FDI and FPI: Foreign Investment Routes in India - UPSC Economy - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

FDI and FPI: Foreign Investment Routes in India - UPSC Economy

Medium⏱️ 8 min read

economy

📖 Introduction

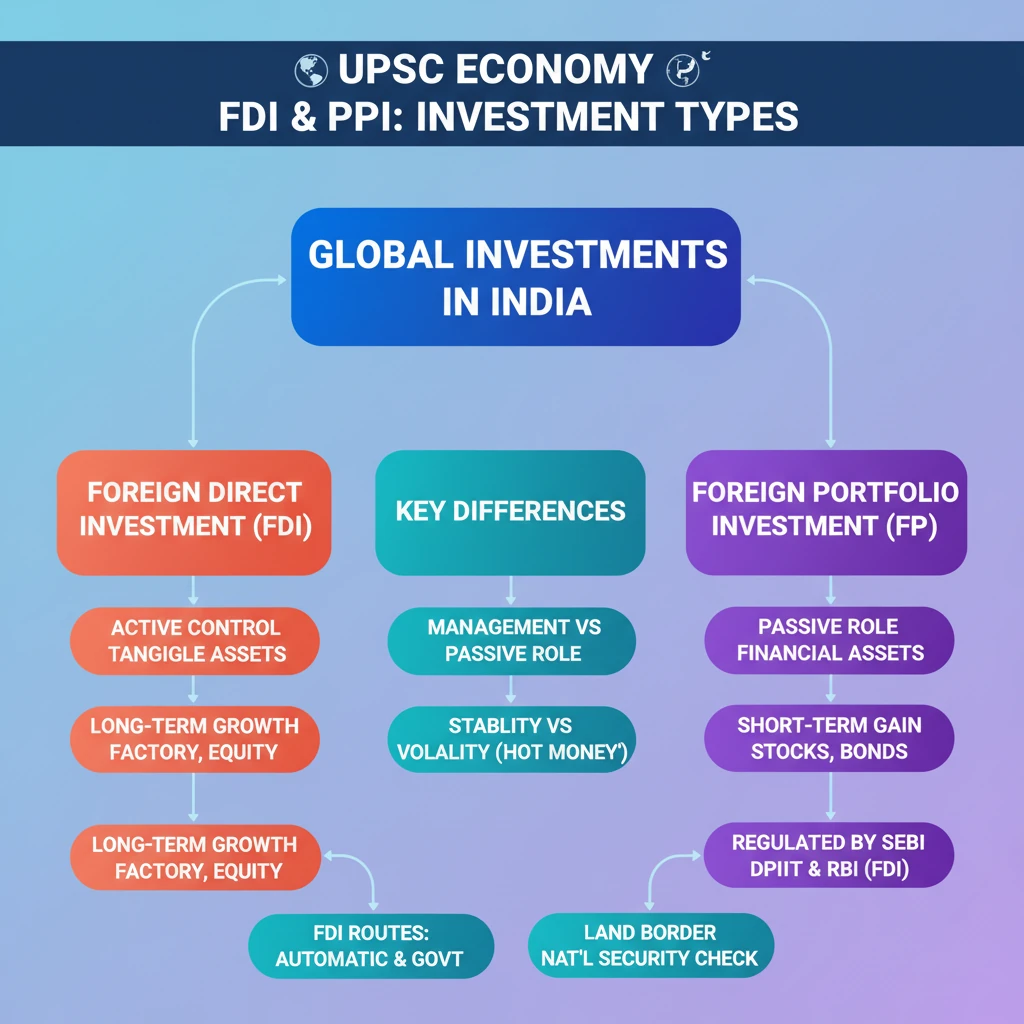

<h4>Understanding Foreign Direct Investment (FDI)</h4><p><strong>Foreign Direct Investment (FDI)</strong> refers to an investment made by a <strong>foreign entity</strong> or <strong>individual</strong> in a business or asset located in a <strong>different country</strong>. This typically involves gaining a lasting management interest and a significant degree of influence.</p><div class='key-point-box'><p>FDI implies a <strong>significant degree of control</strong> over the management of the domestic company, unlike portfolio investments which are purely financial.</p></div><h4>FDI Routes in India</h4><p>In India, FDI can be made through two primary routes, depending on the sector and investment threshold, ensuring a structured approach to foreign capital.</p><h5>Automatic Route</h5><p>Under the <strong>Automatic Route</strong>, foreign investors do <strong>not require prior approval</strong> from the Government of India or the Reserve Bank of India (RBI) for their investments.</p><p>Up to <strong>100% FDI</strong> is allowed in many non-critical sectors via this route, streamlining the investment process and promoting ease of doing business.</p><h5>Government Route</h5><p>The <strong>Government Route</strong> necessitates <strong>prior approval</strong> from the Government of India. This is mandatory for investments in certain sensitive sectors or when investment limits exceed specific thresholds, ensuring strategic oversight.</p><p>Proposals under this route are administered by the <strong>Department for Promotion of Industry and Internal Trade (DPIIT)</strong> and the <strong>RBI</strong>, which review and recommend approvals.</p><h4>Sector-Specific FDI Approvals</h4><p>FDI limits and routes vary significantly across different sectors, reflecting India's calibrated approach to foreign investment.</p><div class='info-box'><ul><li><strong>Banking (Private Sector):</strong> Up to <strong>49%</strong> via Automatic Route; above 49% and above 74% require Government approval.</li><li><strong>Defence:</strong> Up to <strong>74%</strong> via Automatic Route; above 74% requires Government approval, particularly for critical technologies.</li><li><strong>Healthcare (Brownfield):</strong> Up to <strong>74%</strong> via Automatic Route; above 74% requires Government approval, ensuring domestic control in key services.</li><li><strong>Insurance:</strong> Up to <strong>74%</strong> via Automatic Route; above 74% requires Government approval, maintaining regulatory oversight.</li></ul></div><h4>Role of Foreign Investment Promotion Board (FIPB) & FIFP</h4><p>Historically, the <strong>Foreign Investment Promotion Board (FIPB)</strong>, under the <strong>Ministry of Finance</strong>, was responsible for processing FDI proposals requiring government approval.</p><p>Although <strong>FIPB was abolished in 2017</strong>, its functions are now facilitated through the <strong>Foreign Investment Facilitation Portal (FIFP)</strong>, ensuring a single-window clearance for government-approved FDI proposals.</p><div class='key-point-box'><p><strong>Government's prior approval</strong> is mandatory for <strong>FDIs from countries sharing a land border with India</strong>. These countries include <strong>Pakistan, China, Nepal, Bhutan, Myanmar, and Afghanistan</strong>. This measure enhances national security and prevents opportunistic takeovers.</p></div><h4>Key FDI Trends in India (FY 2022-23)</h4><p>Understanding the sources and sectors attracting FDI provides crucial insight into India's economic landscape and investment priorities.</p><div class='info-box'><h5>India’s Top 5 FDI Sources (FY 2022-23):</h5><ol><li><strong>Mauritius</strong></li><li><strong>Singapore</strong></li><li><strong>USA</strong></li><li><strong>Netherlands</strong></li><li><strong>Japan</strong></li></ol></div><div class='info-box'><h5>India’s Top Sectors Attracting FDI (FY 2022-23):</h5><ol><li><strong>Service Sector</strong></li><li><strong>Computer Software & Hardware</strong></li><li><strong>Trading</strong></li><li><strong>Telecommunications</strong></li><li><strong>Automobile Industry</strong></li></ol></div><h4>Understanding Foreign Portfolio Investment (FPI)</h4><p><strong>Foreign Portfolio Investment (FPI)</strong> involves investments made by <strong>foreign individuals, institutions, or funds</strong> in the <strong>financial assets</strong> of another country.</p><p>Unlike FDI, FPI is often characterized as <strong>“Hot Money”</strong> due to its short-term nature and quick entry/exit from the market, driven by immediate returns and market sentiments.</p><h4>Important Features of FPI</h4><p>FPI has distinct characteristics that differentiate it significantly from Foreign Direct Investment.</p><div class='key-point-box'><ul><li><strong>No Ownership Control:</strong> Investors purchase financial assets <strong>without gaining ownership</strong> or significant control over the management of the underlying company.</li><li><strong>Passive Investment:</strong> It is a <strong>passive investment approach</strong>, focusing purely on financial returns rather than operational involvement or strategic influence.</li><li><strong>Returns:</strong> Investors earn returns primarily through <strong>dividends, interest payments</strong>, and <strong>capital gains</strong> from the appreciation of asset values.</li><li><strong>Examples:</strong> Common FPI instruments include publicly traded <strong>stocks, bonds, mutual funds</strong>, and other marketable securities.</li></ul></div><h4>Regulatory Body for FPI</h4><p>In India, the primary regulatory body overseeing Foreign Portfolio Investments is the <strong>Securities and Exchange Board of India (SEBI)</strong>, which ensures market integrity and investor protection.</p><h4>Key Differences Between FDI and FPI</h4><p>Understanding the fundamental distinctions between FDI and FPI is crucial for UPSC aspirants to grasp their economic implications.</p><table class='info-table'><tr><th>Features</th><th>FDI (Foreign Direct Investment)</th><th>FPI (Foreign Portfolio Investment)</th></tr><tr><td><strong>Nature of Investment</strong></td><td><strong>Long-term</strong>, strategic commitment</td><td><strong>Short-term</strong>, speculative in nature</td></tr><tr><td><strong>Objective</strong></td><td><strong>Long-term presence</strong>, operational control, and market expansion in the host country</td><td>Earning <strong>quick returns</strong> through price movements in the stock market</td></tr><tr><td><strong>Control</strong></td><td><strong>Significant control</strong> over the management and operations of the invested entity</td><td><strong>No or limited control</strong> over the management; purely financial stake</td></tr><tr><td><strong>Investments in</strong></td><td><strong>Tangible assets</strong> (e.g., factories, buildings, machinery, real estate)</td><td><strong>Financial assets</strong> (e.g., stocks, bonds, mutual funds, derivatives)</td></tr><tr><td><strong>Returns</strong></td><td><strong>Profits, Dividends</strong>, and <strong>Capital appreciation</strong> over an extended period</td><td><strong>Dividends, Interest</strong>, and <strong>Capital appreciation</strong>, often with higher volatility</td></tr><tr><td><strong>Policy Regulations</strong></td><td><strong>Strict policies</strong> and <strong>sector-specific regulations</strong>; often requires government approval for sensitive sectors</td><td><strong>Easier entry/exit</strong>; regulated by capital market authorities (e.g., SEBI) with less stringent entry barriers</td></tr><tr><td><strong>Impact on Economy</strong></td><td><strong>Sustainable technology transfer</strong>, job creation, infrastructure development, and <strong>economic growth</strong></td><td><strong>Short-term impact</strong>; primarily affects stock market performance, currency volatility, and capital market liquidity</td></tr></table>

💡 Key Takeaways

- •FDI involves active management control and long-term investment in tangible assets like factories.

- •FPI is passive, short-term investment in financial assets (stocks, bonds), often called 'hot money' due to its volatility.

- •FDI in India operates via Automatic Route (no prior approval) and Government Route (prior approval required for sensitive sectors).

- •Government approval is mandatory for FDI from countries sharing a land border with India for national security reasons.

- •SEBI regulates FPI, while DPIIT and RBI administer FDI policies and approvals.

- •FDI brings sustainable growth, technology, and jobs; FPI provides market liquidity but can lead to capital market volatility.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) official publications

•Department for Promotion of Industry and Internal Trade (DPIIT) annual reports

•Securities and Exchange Board of India (SEBI) regulations