Scheme of Special Assistance to States for Capital Investment - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Scheme of Special Assistance to States for Capital Investment

Medium⏱️ 7 min read

economy

📖 Introduction

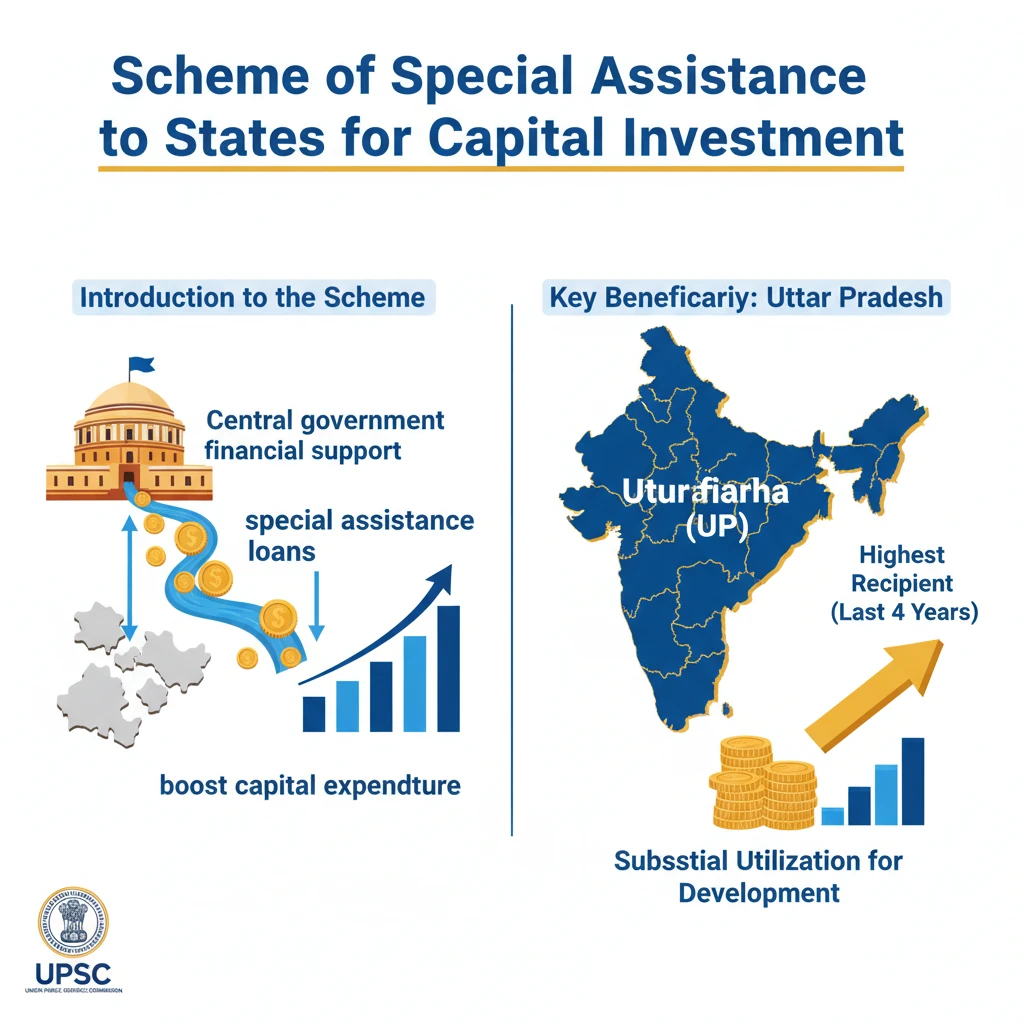

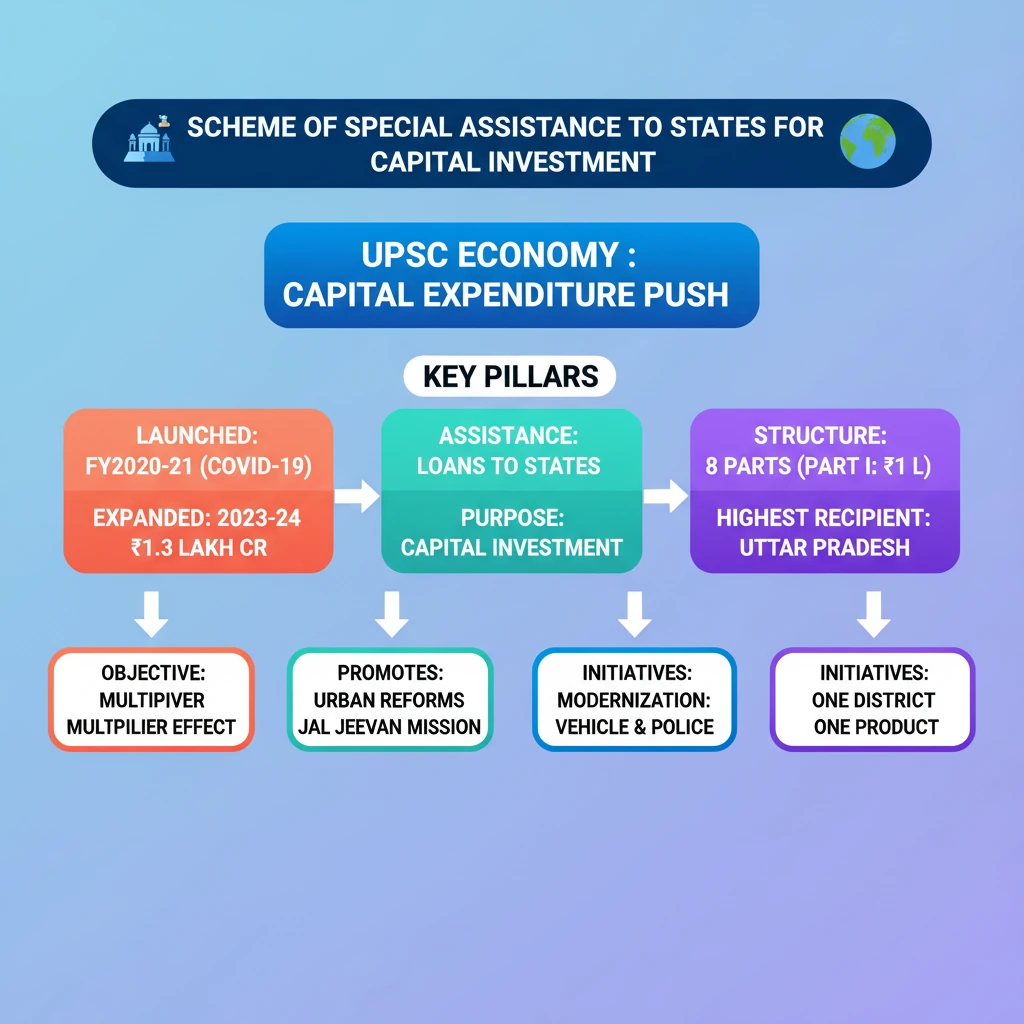

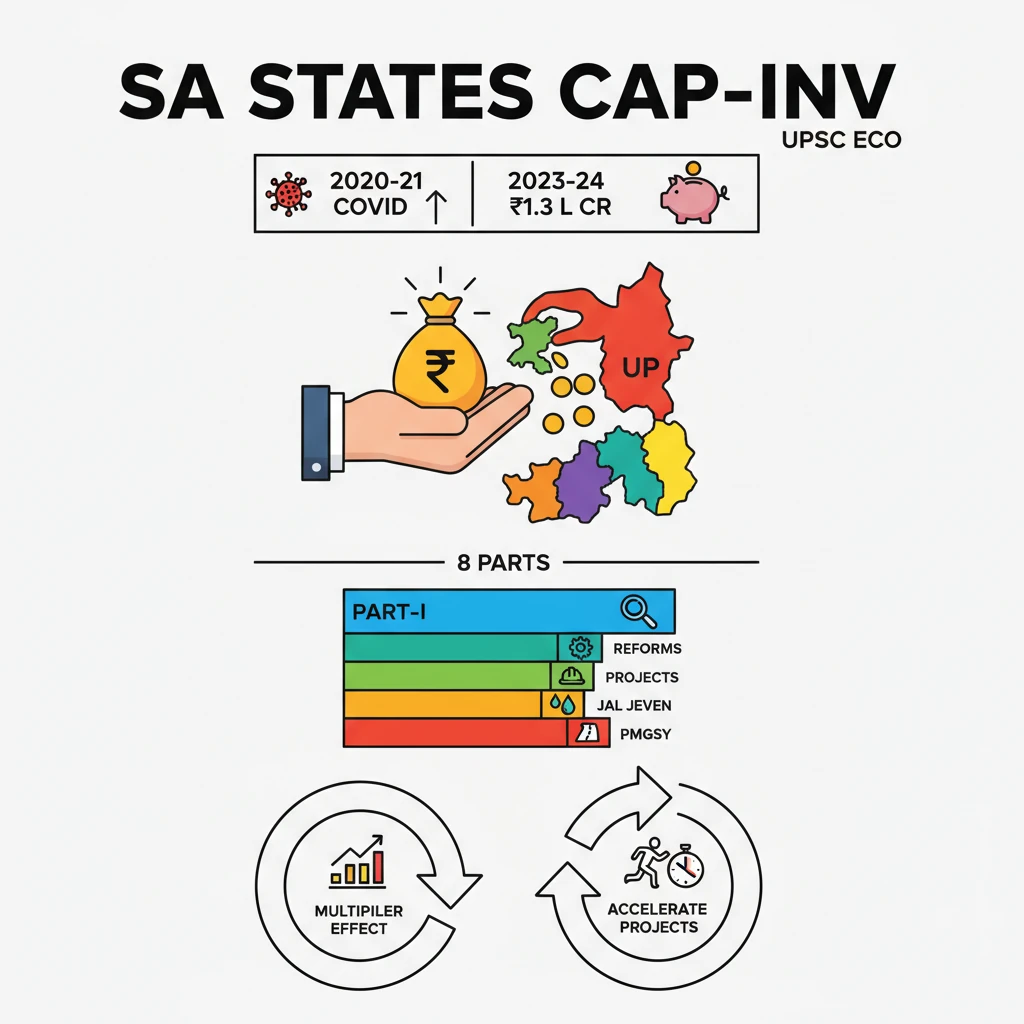

<h4>Introduction to the Scheme</h4><p>The <strong>Scheme of Special Assistance to States for Capital Investment</strong> is a significant initiative by the Central government. It provides financial support to states in the form of <strong>special assistance loans</strong> to boost capital expenditure.</p><p>Over the last four years, <strong>Uttar Pradesh (UP)</strong> has emerged as the highest recipient under this scheme, reflecting its substantial utilization of these funds for development.</p><div class='info-box'><p><strong>Total Allocation:</strong> Rs 1,67,518.6 crore (over four years)</p><p><strong>Highest Recipient:</strong> Uttar Pradesh (UP)</p></div><h4>About the Scheme of Special Assistance to States for Capital Investment</h4><p>This scheme was initially launched in <strong>FY 2020-21</strong>. Its inception was a direct response to the economic challenges posed by the <strong>Covid-19 Pandemic</strong>, aiming to stimulate economic activity through increased capital spending.</p><p>Recognizing its effectiveness, the scheme was expanded and continued as the <strong>‘Scheme for Special Assistance to States for Capital Investment 2023-24’</strong>. This expansion came with a substantial allocation, underscoring its importance in the national economic strategy.</p><div class='info-box'><p><strong>Launch Year:</strong> FY 2020-21</p><p><strong>Context:</strong> Post-Covid-19 Pandemic economic recovery</p><p><strong>Current Allocation (2023-24):</strong> Rs 1.3-lakh crore</p></div><h4>Structure and Parts of the Scheme</h4><p>The scheme is meticulously structured into <strong>eight distinct parts</strong>, each targeting specific areas of capital investment or linked to crucial reforms. This multi-pronged approach ensures comprehensive development.</p><p><strong>Part-I</strong> constitutes the largest component of the scheme, commanding an allocation of <strong>Rs 1 lakh crore</strong>. This significant portion is likely directed towards broad-based infrastructure development and capital projects.</p><div class='key-point-box'><p><strong>Key Principle:</strong> Other parts of the scheme are either linked to specific <strong>reforms</strong> or designed for <strong>sector-specific projects</strong>, promoting targeted development and policy changes.</p></div><ul><li><strong>Part-II:</strong> Focuses on initiatives related to environmental sustainability and modernization, specifically supporting the <strong>scrapping of old vehicles</strong> and the establishment of <strong>automated vehicle testing facilities</strong>.</li><li><strong>Part-III and IV:</strong> Provide crucial <strong>incentives to states</strong> for undertaking reforms in critical urban sectors, specifically <strong>urban planning</strong> and <strong>urban finance</strong>.</li><li><strong>Part-V:</strong> Addresses social infrastructure by providing funds aimed at <strong>increasing the housing stock for police personnel and their families</strong>, enhancing welfare and operational efficiency.</li><li><strong>Part-VI:</strong> Supports national strategic visions such as <strong>national integration</strong>, promoting indigenous manufacturing through <strong>Make in India</strong>, and fostering local economies via the <strong>One District One Product</strong> initiative.</li><li><strong>Part-VII:</strong> Allocates <strong>Rs. 5,000 crore</strong> as general financial assistance to states, providing flexibility for various capital expenditure needs.</li></ul><h4>Objectives and Economic Impact</h4><p>A primary objective of the scheme is to generate a <strong>higher multiplier effect on the economy</strong>. Capital investments are known to stimulate demand, create employment, and boost overall economic growth more effectively than revenue expenditure.</p><p>The scheme also specifically aims to accelerate the pace of projects in vital sectors. It achieves this by providing funds to states to meet their <strong>state share</strong> requirements for flagship national programs.</p><ul><li><strong>Key Sectors Supported:</strong> The scheme provides crucial financial backing for accelerated implementation of projects under the <strong>Jal Jeevan Mission</strong> and the <strong>Pradhan Mantri Gram Sadak Yojana</strong>.</li></ul><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understand the <strong>fiscal federalism</strong> aspect of this scheme. It's an example of how the Centre incentivizes states for capital expenditure, which is crucial for long-term economic growth and infrastructure development. Relate it to the concept of <strong>'crowding in' private investment</strong>.</p></div>

💡 Key Takeaways

- •Launched in FY 2020-21 due to Covid-19, expanded in 2023-24 with Rs 1.3-lakh crore allocation.

- •Provides special assistance (loan) to states for capital investment; UP is the highest recipient.

- •Structured into eight parts; Part-I (Rs 1 lakh crore) is largest, others linked to reforms or sector-specific projects.

- •Objectives: higher multiplier effect on economy, accelerate projects like Jal Jeevan Mission and PMGSY.

- •Promotes urban reforms, vehicle modernization, police housing, national integration, Make in India, and One District One Product.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Ministry of Finance, Government of India (for scheme details and allocations)

•Economic Survey of India (for context on capital expenditure and multiplier effect)