Loan Write-Offs and NPA Reduction in PSBs - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Loan Write-Offs and NPA Reduction in PSBs

Medium⏱️ 6 min read

economy

📖 Introduction

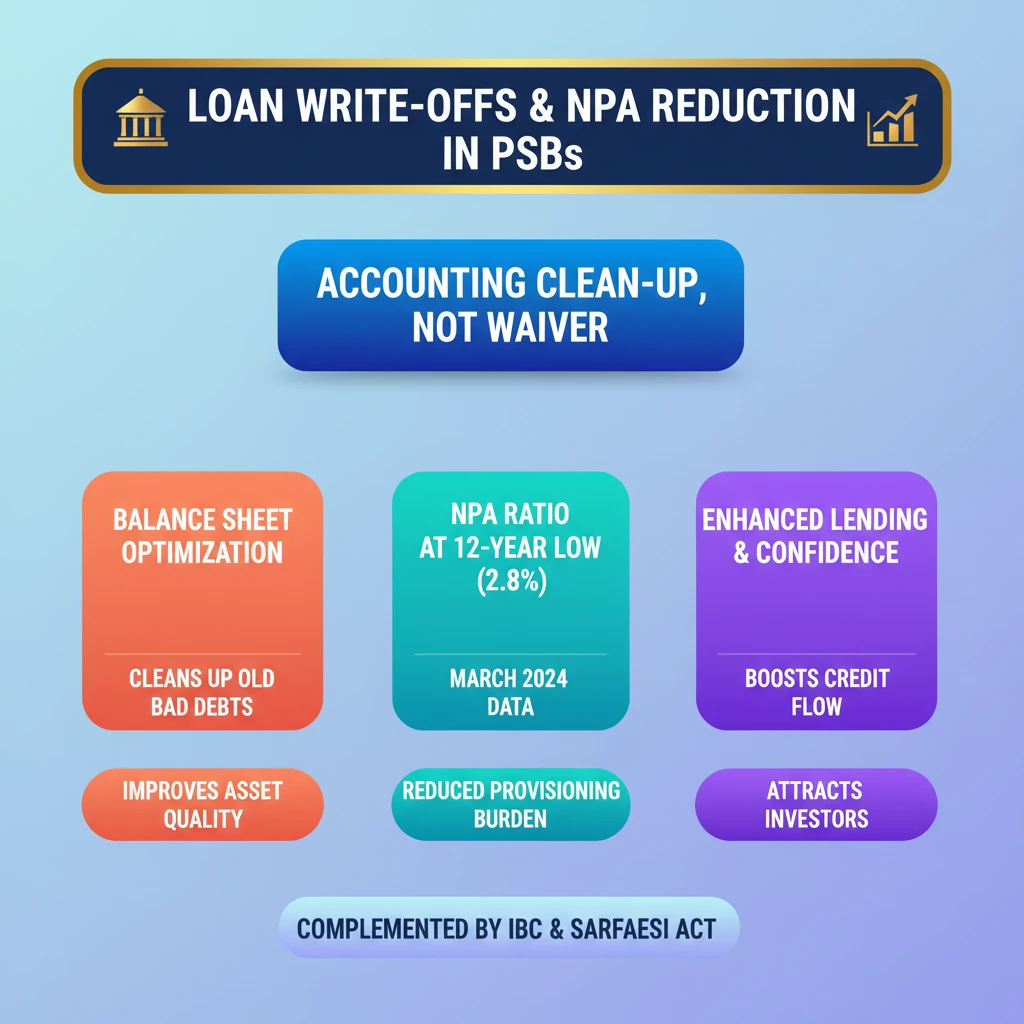

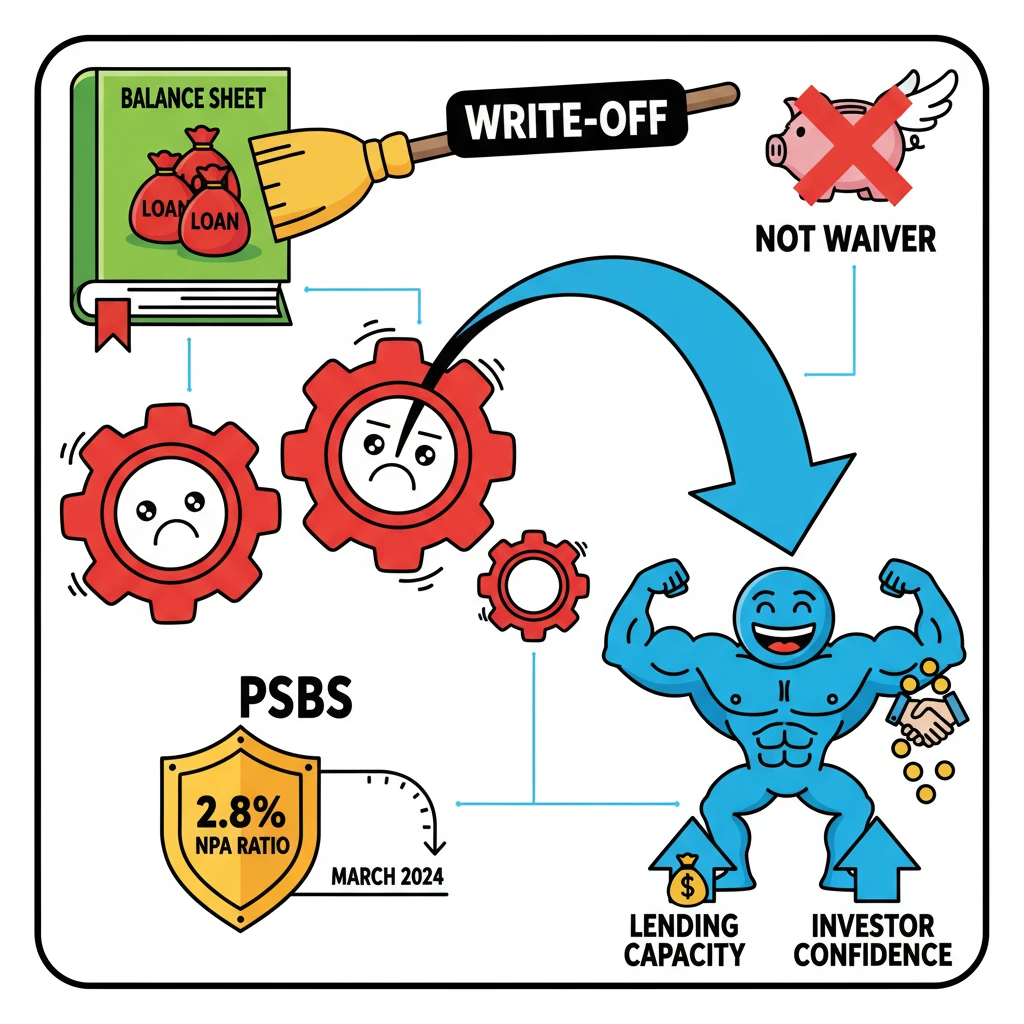

<h4>Introduction to Loan Write-Offs and NPAs</h4><p>The Indian banking sector has witnessed significant efforts to address the issue of <strong>Non-Performing Assets (NPAs)</strong>. A key strategy employed by banks, particularly <strong>Public Sector Banks (PSBs)</strong>, has been the large-scale <strong>loan write-off</strong>.</p><p>These write-offs are a crucial accounting measure aimed at cleaning up bank balance sheets and presenting a more accurate picture of their financial health. They do not, however, absolve borrowers of their repayment obligations.</p><div class='key-point-box'><p><strong>Loan write-offs</strong> refer to the removal of non-performing loans from a bank's balance sheet. This is done when the bank believes that the chances of recovery are minimal, even after sustained efforts.</p></div><h4>Impact on NPA Reduction</h4><p>The concerted efforts, including these large-scale write-offs, have yielded positive results in reducing the overall NPA burden on banks. This strategy has been implemented over the past few years, contributing to a noticeable improvement in asset quality.</p><p>As a direct consequence of these measures, banks have successfully achieved a remarkable reduction in their NPA ratio. This indicates a healthier financial position for the banking system.</p><div class='info-box'><p><strong>Significant Achievement:</strong> Banks have achieved a <strong>12-year low NPA ratio</strong> of <strong>2.8% of advances</strong> by <strong>March 2024</strong>. This marks a substantial improvement in the asset quality of Indian banks.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding <strong>loan write-offs</strong> and their impact on <strong>NPA reduction</strong> is vital for GS Paper 3 (Economy). Be prepared to discuss the mechanisms, implications, and government/RBI policies related to banking sector health.</p></div>

💡 Key Takeaways

- •Loan write-offs are an accounting measure to clean bank balance sheets, not loan waivers.

- •Large-scale write-offs have significantly reduced NPAs in Public Sector Banks (PSBs).

- •India's NPA ratio reached a 12-year low of 2.8% of advances by March 2024.

- •This improvement enhances banks' lending capacity and investor confidence.

- •Key mechanisms like IBC and SARFAESI Act complement write-offs in NPA resolution.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) Annual Reports and Financial Stability Reports

•Ministry of Finance, Government of India Publications

•Economic Survey of India