What is the World Trade Organization (WTO)? - International Relations | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is the World Trade Organization (WTO)?

Medium⏱️ 8 min read

international relations

📖 Introduction

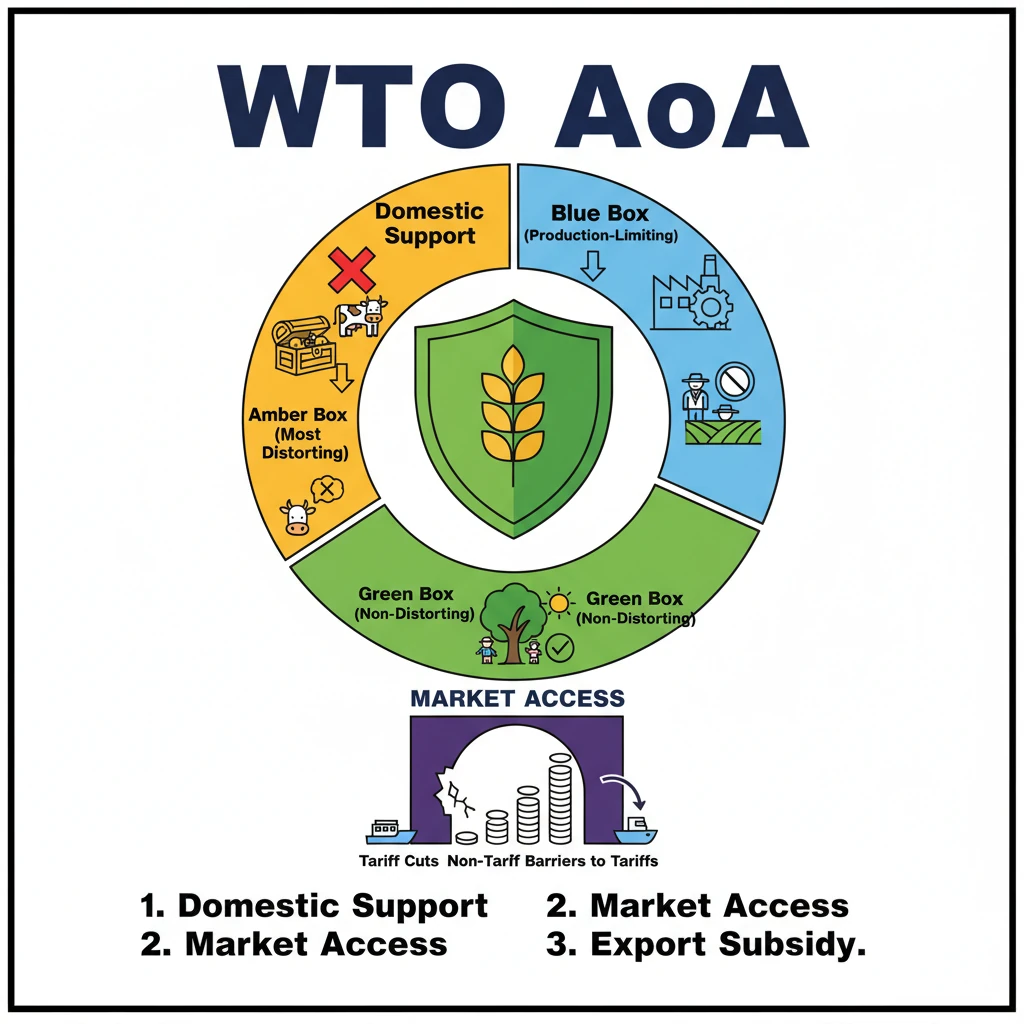

<h4>Understanding the World Trade Organization (WTO) and Agricultural Rules</h4><p>The <strong>World Trade Organization (WTO)</strong> plays a crucial role in shaping global agricultural trade. It establishes a framework of rules applicable to all its member countries, aiming to foster a more open and fair international market for agricultural products.</p><p>A primary objective of these rules is to facilitate substantial and progressive reductions in both agricultural support and protectionist measures implemented by individual nations. This is achieved primarily through the <strong>Agreement on Agriculture (AoA)</strong>.</p><div class='key-point-box'><p>The <strong>Agreement on Agriculture (AoA)</strong> is a key WTO agreement that came into effect in 1995. It aims to reform trade in agriculture and remove trade barriers, promoting market-oriented policies.</p></div><h4>The Three Pillars of the AoA</h4><p>The <strong>Agreement on Agriculture (AoA)</strong> is structured around three main pillars, each addressing a specific aspect of agricultural trade distortion:</p><ol><li><strong>Domestic Support</strong></li><li><strong>Market Access</strong></li><li><strong>Export Subsidy</strong></li></ol><h4>Pillar 1: Domestic Support</h4><p>The <strong>Domestic Support</strong> pillar calls for a significant reduction in domestic subsidies that can distort free trade and lead to unfair pricing in global markets. These subsidies often give an undue advantage to a country's farmers, making their products artificially cheaper.</p><div class='info-box'><p>Under this provision, the <strong>Aggregate Measurement of Support (AMS)</strong>, which quantifies the total value of trade-distorting domestic support, was targeted for reduction:</p><ul><li><strong>Developed countries</strong> were required to reduce their AMS by <strong>20%</strong> over a period of <strong>6 years</strong>.</li><li><strong>Developing countries</strong> were required to reduce their AMS by <strong>13%</strong> over a period of <strong>10 years</strong>.</li></ul></div><p>To categorize and manage these subsidies, the WTO uses a system of 'boxes', each with different implications for trade distortion and reduction commitments.</p><h5>Categories of Domestic Subsidies (Boxes)</h5><ul><li><strong>Amber Box Subsidies:</strong> These are considered the most trade-distorting. They include measures like price support and input subsidies directly linked to production levels. They are subject to reduction commitments.</li><li><strong>Blue Box Subsidies:</strong> These are subsidies that are linked to production-limiting programs. They are considered less trade-distorting than Amber Box subsidies and are therefore allowed, provided certain conditions are met.</li><li><strong>Green Box Subsidies:</strong> These are subsidies that are deemed to have minimal or no trade-distorting effects. They include measures like environmental programs, research and development, and domestic food aid. These are fully permitted and not subject to reduction commitments.</li></ul><h4>Pillar 2: Market Access</h4><p>The <strong>Market Access</strong> pillar focuses on the conditions, both tariff and non-tariff measures, agreed upon by WTO members for the entry of specific goods into their markets. The goal is to open up markets and reduce barriers to trade.</p><p>This pillar requires that <strong>tariffs</strong> (like <strong>custom duties</strong>) fixed by individual countries be cut progressively to allow for freer trade. High tariffs make imported goods more expensive, protecting domestic industries but limiting consumer choice and competition.</p><p>Furthermore, it mandates countries to remove <strong>non-tariff barriers</strong>, such as import quotas, strict licensing requirements, or complex customs procedures, and convert them into measurable <strong>tariff duties</strong> (a process known as 'tariffication'). This increases transparency and makes trade restrictions easier to negotiate and reduce.</p><h4>Pillar 3: Export Subsidy</h4><p>The <strong>Export Subsidy</strong> pillar addresses financial incentives provided by governments that make agricultural exports cheaper. These can include subsidies on agricultural inputs, direct payments for exports, or incentives like import duty remission for export-oriented production.</p><div class='info-box'><p><strong>Export subsidies</strong> can lead to the <strong>dumping</strong> of highly subsidized (and therefore cheaper) products in other countries. This practice can severely damage the domestic agriculture sector of importing nations, making it difficult for local farmers to compete.</p></div><h4>Related Concepts: Fair and Remunerative Price (FRP) and State-Advised Prices (SAPs)</h4><p>While not directly part of the AoA pillars, these concepts are relevant to domestic agricultural support mechanisms in countries like India.</p><div class='info-box'><p><strong>Fair and Remunerative Price (FRP):</strong> This is a minimum price determined by the government that sugar mills are legally obligated to pay to farmers for their sugarcane. Its purpose is to ensure farmers receive a fair and reasonable payment for their crops, safeguarding their income.</p><p><strong>State-Advised Prices (SAPs):</strong> In some Indian states, farmers receive additional payments over and above the FRP. These extra payments are often provided by sugar mills, sometimes with state government guidance, to incentivize improved production efficiency or as specific state-level support.</p></div><div class='exam-tip-box'><p>For <strong>UPSC Mains (GS-II & GS-III)</strong>, understanding the <strong>WTO's AoA</strong> and its pillars is critical for questions on international trade, agricultural policy, and India's position in global forums. Be prepared to discuss the implications of different subsidy boxes and India's stance on issues like public stockholding.</p></div>

💡 Key Takeaways

- •The WTO's Agreement on Agriculture (AoA) aims to reduce trade-distorting agricultural support and protection.

- •The AoA has three pillars: Domestic Support, Market Access, and Export Subsidy.

- •Domestic subsidies are categorized into Amber (most distorting), Blue (production-limiting), and Green (non-distorting) boxes.

- •Market Access requires progressive tariff cuts and conversion of non-tariff barriers to tariffs.

- •Export subsidies, which make exports cheaper, are largely prohibited due to their distorting effect (dumping).

- •Concepts like FRP and SAPs are national mechanisms for farmer support, relevant in the context of domestic support discussions.

- •India actively advocates for a permanent solution on public stockholding for food security at the WTO, often invoking the Peace Clause.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•World Trade Organization (WTO) official website - Agreement on Agriculture

•Economic Survey of India (for India's agricultural policies and WTO stance)