levels.</li></ul><h4>Related Initiatives and Legislative Measures</h4><p>India's commitment to tobacco control extends beyond the NTCP, encompassing specific legislative acts and digital initiatives.</p><div class='key-point-box'><p>The <strong>Prohibition of Electronic Cigarette Act (PECA), 2019</strong>, represents a significant step. This act has unequivocally <strong>banned e-cigarettes</strong> across India, addressing emerging forms of nicotine delivery.</p></div><p>Complementing these efforts are specialized services for cessation support.</p><ul><li><strong>National Tobacco Quitline Services (NTQLS):</strong> Provides accessible support for individuals seeking to quit tobacco.</li><li><strong>MCessation Programme:</strong> Launched in <strong>2016</strong> as part of the government’s <strong>Digital India initiative</strong>, this program utilizes <strong>mobile technology</strong> to deliver tobacco cessation support and interventions.</li></ul><h4>Tobacco Taxation Policy</h4><p>Taxation is a powerful tool in public health, and India employs heavy taxes on tobacco products to discourage consumption.</p><div class='info-box'><p>Currently, <strong>cigarettes</strong> are taxed at approximately <strong>53%</strong> of their retail price. In contrast, <strong>bidis</strong>, which are a significantly cheaper tobacco option, face a much lower tax rate of around <strong>16%</strong>.</p></div><p>Public health experts consistently advocate for policy changes in this area. They strongly recommend <strong>higher taxes on bidis</strong> to effectively discourage their use and simultaneously generate increased government revenue for health initiatives.</p><div class='exam-tip-box'><p>Understanding the differential taxation on tobacco products like <strong>cigarettes</strong> and <strong>bidis</strong> is crucial for Mains answers, particularly in <strong>GS-II (Social Justice)</strong> and <strong>GS-III (Economy)</strong>, highlighting public health vs. economic implications.</p></div>

💡 Key Takeaways

- •NTCP (2007) strengthens COTPA (2003) and FCTC compliance.

- •Key functions include awareness, cessation support, and enforcement.

- •PECA (2019) banned e-cigarettes in India.

- •NTQLS and mCessation (2016) offer digital cessation support.

- •Tobacco taxation is high for cigarettes (53%) but low for bidis (16%), prompting calls for higher bidi taxes.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Ministry of Health and Family Welfare (Government of India)

•WHO Framework Convention on Tobacco Control (FCTC)