What is NEER and REER, and their Significance? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is NEER and REER, and their Significance?

Medium⏱️ 8 min read

economy

📖 Introduction

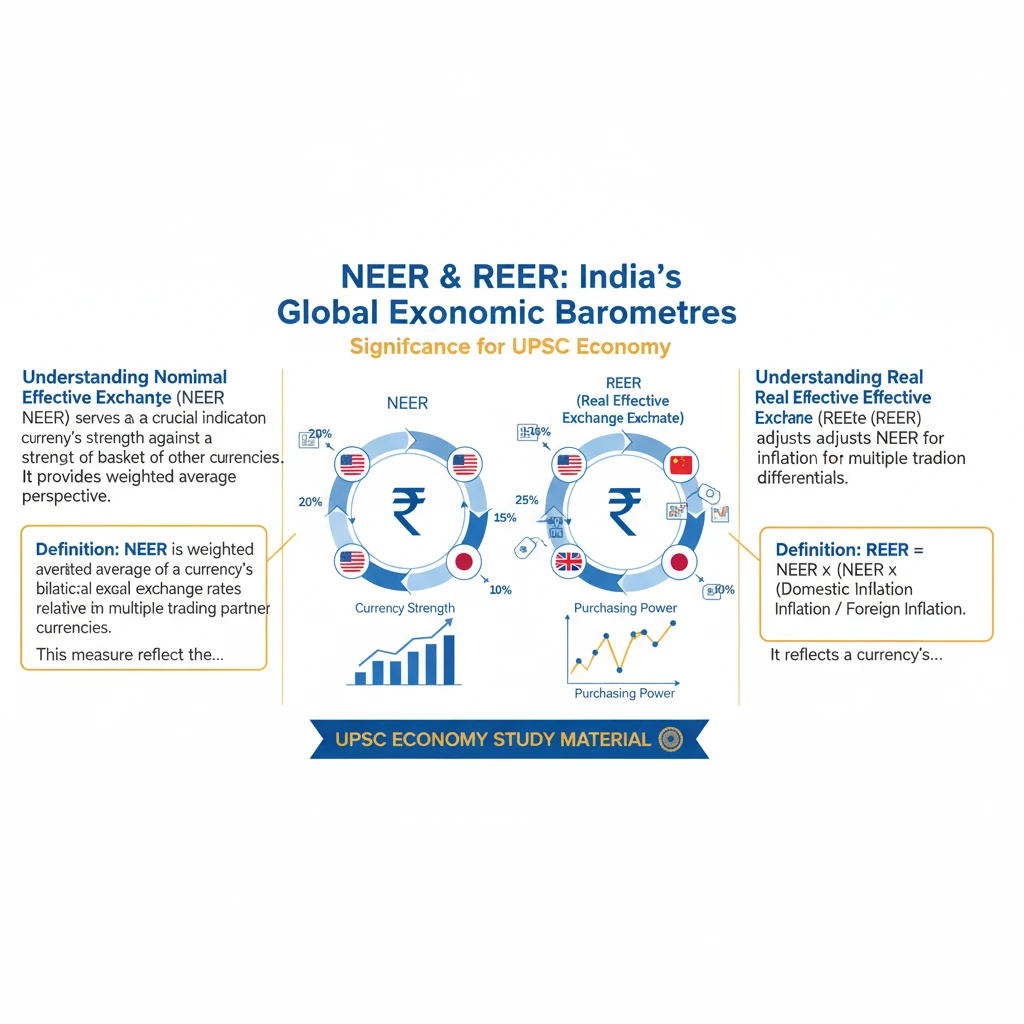

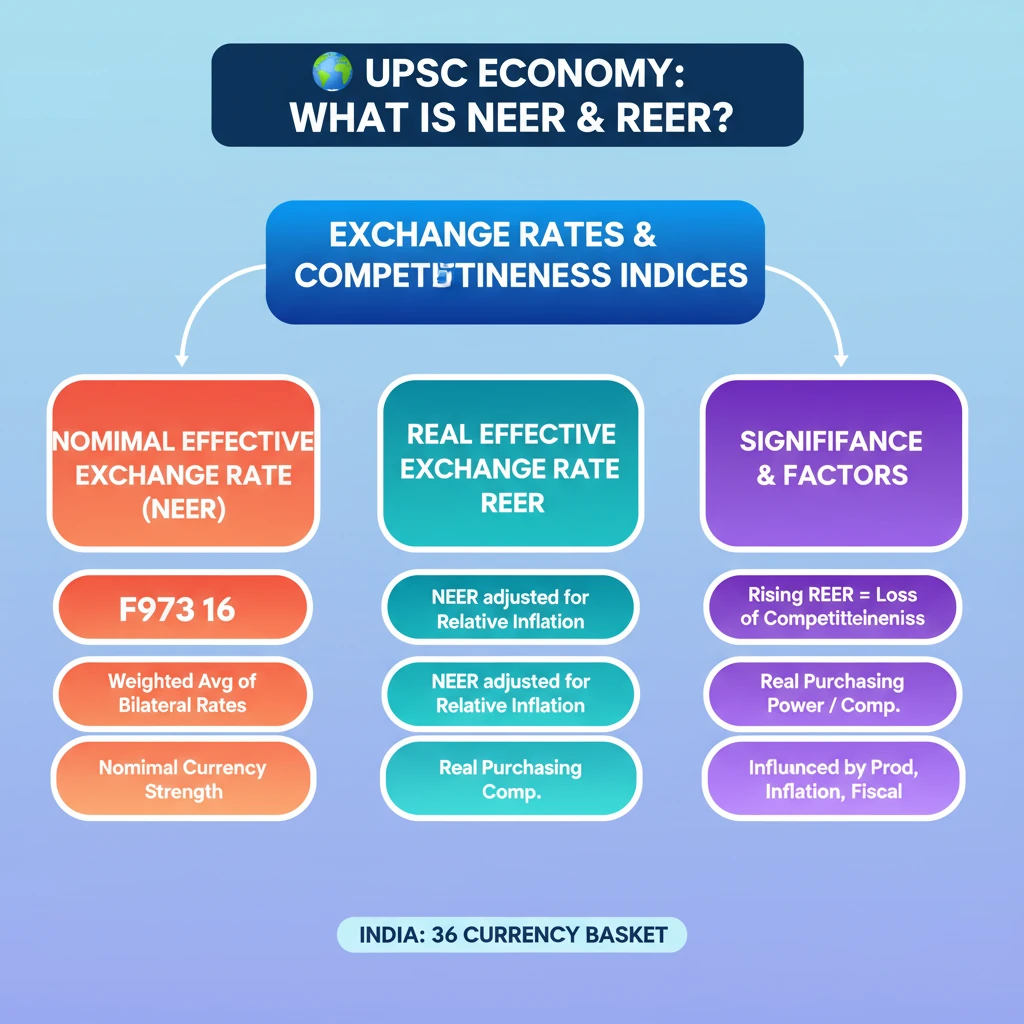

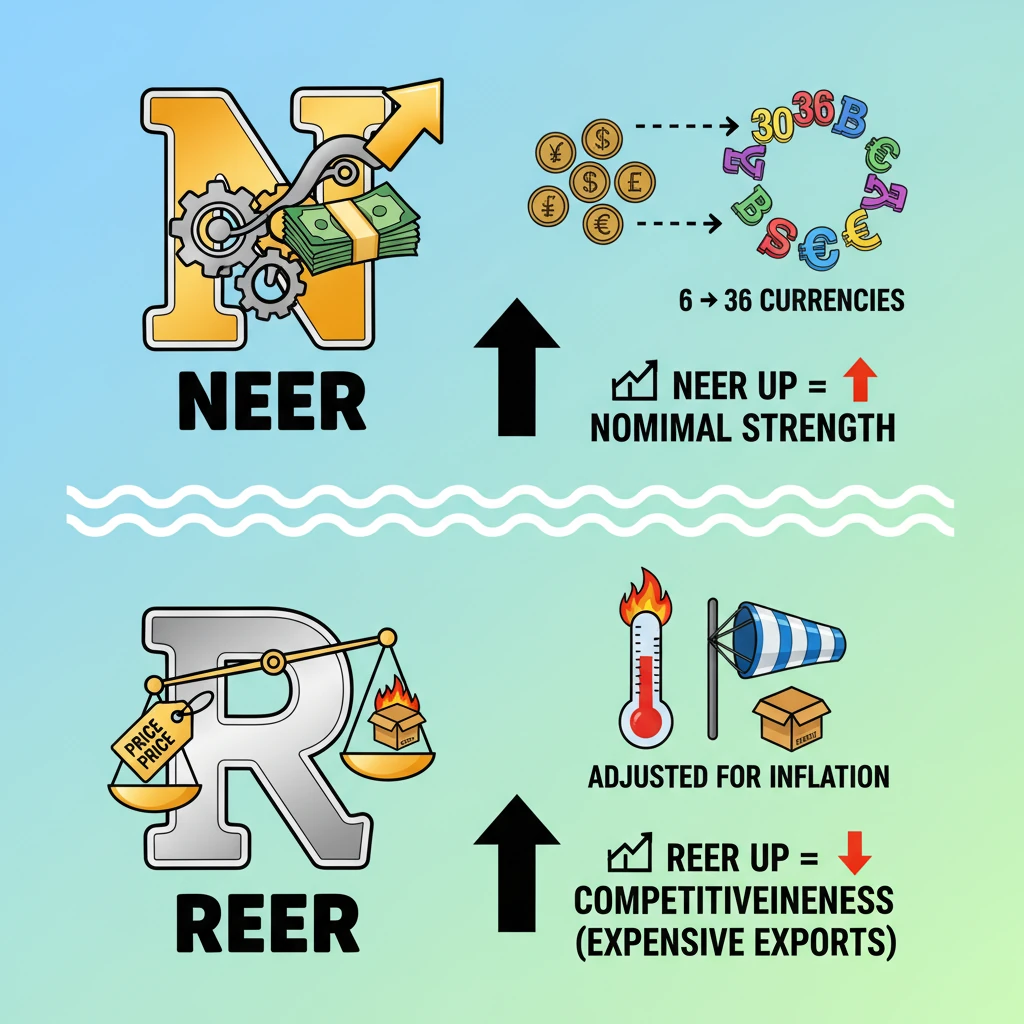

<h4>Understanding Nominal Effective Exchange Rate (NEER)</h4><p>The <strong>Nominal Effective Exchange Rate (NEER)</strong> serves as a crucial indicator of a currency's overall strength against a basket of other currencies. It provides a weighted average perspective.</p><div class='info-box'><p><strong>Definition:</strong> <strong>NEER</strong> is a weighted average of a currency’s bilateral exchange rates relative to multiple trading partner currencies.</p></div><p>This measure reflects the <strong>nominal currency strength</strong> without considering the impact of inflation or existing price level differences across countries.</p><p>A sustained rise in the <strong>NEER</strong> signifies a <strong>nominal appreciation</strong> of the domestic currency. Conversely, a fall indicates a <strong>nominal depreciation</strong> against the basket of currencies.</p><h4>Understanding Real Effective Exchange Rate (REER)</h4><p>The <strong>Real Effective Exchange Rate (REER)</strong> offers a more refined and economically meaningful measure compared to NEER. It adjusts for crucial macroeconomic factors.</p><div class='info-box'><p><strong>Definition:</strong> <strong>REER</strong> improves upon NEER by adjusting for relative price levels (inflation) between the domestic economy and its trading partners.</p></div><p>This adjustment makes <strong>REER</strong> a <strong>purchasing power parity (PPP)</strong>-adjusted measure. It provides a better indication of a country's international competitiveness.</p><p>The calculation for <strong>REER</strong> involves multiplying the <strong>NEER</strong> by the ratio of domestic price indices to foreign price indices. This accounts for inflation differentials.</p><div class='key-point-box'><p><strong>Key Distinction:</strong> While <strong>NEER</strong> shows nominal currency movement, <strong>REER</strong> reflects the real competitiveness and purchasing power of a currency, factoring in inflation.</p></div><h4>Evolution of NEER/REER Indices for India</h4><p>The basket of currencies used to calculate India's <strong>NEER/REER indices</strong> has been periodically updated to reflect changing trade patterns and economic realities.</p><p>Initially, the <strong>NEER/REER indices</strong> for India included six major currencies:</p><ul><li><strong>US Dollar (USD)</strong></li><li><strong>Euro (EUR)</strong></li><li><strong>Japanese Yen (JPY)</strong></li><li><strong>British Pound (GBP)</strong></li><li><strong>Chinese Yuan (CNY)</strong></li><li><strong>Singapore Dollar (SGD)</strong></li></ul><p>These indices have since been revised to include a broader basket of <strong>36 currencies</strong>. This expansion provides a more comprehensive and representative picture of India's trade-weighted currency performance.</p><h4>Factors Influencing NEER and REER</h4><p>Several economic variables can significantly impact the trends observed in both <strong>NEER</strong> and <strong>REER</strong>. These factors highlight the dynamic nature of exchange rates.</p><ul><li><strong>Productivity Differences:</strong> Variations in productivity between countries affect their <strong>competitiveness</strong> in global markets. Higher productivity can lead to currency appreciation.</li><li><strong>Terms of Trade:</strong> Changes in the ratio of export prices to import prices can influence a country's <strong>export/import balance</strong>. Favorable terms of trade can strengthen the currency.</li><li><strong>Inflation:</strong> Higher domestic inflation relative to trading partners can erode a currency's real value, leading to a fall in <strong>REER</strong>, even if <strong>NEER</strong> remains stable or appreciates nominally.</li><li><strong>Fiscal Spending:</strong> Government spending policies can affect economic stability, demand, and ultimately, the currency's value. Large fiscal deficits can put downward pressure on the currency.</li></ul>

💡 Key Takeaways

- •NEER is the Nominal Effective Exchange Rate, a weighted average of bilateral exchange rates, reflecting nominal currency strength.

- •REER is the Real Effective Exchange Rate, which adjusts NEER for relative inflation, reflecting real purchasing power and competitiveness.

- •A rising NEER indicates nominal appreciation; a rising REER indicates a loss of real competitiveness (exports become more expensive).

- •India's NEER/REER indices now include a basket of 36 currencies, up from an initial 6.

- •Factors like productivity, terms of trade, inflation, and fiscal spending influence NEER and REER trends.

- •REER is a more accurate indicator of a country's trade competitiveness than NEER.

- •RBI and policymakers use NEER/REER for monetary policy, trade analysis, and inflation management.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Economic Survey of India (Various Editions)

•Ministry of Finance, Government of India Documents

•Standard Macroeconomics Textbooks (e.g., Dornbusch, Fischer, Startz; Mankiw)