Features of the SGrB - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Features of the SGrB

Medium⏱️ 8 min read

economy

📖 Introduction

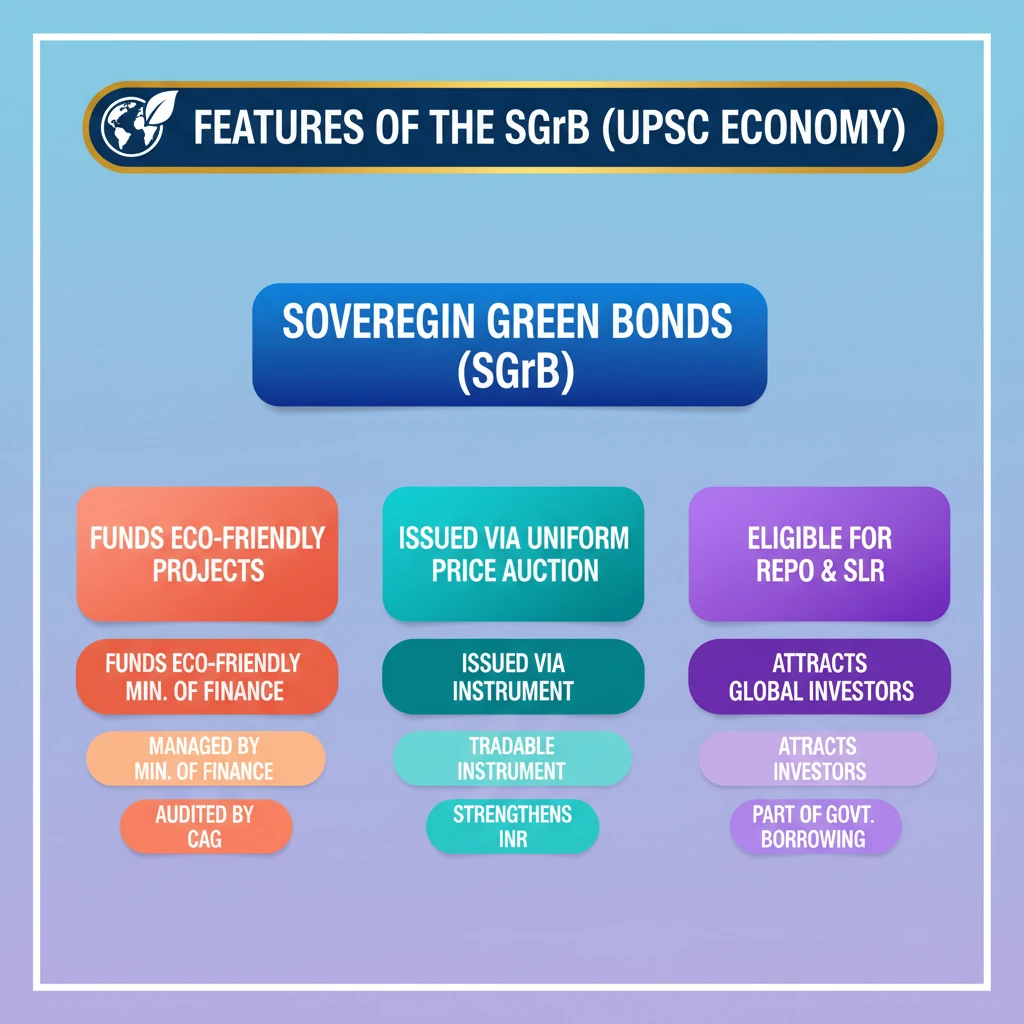

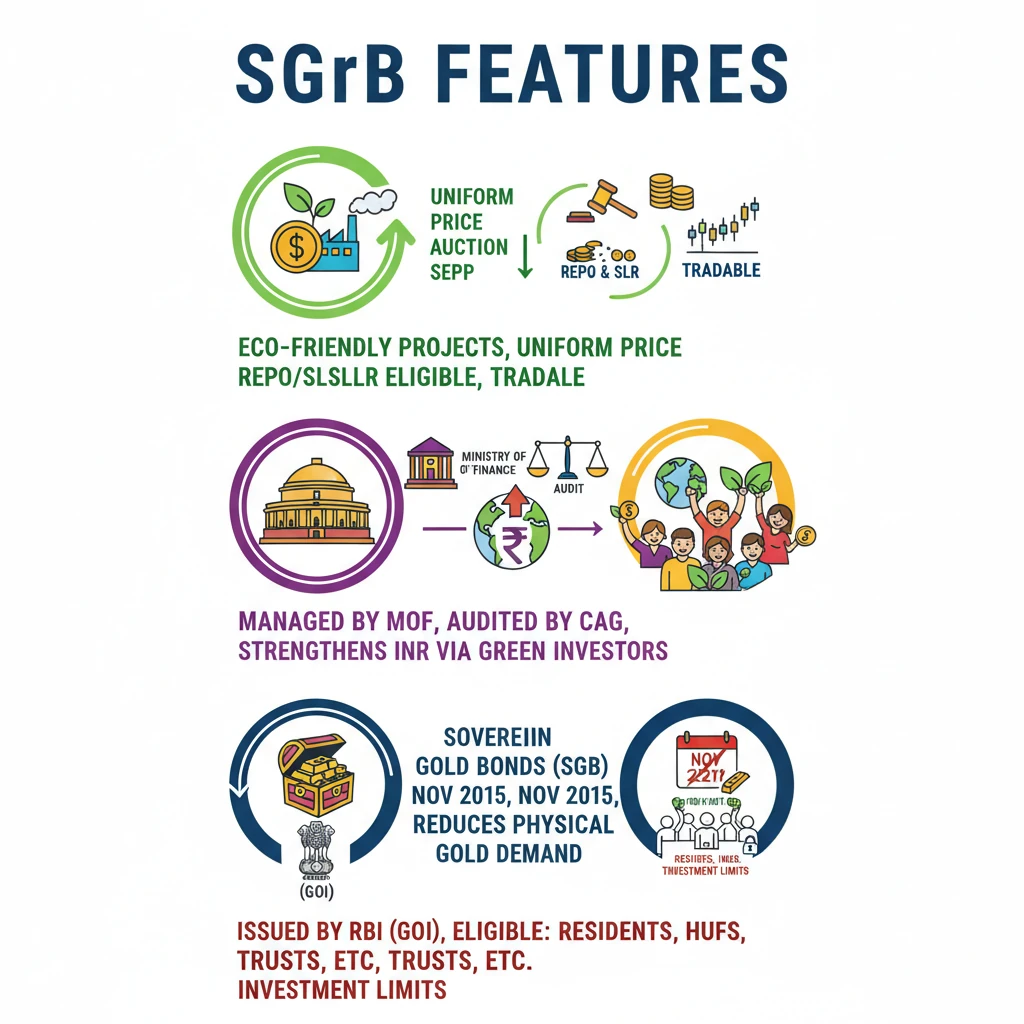

<h4>Features of Sovereign Green Bonds (SGrB)</h4><p><strong>Sovereign Green Bonds (SGrB)</strong> are debt instruments issued by the government to finance environmentally sustainable projects. They are a crucial tool for mobilizing capital towards green initiatives.</p><div class='info-box'><p><strong>Issuance Mechanism:</strong> SGrBs are issued through a <strong>Uniform Price Auction</strong>. This is a public sale where a fixed number of similar items are sold for the same price to all successful bidders.</p></div><p>These bonds are <strong>eligible for Repurchase Transactions (Repo)</strong>, which means they can be used as collateral for short-term borrowing, enhancing their liquidity in the market.</p><p>Furthermore, SGrBs are <strong>reckoned as eligible investments for Statutory Liquidity Ratio (SLR) purposes</strong>. This makes them attractive for commercial banks, as they can hold these bonds to meet their mandatory SLR requirements.</p><p>Sovereign Green Bonds are also <strong>eligible for trading in the secondary market</strong>, providing investors with an exit option and contributing to market liquidity.</p><h4>Management of Sovereign Green Bonds</h4><p>The proceeds from <strong>Sovereign Green Bonds</strong> are deposited into the <strong>Consolidated Fund of India</strong>. This central fund manages all government revenues and expenditures.</p><div class='info-box'><p><strong>Management Authority:</strong> The proceeds are managed by the <strong>Public Debt Management Cell</strong> within the <strong>Ministry of Finance</strong>.</p></div><p>To ensure transparency and accountability, the <strong>allocation and utilization of Green Bonds</strong> are subject to audit by the <strong>Comptroller and Auditor General (CAG) of India</strong>. This oversight mechanism ensures funds are used for their intended green purposes.</p><h4>Advantages of Sovereign Green Bonds</h4><p>Indian <strong>green bonds</strong> serve a dual purpose. They not only support the nation's <strong>sustainability goals</strong> but also contribute to strengthening the <strong>Indian currency</strong>.</p><div class='key-point-box'><p>By attracting international investors, green bonds lead to an <strong>inflow of foreign funds</strong>, increasing foreign exchange reserves within the central bank and bolstering the rupee.</p></div><p>The increasing global demand for <strong>socially responsible investments</strong>, coupled with a limited supply of high-quality green bonds, can lead to an increase in their price and yield, benefiting investors.</p><h4>Sovereign Gold Bond Scheme (SGB) - Overview</h4><p>The <strong>Sovereign Gold Bond (SGB) Scheme</strong> is a government-backed initiative aimed at reducing demand for physical gold.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> The <strong>Union Government's Budget 2024-25</strong> announced a significant reduction of the import duty on gold from <strong>15% to 6%</strong>. This move aims to curb informal gold trade and potentially impact domestic gold prices.</p></div><p>The government is also actively deliberating on the future strategy and potential modifications for the <strong>Sovereign Gold Bonds (SGB)</strong> scheme itself.</p><h4>Status of the Gold Industry in India</h4><p>India holds substantial <strong>gold reserves</strong>. As per the <strong>National Mineral Inventory 2015</strong>, total reserves/resources of gold ore in India are estimated at <strong>501.83 million tonnes</strong>.</p><div class='info-box'><p><strong>Major Gold Ore Resources (2015):</strong><ul><li><strong>Bihar:</strong> 44%</li><li><strong>Rajasthan:</strong> 25%</li><li><strong>Karnataka:</strong> 21%</li><li><strong>West Bengal:</strong> 3%</li><li><strong>Andhra Pradesh:</strong> 3%</li><li><strong>Jharkhand:</strong> 2%</li></ul></p></div><p>Despite these reserves, <strong>Karnataka</strong> accounts for approximately <strong>80% of India’s total gold output</strong>. The historic <strong>Kolar Gold Fields (KGF)</strong> in Kolar district is renowned as one of the world's oldest and deepest gold mines.</p><p>India is the <strong>world's second-largest gold consumer</strong>. In <strong>2023-24</strong>, India's gold imports increased by <strong>30%</strong>, reaching <strong>USD 45.54 billion</strong>. However, <strong>March 2024</strong> witnessed a notable decline of <strong>53.56%</strong> in gold imports.</p><h4>What is the Sovereign Gold Bond Scheme?</h4><p>The <strong>SGB scheme</strong> was introduced in <strong>November 2015</strong>. Its primary objective is to decrease the demand for physical gold and channel domestic savings, otherwise spent on gold, into financial savings.</p><div class='info-box'><p><strong>Issuance:</strong> These bonds are issued as <strong>Government of India Stock</strong> under the <strong>Government Securities (GS) Act, 2006</strong>. The <strong>Reserve Bank of India (RBI)</strong> issues them on behalf of the Government of India.</p></div><p><strong>Eligibility for Purchase:</strong> The bonds are available to <strong>resident individuals</strong>, <strong>Hindu Undivided Families (HUFs)</strong>, <strong>trusts</strong>, <strong>universities</strong>, and <strong>charitable institutions</strong>.</p><h4>Channels for SGB Purchase</h4><p>SGBs can be purchased through various authorized channels:</p><ul><li><strong>Scheduled Commercial Banks</strong> (excluding Small Finance Banks, Payment Banks, and Regional Rural Banks)</li><li><strong>Stock Holding Corporation of India Limited (SHCIL)</strong></li><li><strong>Clearing Corporation of India Limited (CCIL)</strong></li><li>Designated <strong>post offices</strong></li><li><strong>National Stock Exchange of India Limited (NSE)</strong> and <strong>Bombay Stock Exchange Limited (BSE)</strong>, either directly or through agents.</li></ul><h4>Key Features of Sovereign Gold Bonds</h4><p>The <strong>issue price</strong> of gold bonds is directly linked to the price of <strong>gold of 999 purity (24 carats)</strong>, as published by the <strong>India Bullion and Jewellers Association (IBJA), Mumbai</strong>.</p><div class='info-box'><p><strong>Investment Limit:</strong> Gold bonds can be bought in multiples of <strong>one unit (1 gram)</strong>. There are specific maximum limits for different investor categories:</p><ul><li><strong>Retail (Individual) investors:</strong> Maximum <strong>4 kilograms (4,000 units)</strong> per financial year.</li><li><strong>Hindu Undivided Family (HUF):</strong> Maximum <strong>4 kilograms (4,000 units)</strong> per financial year.</li></ul></div>

💡 Key Takeaways

- •Sovereign Green Bonds (SGrB) fund eco-friendly projects, issued via Uniform Price Auction, eligible for Repo and SLR, and tradable.

- •SGrB proceeds are managed by the Ministry of Finance and audited by CAG, strengthening Indian currency by attracting green investors.

- •Sovereign Gold Bonds (SGB) scheme (Nov 2015) aims to reduce physical gold demand by offering gold-denominated government securities.

- •SGBs are issued by RBI on behalf of the Government of India, available to resident individuals, HUFs, trusts, etc., with specific investment limits.

- •India is the second-largest gold consumer; recent Budget 2024-25 reduced gold import duty from 15% to 6%, impacting SGB's future.

🧠 Memory Techniques

95% Verified Content