RBI to Launch Unified Lending Interface - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

RBI to Launch Unified Lending Interface

Medium⏱️ 6 min read

economy

📖 Introduction

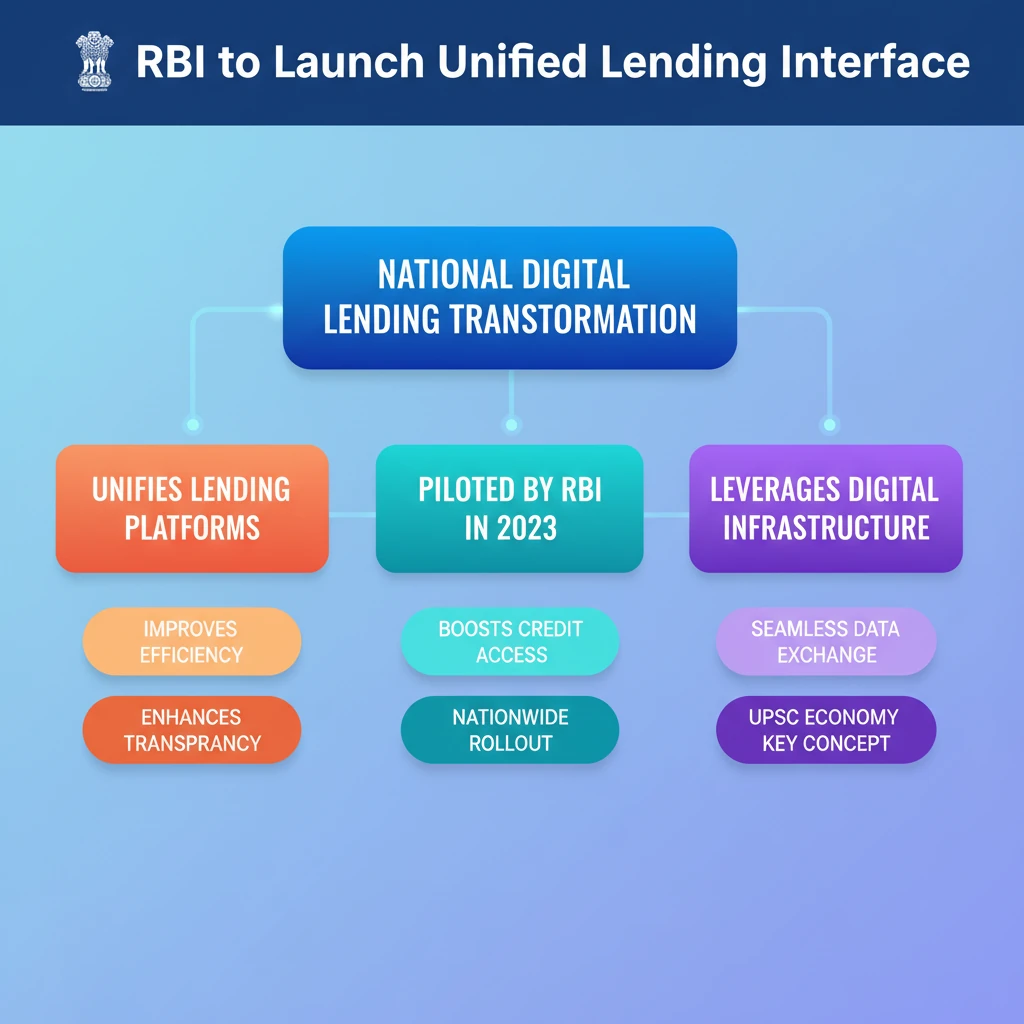

<h4>Introduction to Unified Lending Interface (ULI)</h4><p>The <strong>Reserve Bank of India (RBI)</strong> is set to introduce the <strong>Unified Lending Interface (ULI)</strong> at a national level. This initiative aims to significantly transform India's <strong>lending sector</strong> by streamlining and integrating various aspects of credit delivery.</p><div class='info-box'><p>The <strong>ULI</strong> was initially launched as a <strong>pilot project</strong> by the <strong>RBI</strong> in <strong>2023</strong>. This pilot phase allowed for testing and refinement of the interface before its broader national rollout.</p></div><h4>Objective of the ULI</h4><p>The primary objective of the <strong>ULI</strong> is to create a more efficient, transparent, and accessible lending ecosystem. By unifying various lending platforms, it seeks to reduce friction and enhance the overall experience for both borrowers and lenders.</p><div class='key-point-box'><p>The <strong>ULI</strong> is envisioned as a foundational digital public good that will facilitate seamless flow of credit information and application processes across different financial institutions.</p></div><h4>Expected Impact on the Lending Sector</h4><p>The launch of the <strong>ULI</strong> is expected to bring about several positive changes. It aims to improve credit penetration, especially for underserved segments, by making the loan application and approval process faster and more standardized.</p><div class='exam-tip-box'><p>For <strong>UPSC Mains GS-III (Economy)</strong>, understanding the <strong>ULI</strong>'s potential to foster <strong>financial inclusion</strong> and accelerate <strong>digital transformation</strong> in banking is crucial. Relate it to broader themes of government initiatives for economic growth.</p></div>

💡 Key Takeaways

- •RBI plans to launch the Unified Lending Interface (ULI) nationally.

- •ULI aims to transform India's lending sector by unifying various platforms.

- •It was piloted by the RBI in 2023.

- •Key objectives include improving efficiency, transparency, and credit access.

- •ULI leverages digital public infrastructure for seamless data exchange.

- •It is expected to boost financial inclusion and MSME credit availability.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) official statements and press releases (general knowledge base for RBI initiatives)

•Financial sector reports on digital lending and financial inclusion