SC to Examine Use of Money Bills in Legislation - Polity And Governance | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

SC to Examine Use of Money Bills in Legislation

Medium⏱️ 12 min read

polity and governance

📖 Introduction

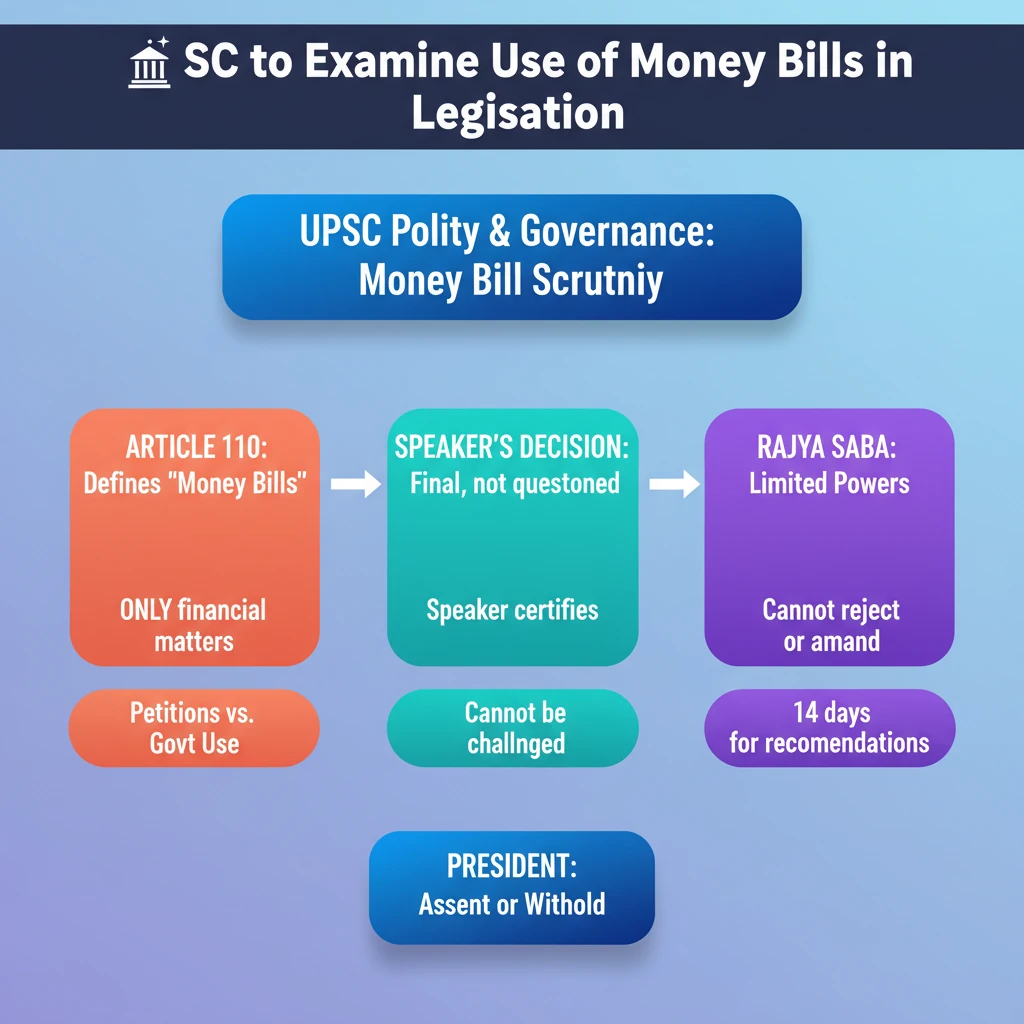

<h4>Context of the Supreme Court's Examination</h4><p>Recently, the <strong>Chief Justice of India (CJI)</strong> has agreed to list petitions challenging the government's use of the <strong>Money Bill</strong> route to pass contentious amendments in the Parliament.</p><p>This issue is crucial as it concerns the <strong>circumvention of the Rajya Sabha</strong> and potential violations of <strong>Article 110</strong> of the <strong>Constitution</strong>.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> The SC's examination highlights the ongoing tension between legislative efficiency and constitutional checks and balances. Understanding the nuances of <strong>Money Bills</strong> is vital for <strong>GS Paper 2 (Polity)</strong>.</p></div><h4>Developments Following the 2019 Ruling</h4><p>A <strong>seven-judge Bench</strong>, which was previously constituted, has yet to address key questions about what precisely constitutes a valid <strong>Money Bill</strong>.</p><p>This unresolved definition impacts subsequent legislation. The court has deliberately avoided resolving the <strong>Money Bill</strong> question in cases related to the <strong>Enforcement Directorate's powers</strong> and <strong>electoral laws</strong>, awaiting the larger Bench's definitive decision.</p><h4>What is a Money Bill?</h4><p><strong>Article 110</strong> of the <strong>Constitution of India</strong> defines a <strong>Money Bill</strong>. A bill is considered a <strong>Money Bill</strong> if it contains <strong>only provisions dealing with specific financial matters</strong>.</p><div class='info-box'><p><strong>Key Financial Matters under Article 110:</strong></p><ul><li><strong>Taxation matters:</strong> Imposition, abolition, remission, alteration, or regulation of any tax.</li><li><strong>Borrowing Regulation:</strong> Regulation of the borrowing of money by the <strong>Union government</strong>.</li><li><strong>Custody of Funds:</strong> Management of the <strong>Consolidated Fund of India</strong> or the <strong>Contingency Fund</strong>.</li><li><strong>Appropriation of Funds:</strong> Appropriation of money out of the <strong>Consolidated Fund</strong>.</li><li><strong>Expenditure Declaration:</strong> Declaration of any expenditure charged on the <strong>Consolidated Fund</strong>.</li><li><strong>Receipt of Money:</strong> Receipt of money related to the <strong>Consolidated Fund</strong> or <strong>public accounts</strong>.</li><li><strong>Other Matters:</strong> Any matters incidental to the above provisions.</li></ul></div><h4>Speaker's Certification</h4><p>The crucial decision on whether a bill is a <strong>Money Bill</strong> rests solely with the <strong>Speaker of the Lok Sabha</strong>.</p><p>The <strong>Speaker's decision is final</strong> and cannot be questioned in any court, by either House of Parliament, nor can it be contested by the <strong>President</strong>.</p><p>Upon certification, the <strong>Speaker</strong> endorses the bill as a <strong>Money Bill</strong> when it is transmitted to the <strong>Rajya Sabha</strong> for recommendations.</p><h4>Legislative Procedure for Money Bills</h4><p><strong>Money Bills</strong> can only be introduced in the <strong>Lok Sabha</strong> and require the prior recommendation of the <strong>President</strong>.</p><p>They are treated as <strong>government bills</strong> and can only be introduced by a <strong>minister</strong>.</p><p>After passing in the <strong>Lok Sabha</strong>, the bill is sent to the <strong>Rajya Sabha</strong>, which has <strong>limited powers</strong>. The <strong>Rajya Sabha</strong> cannot reject or amend a <strong>Money Bill</strong>.</p><p>It can only make recommendations and must return the bill within <strong>14 days</strong>, irrespective of whether it makes recommendations or not.</p><p>The <strong>Lok Sabha</strong> has the discretion to either accept or reject the <strong>Rajya Sabha's recommendations</strong>. If accepted, the bill is deemed passed in the modified form; if rejected, it passes in its original form.</p><h4>Presidential Assent</h4><p>Once a <strong>Money Bill</strong> is presented to the <strong>President</strong>, he can either give <strong>assent</strong> or <strong>withhold it</strong>.</p><p>Crucially, the <strong>President cannot return a Money Bill for reconsideration</strong>.</p><p>Generally, the <strong>President</strong> gives assent to <strong>Money Bills</strong> as they are introduced with his prior permission.</p><h4>Exclusions from Money Bill Classification</h4><div class='key-point-box'><p>A bill cannot be classified as a <strong>Money Bill</strong> simply because it involves:</p><ul><li>Imposition of <strong>fines</strong> or <strong>pecuniary penalties</strong>.</li><li>Demand or payment of <strong>fees for licences or services</strong>.</li><li><strong>Taxation by local authorities</strong> for local purposes.</li></ul></div>

💡 Key Takeaways

- •SC is examining petitions challenging the government's use of Money Bills to pass contentious laws.

- •Article 110 defines Money Bills as those dealing ONLY with specific financial matters.

- •The Speaker of the Lok Sabha's decision on a Money Bill is final and cannot be questioned.

- •Rajya Sabha has limited powers over Money Bills; it cannot reject or amend, only recommend within 14 days.

- •The President cannot return a Money Bill for reconsideration, only assent or withhold.

- •The core concern is the circumvention of Rajya Sabha's scrutiny, impacting legislative checks and balances.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•The Constitution of India (Article 110, Article 109)

•Supreme Court judgments on Aadhaar Act (Justice D.Y. Chandrachud's dissenting opinion)

•Parliamentary debates and analyses on Money Bills