UPI Services in Sri Lanka and Mauritius - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

UPI Services in Sri Lanka and Mauritius

Medium⏱️ 7 min read

economy

📖 Introduction

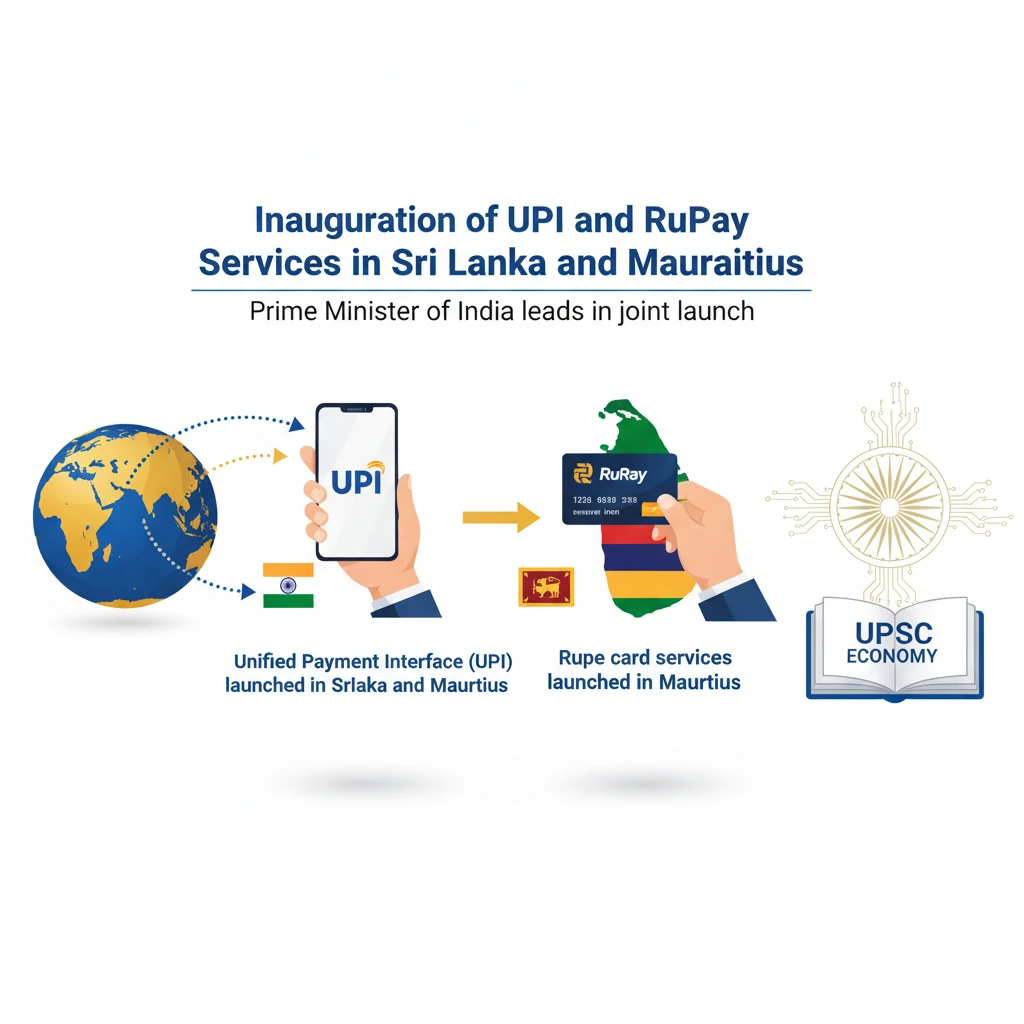

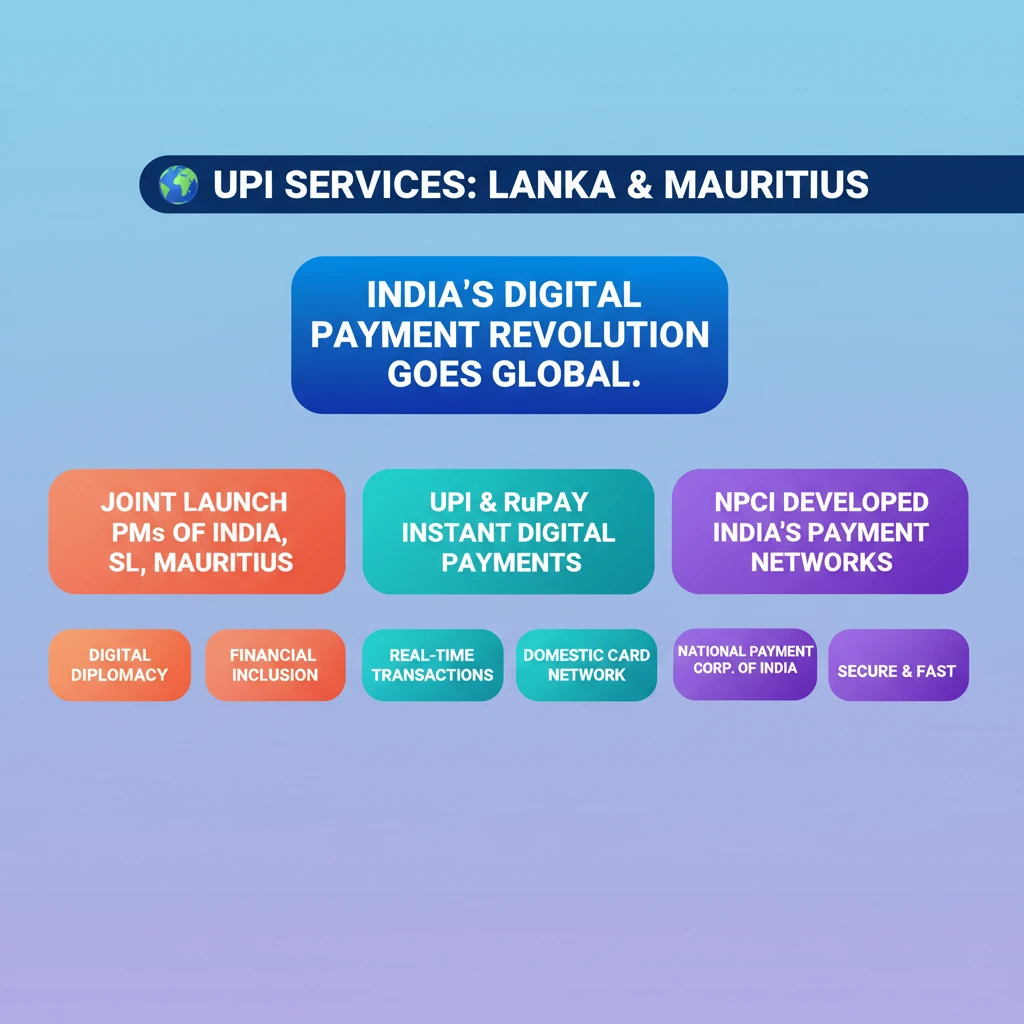

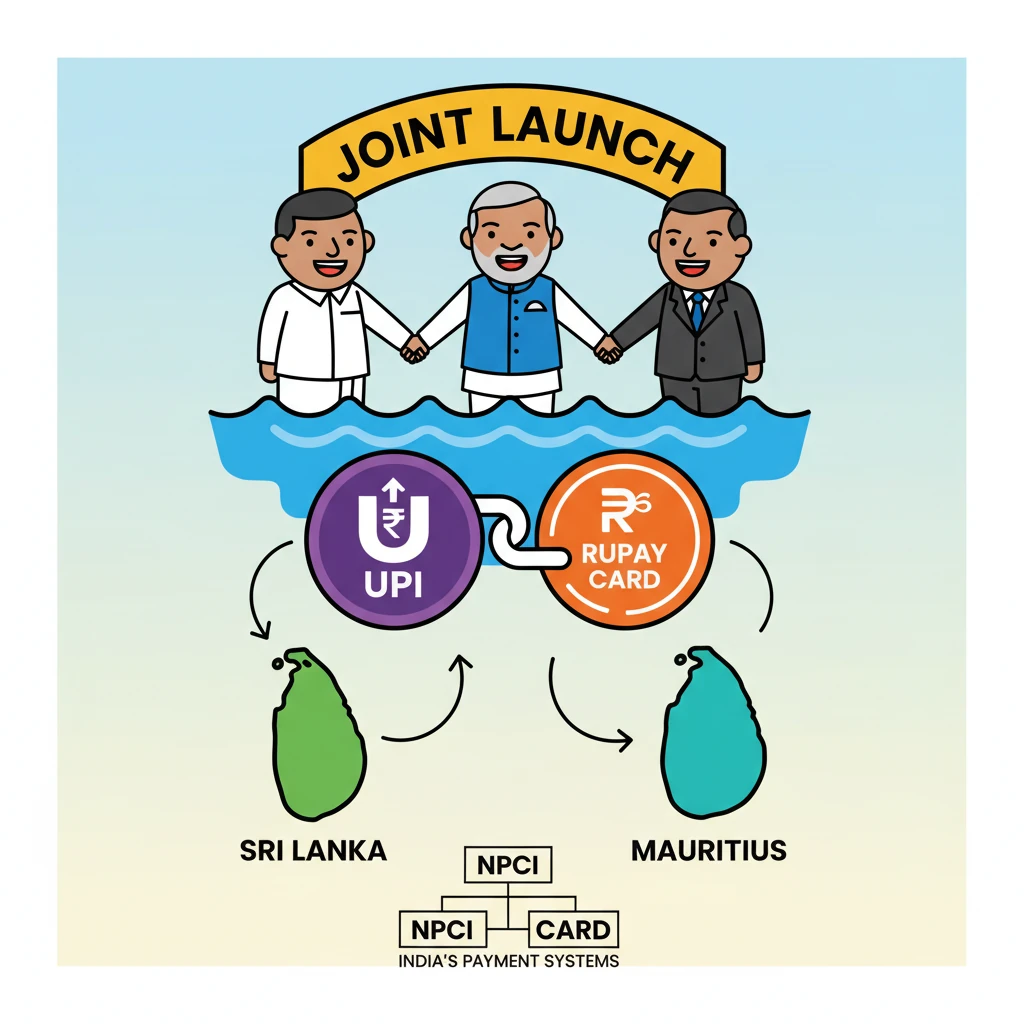

<h4>Inauguration of UPI and RuPay Services in Sri Lanka and Mauritius</h4><p>The <strong>Prime Minister of India</strong> recently led a significant joint inauguration. This event saw the launch of <strong>Unified Payment Interface (UPI)</strong> services in both <strong>Sri Lanka</strong> and <strong>Mauritius</strong>.</p><p>Alongside this, <strong>RuPay card services</strong> were also inaugurated specifically in <strong>Mauritius</strong>. This marks a crucial step in enhancing digital payment connectivity in the region.</p><div class='info-box'><p><strong>Key Dignitaries Present:</strong><ul><li><strong>Prime Minister of India</strong></li><li><strong>President of Sri Lanka</strong>: <strong>Mr. Ranil Wickremesinghe</strong></li><li><strong>Prime Minister of Mauritius</strong>: <strong>Mr. Pravind Jugnauth</strong></li></ul></p></div><div class='key-point-box'><p>This joint initiative underscores India's commitment to fostering <strong>digital public infrastructure (DPI)</strong> cooperation with its neighbouring countries.</p></div><h4>Understanding RuPay</h4><p><strong>RuPay</strong> is India's own domestic card payment network. It functions similarly to international card networks like Visa or Mastercard.</p><div class='info-box'><p><strong>RuPay Definition:</strong> <strong>RuPay</strong> is a payment system and financial services product. It was developed by the <strong>National Payments Corporation of India (NPCI)</strong> to facilitate electronic payments.</p></div><h4>Understanding UPI (Unified Payment Interface)</h4><p>The <strong>Unified Payment Interface (UPI)</strong> is an instant real-time payment system. It was also developed by the <strong>National Payments Corporation of India (NPCI)</strong>.</p><div class='info-box'><p><strong>UPI Definition:</strong> <strong>UPI</strong> allows users to link multiple bank accounts into a single mobile application. It enables instant fund transfers and merchant payments using a unique <strong>Virtual Payment Address (VPA)</strong>.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> The global expansion of <strong>UPI</strong> and <strong>RuPay</strong> is a key aspect of India's <strong>digital diplomacy</strong> and its efforts to promote <strong>financial inclusion</strong> beyond its borders. This topic is relevant for <strong>GS Paper 2 (International Relations)</strong> and <strong>GS Paper 3 (Indian Economy, Science & Technology)</strong>.</p></div>

💡 Key Takeaways

- •UPI and RuPay services launched in Sri Lanka and Mauritius.

- •Indian PM, Sri Lankan President, and Mauritian PM jointly inaugurated the services.

- •RuPay is India's domestic card network, developed by NPCI.

- •UPI is India's instant real-time payment system, also developed by NPCI.

- •This expansion signifies India's digital diplomacy and commitment to financial inclusion.

- •It will ease cross-border transactions, boost tourism, and strengthen bilateral economic ties.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•National Payments Corporation of India (NPCI) official website (for general definitions of UPI and RuPay)

•Government of India official press releases (for inauguration details)