What is the Deposit Insurance Scheme of DICGC? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is the Deposit Insurance Scheme of DICGC?

Medium⏱️ 7 min read

economy

📖 Introduction

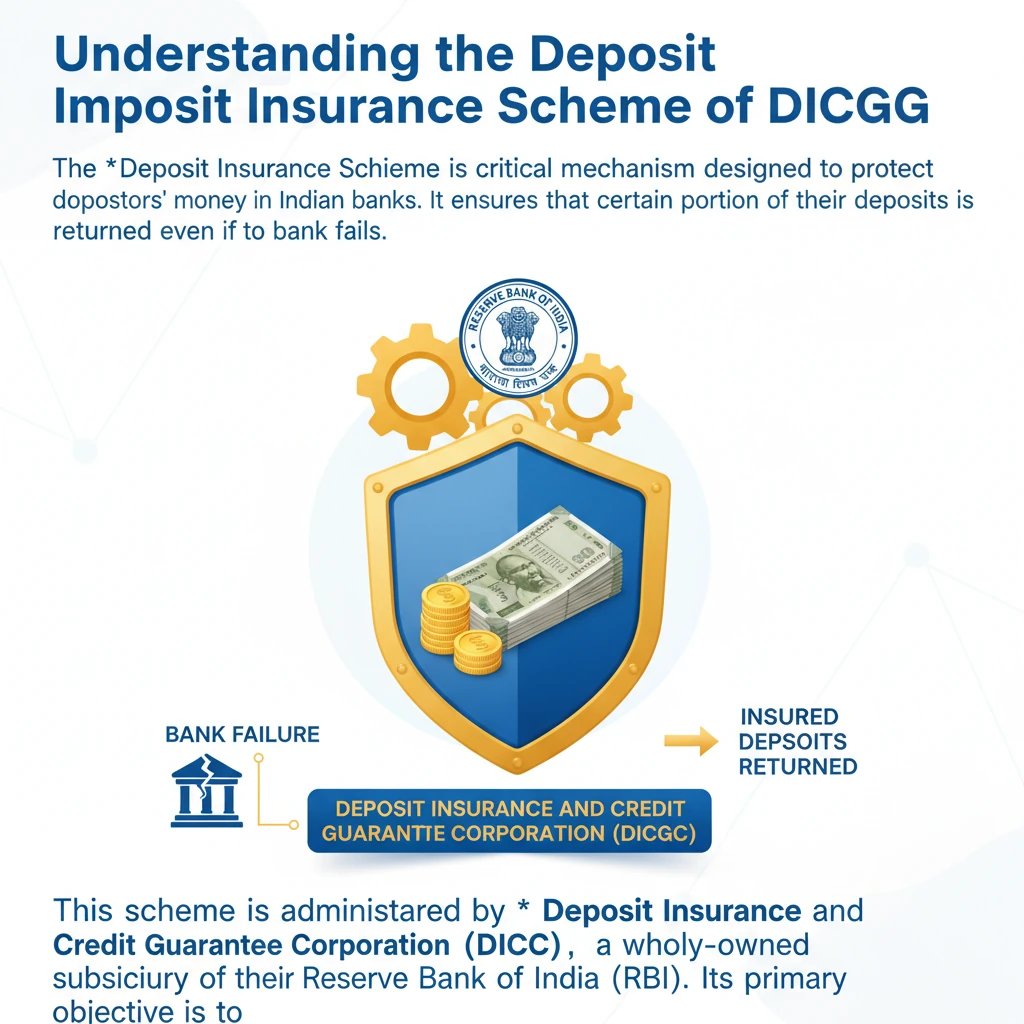

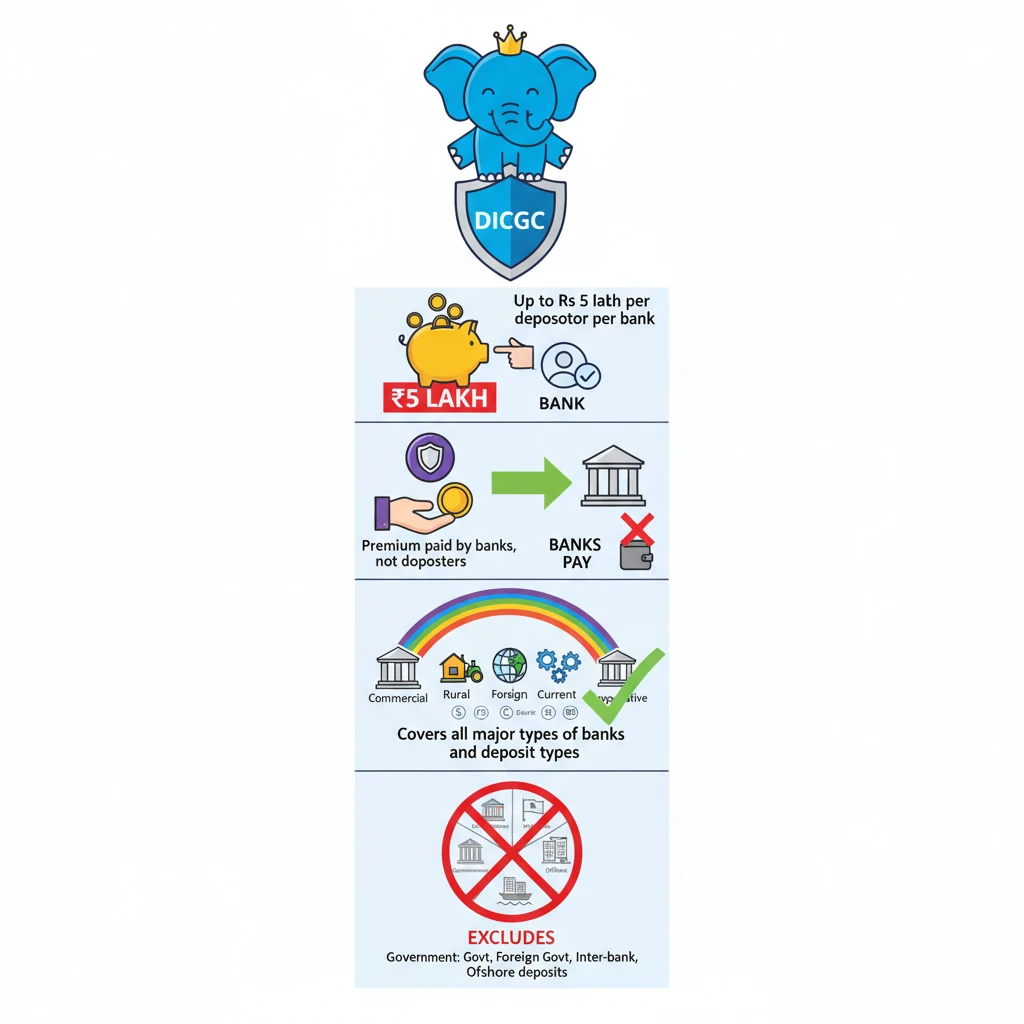

<h4>Understanding the Deposit Insurance Scheme of DICGC</h4><p>The <strong>Deposit Insurance Scheme</strong> is a critical mechanism designed to protect depositors' money in Indian banks. It ensures that a certain portion of their deposits is returned even if a bank fails.</p><p>This scheme is administered by the <strong>Deposit Insurance and Credit Guarantee Corporation (DICGC)</strong>, a wholly-owned subsidiary of the <strong>Reserve Bank of India (RBI)</strong>. Its primary objective is to instill confidence in the banking system.</p><h4>Deposit Insurance Limit</h4><p>Currently, the <strong>deposit insurance limit</strong> provides coverage up to <strong>Rs 5 lakh</strong> per depositor per bank. This means that if a bank collapses, a depositor is legally entitled to receive up to Rs 5 lakh from DICGC, irrespective of the total amount deposited.</p><div class='info-box'><p><strong>Maximum Coverage:</strong> A depositor has a claim to a maximum of <strong>Rs 5 lakh</strong> per account as insurance cover. This amount is termed <strong>‘deposit insurance’</strong>.</p><p><strong>Important Note:</strong> Deposits exceeding <strong>Rs 5 lakh</strong> in an account have no legal recourse to recover the excess funds in case of bank failure, beyond the insured limit.</p></div><h4>Insurance Premium Structure</h4><p>Banks are required to pay a <strong>premium</strong> to the <strong>DICGC</strong> for this insurance cover. This premium is a crucial part of the scheme's funding mechanism.</p><div class='info-box'><ul><li>The premium rate has been raised from <strong>10 paise</strong> for every <strong>Rs 100 deposit</strong> to <strong>12 paise</strong>.</li><li>A maximum limit of <strong>15 paise</strong> per Rs 100 deposit has been imposed.</li><li>Crucially, this premium is paid <strong>by banks</strong> to the DICGC and <strong>cannot be passed on to depositors</strong>.</li></ul></div><p>Insured banks pay these advance insurance premiums to the corporation <strong>semi-annually</strong>. Payments are due within two months from the beginning of each financial half-year, based on their deposits at the end of the previous half-year.</p><h4>Scope of Coverage: Insured Banks</h4><p>The <strong>DICGC scheme</strong> mandates coverage for a wide array of banking institutions in India. This ensures broad protection for depositors across different banking sectors.</p><div class='info-box'><p><strong>Banks Mandated to Take Cover:</strong></p><ul><li>All <strong>Commercial Banks</strong> (including regional rural banks, local area banks).</li><li><strong>Foreign banks</strong> with branches operating in India.</li><li>All <strong>Cooperative Banks</strong> (State, Central, and Primary Cooperative Banks).</li></ul><p><strong>Exclusion:</strong> <strong>Primary cooperative societies</strong> are explicitly <strong>not insured</strong> by the DICGC.</p></div><h4>Types of Deposits Covered</h4><p>The scheme covers almost all types of deposits maintained by depositors in insured banks, providing comprehensive protection for various financial instruments.</p><div class='key-point-box'><p><strong>Covered Deposits Include:</strong></p><ul><li><strong>Savings deposits</strong></li><li><strong>Fixed deposits</strong> (FDs)</li><li><strong>Current accounts</strong></li><li><strong>Recurring deposits</strong> (RDs)</li><li>Any other type of deposit, unless specifically exempted.</li></ul></div><h4>Deposits Not Covered by DICGC</h4><p>While broad, certain categories of deposits are specifically excluded from the <strong>DICGC insurance cover</strong> due to their nature or the entities involved.</p><div class='info-box'><p><strong>Deposits Excluded from Insurance:</strong></p><ul><li>Deposits of <strong>foreign Governments</strong>.</li><li>Deposits of <strong>Central/State Governments</strong>.</li><li><strong>Inter-bank deposits</strong> (deposits made by one bank in another).</li><li>Deposits of the <strong>State Land Development Banks</strong> with State co-operative banks.</li><li>Any amount due on account of any deposit received <strong>outside India</strong>.</li><li>Any amount specifically exempted by the corporation with the previous approval of the <strong>RBI</strong>.</li></ul></div><h4>DICGC's General Fund</h4><p>The <strong>DICGC</strong> maintains a <strong>General Fund</strong> to manage its operational expenditures. This fund is crucial for the smooth functioning of the corporation.</p><div class='info-box'><p>The <strong>General Fund</strong> covers DICGC’s <strong>operational expenses</strong>. It is primarily funded by the surplus generated from its operations, ensuring financial self-sufficiency.</p></div><div class='exam-tip-box'><p>For <strong>UPSC Prelims</strong>, remember the <strong>Rs 5 lakh limit</strong>, who pays the premium (banks), and the major categories of deposits/banks covered and excluded. For <strong>Mains</strong>, understand its role in financial stability and depositor confidence (<strong>GS Paper III: Economy</strong>).</p></div>

💡 Key Takeaways

- •DICGC insures bank deposits up to Rs 5 lakh per depositor per bank.

- •The premium for this insurance is paid by the banks, not the depositors.

- •Covers all major types of banks (commercial, rural, foreign, cooperative) and deposit types (savings, FD, current, RD).

- •Excludes deposits of governments, foreign governments, inter-bank deposits, and offshore deposits.

- •Crucial for maintaining depositor confidence and financial stability in India.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•DICGC Official Website

•Reserve Bank of India (RBI) Publications