Domestic Systemically Important Banks (D-SIBs) - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Domestic Systemically Important Banks (D-SIBs)

Medium⏱️ 4 min read

economy

📖 Introduction

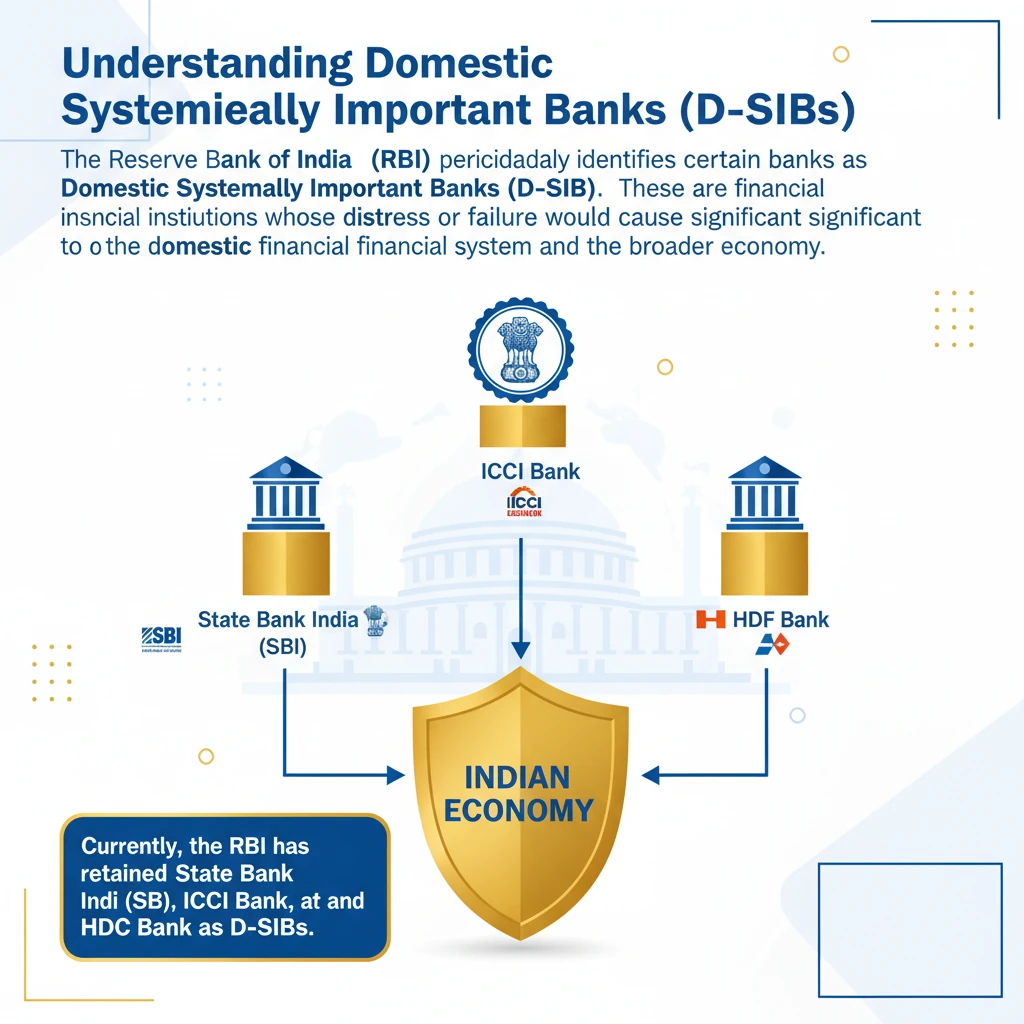

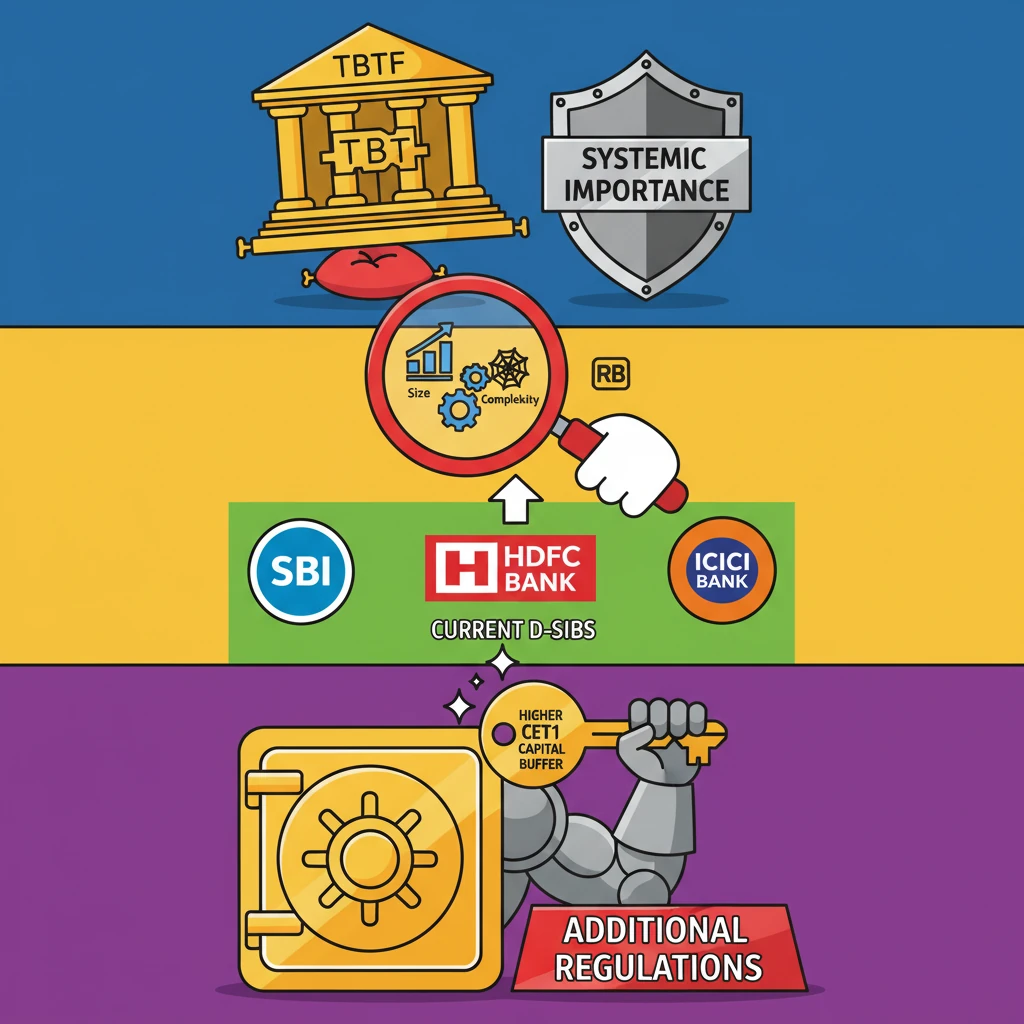

<h4>Understanding Domestic Systemically Important Banks (D-SIBs)</h4><p>The <strong>Reserve Bank of India (RBI)</strong> periodically identifies certain banks as <strong>Domestic Systemically Important Banks (D-SIBs)</strong>. These are financial institutions whose distress or failure would cause significant disruption to the domestic financial system and the broader economy.</p><div class='info-box'><p>Currently, the <strong>RBI</strong> has retained <strong>State Bank of India (SBI)</strong>, <strong>HDFC Bank</strong>, and <strong>ICICI Bank</strong> as <strong>D-SIBs</strong>, acknowledging their critical role in India's financial landscape.</p></div><h4>The "Too Big to Fail" (TBTF) Concept</h4><p><strong>D-SIBs</strong> are often referred to as <strong>"Too Big to Fail" (TBTF)</strong> banks. This classification stems from their immense <strong>size</strong>, intricate <strong>complexity</strong>, and deep <strong>interconnections</strong> within the financial system.</p><div class='key-point-box'><p>The failure of a <strong>D-SIB</strong> could trigger a widespread economic crisis, necessitating government intervention to prevent systemic collapse. Hence, they are subject to enhanced regulatory scrutiny.</p></div><h4>Importance and Enhanced Regulatory Measures</h4><p>Due to their systemic importance, <strong>D-SIBs</strong> are subjected to a stricter regulatory framework. These additional measures are designed to bolster their <strong>resilience</strong> and capacity to withstand severe financial shocks.</p><ul><li><strong>Additional Capital Buffers:</strong> Higher capital requirements ensure they have sufficient financial cushions.</li><li><strong>Stress Tests:</strong> Regular assessments evaluate their ability to cope with adverse economic scenarios.</li><li><strong>Recovery and Resolution Planning:</strong> Banks must have plans in place for orderly recovery from distress or resolution in case of failure, minimizing broader impact.</li></ul><h4>Additional Capital Requirement for D-SIBs</h4><p>A crucial regulatory measure for <strong>D-SIBs</strong> is the requirement to maintain an additional <strong>Common Equity Tier 1 (CET1)</strong> capital. This requirement varies based on the "bucket" in which a <strong>D-SIB</strong> is placed, reflecting its degree of systemic importance.</p><div class='info-box'><ul><li><strong>State Bank of India (SBI):</strong> Requires an additional <strong>0.80%</strong> <strong>CET1</strong>.</li><li><strong>HDFC Bank:</strong> Requires an additional <strong>0.40%</strong> <strong>CET1</strong>.</li><li><strong>ICICI Bank:</strong> Requires an additional <strong>0.20%</strong> <strong>CET1</strong>.</li></ul></div><div class='exam-tip-box'><p>Understanding the specific <strong>CET1</strong> requirements for each identified <strong>D-SIB</strong> can be important for objective-type questions in <strong>UPSC Prelims</strong>, especially regarding financial sector regulations.</p></div><h4>The D-SIB Identification Process by RBI</h4><p>The <strong>RBI</strong> employs a rigorous <strong>two-step process</strong> to identify <strong>D-SIBs</strong>, ensuring that only truly systemically important institutions are designated as such.</p><ol><li><strong>Sample Selection:</strong> The initial step involves identifying a sample of banks for assessment. Only banks whose <strong>assets exceed 2% of India's GDP</strong> are considered for this preliminary selection.</li><li><strong>Systemic Importance Assessment:</strong> For the selected banks, a comprehensive assessment is conducted. This involves calculating a <strong>composite score</strong> based on several key indicators.</li></ol><div class='info-box'><p>Key indicators for systemic importance include: <strong>lack of substitutability</strong> (how difficult it would be to replace their services), <strong>interconnectedness</strong> (their links with other financial institutions), <strong>size</strong>, and <strong>complexity</strong>.</p></div><p>Banks exceeding a predetermined <strong>threshold</strong> based on this composite score are then officially classified as <strong>Domestic Systemically Important Banks (D-SIBs)</strong>.</p>

💡 Key Takeaways

- •D-SIBs are banks deemed "Too Big to Fail" (TBTF) due to their systemic importance.

- •RBI identifies D-SIBs based on size, complexity, and interconnectedness.

- •Currently, SBI, HDFC Bank, and ICICI Bank are identified as D-SIBs.

- •D-SIBs face additional regulatory requirements, including higher Common Equity Tier 1 (CET1) capital buffers.

- •The framework aims to enhance resilience and mitigate systemic risk, safeguarding financial stability.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) official press releases and policy documents (implied by content)