Sovereign Gold Bonds: Benefits, Interest, & Tax Implications - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Sovereign Gold Bonds: Benefits, Interest, & Tax Implications

Medium⏱️ 8 min read

economy

📖 Introduction

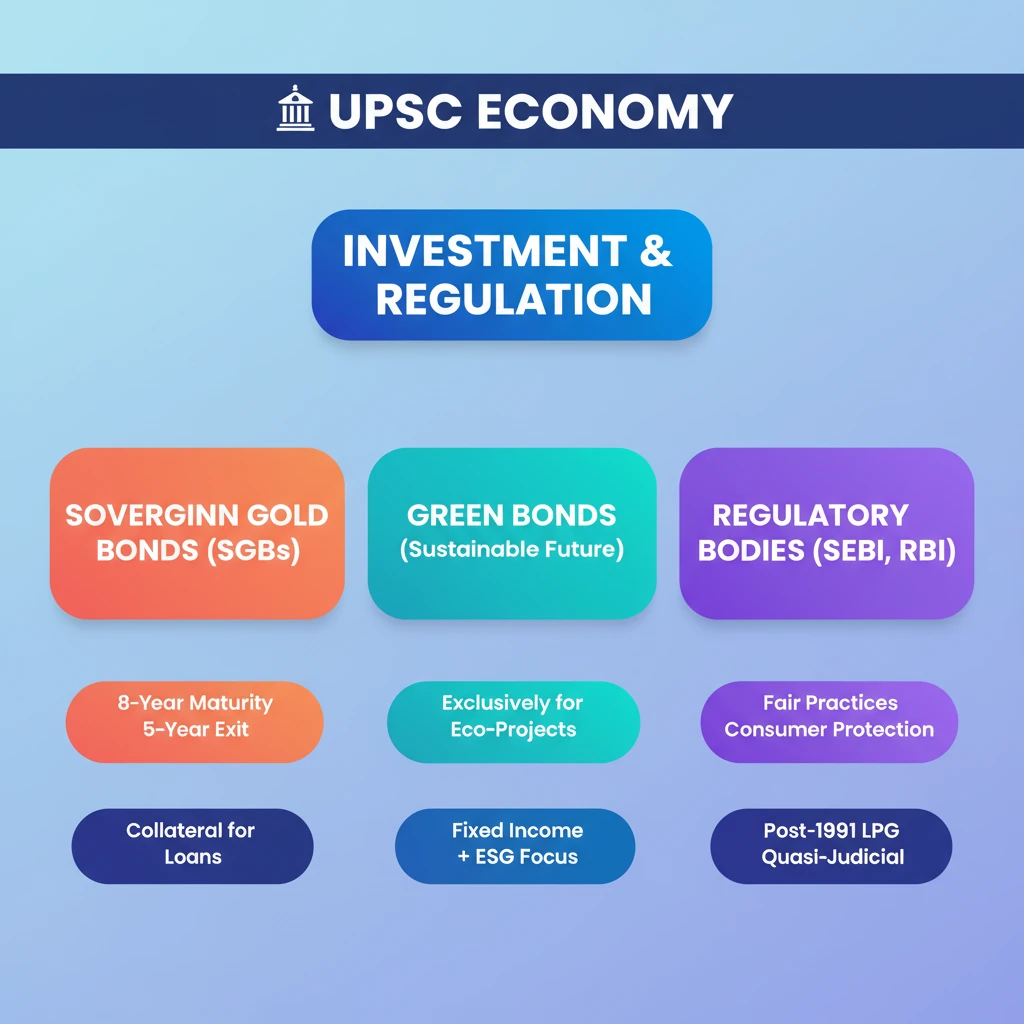

<h4>Sovereign Gold Bonds (SGBs)</h4><p><strong>Sovereign Gold Bonds (SGBs)</strong> are government securities denominated in grams of gold. They offer an alternative to holding physical gold, providing investors with the benefits of gold price appreciation without the associated storage risks and costs.</p><div class='info-box'><p>The minimum investment permitted in <strong>SGBs</strong> is <strong>1 gram of gold</strong>. For individuals and Hindu Undivided Families (HUFs), the maximum investment limit is <strong>4 kilograms</strong> per financial year. Trusts and similar entities have a higher limit of <strong>20 kilograms</strong> per financial year.</p><p><strong>SGBs</strong> have a maturity period of <strong>eight years</strong>. Investors are provided with an option to exit the investment after the first <strong>five years</strong>, aligning with long-term investment horizons.</p><p>The scheme offers a fixed annual interest rate of <strong>2.5%</strong>, which is payable semi-annually. The interest earned on <strong>Gold Bonds</strong> is taxable according to the provisions of the <strong>Income Tax Act, 1961</strong>.</p></div><h4>Benefits of Investing in SGBs</h4><p>One significant advantage of <strong>SGBs</strong> is their utility as a financial instrument. They can be readily used as <strong>collateral for loans</strong>, offering liquidity to investors when needed.</p><p>Another key benefit for individual investors is the exemption from <strong>capital gains tax</strong> upon the redemption of <strong>SGBs</strong>. This makes them a tax-efficient investment option compared to physical gold.</p><div class='info-box'><p><strong>Redemption</strong> refers to the issuer repurchasing a bond at or before its maturity date. In the context of <strong>SGBs</strong>, it's when the government buys back the bond.</p><p><strong>Capital gain</strong> is the profit realized when the selling price of an asset, such as stocks, bonds, or real estate, exceeds its original purchase price. For <strong>SGBs</strong>, this profit is tax-exempt for individuals at redemption.</p></div><h4>Disadvantages of Investing in SGBs</h4><p>Despite their benefits, <strong>SGBs</strong> have certain drawbacks. They are designed as a <strong>long-term investment</strong>, which differs from physical gold that can be sold immediately for instant liquidity.</p><p>Although <strong>SGBs</strong> are listed on stock exchanges for secondary market trading, the <strong>trading volumes are relatively low</strong>. This can make it challenging for investors to exit their investment before the maturity period of eight years, or even before the five-year exit option.</p><h4>Green Bonds</h4><p><strong>Green bonds</strong> are a specific type of debt instrument. They are issued by companies, countries, and multilateral organizations with a unique purpose: to exclusively fund projects that yield positive <strong>environmental or climate benefits</strong>.</p><p>These bonds provide investors with <strong>fixed income payments</strong>, similar to conventional bonds, while simultaneously contributing to sustainable development initiatives.</p><div class='info-box'><p>The Indian government has demonstrated its commitment to sustainable finance. It plans to issue <strong>sovereign green bonds</strong> worth approximately <strong>Rs 20,000 crore</strong> in the financial year <strong>2024-25</strong>, signaling a growing focus on green initiatives.</p></div><h4>Strengthening Regulatory Bodies</h4><p>Experts have emphasized the importance of evaluating the impact of <strong>regulatory bodies</strong>, such as the <strong>Securities and Exchange Board of India (SEBI)</strong>. This assessment is crucial for incorporating their effects into effective decision-making processes.</p><p>There is a strong argument that regulatory bodies should provide <strong>clear explanations for their decisions</strong>. This transparency is vital to ensure that all stakeholders feel satisfied, not only with the reality of the decisions but also with their perception of fairness and clarity.</p><h4>What are Regulatory Bodies?</h4><div class='info-box'><p><strong>Regulatory bodies</strong> are organizations specifically established to monitor and regulate particular sectors of the economy. Their primary role is to ensure <strong>fair practices</strong>, promote market integrity, and protect the broader <strong>public interests</strong>.</p></div><p>Following the <strong>1991 Liberalization, Privatization, and Globalization (LPG) reforms</strong> in India, numerous authorities were formed. Their objective was to prevent monopolies and regulate critical sectors like banking, insurance, and capital markets, fostering a competitive and orderly environment.</p><p>Most regulatory bodies in India operate with a <strong>quasi-judicial nature</strong>. This means they possess powers similar to a court in specific areas, allowing them to adjudicate disputes and enforce regulations within their jurisdiction.</p><h4>Types of Regulatory Bodies</h4><ul><li><strong>Statutory regulatory bodies:</strong> These are established by an Act of Parliament or a State Legislature. An example is the <strong>Securities and Exchange Board of India (SEBI)</strong>.</li><li><strong>Self-regulatory bodies:</strong> These are organizations that regulate their own members or a specific profession. An example is the <strong>Bar Council of India</strong>, which governs legal professionals.</li></ul><h4>Need for Regulatory Bodies</h4><ul><li><strong>Protecting Consumer Interests:</strong> They enforce standards and ensure fair practices, such as <strong>FSSAI</strong> for food safety and <strong>TRAI</strong> for telecom pricing.</li><li><strong>Setting Health and Safety Standards:</strong> Bodies like the <strong>CPCB</strong> (Central Pollution Control Board) establish norms for environmental protection.</li><li><strong>Market Integrity:</strong> They prevent fraud and promote healthy competition, exemplified by <strong>SEBI</strong> for financial markets and the <strong>CCI</strong> (Competition Commission of India) for fair competition.</li><li><strong>Economic Growth:</strong> Regulatory bodies support sectoral growth, with <strong>RBI</strong> ensuring financial health and <strong>IRDAI</strong> regulating the insurance sector to attract investments.</li><li><strong>Legal Compliance:</strong> They uphold laws and promote transparency, with bodies like the <strong>CVC</strong> (Central Vigilance Commission) and <strong>ED</strong> (Enforcement Directorate) ensuring adherence to legal frameworks.</li><li><strong>Ethical Standards:</strong> They regulate professional ethics, as seen with the <strong>Bar Council of India</strong> for legal professionals.</li></ul><h4>Examples of Regulatory Bodies in India</h4><p>India has over <strong>30 regulatory bodies</strong>. Some prominent examples include:</p><ul><li><strong>Reserve Bank of India (RBI):</strong> Oversees credit supply, banking operations, and ensures overall financial stability of the nation.</li><li><strong>Securities and Exchange Board of India (SEBI):</strong> Regulates the securities market, ensures fair practices, and protects the interests of investors.</li><li><strong>Insurance Regulatory and Development Authority of India (IRDAI):</strong> Regulates the insurance sector, ensuring fairness in practices and robust consumer protection.</li><li><strong>Ministry of Corporate Affairs (MCA):</strong> Primarily regulates corporate governance and safeguards the interests of various stakeholders in the corporate sector.

💡 Key Takeaways

- •Sovereign Gold Bonds (SGBs) offer a secure, interest-bearing, and tax-exempt alternative to physical gold for individuals.

- •SGBs have an eight-year maturity with a five-year exit option and can be used as collateral for loans.

- •Green Bonds exclusively fund environmentally beneficial projects, providing fixed income to investors while promoting sustainability.

- •Regulatory Bodies like SEBI, RBI, and IRDAI are crucial for ensuring fair practices, protecting consumer interests, and maintaining market integrity.

- •Post-1991 LPG reforms led to the establishment of numerous quasi-judicial regulatory bodies to govern various economic sectors.

- •Strengthening regulatory transparency and accountability is vital for stakeholder satisfaction and effective decision-making.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) website for Sovereign Gold Bond scheme details

•Securities and Exchange Board of India (SEBI) website for regulatory functions

•Ministry of Finance documents for Green Bonds