What are the Key Highlights of the Economic Survey 2024-25? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are the Key Highlights of the Economic Survey 2024-25?

Medium⏱️ 10 min read

economy

📖 Introduction

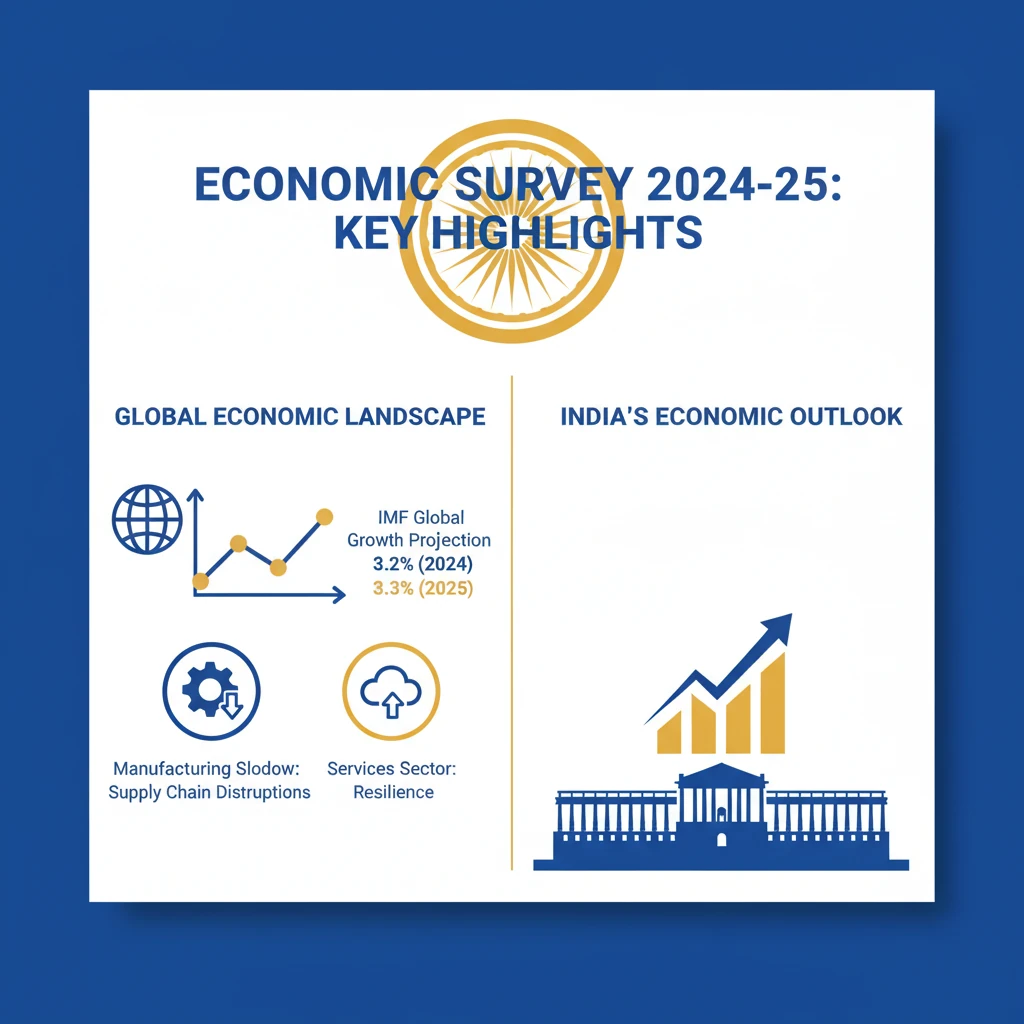

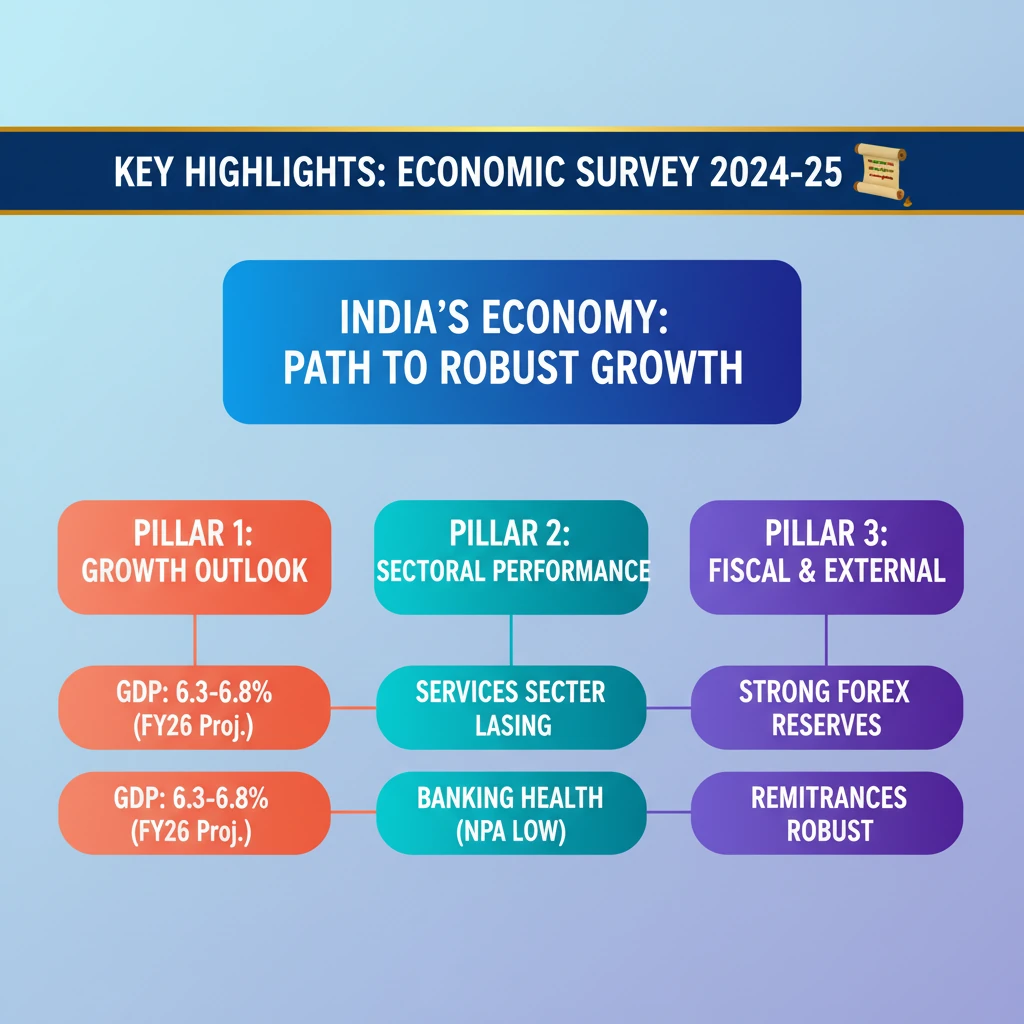

<h4>Global Economic Landscape</h4><p>The <strong>International Monetary Fund (IMF)</strong> projected a <strong>3.2% global growth</strong> in <strong>2024</strong>, with a slight increase to <strong>3.3% in 2025</strong>. This forecast suggests a cautious yet stable outlook for the world economy.</p><p>Globally, the <strong>manufacturing sector</strong> experienced a slowdown, primarily due to persistent <strong>supply chain disruptions</strong>. In contrast, the <strong>services sector</strong> demonstrated strong performance, helping to offset some of the manufacturing weaknesses.</p><p>Global inflation generally eased, providing some relief from previous pressures. However, <strong>services inflation</strong> remained notably persistent, leading to diverse <strong>monetary policy responses</strong> across various central banks worldwide.</p><p>Ongoing geopolitical conflicts, such as the <strong>Russia-Ukraine war</strong> and the <strong>Israel-Hamas conflict</strong>, significantly impacted global trade, energy security, and inflationary pressures. These events introduced considerable uncertainty into the global economic environment.</p><p>Disruptions in the <strong>Suez Canal</strong> forced many ships to reroute via the <strong>Cape of Good Hope</strong>. This longer route resulted in increased <strong>freight costs</strong> and extended <strong>delivery times</strong>, affecting global supply chains and trade efficiency.</p><div class='info-box'><p><strong>Key Global Economic Projections (2024-25)</strong></p><ul><li><strong>IMF Global Growth 2024</strong>: 3.2%</li><li><strong>IMF Global Growth 2025</strong>: 3.3%</li><li><strong>Persistent Issue</strong>: Services inflation</li><li><strong>Major Disruptions</strong>: Geopolitical conflicts, Suez Canal rerouting</li></ul></div><h4>India's Economic Performance</h4><p>India's <strong>Gross Domestic Product (GDP)</strong> is projected to grow between <strong>6.3-6.8% in FY26 (2025-26)</strong>. The <strong>real Gross Value Added (GVA)</strong> is estimated at <strong>6.4% in FY25 (2024-25)</strong>, reflecting robust domestic economic activity.</p><div class='key-point-box'><p>India maintains its position as a fast-growing major economy, driven by strong domestic demand and strategic policy interventions.</p></div><h4>Sector-Wise Performance in India (FY25)</h4><p>The <strong>agriculture sector</strong> is estimated to achieve a <strong>3.8% growth in FY25</strong>. This growth is primarily attributed to record <strong>Kharif production</strong> and sustained strong <strong>rural demand</strong>, indicating resilience in the primary sector.</p><p>The <strong>industry and manufacturing sector</strong> recorded a <strong>6.2% growth in FY25</strong>. However, manufacturing specifically experienced a slowdown due to weak global demand, highlighting external vulnerabilities.</p><p>The <strong>services sector</strong> emerged as the fastest-growing segment, expanding by <strong>7.2% in FY25</strong>. This growth was significantly led by strong performances in <strong>Information Technology (IT)</strong>, <strong>finance</strong>, and <strong>hospitality</strong>.</p><div class='info-box'><p><strong>Sectoral Growth Rates (FY25)</strong></p><ul><li><strong>Agriculture</strong>: 3.8%</li><li><strong>Industry & Manufacturing</strong>: 6.2%</li><li><strong>Services</strong>: 7.2% (Fastest-growing)</li></ul></div><h4>External Sector Developments</h4><p>India's overall exports, encompassing both <strong>merchandise and services</strong>, grew by <strong>5% (Year-on-Year)</strong> during the first nine months of <strong>FY25</strong>. The <strong>services sector exports</strong> notably expanded by <strong>11.6%</strong> in the same period.</p><p>While <strong>merchandise exports</strong> grew by <strong>1.6%</strong>, <strong>imports</strong> saw a higher increase of <strong>5.2%</strong>. This disparity led to a widening of the <strong>trade deficit</strong>, posing a challenge for external balance.</p><p>India continued to be the <strong>top global recipient of remittances</strong>, which played a crucial role in containing the <strong>Current Account Deficit (CAD)</strong>. The CAD was maintained at a manageable <strong>1.2% of GDP</strong>, ensuring macroeconomic stability.</p><p>Global trade faced significant headwinds from rising <strong>trade policy uncertainty</strong> and disruptions in critical shipping routes like the <strong>Red Sea</strong> and due to the <strong>Panama Canal drought</strong>. These issues led to higher costs and longer delivery times.</p><p>A notable global trend observed was a shift towards <strong>friend-shoring</strong> and <strong>near-shoring</strong>. Countries increasingly prioritized trade within their geopolitical alliances, impacting global supply chain configurations.</p><p><strong>Foreign Portfolio Investments (FPIs)</strong> experienced fluctuations due to global uncertainties. However, India's strong economic fundamentals ensured that overall inflows remained positive, reflecting investor confidence.</p><p>India's <strong>Foreign Exchange Reserves</strong> stood at <strong>USD 640.3 billion as of December 2024</strong>. These reserves covered <strong>90% of the external debt (USD 711.8 billion as of September 2024)</strong>, providing robust macroeconomic stability and resilience against external shocks.</p><div class='exam-tip-box'><p>The external sector's resilience, particularly the role of remittances in managing CAD and the robust forex reserves, are crucial points for <strong>UPSC Mains GS-III</strong> questions on India's balance of payments and external stability.</p></div><h4>Monetary and Financial Sector Developments</h4><p>The <strong>Gross Non-Performing Assets (GNPA)</strong> of <strong>Scheduled Commercial Banks (SCBs)</strong> dropped to a <strong>12-year low of 2.6% in 2024</strong>. <strong>Net NPAs</strong> also significantly reduced to <strong>0.6%</strong>, indicating improved asset quality.</p><p>Bank profitability improved, with <strong>Return on Assets (ROA)</strong> rising to <strong>1.1%</strong> and <strong>Return on Equity (ROE)</strong> improving to <strong>13.1% by September 2024</strong>. These metrics reflect better operational efficiency and financial health of SCBs.</p><p>The <strong>Reserve Bank of India (RBI)'s Financial Inclusion Index</strong> increased from <strong>53.9 in 2021 to 64.2 in 2024</strong>. This progress was significantly supported by the efforts of <strong>Regional Rural Banks (RRBs)</strong>.</p><p>The <strong>RBI maintained the repo rate at 6.5%</strong>, signalling a cautious approach to inflation management. Simultaneously, it reduced the <strong>Cash Reserve Ratio (CRR) to 4%</strong>, injecting <strong>₹1.16 lakh crore</strong> into the banking system to enhance liquidity.</p><p>The <strong>money multiplier</strong> rose to <strong>5.7</strong>, indicating increased liquidity and credit creation capacity within the economy, partly due to the CRR reduction.</p><p>Capital markets mobilized a substantial <strong>₹11.1 lakh crore</strong> in primary markets during <strong>April–December 2024</strong>, representing a <strong>5% increase over FY24</strong>. <strong>Initial Public Offerings (IPOs)</strong> saw a threefold increase in fundraising to <strong>₹1.53 lakh crore</strong>.</p><p><strong>Development Financial Institutions (DFIs)</strong> such as <strong>National Bank for Financing Infrastructure and Development (NaBFID)</strong> and <strong>India Infrastructure Finance Company Limited (IIFCL)</strong> played a crucial role in financing infrastructure projects. <strong>NaBFID</strong> alone sanctioned <strong>₹1.15 lakh crore</strong> in loans.</p><div class='info-box'><p><strong>Key Financial Indicators (2024)</strong></p><ul><li><strong>SCB GNPA</strong>: 2.6% (12-year low)</li><li><strong>SCB Net NPA</strong>: 0.6%</li><li><strong>RBI Financial Inclusion Index</strong>: 64.2</li><li><strong>Repo Rate</strong>: 6.5%</li><li><strong>CRR</strong>: 4%</li><li><strong>Capital Mobilization (Primary Mkts)</strong>: ₹11.1 lakh crore</li></ul></div><h4>Prices and Inflation Trends</h4><p>Global inflation peaked at <strong>8.7% in 2022</strong>, largely driven by widespread <strong>supply chain disruptions</strong>. It subsequently fell to <strong>5.7% in 2024</strong>, primarily due to global <strong>monetary tightening measures</strong>.</p><p>India's <strong>retail inflation</strong> eased from <strong>5.4% in FY24 to 4.9% in FY25</strong>, indicating some success in managing overall price levels. However, this trend was not uniform across all categories.</p><p>Despite the overall easing, <strong>food inflation</strong> rose from <strong>7.5% to 8.4%</strong>. This surge was primarily driven by price increases in essential vegetables like <strong>tomatoes and onions</strong>, and <strong>pulses</strong>, despite government efforts for price stabilization.</p><p>Persistent <strong>supply chain issues</strong> and adverse <strong>weather disruptions</strong> continued to keep the <strong>Consumer Price Index (CPI) volatility</strong> high, particularly for food items.</p><p><strong>Core inflation</strong>, which excludes volatile food and fuel prices, hit a <strong>10-year low</strong>. This was supported by declining inflation in both the services and fuel price segments, suggesting underlying price stability in other sectors.</p><div class='key-point-box'><p>While overall retail inflation showed signs of easing, elevated food inflation remains a key challenge for policymakers and household budgets in India.</p></div>

💡 Key Takeaways

- •India's economy projected for strong growth (6.3-6.8% in FY26), with services leading sectoral performance.

- •Global economy faces geopolitical risks and supply chain issues, though inflation is easing.

- •Banking sector health improved significantly with NPAs at a 12-year low.

- •External sector resilient due to strong remittances and robust forex reserves, despite a widening trade deficit.

- •Domestic retail inflation eased, but food inflation remains a concern due to supply chain and weather disruptions.

🧠 Memory Techniques

95% Verified Content