What is the RoDTEP Scheme? - International Relations | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is the RoDTEP Scheme?

Medium⏱️ 7 min read

international relations

📖 Introduction

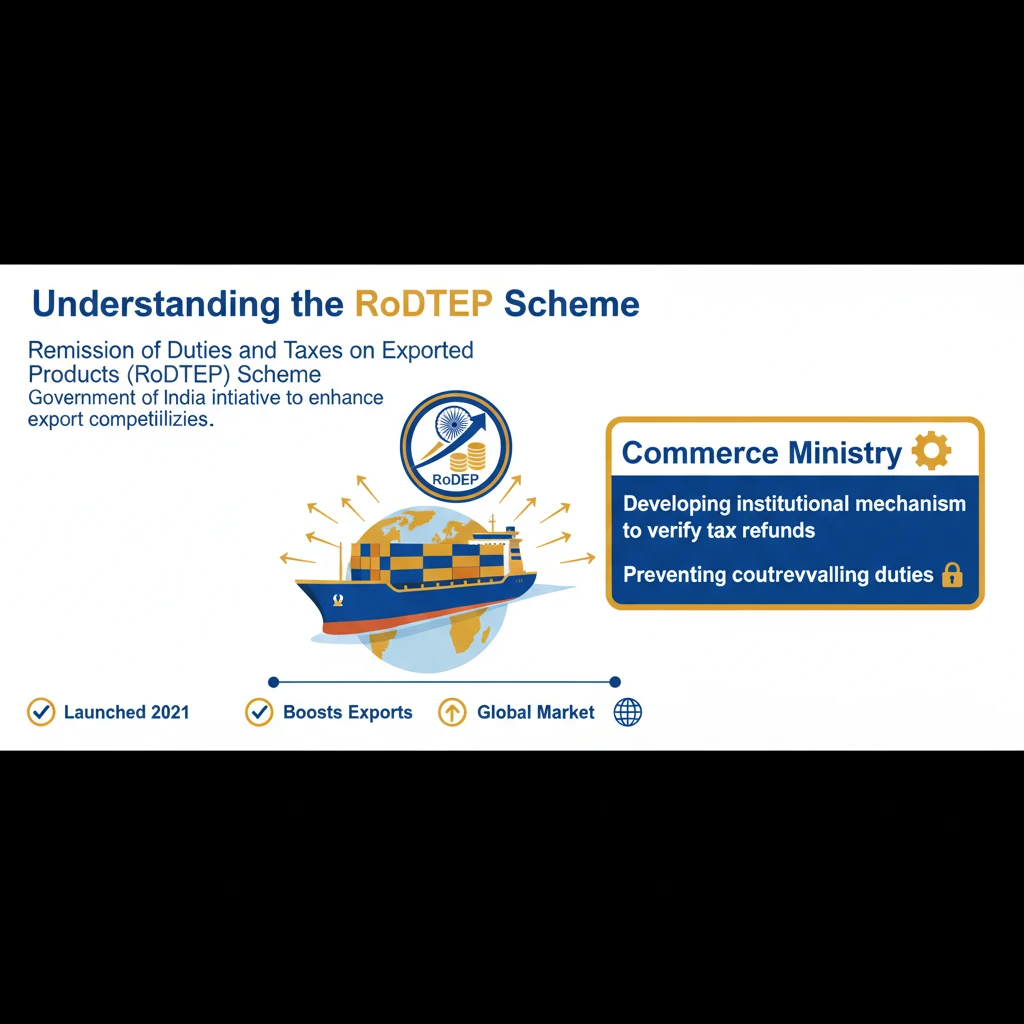

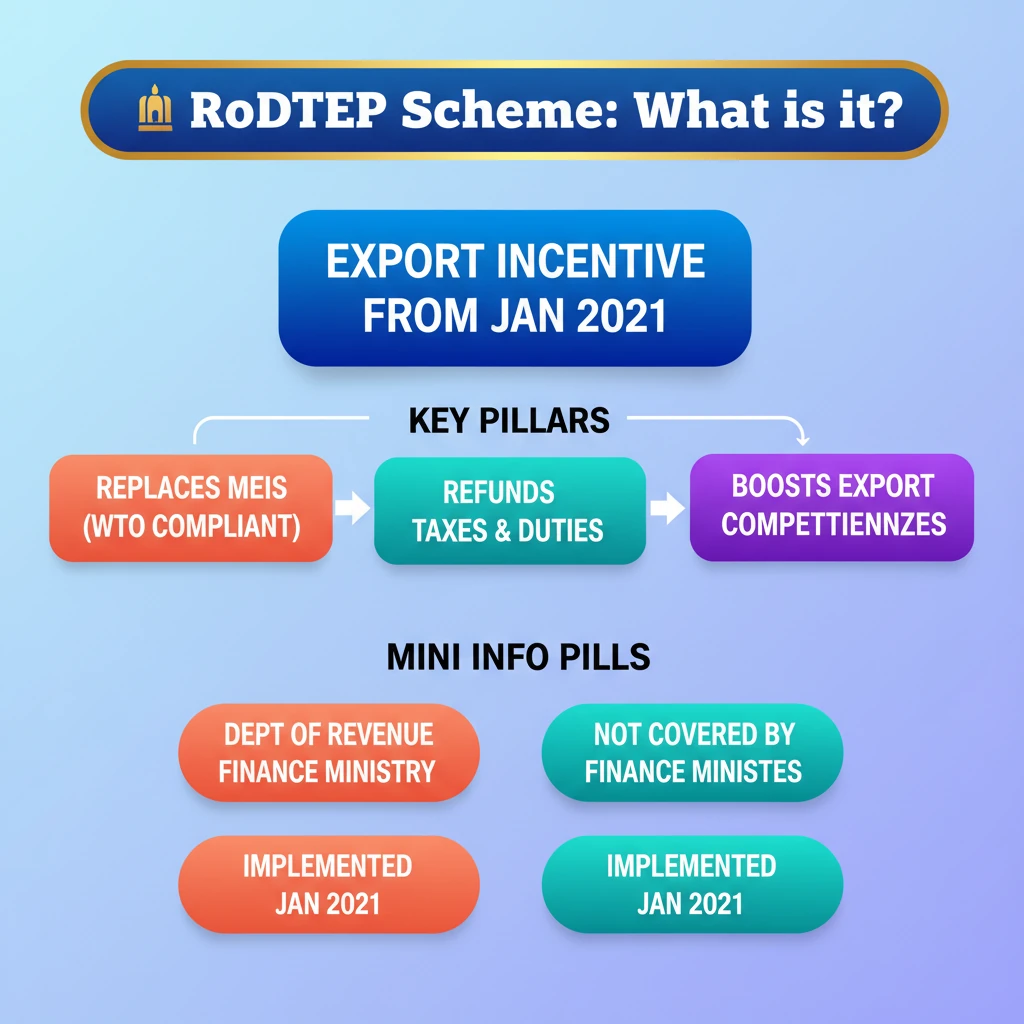

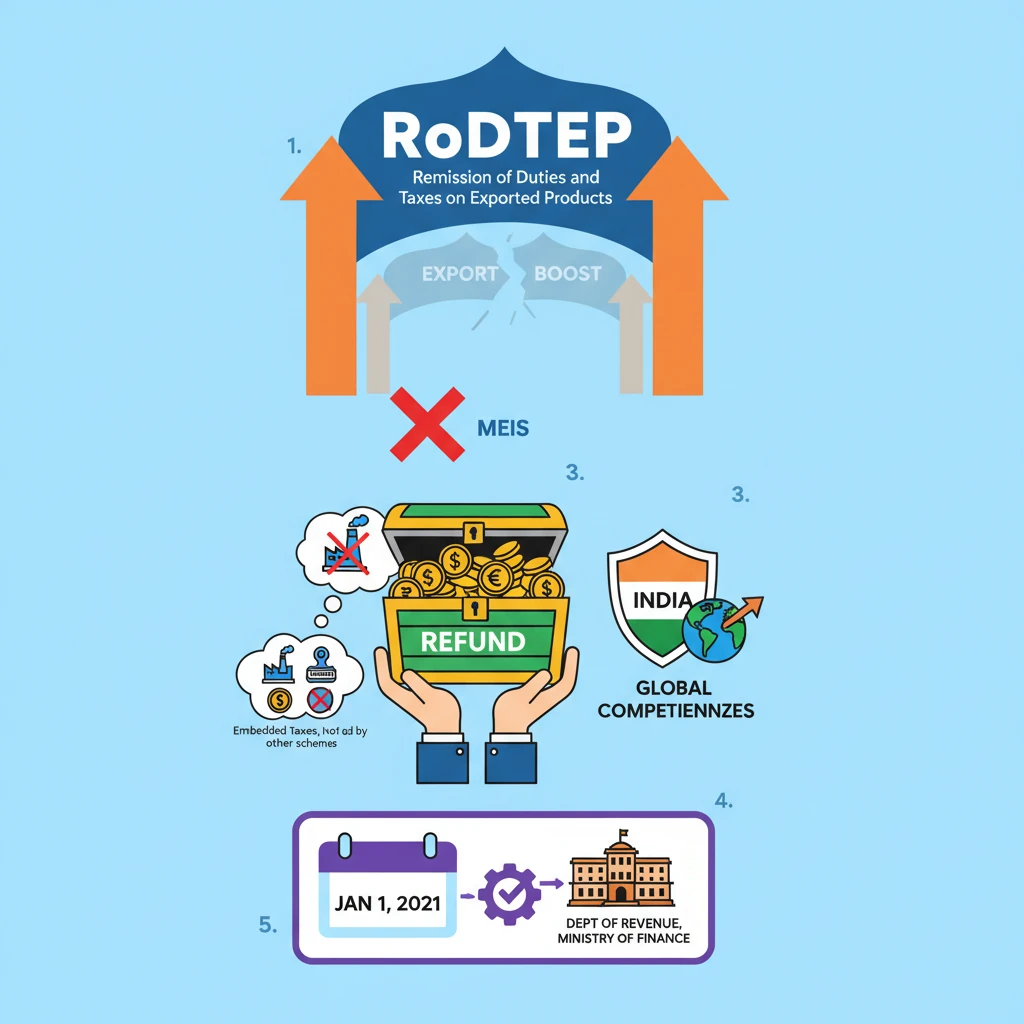

<h4>Understanding the RoDTEP Scheme</h4><p>The <strong>Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme</strong> is a crucial initiative by the Government of India. It was implemented to enhance the competitiveness of Indian exports in the global market.</p><div class='info-box'><p>The <strong>Commerce Ministry</strong> is actively developing an institutional mechanism. This mechanism aims to verify tax refunds under RoDTEP to prevent the imposition of <strong>countervailing duties</strong> by major importing nations.</p></div><h4>What is the RoDTEP Scheme?</h4><p><strong>RoDTEP</strong> is a <strong>duty remission program</strong> that came into effect on <strong>January 1, 2021</strong>. Its primary design is to significantly boost India's exports by alleviating the tax burden on goods manufactured for export.</p><div class='info-box'><p>The scheme is administered by the <strong>Department of Revenue</strong>, which falls under the <strong>Ministry of Finance</strong>. This central administration ensures uniform application and oversight.</p></div><div class='key-point-box'><p><strong>RoDTEP</strong> explicitly replaced the previous export incentive program, the <strong>Merchandise Exports from India Scheme (MEIS)</strong>. The transition was necessitated by a <strong>World Trade Organization (WTO)</strong> decision.</p></div><p>The <strong>MEIS scheme</strong> was found to be in violation of <strong>WTO regulations</strong>, prompting India to devise a compliant alternative to continue supporting its exporters.</p><h4>Objectives of the RoDTEP Scheme</h4><p>The core objective of the <strong>RoDTEP scheme</strong> is to provide comprehensive support to exporters. It achieves this by reimbursing a broad spectrum of costs incurred during the export process.</p><p>Specifically, it aims to refund exporters for various <strong>taxes, duties, and levies</strong>. These are charges incurred during the production and distribution phases that are not typically refunded under other existing schemes.</p><h4>Extension of RoDTEP to New Sectors</h4><p>The Government of India has broadened the scope of <strong>RoDTEP support</strong>. This extension now includes several additional export sectors to ensure wider coverage and benefit.</p><ul><li><strong>Advance Authorisation (AA) holders</strong> are now eligible for benefits.</li><li><strong>Export Oriented Unit (EOU)</strong> export units can also avail the scheme.</li><li><strong>Special Economic Zones (SEZ)</strong> export units have been brought under its ambit.</li></ul><p>Key sectors such as <strong>Engineering, Textiles, Chemicals, Pharmaceuticals</strong>, and <strong>Food Processing</strong>, among many others, are significant beneficiaries of this expanded scheme.</p><h4>Financial Allocation and Impact</h4><p>Since its inception, the <strong>RoDTEP Scheme</strong> has provided substantial financial assistance to Indian exporters. This demonstrates the government's commitment to promoting exports.</p><div class='info-box'><p>Support amounting to over <strong>Rs 42,000 Crores</strong> has already been disbursed. This has benefited more than <strong>10,500 export items</strong> across various sectors.</p></div><p>For the current financial year, the scheme operates with a budget of <strong>Rs 15,070 Crore</strong>. An additional increase of <strong>10%</strong> is projected for <strong>FY 2024-25</strong>, signaling continued governmental backing.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding <strong>RoDTEP's mechanism</strong> and its distinction from <strong>MEIS</strong> is vital for questions on India's trade policy and WTO compliance in <strong>GS Paper 2</strong> and <strong>GS Paper 3</strong>. Note the financial outlays as they indicate economic impact.</p></div>

💡 Key Takeaways

- •RoDTEP (Remission of Duties and Taxes on Exported Products) is an export incentive scheme implemented from January 1, 2021.

- •It replaced the WTO-non-compliant Merchandise Exports from India Scheme (MEIS).

- •Administered by the Department of Revenue, Ministry of Finance, it aims to refund embedded taxes and duties not covered by other schemes.

- •The scheme boosts export competitiveness by reducing the cost of Indian goods in international markets.

- •Its scope has been extended to Advance Authorisation holders, Export Oriented Units (EOUs), and Special Economic Zones (SEZs).

- •Significant financial support (Rs 42,000 Cr since inception, Rs 15,070 Cr budget for current FY) demonstrates its importance.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Ministry of Commerce & Industry, Government of India official notifications

•World Trade Organization (WTO) dispute settlement reports (reference to MEIS ruling)