What is the Difference Between FDI and FPI? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is the Difference Between FDI and FPI?

Medium⏱️ 8 min read

economy

📖 Introduction

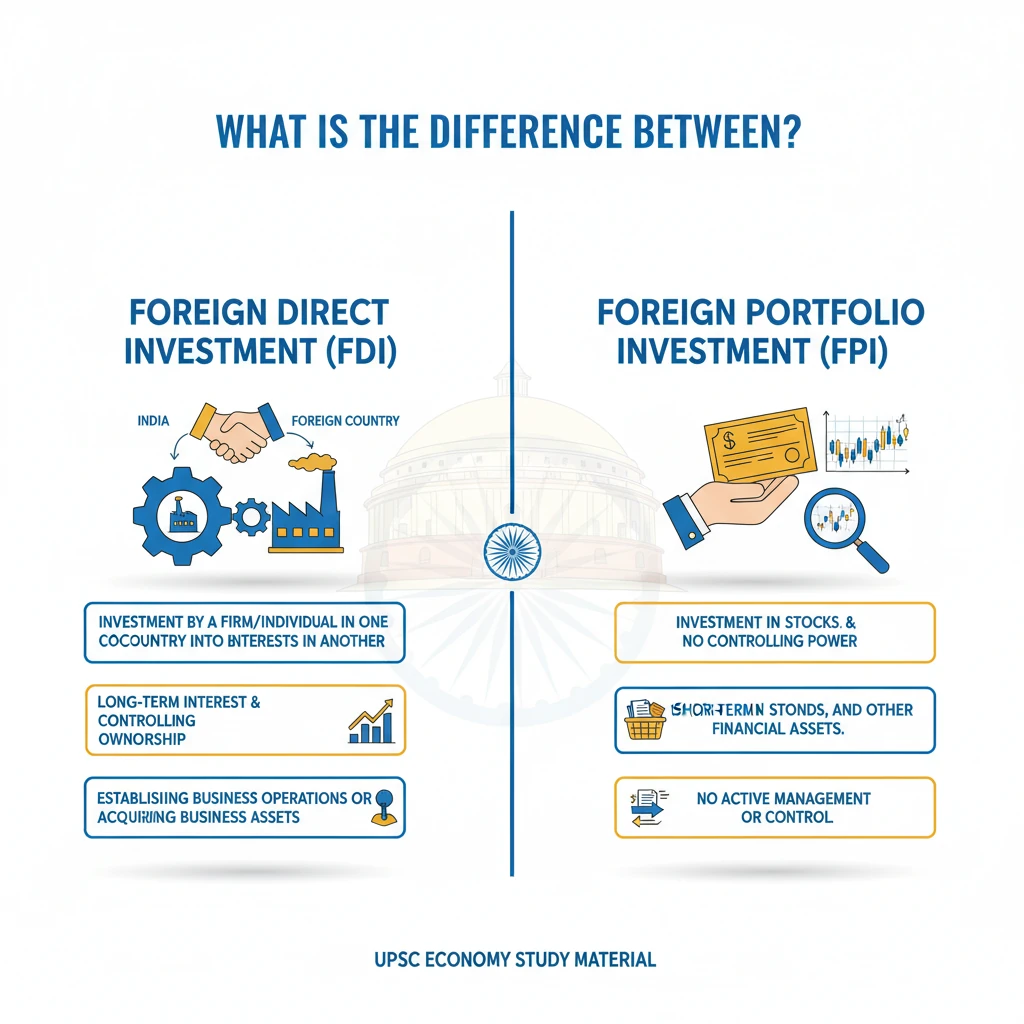

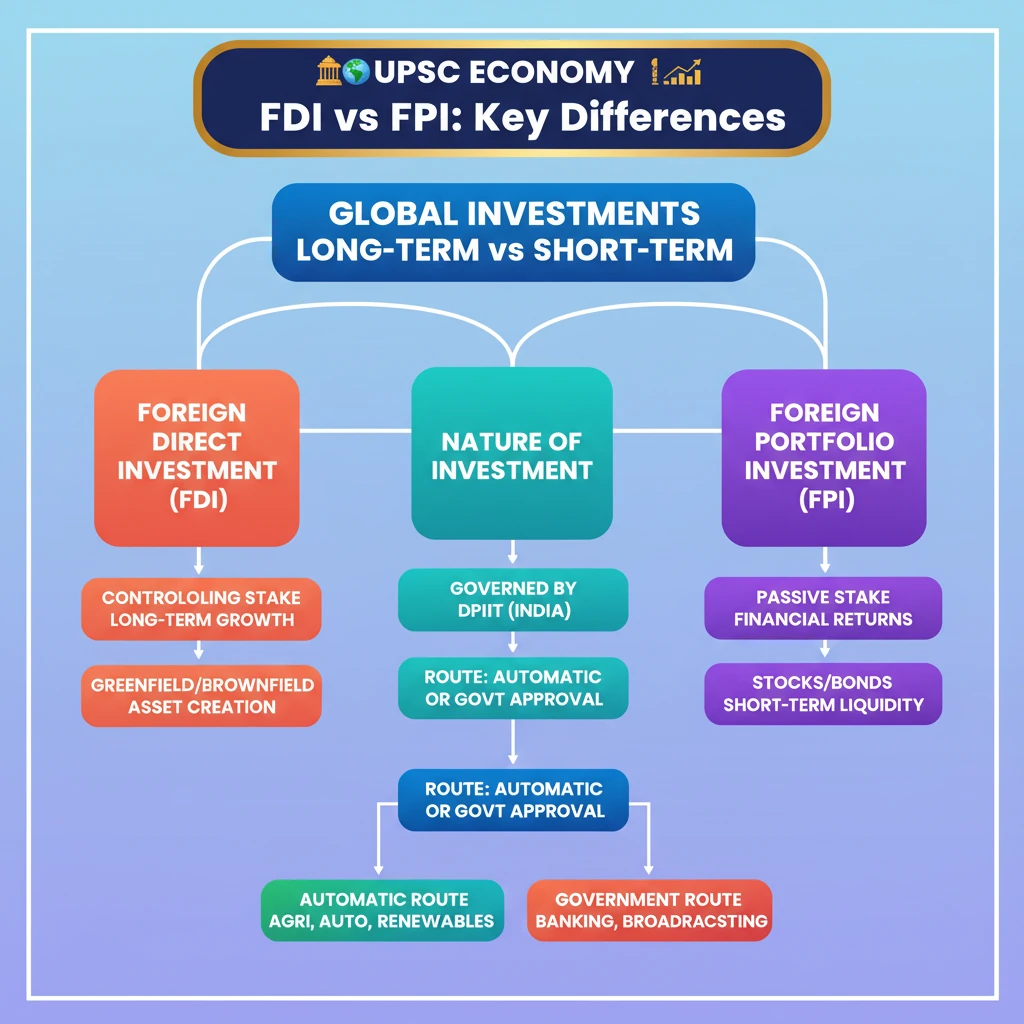

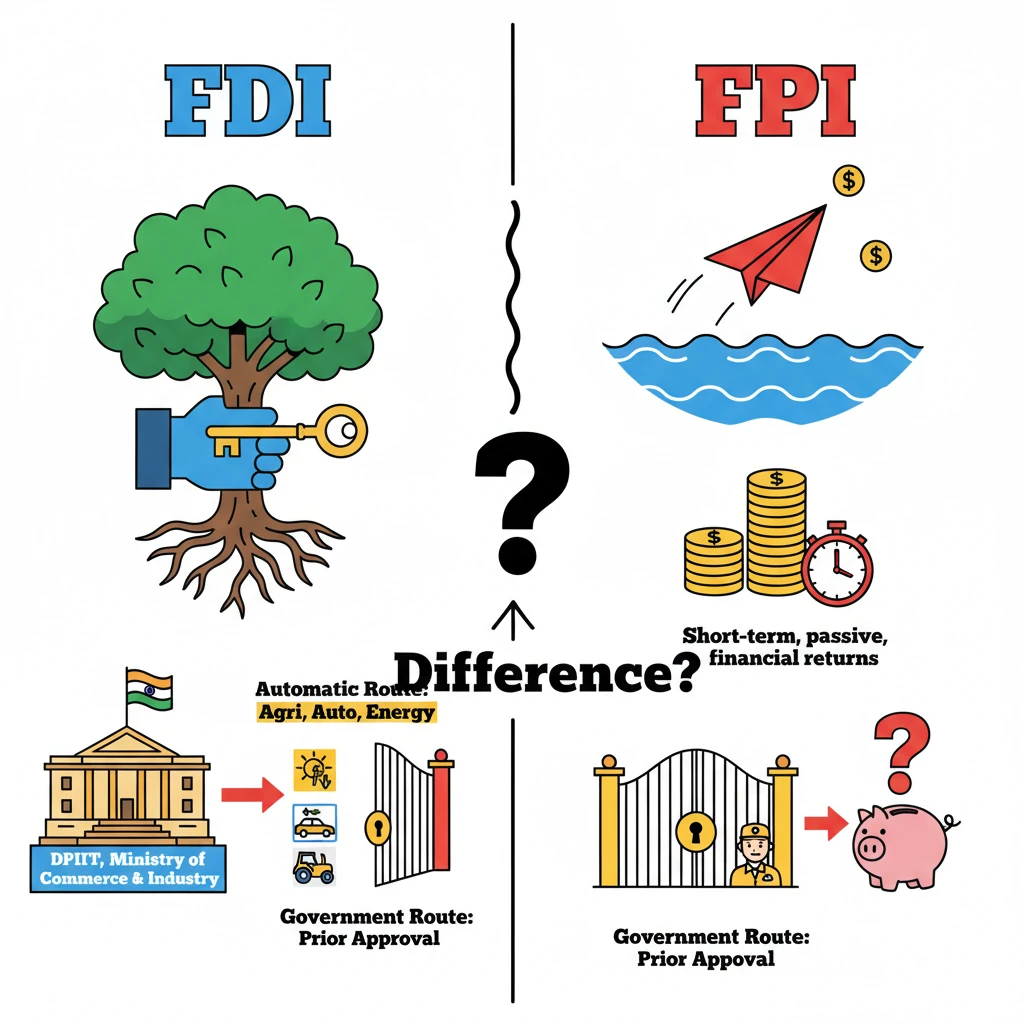

<h4>Understanding Foreign Direct Investment (FDI)</h4><p><strong>Foreign Direct Investment (FDI)</strong> represents an investment made by a firm or individual in one country into business interests located in another country.</p><p>It involves establishing either business operations or acquiring business assets, including controlling ownership, in a foreign company.</p><div class='key-point-box'><p>FDI is characterized by a <strong>long-term interest</strong> and a <strong>significant degree of influence or control</strong> over the foreign entity.</p></div><h4>Regulatory Authority for FDI in India</h4><p>In India, the nodal government body responsible for formulating and implementing <strong>FDI policy</strong> is the <strong>Department for Promotion of Industry and Internal Trade (DPIIT)</strong>.</p><p>The <strong>DPIIT</strong> functions under the aegis of the <strong>Ministry of Commerce and Industry</strong>.</p><h4>FDI Entry Routes in India</h4><p>Foreign investments into various sectors in India are primarily permitted through two distinct routes: the <strong>Automatic Route</strong> and the <strong>Government Route</strong>.</p><div class='info-box'><p>These routes determine the level of <strong>prior approval required</strong> from the <strong>Government of India</strong> for an investment to proceed.</p></div><h4>The Automatic Route</h4><p>Under the <strong>Automatic Route</strong>, a non-resident investor or an Indian company does <strong>not require any prior approval</strong> from the <strong>Government of India</strong>.</p><p>The investment can be made directly, subject to specified sector-specific conditions and caps.</p><div class='exam-tip-box'><p>Understanding the <strong>Automatic Route</strong> is crucial for Mains answers, especially when discussing ease of doing business and investment climate in India.</p></div><h4>Sectors Under the Automatic Route</h4><p>Several key sectors in India are open for <strong>FDI</strong> via the <strong>Automatic Route</strong>, promoting ease of investment.</p><ul><li><strong>Agriculture & Animal Husbandry</strong></li><li><strong>Air-Transport Services</strong></li><li><strong>Auto-components</strong></li><li><strong>Automobiles</strong></li><li><strong>Biotechnology (Greenfield)</strong></li><li><strong>E-commerce Activities</strong></li><li><strong>Renewable Energy</strong></li><li>And various other sectors, subject to specific conditions.</li></ul><h4>The Government Route</h4><p>Conversely, the <strong>Government Route</strong> mandates <strong>prior approval</strong> from the <strong>Government of India</strong> before any investment can be made.</p><p>Proposals for foreign investment under this route are meticulously considered by the <strong>respective Administrative Ministry/Department</strong> responsible for that sector.</p><div class='key-point-box'><p>This route is typically reserved for strategically sensitive sectors or those requiring closer governmental oversight.</p></div><h4>Sectors Under the Government Route</h4><p>Specific sectors require government approval due to their strategic importance or regulatory complexities.</p><ul><li><strong>Banking & Non-Banking Broadcasting Content Services</strong></li><li><strong>Food Products Retail Trading</strong></li><li><strong>Satellite Establishment and Operations</strong></li><li>And other designated sectors.</li></ul><h4>FDI Prohibition in India</h4><p>Certain sectors in India are entirely <strong>prohibited</strong> for <strong>FDI</strong>, reflecting national policy considerations and regulatory concerns.</p><div class='info-box'><p>These prohibitions are strict and aim to safeguard specific areas from foreign ownership or influence.</p></div><ul><li><strong>Atomic Energy Generation</strong></li><li><strong>Gambling and Betting</strong></li><li><strong>Lotteries</strong></li><li><strong>Chit Funds</strong></li><li><strong>Real Estate (excluding construction development)</strong></li><li><strong>Tobacco Industry</strong></li></ul><div class='exam-tip-box'><p>Remembering the <strong>prohibited sectors</strong> is vital for both <strong>Prelims</strong> (direct questions) and <strong>Mains</strong> (policy analysis).</p></div><h4>India’s Top FDI Sources</h4><p>India attracts significant <strong>FDI</strong> from various global economies, reflecting its growing economic appeal.</p><p>In <strong>2022-24</strong>, <strong>Singapore</strong> emerged as the top source country for <strong>FDI</strong> into India.</p><div class='info-box'><p>Following <strong>Singapore</strong>, other major contributors included <strong>Mauritius</strong>, the <strong>United States</strong>, the <strong>Netherlands</strong>, and <strong>Japan</strong>.</p></div>

💡 Key Takeaways

- •FDI involves long-term, controlling investment, while FPI is short-term, passive, and for financial returns.

- •DPIIT under Ministry of Commerce and Industry governs FDI policy in India.

- •FDI in India can enter via Automatic Route (no prior approval) or Government Route (requires prior approval).

- •Key sectors like Agriculture, Auto-components, Renewable Energy are under Automatic Route.

- •Sensitive sectors like Banking, Broadcasting Content Services are under Government Route.

- •FDI is strictly prohibited in sectors like Atomic Energy, Gambling, Lotteries, Chit Funds, Real Estate, and Tobacco.

- •Singapore, Mauritius, USA, Netherlands, and Japan are India's top FDI sources (2022-24).

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry, Government of India

•Reserve Bank of India (RBI) publications on Foreign Investment

•Economic Survey of India