Cybersecurity in India's Financial Ecosystem: Regulations & Trust - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Cybersecurity in India's Financial Ecosystem: Regulations & Trust

Medium⏱️ 8 min read

economy

📖 Introduction

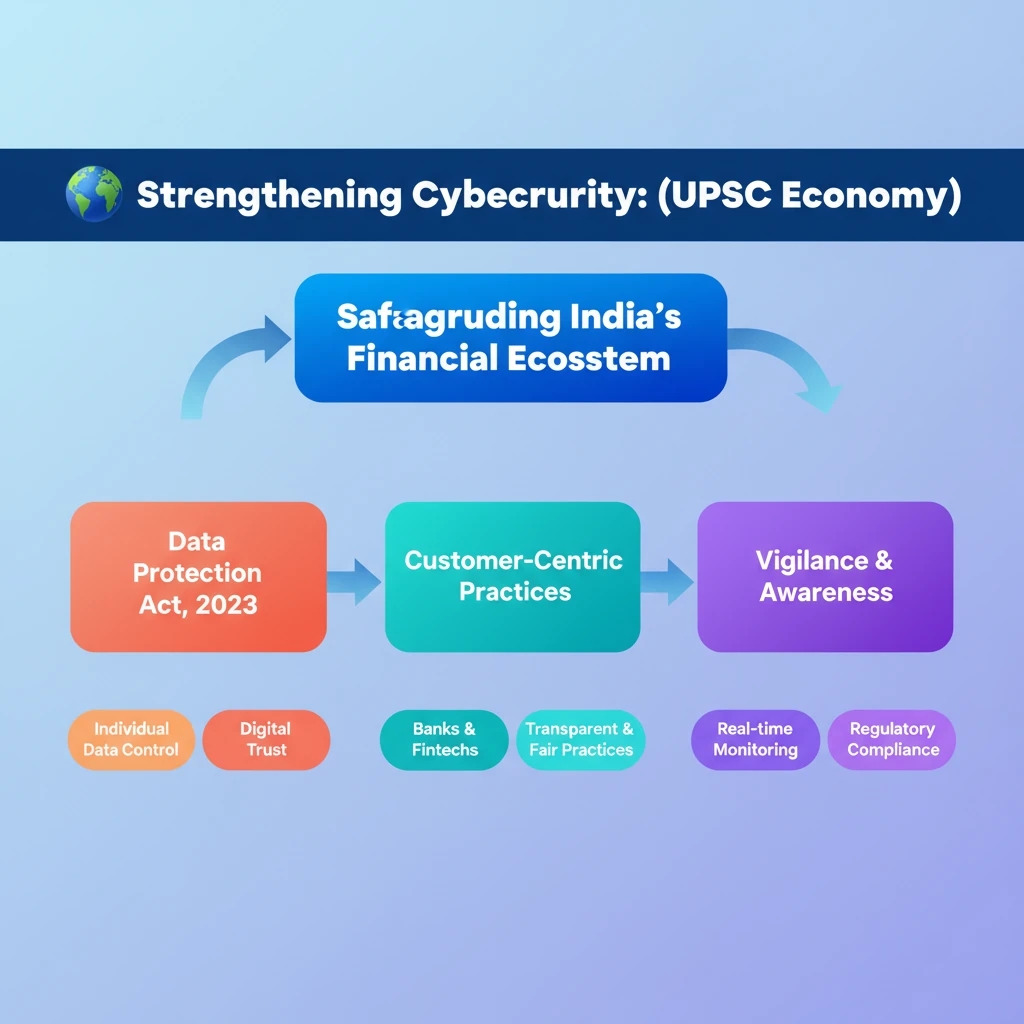

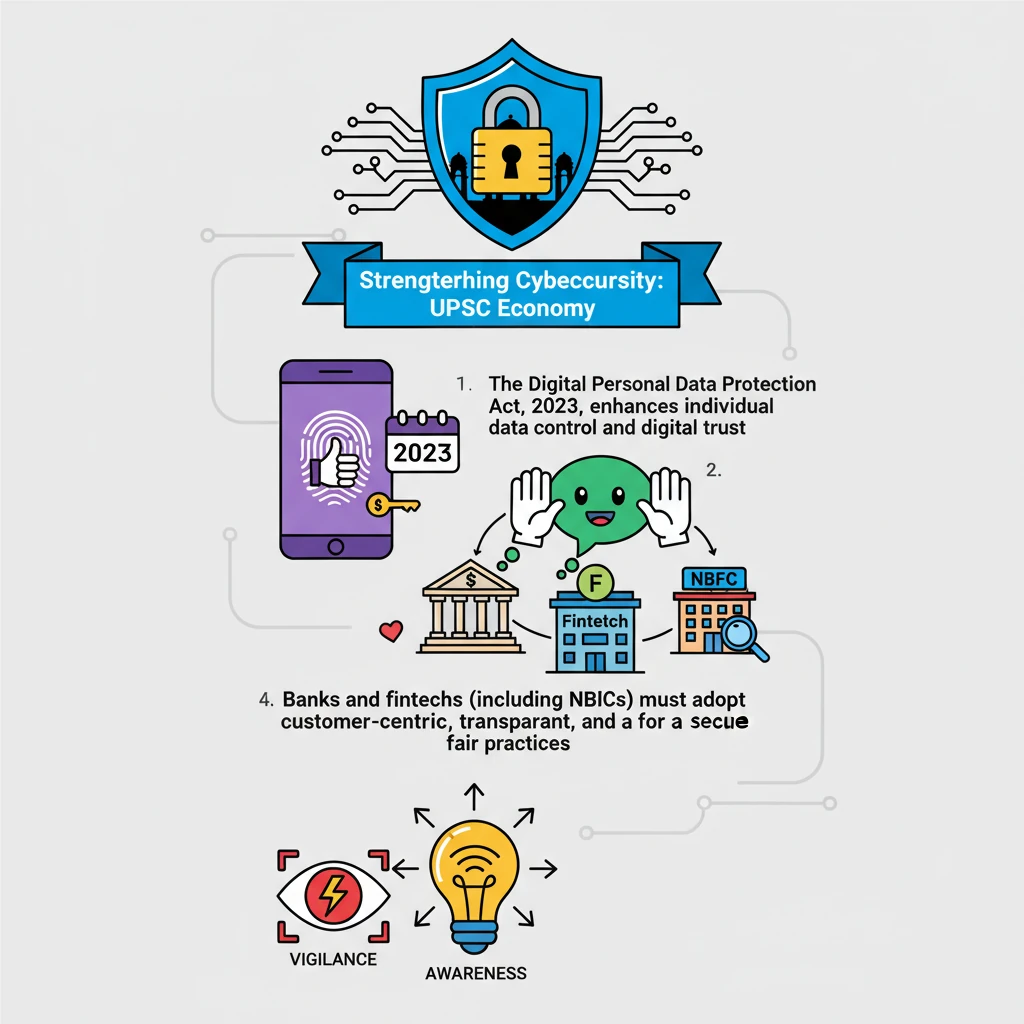

<h4>Introduction to Cybersecurity in India's Financial Sector</h4><p>In our rapidly evolving <strong>digital world</strong>, <strong>cybersecurity</strong> stands as an indispensable foundation. It is a critical pillar essential for safeguarding India's entire <strong>financial ecosystem</strong> from various threats.</p><div class='key-point-box'><p>A robust <strong>cybersecurity framework</strong> ensures the stability, integrity, and trustworthiness of financial transactions and services across the nation.</p></div><h4>Regulatory Framework and Data Protection</h4><p><strong>Real-time monitoring</strong> of digital financial activities and strict adherence to <strong>regulatory compliance</strong> are paramount. These measures are crucial for maintaining a secure and reliable digital environment.</p><p>A significant development in this regard is the recently enacted <strong>Digital Personal Data Protection Act, 2023</strong>. This landmark legislation plays a vital role in strengthening the overall cybersecurity posture.</p><div class='info-box'><p>The <strong>Digital Personal Data Protection Act, 2023</strong>, empowers individuals with significantly greater control over their personal data. This empowerment is key to enhancing public trust in <strong>digital financial services</strong>.</p></div><h4>Expectations from Financial Institutions</h4><p><strong>Banks</strong> and various <strong>fintech firms</strong>, including <strong>Non-Banking Financial Companies (NBFCs)</strong>, bear a significant responsibility. They are expected to adopt a truly <strong>customer-centric approach</strong> in their operations.</p><p>This approach mandates ensuring complete <strong>transparency</strong> in all financial products offered. Furthermore, it requires the implementation of unequivocally <strong>fair lending practices</strong> to protect consumer interests.</p><h4>Continuous Vigilance and Awareness</h4><p>There is an ongoing and urgent need for continuous <strong>vigilance</strong> against evolving <strong>cyber threats</strong>. The landscape of digital risks is constantly changing, demanding proactive defense mechanisms.</p><div class='exam-tip-box'><p>Promoting widespread <strong>cybersecurity awareness</strong> is not just a technical requirement but a societal imperative. It is fundamental to building a truly secure and resilient <strong>digital economy</strong> for India.</p></div>

💡 Key Takeaways

- •Cybersecurity is a critical pillar for safeguarding India's financial ecosystem.

- •The Digital Personal Data Protection Act, 2023, enhances individual data control and digital trust.

- •Banks and fintechs (including NBFCs) must adopt customer-centric, transparent, and fair practices.

- •Continuous vigilance against cyber threats and promoting cybersecurity awareness are essential for a secure digital economy.

- •Regulatory compliance and real-time monitoring are key to a resilient financial sector.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•The Digital Personal Data Protection Act, 2023

•Reserve Bank of India (RBI) guidelines on Cybersecurity Framework for Banks