Disbursal of Duty Drawback by PFMS - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Disbursal of Duty Drawback by PFMS

Medium⏱️ 7 min read

economy

📖 Introduction

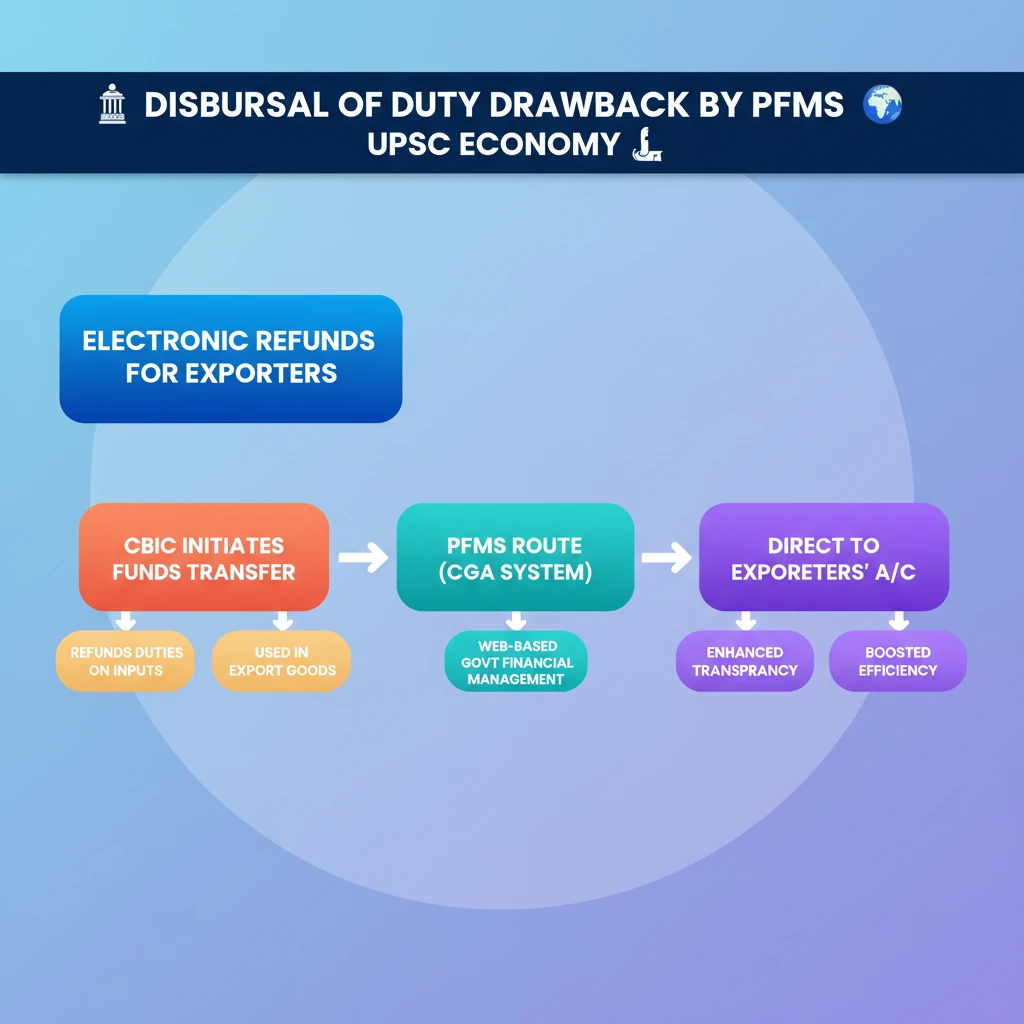

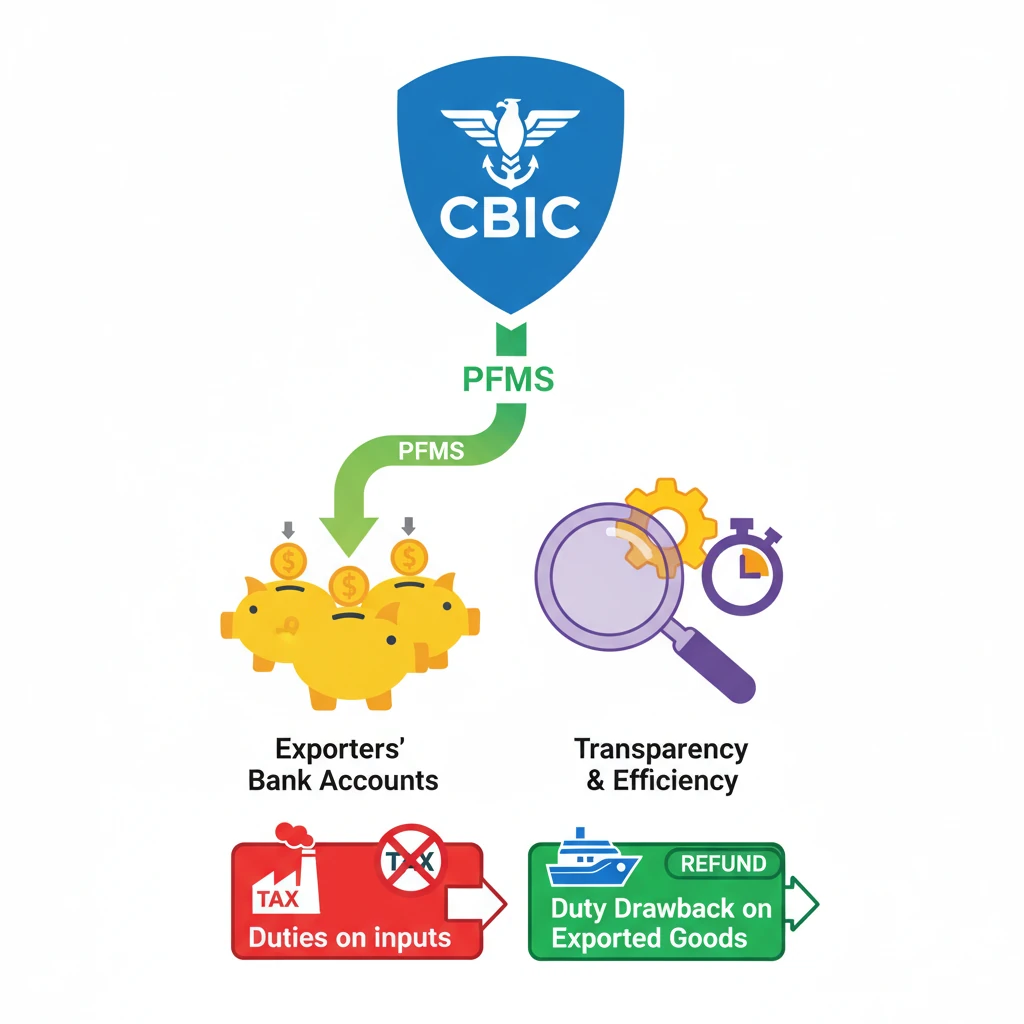

<h4>Introduction to Duty Drawback</h4><p>The <strong>Duty Drawback scheme</strong> is a crucial export promotion measure in India. It aims to refund duties of customs and central excise chargeable on imported and excisable materials used in the manufacture of export goods. This prevents the export of taxes and duties, making Indian goods more competitive in international markets.</p><div class='info-box'><p><strong>Definition:</strong> <strong>Duty Drawback</strong> is the refund of duties paid on inputs (raw materials, components, etc.) used in the manufacture of goods that are subsequently exported. It essentially neutralizes the domestic taxes on exported products.</p></div><h4>Understanding Public Finance Management System (PFMS)</h4><p>The <strong>Public Finance Management System (PFMS)</strong> is a web-based online software application developed and implemented by the <strong>Controller General of Accounts (CGA)</strong>, under the <strong>Ministry of Finance</strong>. It serves as a comprehensive payment, accounting, and reconciliation system for government transactions.</p><div class='key-point-box'><p><strong>Key Function:</strong> <strong>PFMS</strong> facilitates real-time tracking of funds, direct benefit transfers (DBT), and efficient financial management across various government schemes and departments. It enhances transparency and accountability in public expenditure.</p></div><h4>The New Disbursal Mechanism</h4><p>The <strong>Central Board of Indirect Taxes and Customs (CBIC)</strong> has implemented a significant reform for the disbursal of <strong>Duty Drawback funds</strong>. This involves the electronic transfer of these funds directly to the bank accounts of exporters.</p><p>This electronic transfer is executed through the <strong>Public Finance Management System (PFMS)</strong>. The integration with PFMS ensures that the funds move seamlessly from the government treasury to the beneficiaries.</p><h4>Objectives and Benefits of PFMS Integration</h4><p>The primary objectives behind this shift to <strong>PFMS-based disbursal</strong> are to enhance <strong>transparency</strong> and improve <strong>efficiency</strong> in the Duty Drawback process. It eliminates manual interventions and reduces the scope for delays and errors.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> This initiative aligns with the government's broader agenda of <strong>digital governance</strong> and <strong>Ease of Doing Business</strong>. It's important to connect such reforms to their impact on trade, exports, and administrative efficiency for Mains answers.</p></div><ul><li><strong>Increased Transparency:</strong> Funds are directly credited, reducing intermediaries and enhancing visibility of transactions.</li><li><strong>Enhanced Efficiency:</strong> Electronic transfers are faster than traditional methods, leading to quicker refunds for exporters.</li><li><strong>Reduced Delays:</strong> Automation minimizes human intervention, cutting down processing times.</li><li><strong>Better Accountability:</strong> PFMS provides an audit trail for all transactions, ensuring greater accountability.</li><li><strong>Boost to Exports:</strong> Timely refunds improve exporters' liquidity, encouraging more trade.</li></ul>

💡 Key Takeaways

- •CBIC disburses Duty Drawback funds electronically via PFMS.

- •Funds are transferred directly to exporters' bank accounts.

- •Primary goals: enhance transparency and efficiency in refunds.

- •Duty Drawback refunds duties on inputs used in exported goods.

- •PFMS is a web-based system by CGA for government financial management.

- •This initiative boosts exports, improves liquidity for exporters, and aligns with Digital India.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•CBIC notifications and circulars regarding Duty Drawback

•Public Finance Management System (PFMS) official website

•Economic Survey of India (various editions)

•Ministry of Finance reports on financial reforms