FIIs to Invest in India’s Sovereign Green Bonds - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

FIIs to Invest in India’s Sovereign Green Bonds

Medium⏱️ 7 min read

economy

📖 Introduction

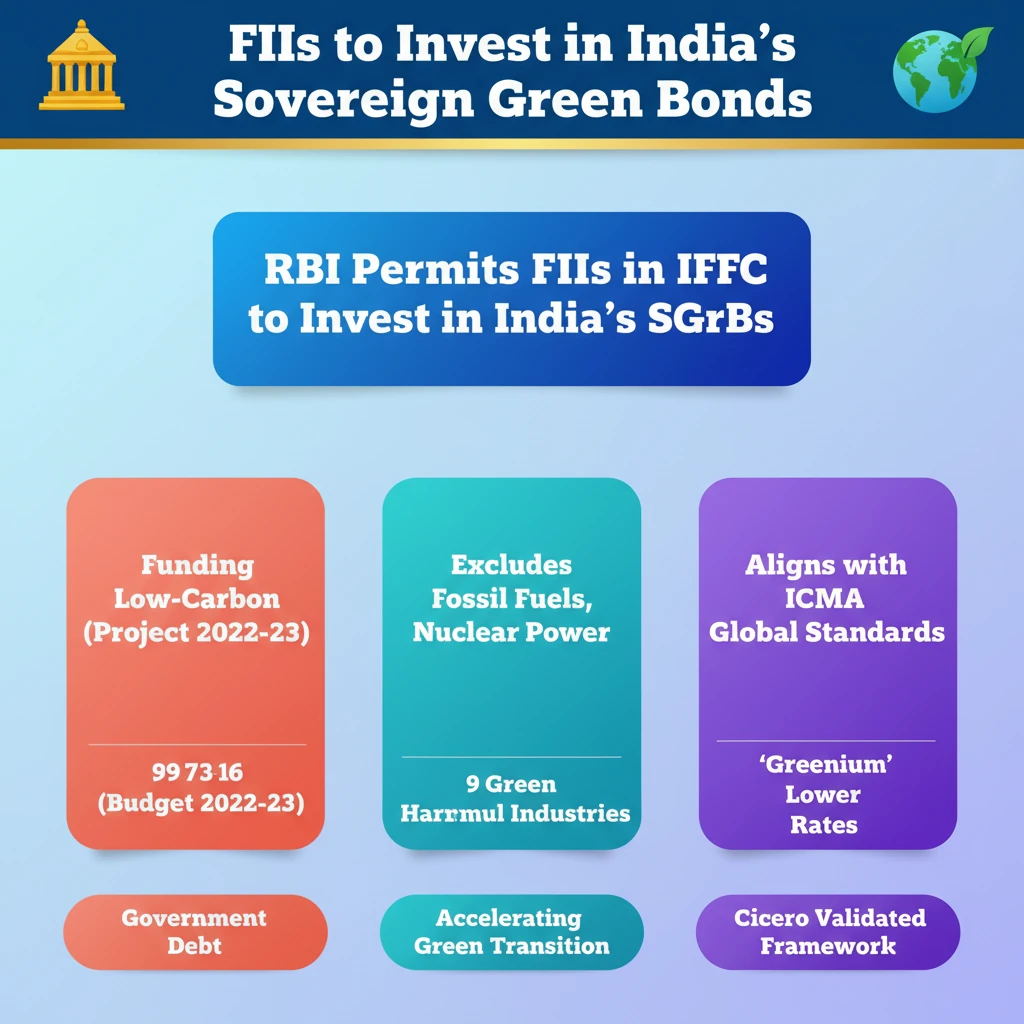

<h4>Introduction: FIIs and Sovereign Green Bonds</h4><p>The <strong>Reserve Bank of India (RBI)</strong> has made a significant decision, allowing <strong>Foreign Institutional Investors (FIIs)</strong> operating within the <strong>International Financial Services Centre (IFSC)</strong> to invest in <strong>India’s Sovereign Green Bonds (SGrBs)</strong>.</p><p>This move represents a crucial step towards securing financing for India's transition to a <strong>low-carbon economy</strong>.</p><div class='info-box'><p><strong>FIIs</strong> are <strong>institutional investors</strong> that invest in assets belonging to a different country than where their organizations are based.</p></div><div class='info-box'><p>The <strong>Securities and Exchange Board of India (SEBI)</strong> regulates <strong>FII investments</strong> in India, while the <strong>RBI</strong> is responsible for maintaining <strong>investment ceilings</strong> to manage FII participation.</p></div><h4>What are Sovereign Green Bonds (SGrBs)?</h4><p>The concept of <strong>Sovereign Green Bonds</strong> was first announced by the <strong>Finance Minister (FM)</strong> in the <strong>Union Budget 2022-23</strong>.</p><p><strong>SGrBs</strong> are a specific type of <strong>government debt</strong> designed to fund projects that accelerate India's transition to a <strong>low-carbon economy</strong>.</p><p>Funds raised through <strong>SGrBs</strong> are <strong>earmarked exclusively for green projects</strong>, ensuring high levels of <strong>transparency</strong> and <strong>accountability</strong> in their utilization.</p><p>These bonds typically offer <strong>lower interest rates</strong> compared to conventional <strong>Government Securities (G-Secs)</strong>, reflecting their alignment with broader <strong>sustainable development objectives</strong>.</p><p>Issuance of <strong>SGrBs</strong> mandates adherence to <strong>internationally recognised green standards</strong> and rigorous <strong>certification processes</strong> to ensure the credibility of the funded projects.</p><h4>Classification of SGrBs</h4><p><strong>Sovereign Green Bonds</strong> are classified under the <strong>Statutory Liquidity Ratio (SLR)</strong> framework.</p><div class='info-box'><p>The <strong>SLR</strong> is a <strong>liquidity rate</strong> stipulated by the <strong>RBI</strong> for <strong>financial institutions</strong>.</p></div><p><strong>Financial institutions</strong> are required to maintain a certain percentage of their deposits as <strong>SLR</strong> with themselves before they can lend to customers, which can impact the availability of funds for other purposes.</p><h4>Understanding 'Greenium'</h4><p><strong>SGrBs</strong> generally yield <strong>lower interest rates</strong> when compared to conventional <strong>G-Secs</strong>.</p><div class='info-box'><p>This difference in interest rates between <strong>Sovereign Green Bonds</strong> and traditional <strong>Government Securities</strong> is termed a <strong>greenium</strong>.</p></div><p>Globally, <strong>central banks</strong> and <strong>governments</strong> are actively encouraging the adoption of <strong>greeniums</strong> to support the transition towards a more <strong>environmentally sustainable future</strong>.</p><h4>India's Sovereign Green Bonds Framework</h4><p>The <strong>Finance Ministry</strong> released <strong>India’s first SGrB Framework</strong> in <strong>2022</strong>.</p><p>This comprehensive framework provides detailed guidelines on the specific types of projects that are eligible to receive funding through this class of bonds.</p><h4>Funding Projects under SGrBs</h4><p>Funds generated from <strong>SGrBs</strong> are specifically directed towards <strong>nine green project categories</strong>:</p><ul><li><strong>Renewable energy</strong> projects.</li><li>Initiatives promoting <strong>energy efficiency</strong>.</li><li>Development of <strong>clean transportation</strong> systems.</li><li>Projects focused on <strong>climate adaptation</strong>.</li><li>Strategies for <strong>sustainable water management</strong>.</li><li>Measures for <strong>pollution control</strong>.</li><li>Practices supporting <strong>sustainable land use</strong>.</li><li>Construction of <strong>green buildings</strong>.</li><li>Efforts in <strong>biodiversity conservation</strong>.</li></ul><h4>Excluded Projects</h4><p>To maintain the integrity and focus of <strong>green financing</strong>, certain types of projects are explicitly excluded from <strong>SGrB funding</strong>.</p><ul><li>Projects involving <strong>fossil fuel extraction</strong>.</li><li><strong>Nuclear power generation</strong> facilities.</li><li>Operations related to <strong>direct waste incineration</strong>.</li><li>Projects linked to the <strong>alcohol, weapons, tobacco, gaming, or palm oil industries</strong>.</li><li><strong>Renewable energy projects</strong> that utilize biomass sourced from <strong>protected areas</strong>.</li><li><strong>Landfill projects</strong>.</li><li><strong>Hydropower plants</strong> with a capacity larger than <strong>25 MW</strong>.</li></ul><h4>Credibility and Validation</h4><p>To enhance the credibility of its <strong>SGrB Framework</strong>, the <strong>Indian government</strong> sought independent validation.</p><p>This validation was provided by <strong>Cicero</strong>, a <strong>Norway-based validator</strong>.</p><div class='info-box'><p><strong>Cicero</strong> rated <strong>India’s framework</strong> as a <strong>“green medium”</strong> and assigned it a score of <strong>“good governance”</strong>.</p></div><p>This positive rating confirms the framework's strong alignment with the <strong>global green standards</strong> established by the <strong>International Capital Market Association (ICMA)</strong>.</p>

💡 Key Takeaways

- •RBI permits FIIs in IFSC to invest in India's Sovereign Green Bonds (SGrBs).

- •SGrBs are government debt issued for funding projects accelerating India's low-carbon economy transition, announced in Budget 2022-23.

- •Funds are exclusively earmarked for nine green categories, strictly excluding fossil fuel, nuclear power, and certain industries.

- •'Greenium' is the lower interest rate SGrBs offer compared to conventional Government Securities (G-Secs).

- •India's SGrB framework, validated by Norway-based Cicero, aligns with global green standards set by ICMA.

🧠 Memory Techniques

95% Verified Content