What is the Divisible Pool of Taxes? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is the Divisible Pool of Taxes?

Medium⏱️ 8 min read

economy

📖 Introduction

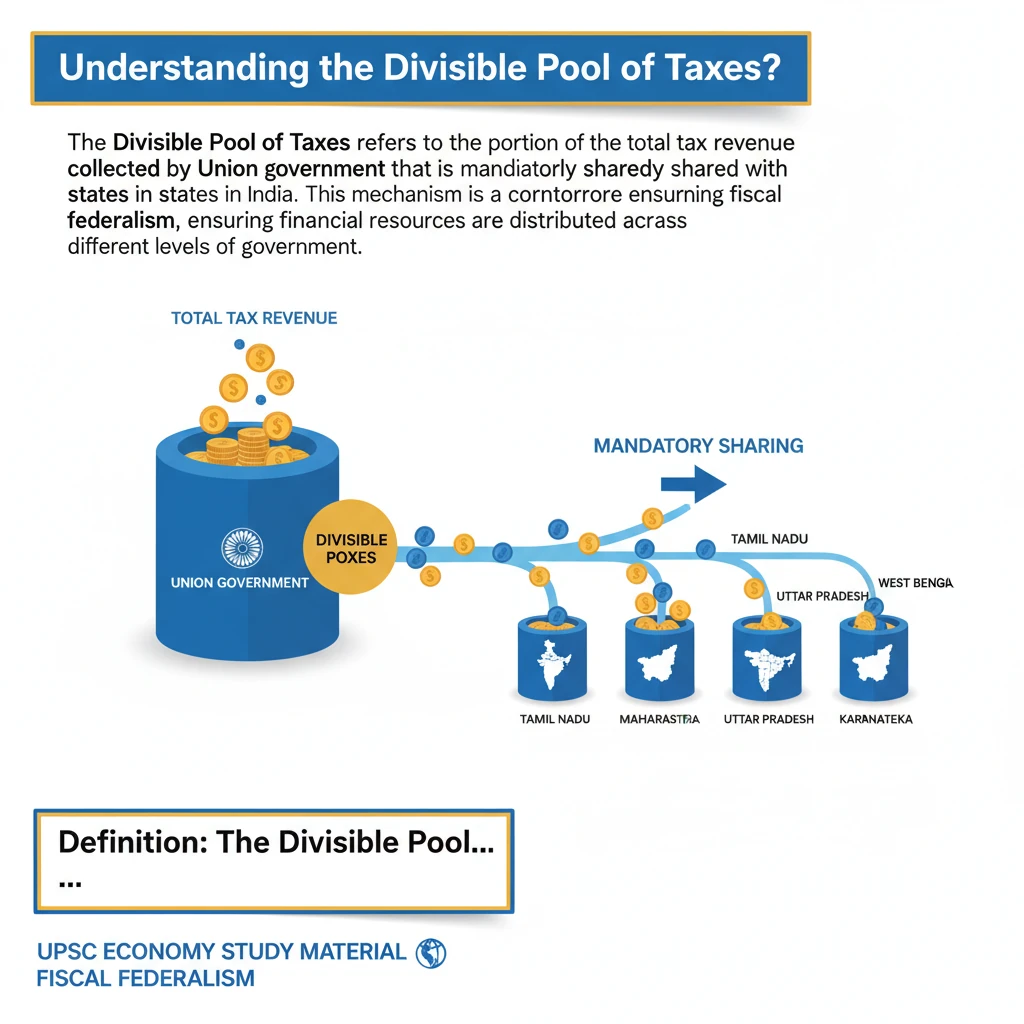

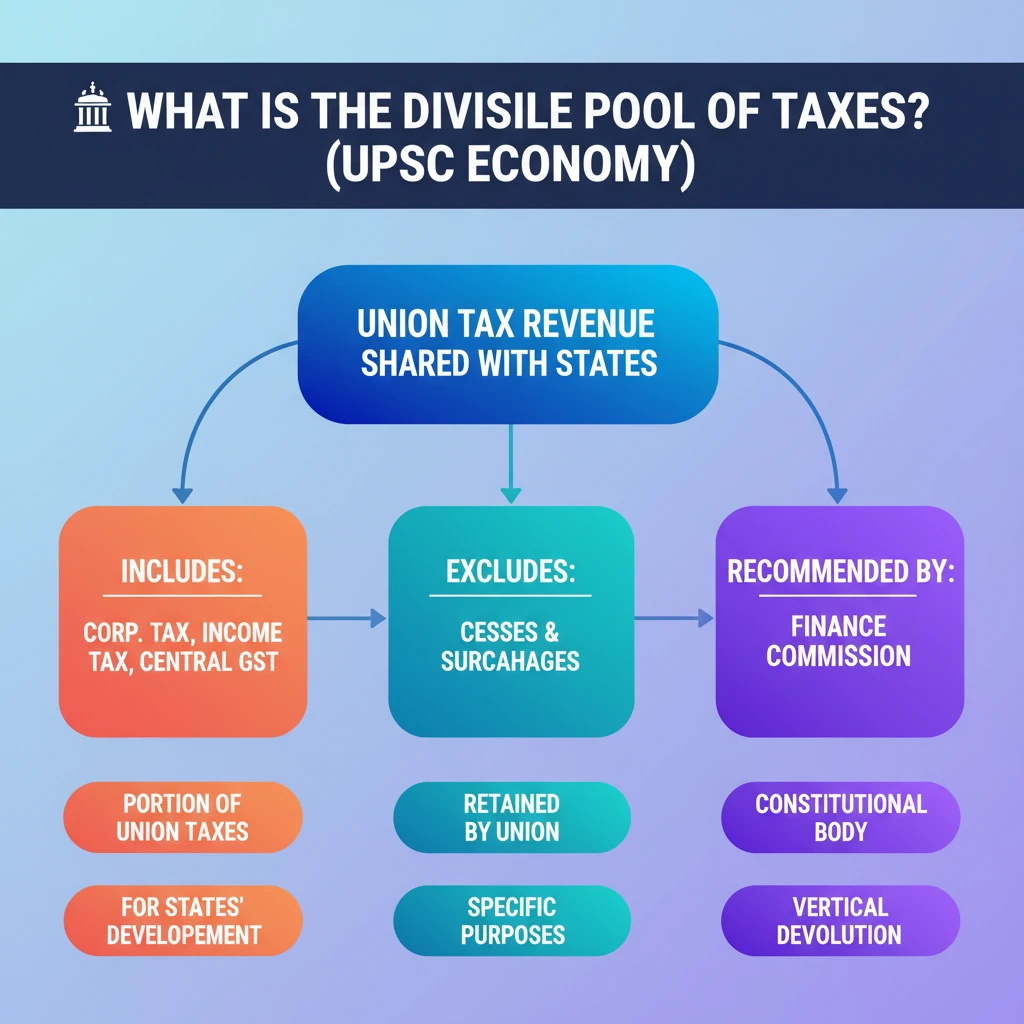

<h4>Understanding the Divisible Pool of Taxes</h4><p>The <strong>Divisible Pool of Taxes</strong> refers to the portion of the total tax revenue collected by the <strong>Union government</strong> that is mandatorily shared with the <strong>states</strong> in India. This mechanism is a cornerstone of <strong>fiscal federalism</strong>, ensuring financial resources are distributed across different levels of government.</p><div class='info-box'><p><strong>Definition:</strong> The <strong>Divisible Pool</strong> is the aggregate of certain taxes collected by the Union, earmarked for sharing with states as per constitutional provisions and Finance Commission recommendations.</p></div><h4>Key Components of the Divisible Pool</h4><p>The divisible pool primarily includes major tax revenues collected by the <strong>Union government</strong>. These are significant sources of income that contribute to both central and state exchequers.</p><ul><li><strong>Corporation Tax:</strong> Tax levied on the net income or profit of corporate entities.</li><li><strong>Personal Income Tax:</strong> Tax levied on the income of individuals.</li><li><strong>Central Goods and Services Tax (GST):</strong> A consumption tax levied on the supply of goods and services, shared between the Centre and states.</li></ul><div class='key-point-box'><p>These taxes form the core of the shared revenue, enabling states to fund their developmental and administrative expenditures.</p></div><h4>Role of the Finance Commission</h4><p>The distribution of the <strong>Divisible Pool of Taxes</strong> is not arbitrary. It is based on the meticulous recommendations of the <strong>Finance Commission</strong>, a constitutional body constituted every <strong>five years</strong> by the President of India.</p><p>The <strong>Finance Commission</strong> plays a crucial role in balancing the financial needs and resources of the Union and the States, ensuring an equitable distribution of funds.</p><div class='exam-tip-box'><p>UPSC often asks about the <strong>Finance Commission's mandate</strong> and its impact on <strong>Centre-State financial relations</strong>. Understanding its role in the Divisible Pool is vital.</p></div><h4>Vertical Devolution Explained</h4><p><strong>Vertical Devolution</strong> refers to the proportion of the <strong>Divisible Pool</strong> that is allocated between the <strong>Union government</strong> and the <strong>States</strong> collectively. It determines how much of the total shared tax revenue goes to the Centre and how much is available for distribution among all states.</p><p>For instance, if the Finance Commission recommends <strong>41%</strong> of the Divisible Pool for states, this <strong>41%</strong> represents the vertical devolution share for all states combined.</p><h4>Horizontal Devolution Explained</h4><p>Once the states' collective share (vertical devolution) is determined, <strong>Horizontal Devolution</strong> dictates how this share is distributed among the <strong>individual states</strong>. This distribution is based on various criteria recommended by the <strong>Finance Commission</strong>.</p><p>Factors typically considered for <strong>horizontal devolution</strong> include <strong>population</strong>, <strong>income disparity</strong> (often measured by per capita income), <strong>area</strong>, <strong>forest and ecology</strong>, <strong>demographic performance</strong>, and <strong>tax efforts</strong> made by the states.</p><div class='key-point-box'><p><strong>Horizontal devolution</strong> aims to address regional imbalances and incentivize fiscal prudence among states.</p></div><h4>Exclusions from the Divisible Pool</h4><p>It is important to note that not all central government revenues are part of the <strong>Divisible Pool</strong>. Specifically, <strong>Cesses</strong> and <strong>Surcharges</strong> levied by the Union government are explicitly excluded from this sharing mechanism.</p><p>These revenues are retained entirely by the <strong>Union government</strong>, often earmarked for specific purposes or for meeting urgent expenditure needs. This exclusion can sometimes be a point of contention between the Centre and states.</p>

💡 Key Takeaways

- •Divisible Pool: Portion of Union tax revenue shared with states.

- •Includes: Corporation Tax, Personal Income Tax, Central GST.

- •Excludes: Cesses and Surcharges (retained by Union).

- •Finance Commission: Constitutional body recommending distribution every five years.

- •Vertical Devolution: Union vs. States' collective share.

- •Horizontal Devolution: Distribution among individual states based on criteria (e.g., income distance, population, area, tax effort).

- •Crucial for fiscal federalism and state financial autonomy.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•The Constitution of India (Articles 270, 280)

•Reports of the 15th Finance Commission

•Ministry of Finance, Government of India publications