Money Laundering - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Money Laundering

Medium⏱️ 7 min read

economy

📖 Introduction

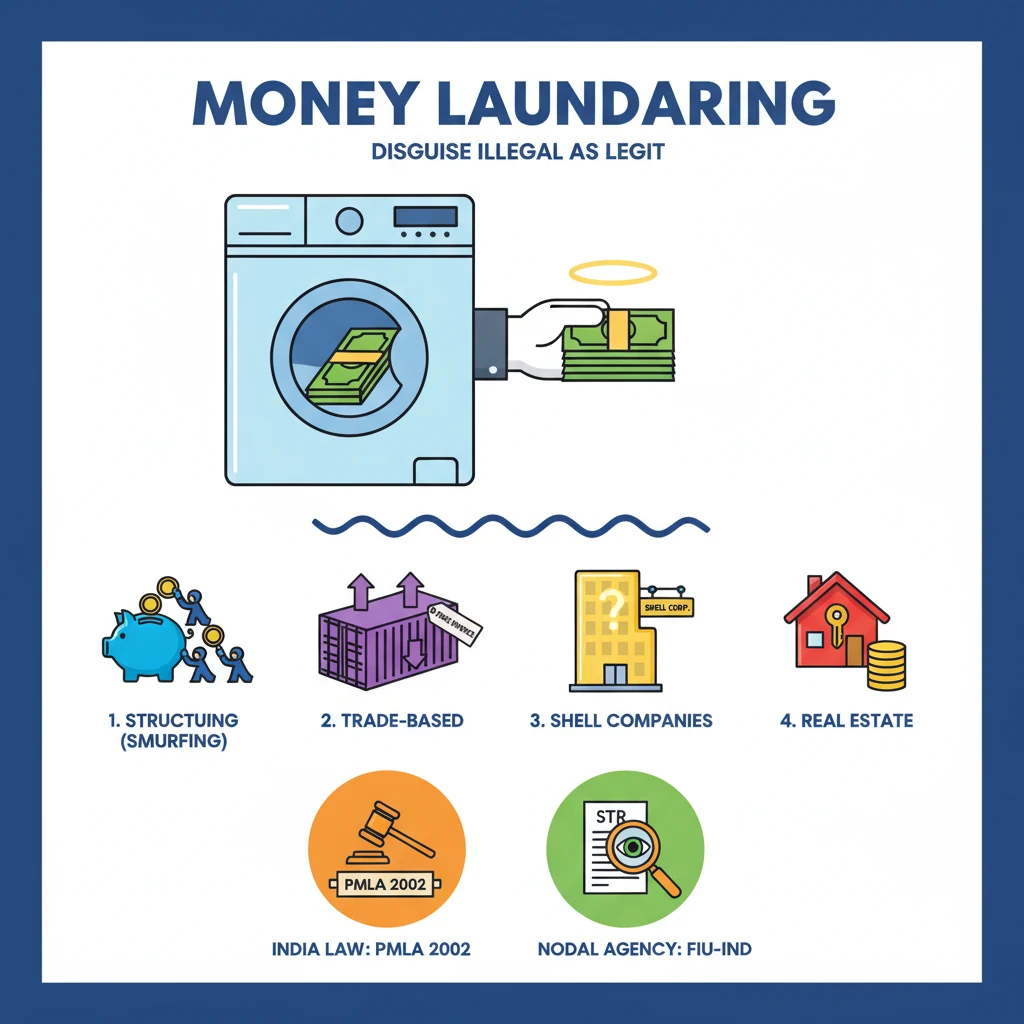

<h4>Understanding Money Laundering</h4><p><strong>Money laundering</strong> is a complex process employed by individuals and organizations to conceal the illicit origins of funds.</p><p>It involves transforming illegally acquired money into seemingly legitimate assets through a series of intricate financial transactions.</p><div class='info-box'><p><strong>Definition:</strong> The process of disguising the proceeds of crime and integrating them into the legitimate financial system to make them appear legal.</p></div><h4>Methods of Money Laundering</h4><div class='key-point-box'><p>Criminals utilize various sophisticated techniques to clean their illicit money, making it difficult to trace its true source.</p></div><h5>Structuring (Smurfing)</h5><p><strong>Structuring</strong>, also known as <strong>Smurfing</strong>, involves breaking down large sums of cash into smaller, less noticeable amounts.</p><p>These smaller amounts are then deposited into bank accounts, often across multiple banks or by various individuals, to avoid detection thresholds for large transactions.</p><h5>Trade-Based Laundering</h5><p><strong>Trade-Based Laundering</strong> utilizes international trade transactions to transfer value across borders while masking the origins of illegal funds.</p><p>This method involves manipulating invoices, over-invoicing, under-invoicing, or creating fictitious trades to obscure the illicit nature of the funds.</p><h5>Shell Companies</h5><p><strong>Shell companies</strong> are businesses established with no real operational activity or assets.</p><p>They are used as fronts to route illicit funds through seemingly legitimate transactions, making it challenging to identify the true beneficial owner.</p><h5>Real Estate</h5><p>The acquisition of <strong>real estate</strong> is a common method where illegal funds are used to purchase properties.</p><p>Later, these properties are sold, converting the illicit cash into legitimate assets that appear to have originated from a property sale.</p><h4>Steps to Prevent Money Laundering in India</h4><div class='key-point-box'><p>India has implemented a robust framework to combat money laundering activities and strengthen its financial integrity.</p></div><ul><li><strong>Enforcement of the Prevention of Money Laundering Act (PMLA):</strong> This is the principal legislation in India, enacted in <strong>2002</strong>, to prevent money laundering and confiscate property derived from it.</li><li><strong>Formation of the Financial Intelligence Unit (FIU):</strong> The <strong>FIU-IND</strong> was established in <strong>2004</strong> as the central national agency responsible for receiving, processing, analyzing, and disseminating information relating to suspicious financial transactions.</li><li><strong>Mandatory Reporting:</strong> Banks and financial institutions are required to report cash transactions above a certain threshold and any suspicious activities to the <strong>FIU-IND</strong>.</li><li><strong>Strict KYC Guidelines:</strong> <strong>Know Your Customer (KYC)</strong> norms mandate financial institutions to verify the identity of their clients, thereby reducing anonymity and preventing misuse.</li><li><strong>Coordination with International Organisations:</strong> India collaborates with global bodies like the <strong>Financial Action Task Force (FATF)</strong> to align its anti-money laundering efforts with international standards and share intelligence.</li><li><strong>Information Technology Rules, 2021:</strong> These rules provide regulatory oversight, particularly in the <strong>online gaming industry</strong>, to prevent its misuse for money laundering activities.</li></ul><div class='exam-tip-box'><p>Understanding the interplay between <strong>PMLA</strong>, <strong>FIU-IND</strong>, and <strong>FATF</strong> is crucial for Mains answers on economic crimes and national security in India.</p></div>

💡 Key Takeaways

- •Money laundering is the process of disguising illegally acquired funds as legitimate money.

- •Key methods include Structuring (Smurfing), Trade-Based Laundering, Shell Companies, and Real Estate investments.

- •India's primary legal framework to combat this is the Prevention of Money Laundering Act (PMLA), 2002.

- •The Financial Intelligence Unit – India (FIU-IND) is the nodal agency for receiving and analyzing suspicious transaction reports.

- •Strict KYC norms and international cooperation, particularly with FATF, are crucial for effective prevention.

- •The Information Technology Rules, 2021, extend oversight to the online gaming industry to address new laundering risks.

🧠 Memory Techniques

95% Verified Content