What is a Currency Swap Agreement? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is a Currency Swap Agreement?

Medium⏱️ 8 min read

economy

📖 Introduction

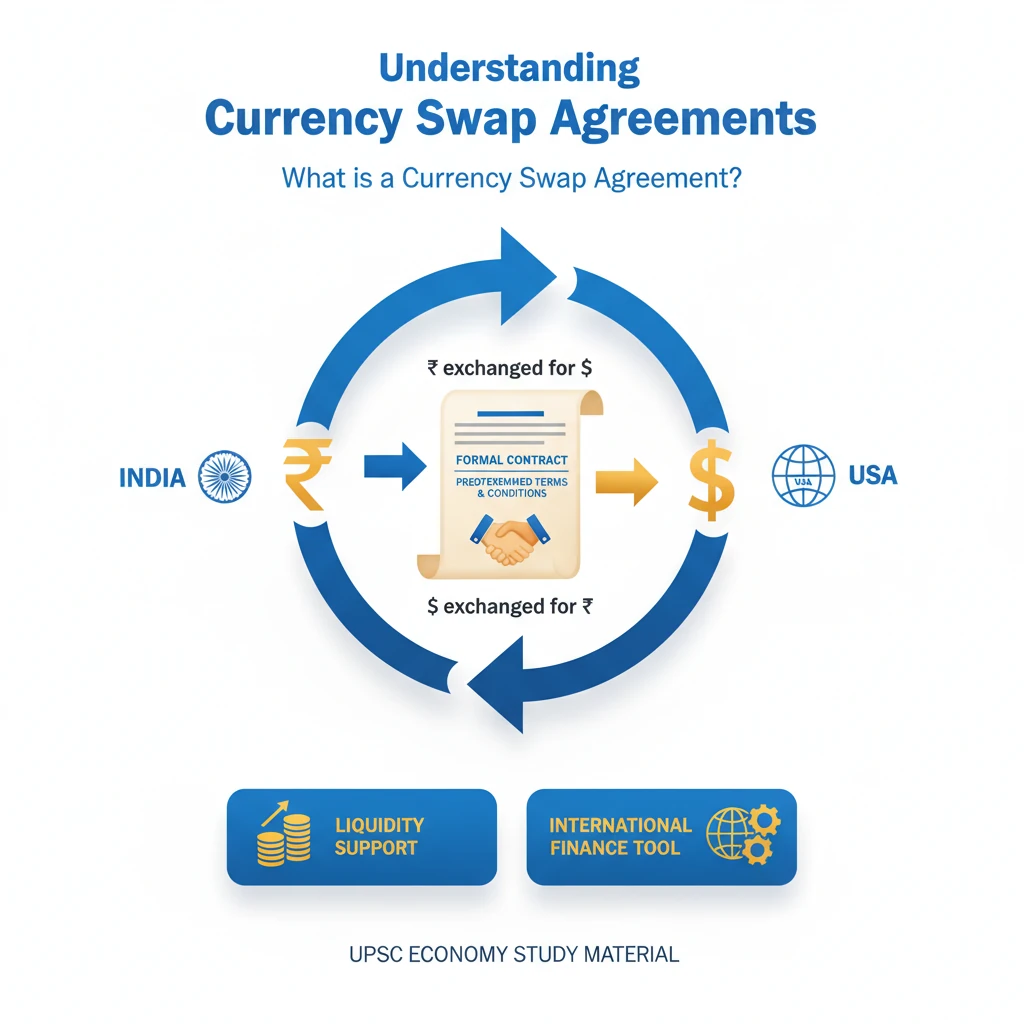

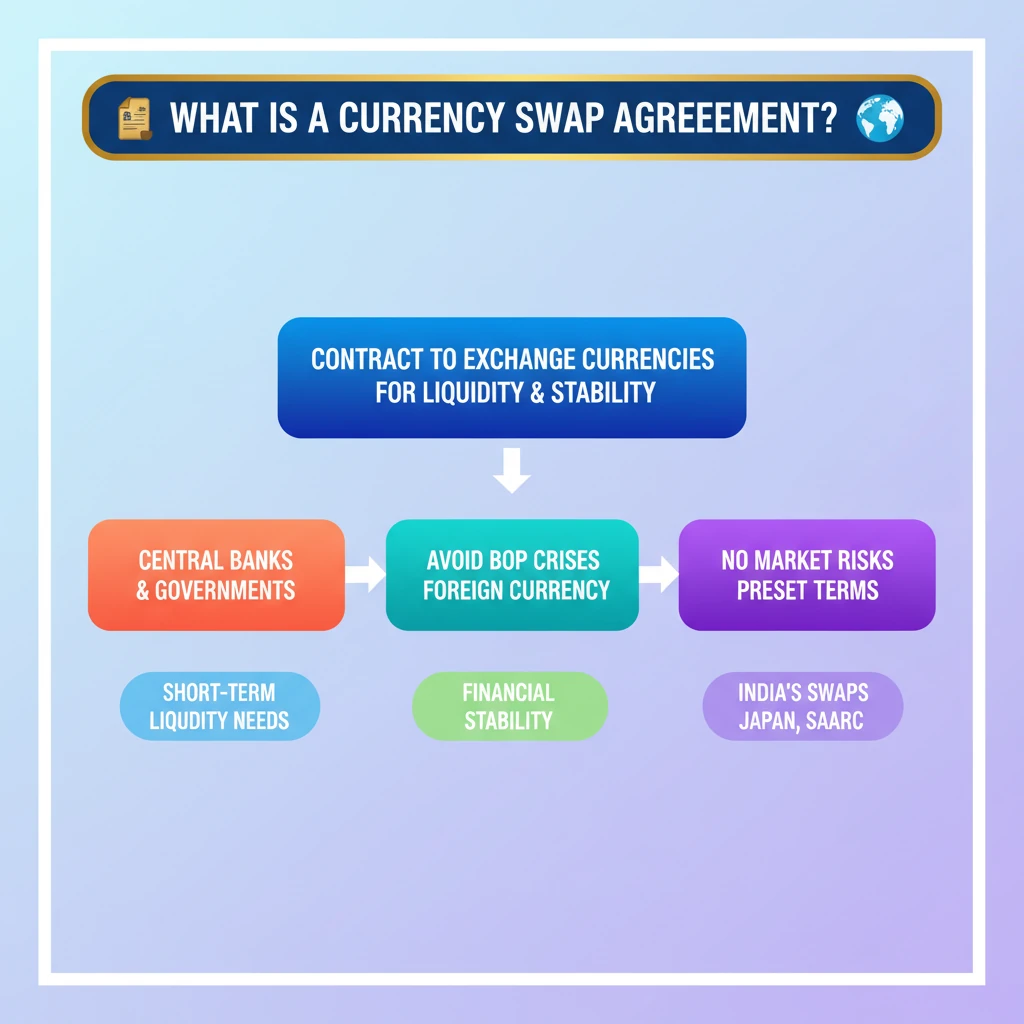

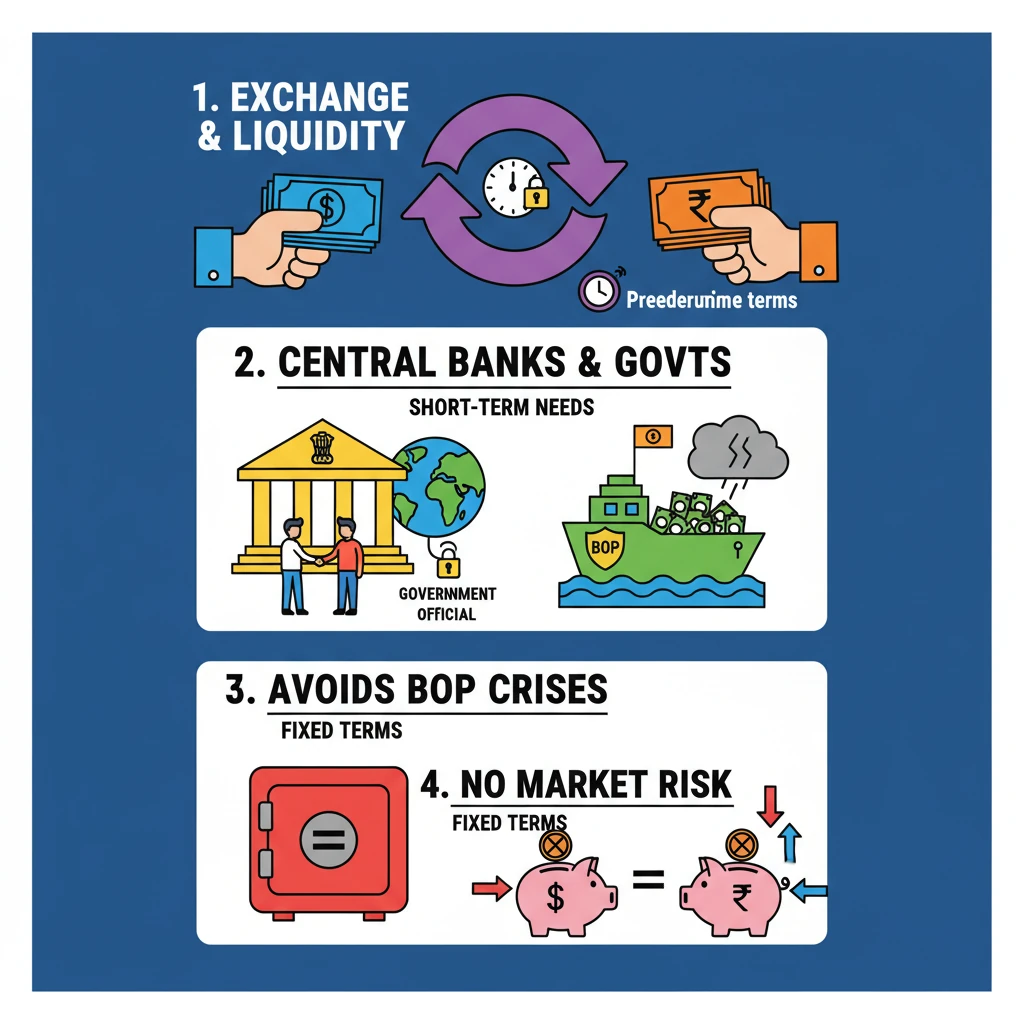

<h4>Understanding Currency Swap Agreements</h4><p>A <strong>Currency Swap Agreement</strong> is a formal <strong>contract</strong> between <strong>two countries</strong>. Its primary purpose is to facilitate the <strong>exchange of currencies</strong> under <strong>predetermined terms and conditions</strong>.</p><p>These agreements are crucial for providing immediate <strong>liquidity support</strong> to the participating nations. They serve as a vital tool in international finance.</p><div class='info-box'><p><strong>Definition:</strong> A <strong>Currency Swap Agreement</strong> is a bilateral contract for exchanging currencies between two countries, with all transaction terms (like exchange rate and tenor) set in advance.</p></div><h4>Primary Objectives of Currency Swaps</h4><p><strong>Central banks</strong> and <strong>Governments</strong> are the key entities that engage in these agreements with their <strong>foreign counterparts</strong>. They do so to address specific financial needs.</p><p>One main objective is to meet <strong>short-term foreign exchange liquidity requirements</strong>. This ensures a country has enough foreign currency to manage its immediate obligations.</p><ul><li><strong>Liquidity Support:</strong> To provide quick access to foreign currency for immediate needs.</li><li><strong>BOP Crisis Avoidance:</strong> To ensure <strong>adequate foreign currency</strong> and prevent a potential <strong>Balance of Payments (BOP) crisis</strong> until more permanent arrangements can be made.</li></ul><h4>Key Characteristics and Risk Mitigation</h4><p>A significant feature of <strong>currency swap operations</strong> is their inherent safety. They are designed to carry <strong>no exchange rate risk</strong> for the participating parties.</p><p>Furthermore, these agreements are structured to avoid <strong>other market risks</strong>. This stability is achieved because all <strong>transaction terms are set in advance</strong>, eliminating uncertainty.</p><div class='key-point-box'><p><strong>Risk-Free Nature:</strong> Due to <strong>predetermined terms</strong>, currency swaps largely eliminate <strong>exchange rate risk</strong> and <strong>market risks</strong> for the central banks or governments involved.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding <strong>currency swaps</strong> is vital for topics related to <strong>external sector management</strong>, <strong>financial stability</strong>, and the role of the <strong>Reserve Bank of India (RBI)</strong> in managing foreign exchange reserves. It often appears in <strong>GS Paper III (Economy)</strong>.</p></div>

💡 Key Takeaways

- •A Currency Swap Agreement is a contract between two countries to exchange currencies with predetermined terms for liquidity.

- •Central banks and governments use swaps to meet short-term foreign exchange liquidity needs.

- •They help avoid Balance of Payments (BOP) crises by ensuring adequate foreign currency.

- •Swap operations carry no exchange rate or other market risks as terms are set in advance.

- •India actively engages in currency swaps (e.g., with Japan, SAARC nations) to enhance financial stability and bilateral ties.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) publications on currency swap agreements

•Ministry of Finance, Government of India reports

•International Monetary Fund (IMF) articles on financial stability tools