What is Non-Performing Asset (NPA)? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is Non-Performing Asset (NPA)?

Medium⏱️ 8 min read

economy

📖 Introduction

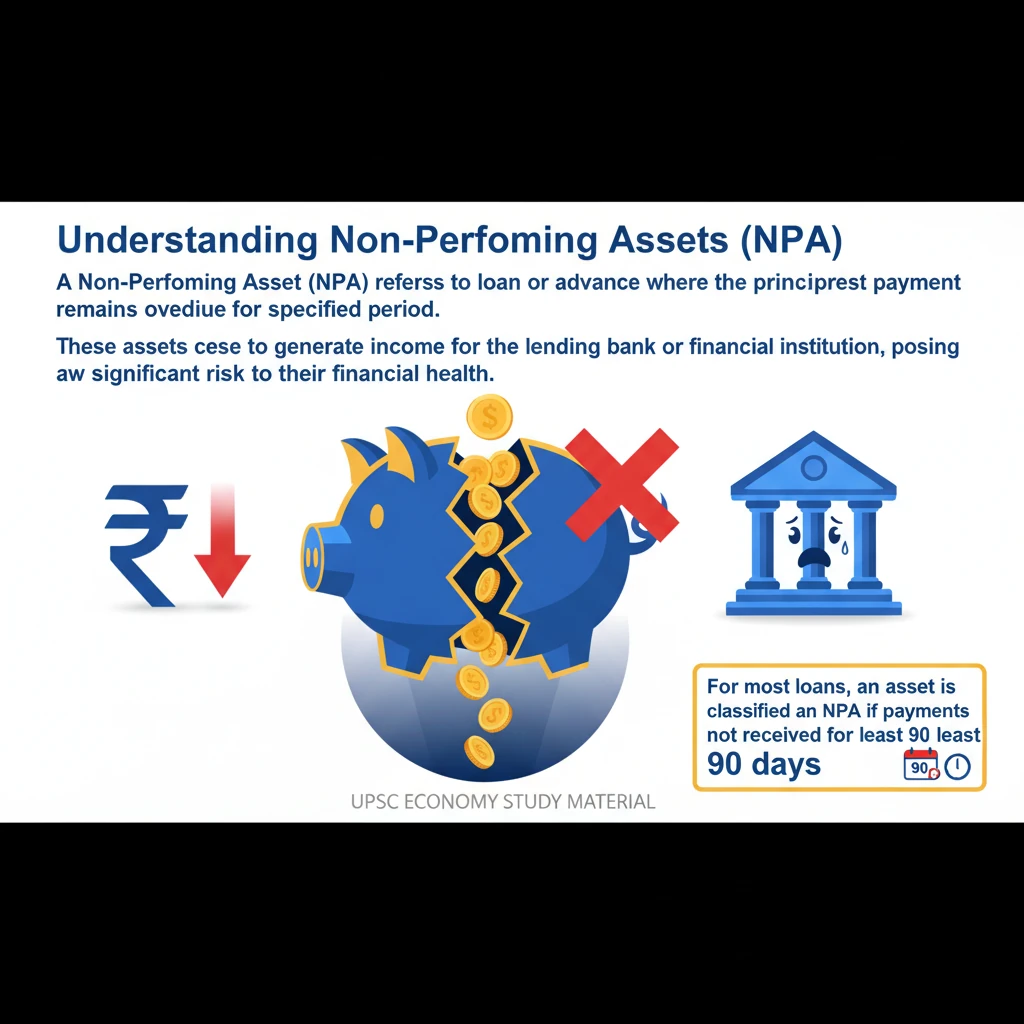

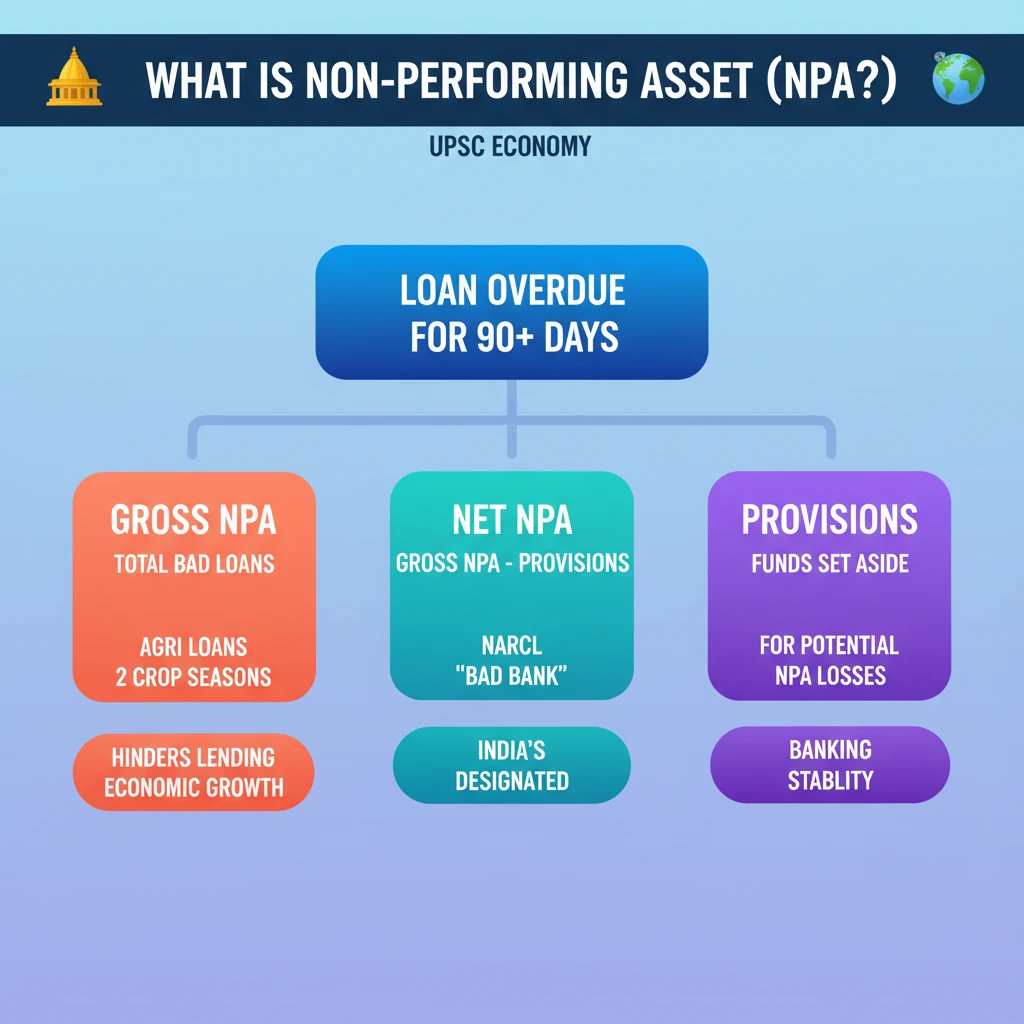

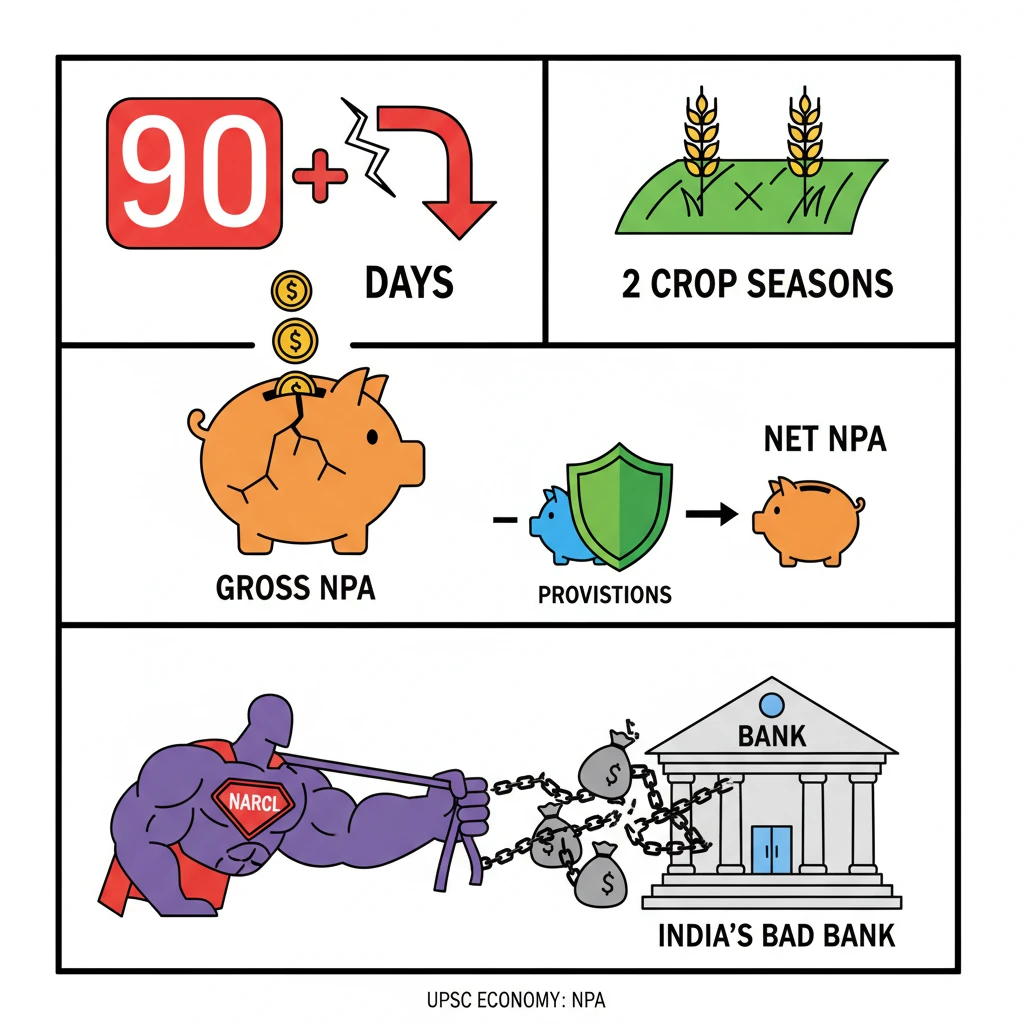

<h4>Understanding Non-Performing Assets (NPA)</h4><p>A <strong>Non-Performing Asset (NPA)</strong> refers to a loan or advance where the principal or interest payment remains overdue for a specified period.</p><p>These assets cease to generate income for the lending bank or financial institution, posing a significant risk to their financial health.</p><div class='info-box'><p>For most loans, an asset is classified as an <strong>NPA</strong> if payments are not received for at least <strong>90 days</strong>.</p></div><h4>Special Case: Agricultural Loans</h4><p>The classification criteria for <strong>agricultural loans</strong> differ, considering the seasonal nature of farming.</p><div class='info-box'><p>A loan granted for <strong>short-duration crops</strong> becomes an <strong>NPA</strong> if the principal or interest remains overdue for <strong>two crop seasons</strong>.</p></div><p>This adjustment recognizes the unique challenges faced by farmers in timely repayments.</p><h4>Types of NPAs</h4><p>NPAs are broadly categorized into <strong>Gross NPA</strong> and <strong>Net NPA</strong>, providing different perspectives on a bank's asset quality.</p><ul><li><strong>Gross NPA:</strong> This represents the <strong>total value</strong> of non-performing assets held by a bank before any provisions are deducted.</li><li><strong>Net NPA:</strong> This is calculated by subtracting the <strong>provisions</strong> made by the bank from its <strong>Gross NPA</strong>. It gives a more realistic picture of the actual burden.</li></ul><h4>Understanding Provisions</h4><p><strong>Provisions</strong> are crucial for banks to mitigate risks associated with bad loans.</p><div class='info-box'><p>A <strong>provision</strong> refers to the funds that banks are mandated to set aside from their profits to cover potential losses arising from <strong>NPAs</strong>.</p></div><p>These funds act as a buffer, ensuring the bank can absorb losses without jeopardizing its stability.</p><h4>Laws and Provisions Related to NPAs: The Bad Bank Concept</h4><p>To address the burgeoning issue of NPAs, the concept of a <strong>"Bad Bank"</strong> has emerged as a significant mechanism.</p><div class='key-point-box'><p>A <strong>Bad Bank</strong> is essentially an entity that buys the bad loans (NPAs) from commercial banks, allowing them to clean up their balance sheets and focus on fresh lending.</p></div><div class='info-box'><p>In India, the <strong>National Asset Reconstruction Company Ltd (NARCL)</strong> has been designated as the country's "bad bank" to aggregate and resolve stressed assets.</p></div><div class='exam-tip-box'><p>Understanding <strong>NARCL</strong> is vital for <strong>UPSC Mains GS Paper 3 (Economy)</strong>, especially questions related to financial sector reforms and banking challenges.</p></div>

💡 Key Takeaways

- •NPA: Loan overdue for 90+ days (or 2 crop seasons for short-duration agri loans).

- •Gross NPA = total bad loans; Net NPA = Gross NPA minus provisions.

- •Provisions are funds set aside by banks for potential NPA losses.

- •NARCL (National Asset Reconstruction Company Ltd) is India's designated 'Bad Bank'.

- •High NPAs hinder fresh lending, impacting economic growth and investment.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) Guidelines on Asset Classification

•Ministry of Finance Reports

•Economic Survey of India