FDI in Insurance Sector - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

FDI in Insurance Sector

Medium⏱️ 5 min read

economy

📖 Introduction

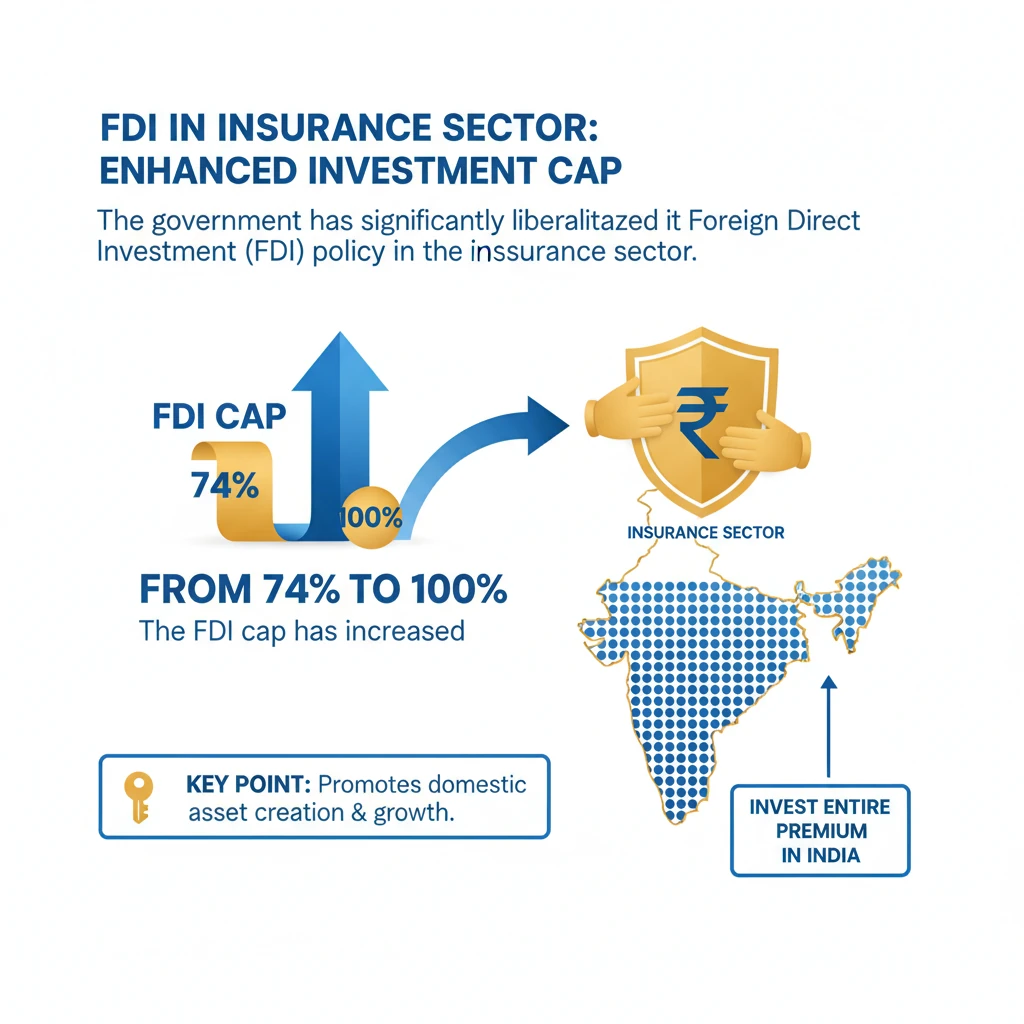

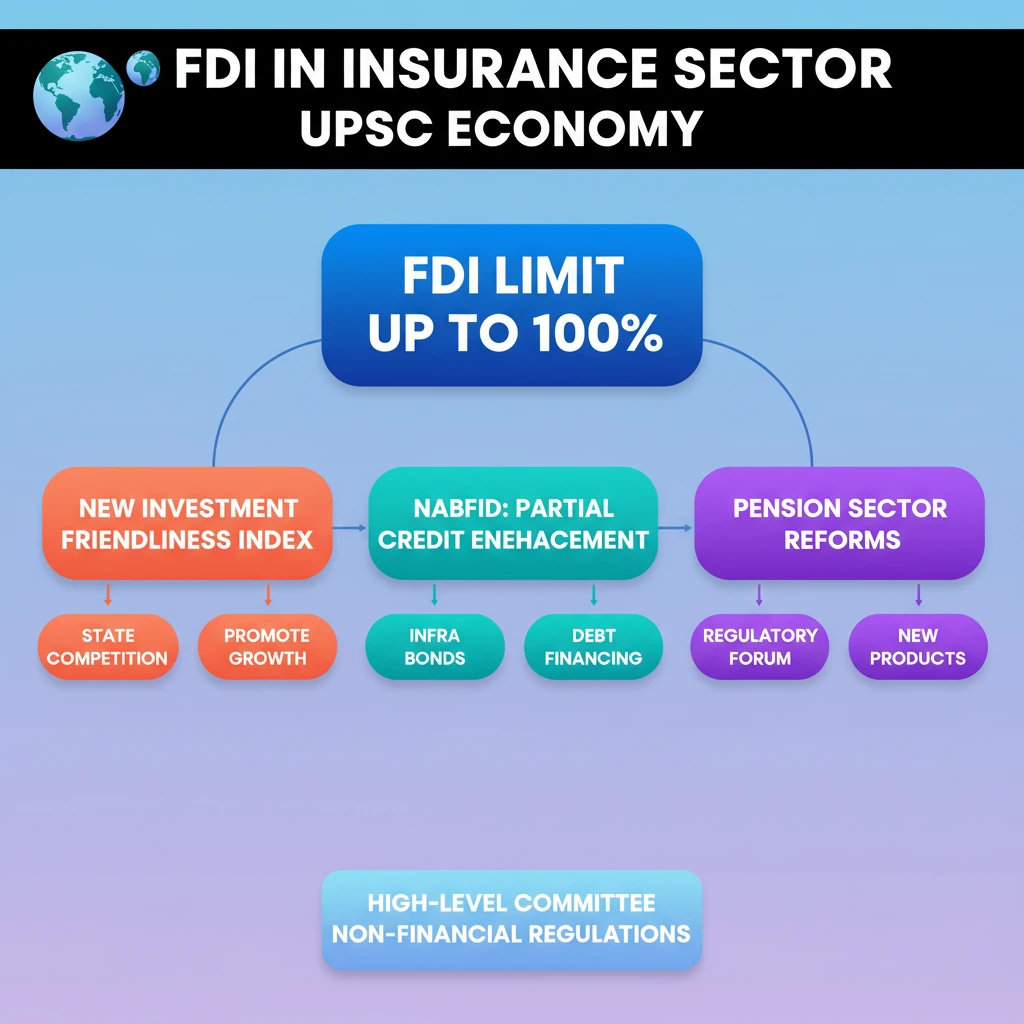

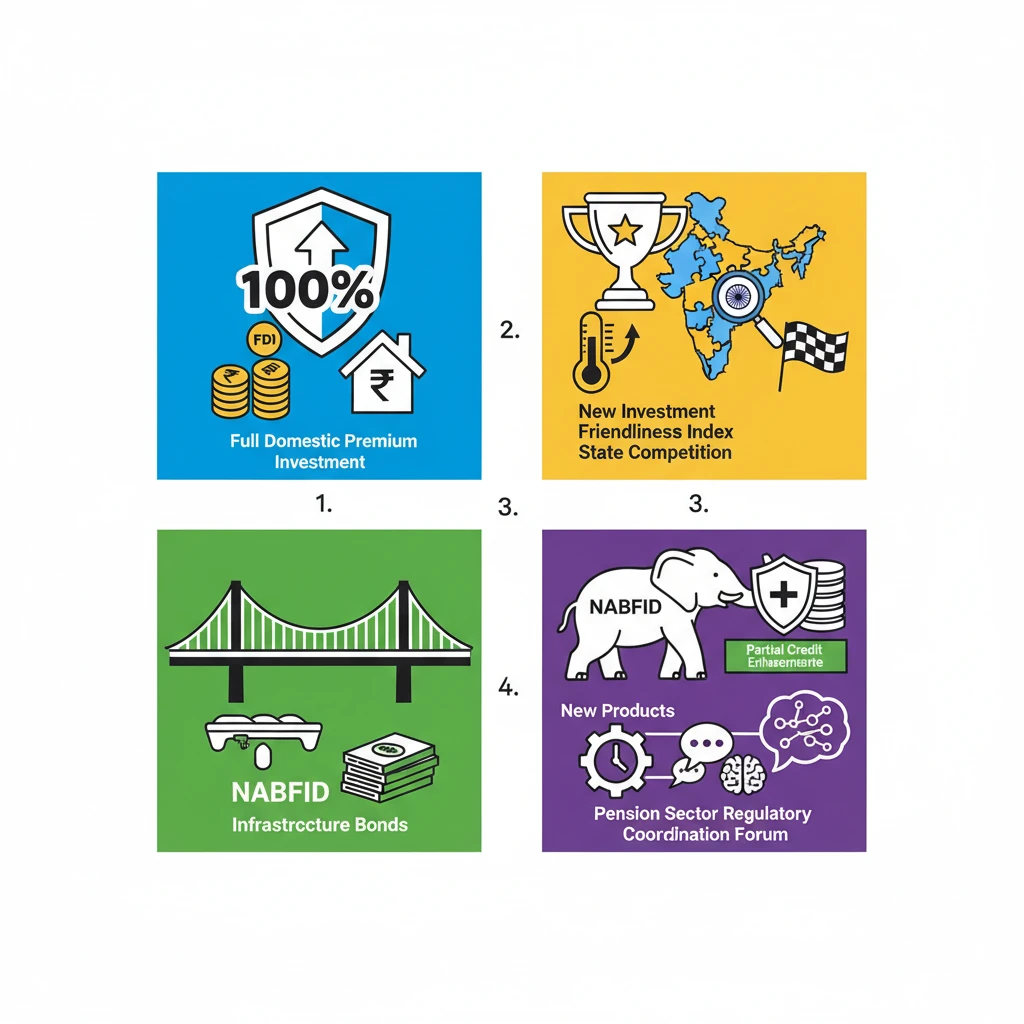

<h4>FDI in Insurance Sector: Enhanced Investment Cap</h4><p>The government has significantly liberalized the <strong>Foreign Direct Investment (FDI)</strong> policy in the <strong>insurance sector</strong>.</p><p>The <strong>FDI cap</strong> has been increased from <strong>74% to 100%</strong>.</p><div class='info-box'><p>This enhanced cap applies specifically to companies that commit to <strong>investing the entire premium collected in India</strong>.</p></div><div class='key-point-box'><p>This move aims to attract greater foreign capital, enhance competition, and improve efficiency within the Indian insurance market.</p></div><h4>Investment Friendliness Index of States</h4><p>A new framework is being introduced to rank states based on their <strong>investment friendliness</strong>.</p><div class='info-box'><p>This <strong>ranking framework</strong> is designed to foster <strong>competitive cooperative federalism</strong> among states.</p></div><p>It will encourage states to improve their business environment and attract more investments.</p><h4>Credit Enhancement Facility by NABFID</h4><p>The <strong>National Bank for Financing Infrastructure and Development (NABFID)</strong> will play a crucial role in infrastructure financing.</p><p>NABFID is mandated to establish a <strong>‘Partial Credit Enhancement Facility’</strong>.</p><div class='info-box'><p>This facility is intended to support the development and liquidity of the <strong>corporate bond market</strong>, particularly for <strong>infrastructure projects</strong>.</p></div><div class='key-point-box'><p><strong>Credit enhancement</strong> helps reduce the risk perception of corporate bonds, making them more attractive to investors.</p></div><h4>Pension Sector Reforms</h4><p>Efforts are underway to streamline the <strong>pension sector</strong> in India.</p><p>A dedicated <strong>forum</strong> will be established for <strong>regulatory coordination</strong>.</p><div class='info-box'><p>This forum will also focus on the <strong>development of new pension products</strong> to cater to diverse needs of the population.</p></div><h4>High-Level Committee for Regulatory Reforms</h4><p>To improve the ease of doing business, a <strong>high-level committee</strong> will be formed.</p><div class='info-box'><p>The committee's mandate is to <strong>review all non-financial sector regulations</strong>, including <strong>certifications, licenses, and permissions</strong>.</p></div><div class='exam-tip-box'><p>This initiative aligns with the government's broader agenda of <strong>deregulation</strong> and reducing compliance burden, which is a recurring theme in <strong>UPSC Mains GS-III</strong> questions on economic reforms.</p></div>

💡 Key Takeaways

- •FDI in insurance increased to 100% for full domestic premium investment.

- •New Investment Friendliness Index to promote state competition.

- •NABFID to provide Partial Credit Enhancement for infrastructure bonds.

- •Pension sector to get a regulatory coordination forum and new products.

- •High-level committee to review non-financial sector regulations.

- •Reforms aim to boost capital, ease business, and strengthen financial markets.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Union Budget documents (relevant year)

•Ministry of Finance reports on FDI policy

•IRDAI (Insurance Regulatory and Development Authority of India) notifications