DICGC Overcharging Commercial Banks - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

DICGC Overcharging Commercial Banks

Medium⏱️ 5 min read

economy

📖 Introduction

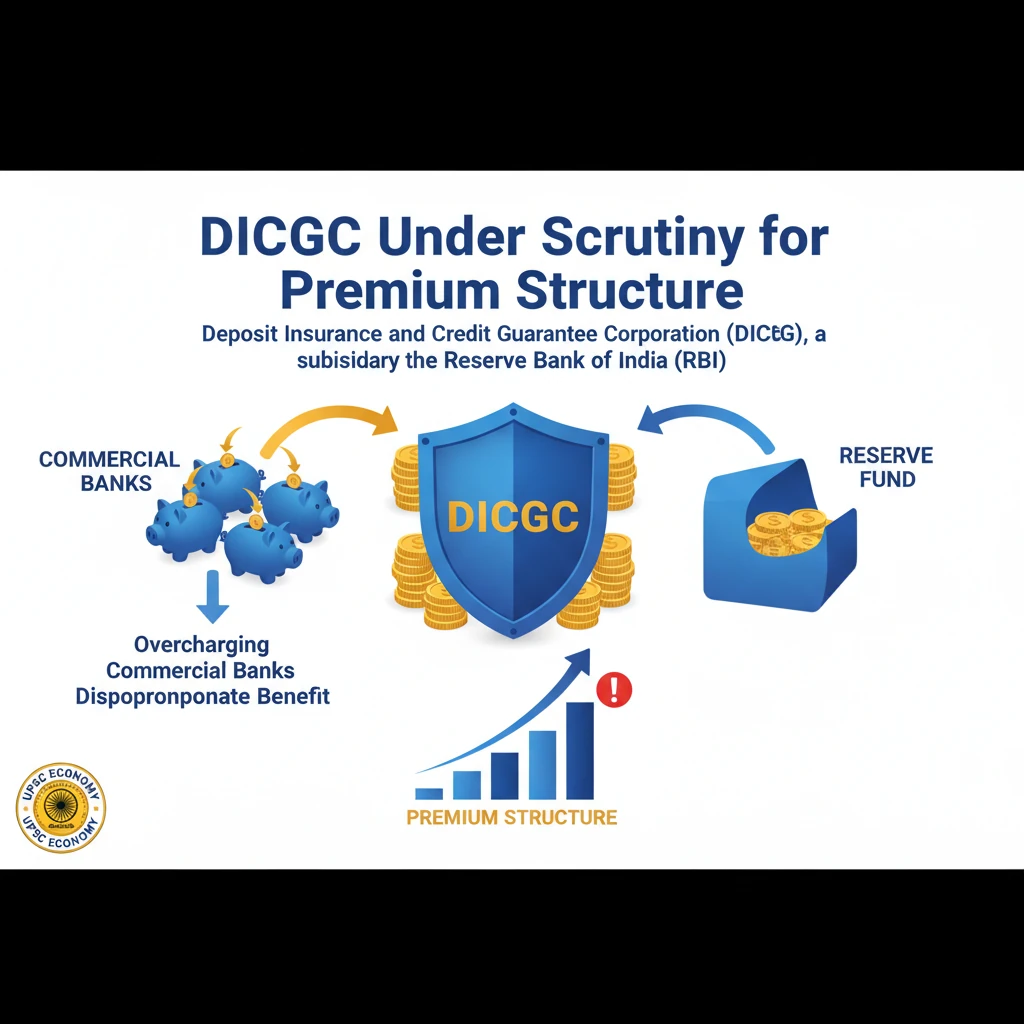

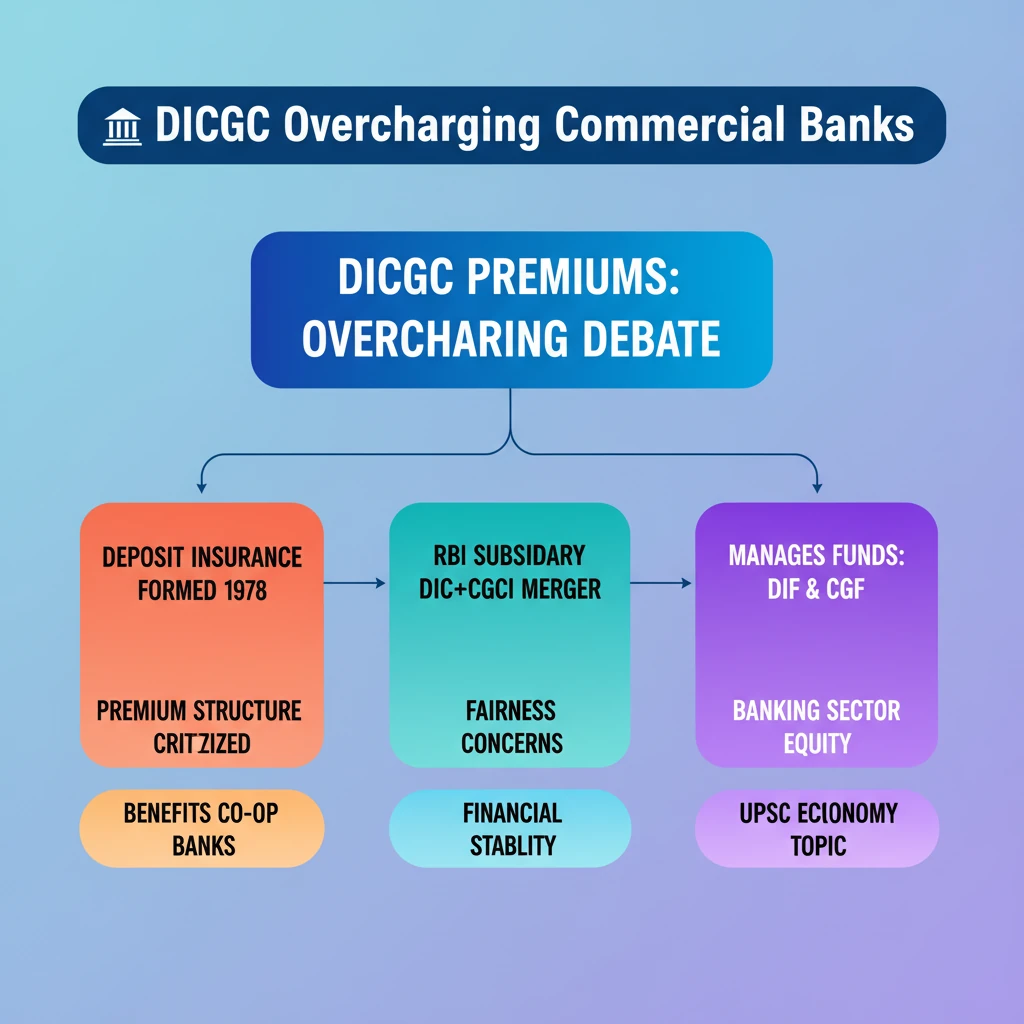

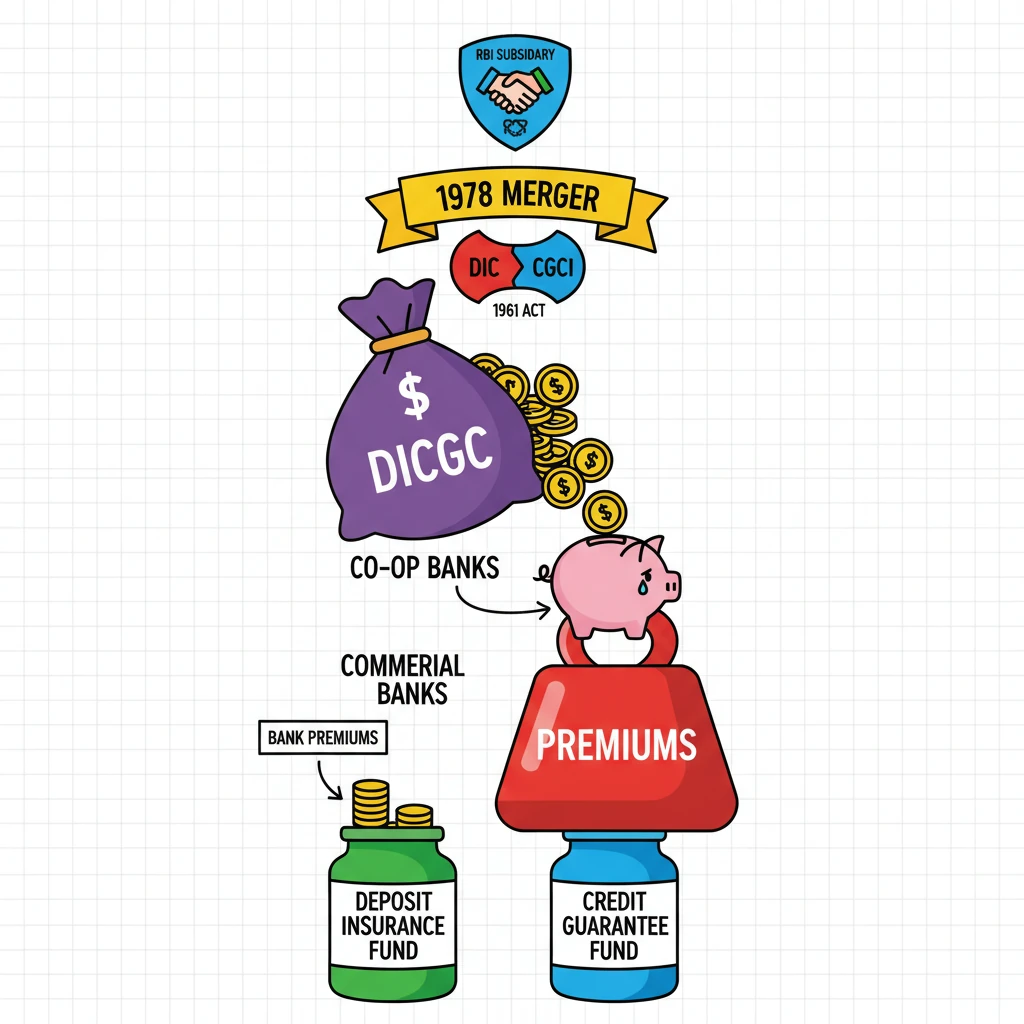

<h4>DICGC Under Scrutiny for Premium Structure</h4><p>The <strong>Deposit Insurance and Credit Guarantee Corporation (DICGC)</strong>, a key subsidiary of the <strong>Reserve Bank of India (RBI)</strong>, is currently facing scrutiny. This attention stems from concerns regarding its existing premium structure.</p><p>It has been observed that the current premium mechanism might be <strong>overcharging commercial banks</strong>. This overcharging, in turn, appears to create a disproportionate benefit for <strong>cooperative banks</strong>.</p><div class='key-point-box'><p><strong>Key Issue:</strong> The premium structure of <strong>DICGC</strong> is perceived to be inequitable, potentially burdening <strong>commercial banks</strong> while favoring <strong>cooperative banks</strong>.</p></div><h4>Key Functions of DICGC</h4><p>The <strong>DICGC</strong> plays a vital dual role in India's financial system. It provides both <strong>deposit insurance</strong> and <strong>credit guarantee</strong> for eligible banks across the country.</p><div class='info-box'><p><strong>Dual Mandate:</strong></p><ul><li><strong>Deposit Insurance:</strong> Protects depositors' funds in case of bank failure.</li><li><strong>Credit Guarantee:</strong> Offers a guarantee to creditors against debtor defaults.</li></ul></div>

💡 Key Takeaways

- •DICGC is an RBI subsidiary providing deposit insurance and credit guarantee.

- •It was formed in 1978 by merging DIC and CGCI, under the 1961 Act.

- •DICGC manages Deposit Insurance Fund (from bank premiums) and Credit Guarantee Fund.

- •Current issue: DICGC's premium structure is accused of overcharging commercial banks, benefiting cooperative banks.

- •This raises concerns about fairness, financial stability, and banking sector equity.

🧠 Memory Techniques

95% Verified Content