National Bank for Financing Infrastructure and Development - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

National Bank for Financing Infrastructure and Development

Medium⏱️ 8 min read

economy

📖 Introduction

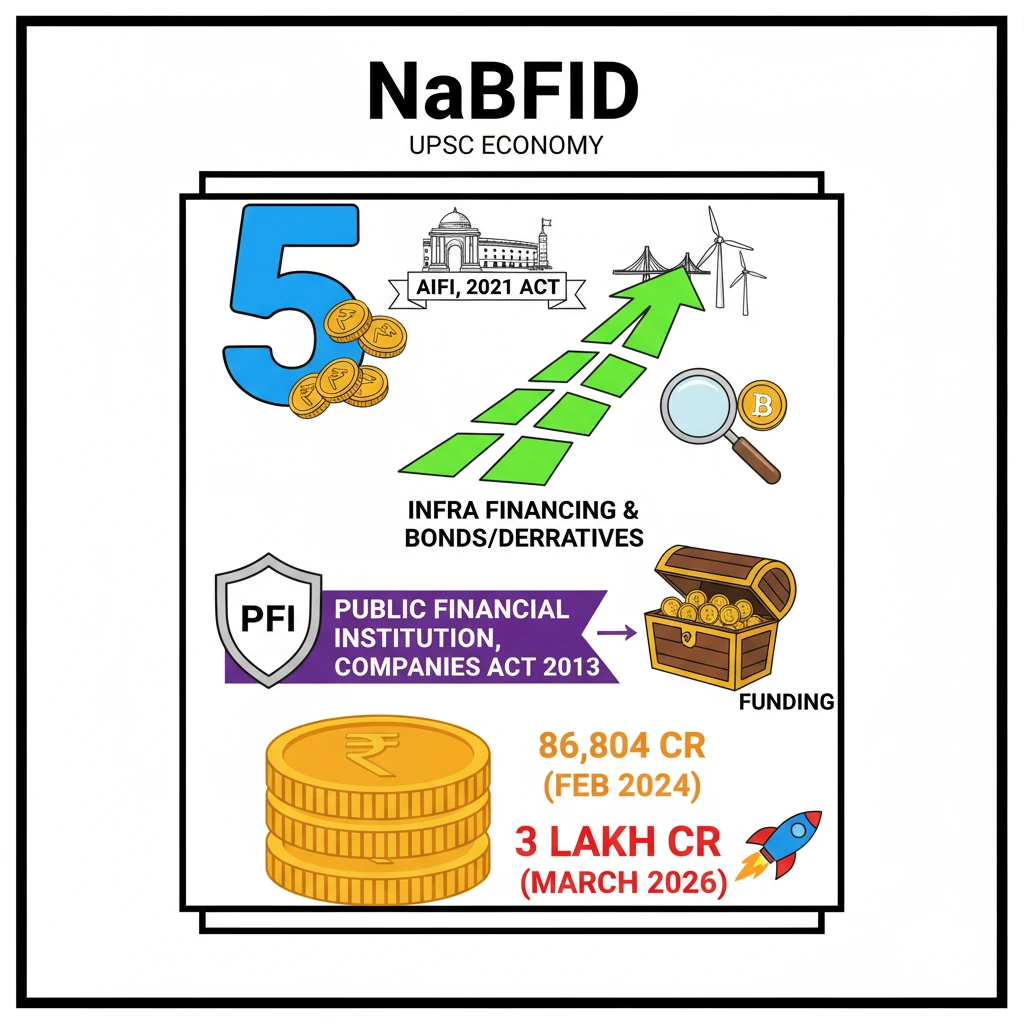

<h4>Introduction to NaBFID</h4><p>The <strong>National Bank for Financing Infrastructure and Development (NaBFID)</strong> has been officially designated as a <strong>“public financial institution”</strong>. This notification was issued by the <strong>Government of India</strong> in collaboration with the <strong>Reserve Bank of India (RBI)</strong>.</p><p>The primary objective behind establishing <strong>NaBFID</strong> and granting it this status is to significantly enhance <strong>infrastructure financing</strong> capabilities across the country.</p><h4>Establishment and Core Mandate</h4><p><strong>NaBFID</strong> was formally established in <strong>2021</strong> under the specific legislation of the <strong>National Bank for Financing Infrastructure and Development Act, 2021</strong>. It holds the crucial position as <strong>India’s fifth All India Financial Institution (AIFI)</strong>.</p><div class='info-box'><p><strong>Key Mandate of NaBFID:</strong></p><ul><li>To support <strong>long-term infrastructure financing</strong>.</li><li>To facilitate the development of <strong>bonds and derivatives markets</strong>, crucial for robust infrastructure funding.</li></ul></div><h4>Status as Public Financial Institution</h4><p>The designation of <strong>NaBFID</strong> as a <strong>“public financial institution”</strong> falls under the ambit of the <strong>Companies Act, 2013</strong>. This legal classification is pivotal for its operational framework and regulatory compliance.</p><div class='info-box'><p><strong>About the Companies Act, 2013:</strong></p><ul><li>It governs the <strong>incorporation</strong>, <strong>responsibilities</strong>, <strong>directors</strong>, and <strong>dissolution</strong> of companies in India.</li><li>This Act partially superseded the earlier <strong>Companies Act, 1956</strong>, introducing modern corporate governance principles.</li></ul></div><h4>Impact of the Notification</h4><p>The official notification significantly bolsters <strong>NaBFID’s capacity</strong> to provide funding for <strong>large-scale infrastructure projects</strong>. This move is a strategic step towards strengthening India's overall <strong>national infrastructure finance system</strong>.</p><div class='key-point-box'><p><strong>Enhanced Capacity:</strong> The "public financial institution" status grants NaBFID greater flexibility and authority in mobilizing and deploying capital for critical infrastructure development.</p></div><h4>Key Achievements and Future Outlook</h4><p>As of <strong>February 2024</strong>, <strong>NaBFID</strong>, functioning as a specialized <strong>Development Finance Institution (DFI)</strong>, has already made substantial progress. It has sanctioned over <strong>Rs 86,804 crore</strong> for various infrastructure projects nationwide.</p><p>A notable characteristic of these sanctions is their long tenure, with <strong>50%</strong> of the approved funds having repayment periods ranging from <strong>20 to 50 years</strong>. This long-term commitment is vital for infrastructure development.</p><div class='info-box'><p><strong>Future Targets:</strong> <strong>NaBFID</strong> aims to sanction over <strong>Rs 3 lakh crore</strong> for infrastructure projects by <strong>March 2026</strong>, indicating ambitious growth plans.</p></div><h4>NaBFID's Role as an All India Financial Institution (AIFI)</h4><p>As the <strong>fifth AIFI</strong>, <strong>NaBFID</strong> joins a select group of institutions critical for India's financial architecture. These institutions play specialized roles in economic development.</p><div class='info-box'><p><strong>Other Noted AIFIs (as per source):</strong></p><ul><li><strong>Export-Import Bank of India (EXIM Bank)</strong></li></ul></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the roles and mandates of <strong>All India Financial Institutions (AIFIs)</strong> is crucial for <strong>GS Paper III (Indian Economy)</strong>. Questions often revolve around their functions, impact on specific sectors, and their evolution.</p></div>

💡 Key Takeaways

- •NaBFID is India's fifth AIFI, established in 2021 by an Act of Parliament.

- •It is a specialized DFI focused on long-term infrastructure financing and developing bonds/derivatives markets.

- •Notified as a 'public financial institution' under the Companies Act, 2013, enhancing its funding capacity.

- •Sanctioned over Rs 86,804 crore by Feb 2024, with a target of Rs 3 lakh crore by March 2026.

- •Aims to bridge the infrastructure financing gap and de-risk commercial banks.

🧠 Memory Techniques

95% Verified Content