Including Non-Mineralised Areas in Mining Leases - Geography | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Including Non-Mineralised Areas in Mining Leases

Medium⏱️ 8 min read

geography

📖 Introduction

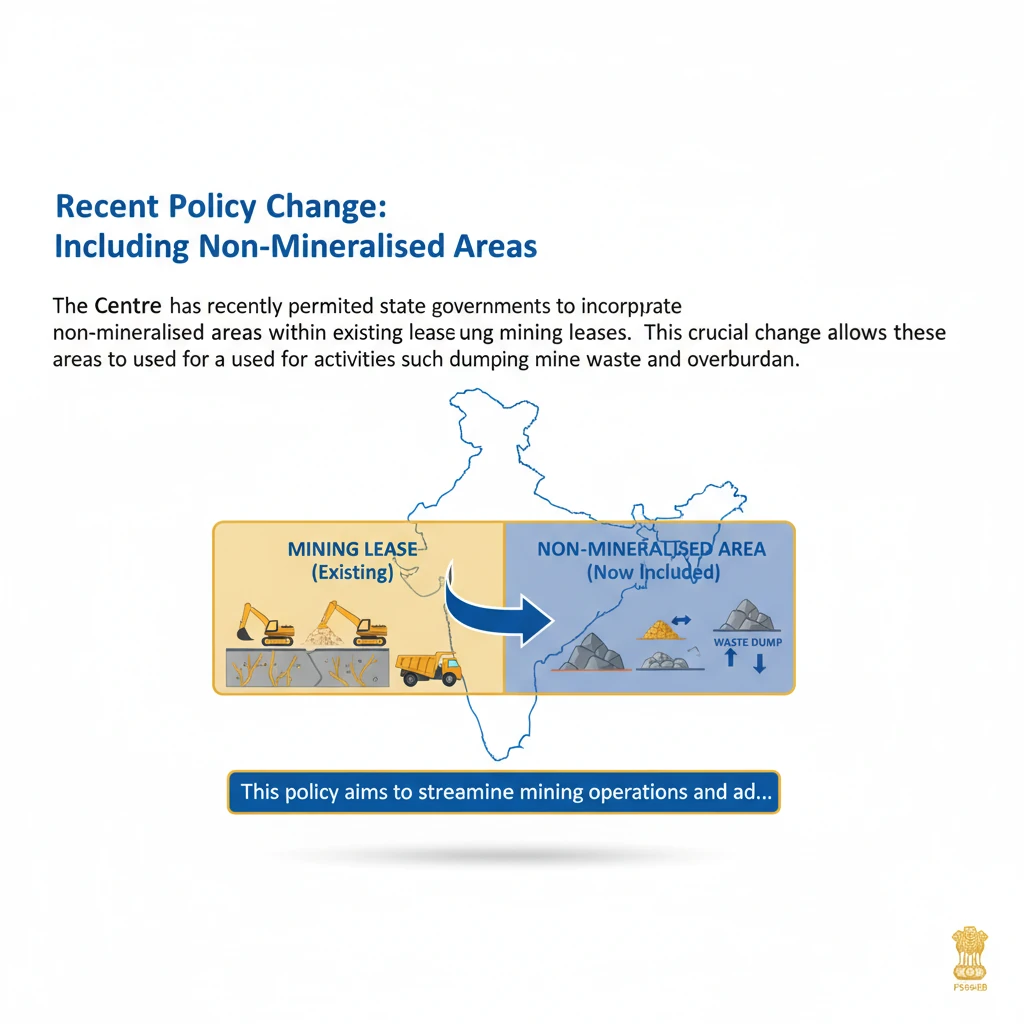

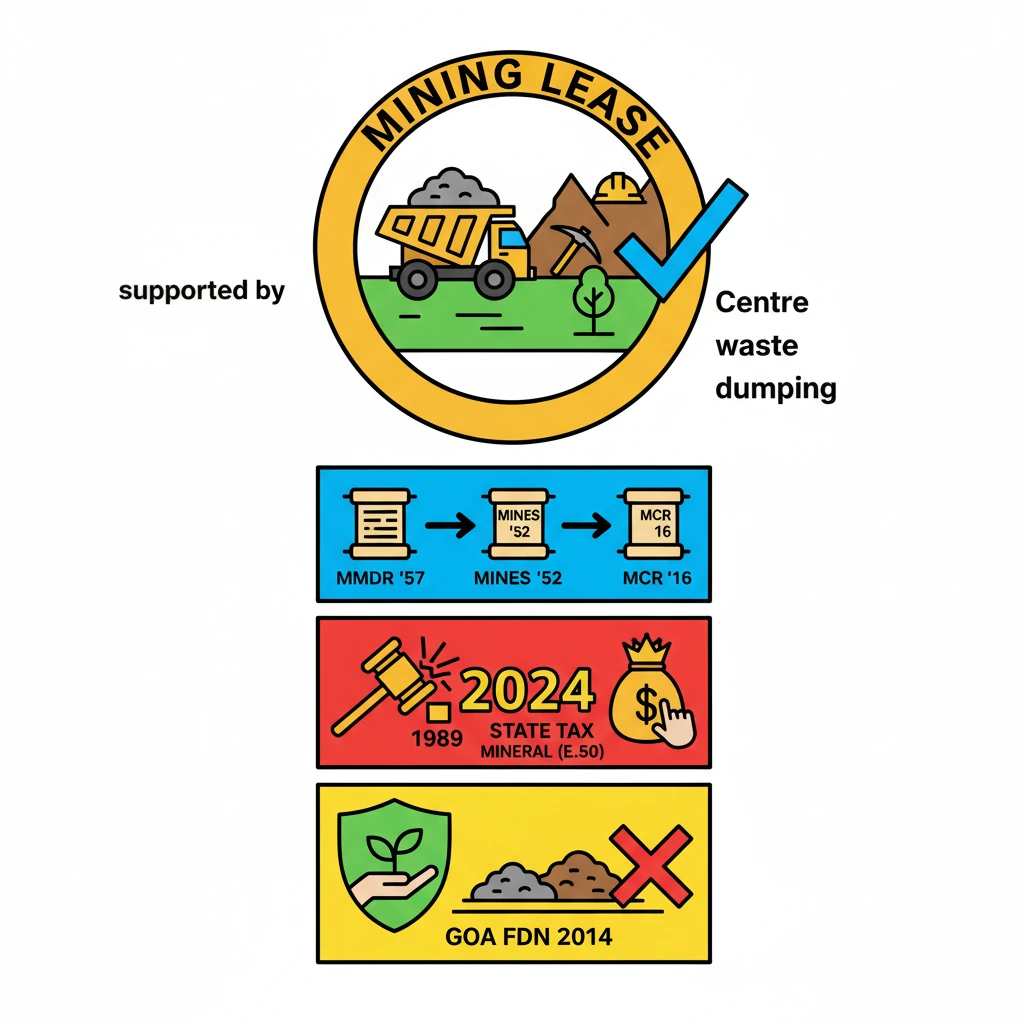

<h4>Recent Policy Change: Including Non-Mineralised Areas</h4><p>The <strong>Centre</strong> has recently permitted <strong>state governments</strong> to incorporate <strong>non-mineralised areas</strong> within existing <strong>mining leases</strong>. This crucial change allows these areas to be used for activities such as dumping <strong>mine waste</strong> and <strong>overburden</strong>.</p><div class='key-point-box'><p>This policy aims to <strong>streamline mining operations</strong> and address long-standing <strong>industry challenges</strong> related to waste disposal. It represents a significant step towards practical and efficient resource management.</p></div><h4>Legal Basis for the Policy Clarification</h4><p>The <strong>Ministry of Mines</strong> clarified that the inclusion of <strong>non-mineralised areas</strong> for <strong>ancillary activities</strong> like waste disposal is permissible under the existing legal framework.</p><div class='info-box'><p>The interpretation is rooted in the <strong>Mines and Minerals (Development and Regulation) Act, 1957 (MMDR Act)</strong>. Further support comes from the <strong>Mines Act, 1952</strong>, and <strong>Rule 57 of the Mineral Concession Rules, 2016</strong>, which collectively allow for ancillary zones within a lease area.</p></div><h4>Supreme Court Rulings: Regulating Mining and Minerals</h4><p>The <strong>Supreme Court</strong> has delivered several landmark judgments shaping the regulatory landscape of India's mining sector, particularly concerning the division of powers between the <strong>Centre</strong> and <strong>states</strong>.</p><h4>Historical Ruling: Centre's Primary Authority (1989)</h4><p>In <strong>1989</strong>, a <strong>seven-judge Bench</strong> in the case of <strong>Orissa Cement Ltd. vs the State of Tamil Nadu</strong> ruled that <strong>mineral regulation</strong> falls primarily under the <strong>Centre’s authority</strong>.</p><div class='info-box'><p>This authority was established through the <strong>Mines and Minerals (Development and Regulation) Act, 1957</strong>, and was aligned with <strong>Entry 54 of the Union List</strong> in the Constitution.</p></div><h4>State Authority on Taxes (Pre-2024)</h4><p>In <strong>State of Orissa v. M.A. Tulloch & Co.</strong>, it was held that <strong>states</strong> could only collect <strong>royalties</strong>, not impose additional <strong>taxes</strong>, as <strong>royalties</strong> were then classified as <strong>taxes</strong>.</p><p>A <strong>2004 judgment</strong> in <strong>State of West Bengal v. Kesoram Industries Ltd. Case</strong> questioned this classification, leading to a review by a larger bench.</p><h4>Overruling the 1989 Verdict: States' Power to Tax (July 2024)</h4><p>In <strong>July 2024</strong>, the <strong>Supreme Court</strong> delivered a significant ruling, overturning its <strong>1989 judgment</strong>. This new verdict asserted the <strong>states' power to tax mineral rights</strong> under <strong>Entry 50 of List II (State List)</strong>.</p><p>While granting this power, the Court limited <strong>Parliament’s</strong> role to imposing constraints to ensure that <strong>mineral development</strong> is not hindered. Some judges, however, expressed concerns that unchecked <strong>state taxation</strong> could disrupt federal uniformity in <strong>mineral pricing and development</strong>, urging <strong>Parliament</strong> to intervene for consistency.</p><h4>Goa Foundation v. Union of India Case, 2014: Against External Dumping</h4><p>The <strong>Supreme Court</strong> in the <strong>Goa Foundation v. Union of India Case, 2014</strong>, issued a strict directive against dumping <strong>mine waste</strong> or <strong>overburden</strong> outside the boundaries of <strong>valid mining leases</strong>.</p><div class='info-box'><p>This ruling aimed to prevent <strong>environmental and legal violations</strong> and emphasized the <strong>protection of non-lease areas</strong> from mining-related activities. It reinforced compliance with the <strong>Mines and Minerals (Development and Regulation) Act, 1957</strong>, and other related laws.</p></div><div class='exam-tip-box'><p>This case highlighted the judiciary's role in environmental protection and the importance of adhering to lease boundaries for waste management, a critical point for <strong>UPSC Mains GS-III Environment</strong>.</p></div><h4>Impact on Mining Practices (Post-2014)</h4><p>Following the <strong>Goa Foundation</strong> ruling, <strong>mining operations</strong> were mandated to include <strong>waste management</strong> strategies strictly within their <strong>leased areas</strong>. This prompted significant changes in planning and allocation processes within the industry.</p><h4>Mines and Minerals (Development and Regulation) Act, 1957 (MMDR Act)</h4><p>The <strong>MMDR Act, 1957</strong>, is the pivotal legislation governing India’s <strong>mining sector</strong>. Its primary objective is to develop the industry, conserve minerals, and ensure <strong>transparency and efficiency</strong> in mineral exploitation.</p><h4>Initial Objectives of MMDR Act</h4><p>Initially, the Act focused on promoting mining, conserving resources, and regulating concessions through a system of licenses and leases.</p><h4>2015 Amendment: Key Reforms</h4><p>The <strong>2015 Amendment</strong> introduced significant reforms to the <strong>MMDR Act</strong>, enhancing transparency and social responsibility.</p><ul><li><strong>Auction Method:</strong> Introduced for granting mineral concessions, promoting transparency.</li><li><strong>District Mineral Foundation (DMF):</strong> Established to work for the welfare of <strong>mining-affected areas</strong>.</li><li><strong>National Minerals Exploration Trust (NMET):</strong> Created to boost <strong>exploration</strong> activities.</li><li><strong>Stringent Penalties:</strong> Imposed for <strong>illegal mining</strong> to deter unauthorized extraction.</li></ul><h4>2021 Amendment: Captive Mines Liberalization</h4><p>The <strong>2021 Amendment</strong> brought further changes, particularly for <strong>captive mines</strong>. These mines are operated by companies to extract minerals for their own industrial use.</p><div class='info-box'><p>The amendment allowed <strong>captive mines</strong> to sell up to <strong>50%</strong> of their annual production in the <strong>open market</strong> after fulfilling the requirements of their <strong>end-use plant</strong>. This move aimed to liberalize the mining sector and improve mineral availability.</p></div>

💡 Key Takeaways

- •Centre now allows non-mineralised areas within mining leases for waste dumping, streamlining operations.

- •This is supported by MMDR Act, 1957, Mines Act, 1952, and Mineral Concession Rules, 2016.

- •Supreme Court's July 2024 ruling overturned its 1989 verdict, empowering states to tax mineral rights (Entry 50, State List).

- •The 2014 Goa Foundation case prohibited dumping outside valid lease areas, emphasizing environmental protection.

- •MMDR Act, 1957, is pivotal; its 2015 amendment introduced auction, DMF, NMET, and 2021 amendment liberalized captive mines.

🧠 Memory Techniques

95% Verified Content