NPS Vatsalya Scheme - Polity And Governance | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

NPS Vatsalya Scheme

Easy⏱️ 5 min read

polity and governance

📖 Introduction

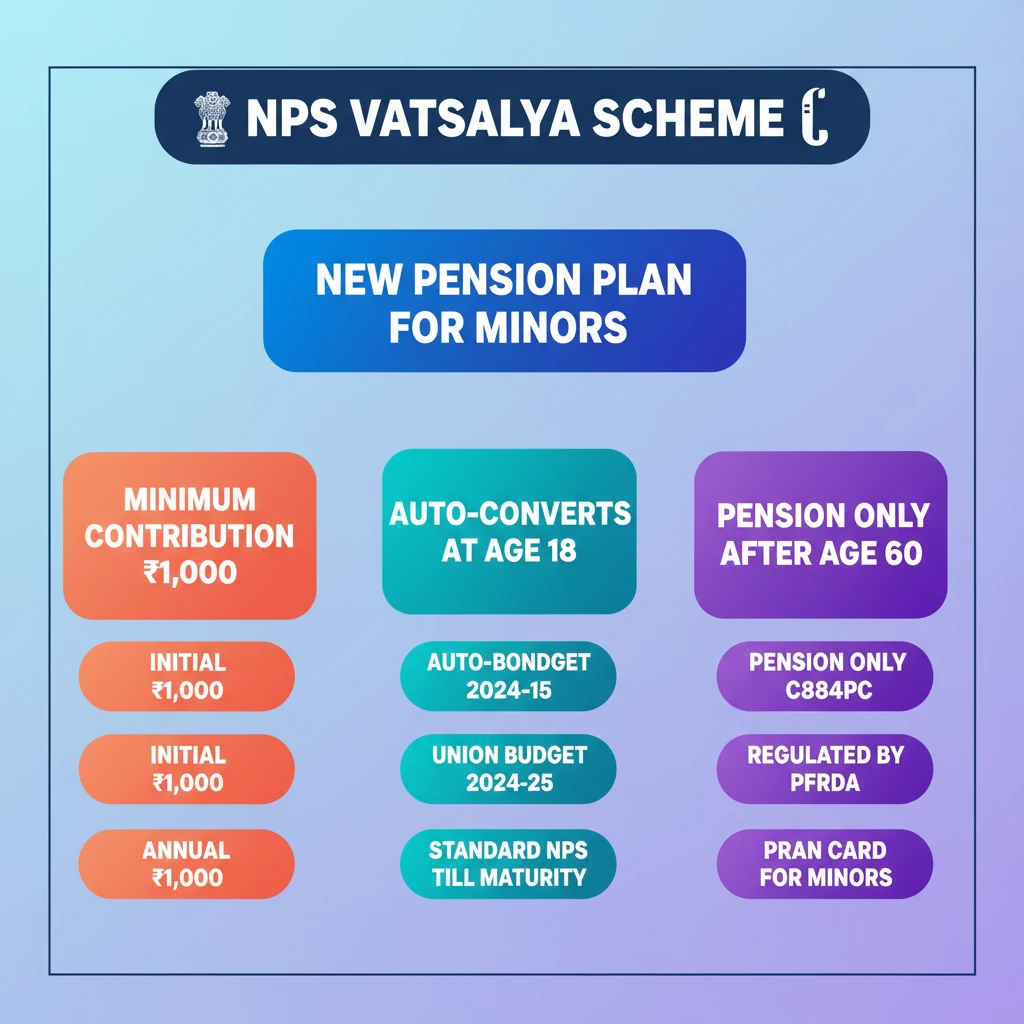

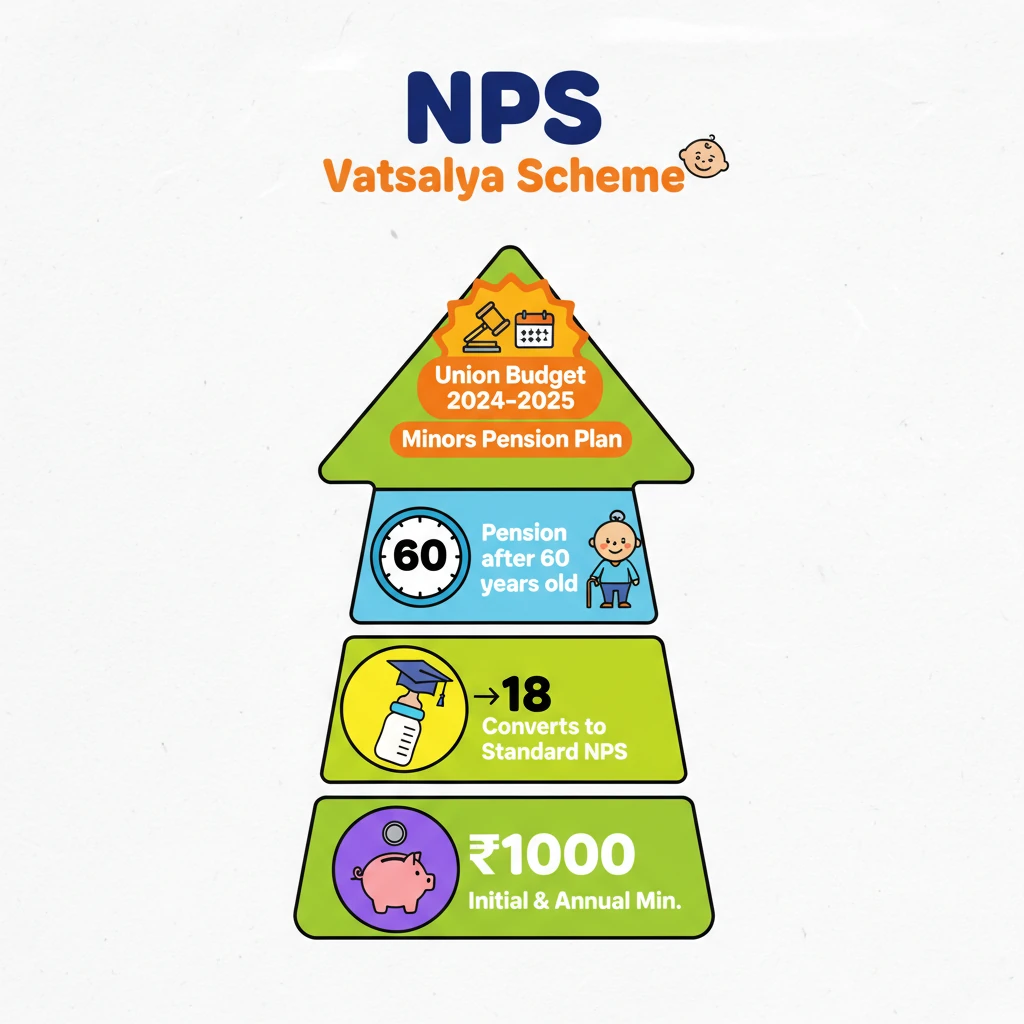

<h4>Introduction to NPS Vatsalya Scheme</h4><p>The <strong>NPS Vatsalya Scheme</strong> was unveiled by the <strong>Union Finance Minister</strong>, representing a new <strong>pension plan</strong> specifically designed for <strong>minors</strong>. This initiative was a significant announcement made during the <strong>Union Budget 2024-2025</strong>, aiming to foster long-term savings for children.</p><div class='key-point-box'><p>The primary objective of <strong>NPS Vatsalya</strong> is to enable parents or guardians to start a pension corpus for their children from a young age, promoting financial security for their future.</p></div><h4>Key Features and Requirements</h4><p>To open a <strong>Vatsalya account</strong>, a <strong>minimum initial contribution</strong> of <strong>Rs 1,000</strong> is required. This accessible entry point encourages broader participation.</p><div class='info-box'><p>Subscribers are mandated to make an <strong>annual contribution</strong> of <strong>Rs 1,000</strong> each year to ensure the account remains active and continues to grow.</p></div><p>Upon the minor reaching <strong>adulthood</strong>, specifically <strong>18 years</strong> of age, the <strong>Vatsalya account</strong> undergoes an automatic conversion. It transforms into a <strong>standard National Pension System (NPS) account</strong>, seamlessly integrating the child into the broader pension framework.</p><p>The accumulated <strong>pension</strong> from this account will only be accessible once the individual turns <strong>60 years</strong> of age, aligning with the standard NPS withdrawal rules.</p><h4>Regulatory Authority and Identification</h4><p>The <strong>NPS Vatsalya Scheme</strong> is rigorously regulated and administered by the <strong>Pension Fund Regulatory and Development Authority (PFRDA)</strong>. This ensures transparency, accountability, and the protection of subscribers' interests.</p><div class='info-box'><p>Newly registered <strong>minor subscribers</strong> under the scheme will be issued <strong>Permanent Retirement Account Number (PRAN) cards</strong>. The <strong>PRAN</strong> is a unique identification number essential for all NPS-related transactions and record-keeping.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Questions on <strong>social security schemes</strong>, <strong>child welfare initiatives</strong>, and <strong>financial inclusion</strong> often feature new government programs. Understanding the mechanics and regulatory body of <strong>NPS Vatsalya</strong> is crucial for both Prelims (factual) and Mains (policy analysis) in <strong>GS Paper 2</strong> and <strong>GS Paper 3</strong>.</p></div>

💡 Key Takeaways

- •NPS Vatsalya is a new pension plan for minors, announced in Union Budget 2024-2025.

- •Requires a minimum initial contribution of Rs 1,000 and annual contribution of Rs 1,000.

- •Account automatically converts to standard NPS at 18 years of age.

- •Pension is accessible only after the subscriber turns 60 years old.

- •Regulated by PFRDA; Permanent Retirement Account Number (PRAN) cards issued to minor subscribers.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Union Budget 2024-2025 official documents (for scheme announcement)

•Pension Fund Regulatory and Development Authority (PFRDA) official website (for regulatory details of NPS)