Customs Duty Elimination - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Customs Duty Elimination

Medium⏱️ 8 min read

economy

📖 Introduction

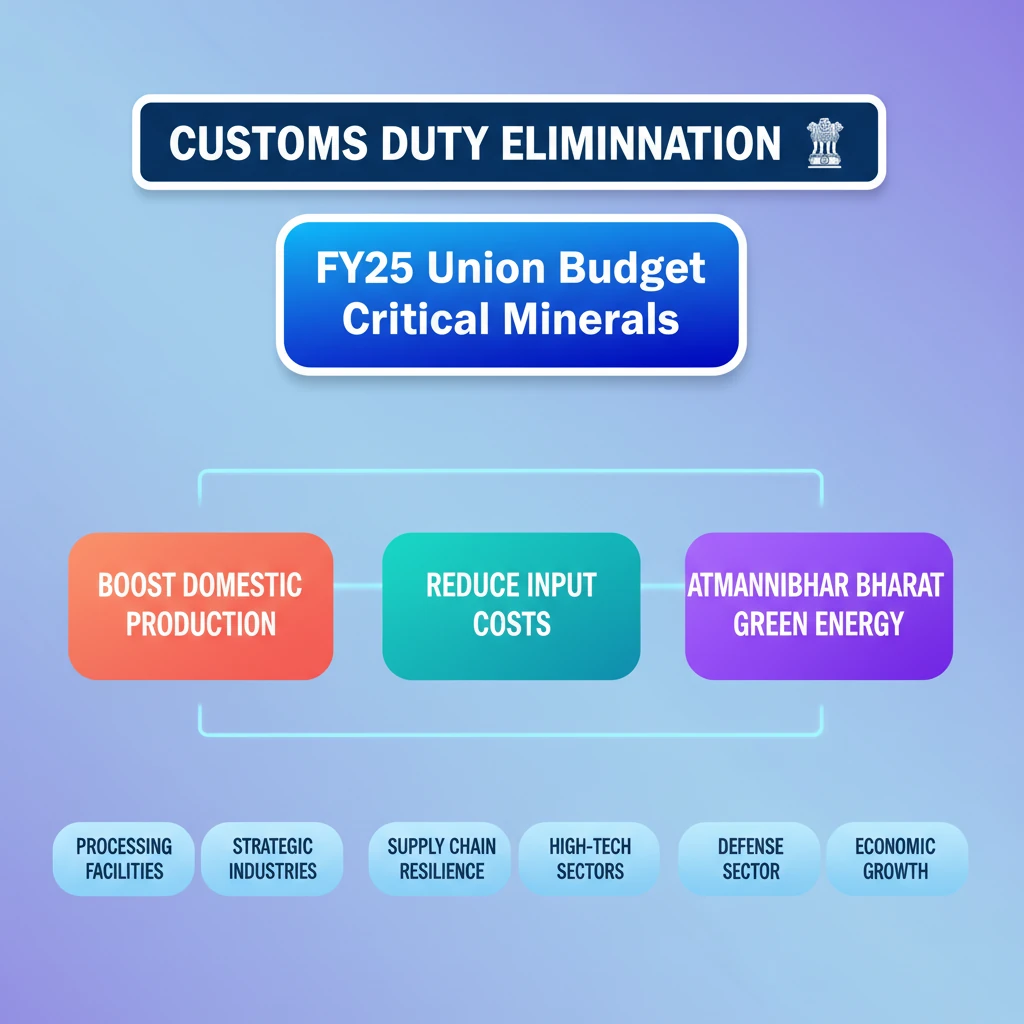

<h4>Introduction to Customs Duty Elimination</h4><p>The <strong>FY25 Union Budget</strong> introduced a significant policy change regarding <strong>customs duties</strong> on specific raw materials. This move aims to bolster India's economic resilience and industrial growth.</p><p>Specifically, the budget announced the <strong>removal of customs duties</strong> on various <strong>critical minerals</strong>. This strategic decision is designed to achieve multiple objectives within the domestic economy.</p><div class='info-box'><p><strong>Customs Duty:</strong> A tax levied on goods imported into or, less commonly, exported from a country. It serves as a revenue source and a tool for trade policy, influencing domestic industries.</p></div><div class='key-point-box'><p>The primary goals behind this customs duty elimination are to <strong>promote domestic production</strong> of these essential minerals and to <strong>encourage the establishment and expansion of processing facilities</strong> within India.</p></div><p>By making raw critical minerals cheaper to import, the government intends to reduce input costs for domestic industries, thereby fostering a more competitive manufacturing environment.</p><h4>Objectives of Customs Duty Elimination</h4><p>The government's decision is rooted in a clear vision for India's industrial future. Lowering import costs for raw critical minerals directly benefits downstream industries.</p><ul><li><strong>Boosting Domestic Production:</strong> It makes it more economically viable for Indian companies to manufacture products that rely on these minerals.</li><li><strong>Encouraging Processing Facilities:</strong> The policy incentivizes the setup of advanced processing units within India, reducing reliance on imported processed minerals.</li><li><strong>Enhancing Value Addition:</strong> By processing minerals domestically, India can move up the value chain, creating more jobs and economic output.</li></ul><div class='exam-tip-box'><p>Understanding the 'why' behind policy changes like customs duty elimination is crucial for UPSC. Focus on the <strong>economic rationale</strong> and <strong>intended outcomes</strong> for both Prelims and Mains.</p></div>

💡 Key Takeaways

- •FY25 Union Budget eliminated customs duties on critical minerals.

- •Primary goal: Boost domestic production and processing facilities for these minerals.

- •Aims to reduce input costs for strategic industries.

- •Supports India's 'Aatmanirbhar Bharat' vision and green energy transition.

- •Enhances supply chain resilience for high-tech and defense sectors.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Press Information Bureau (PIB) releases related to the Union Budget

•Economic Survey documents (relevant sections on trade and industry)