What are the Key Facts About the Central Board of Direct Taxes? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are the Key Facts About the Central Board of Direct Taxes?

Medium⏱️ 7 min read

economy

📖 Introduction

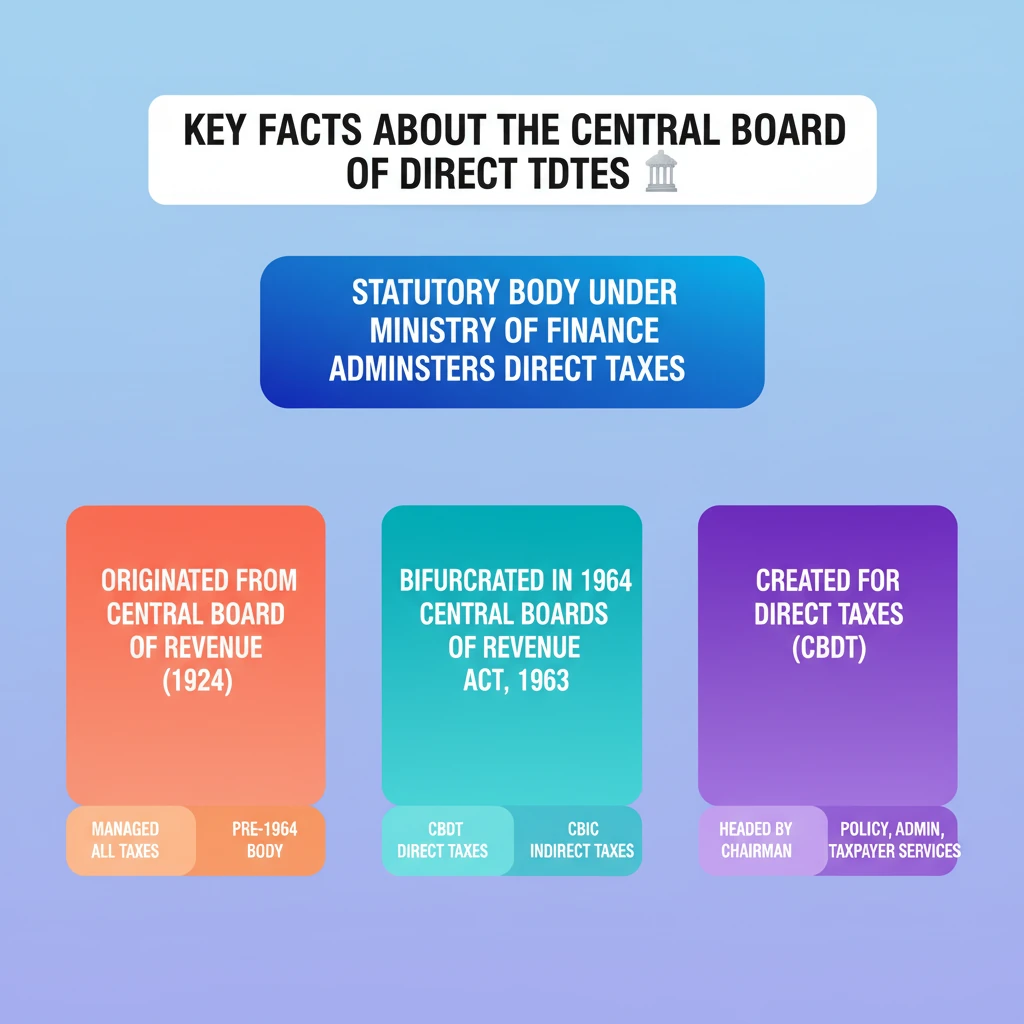

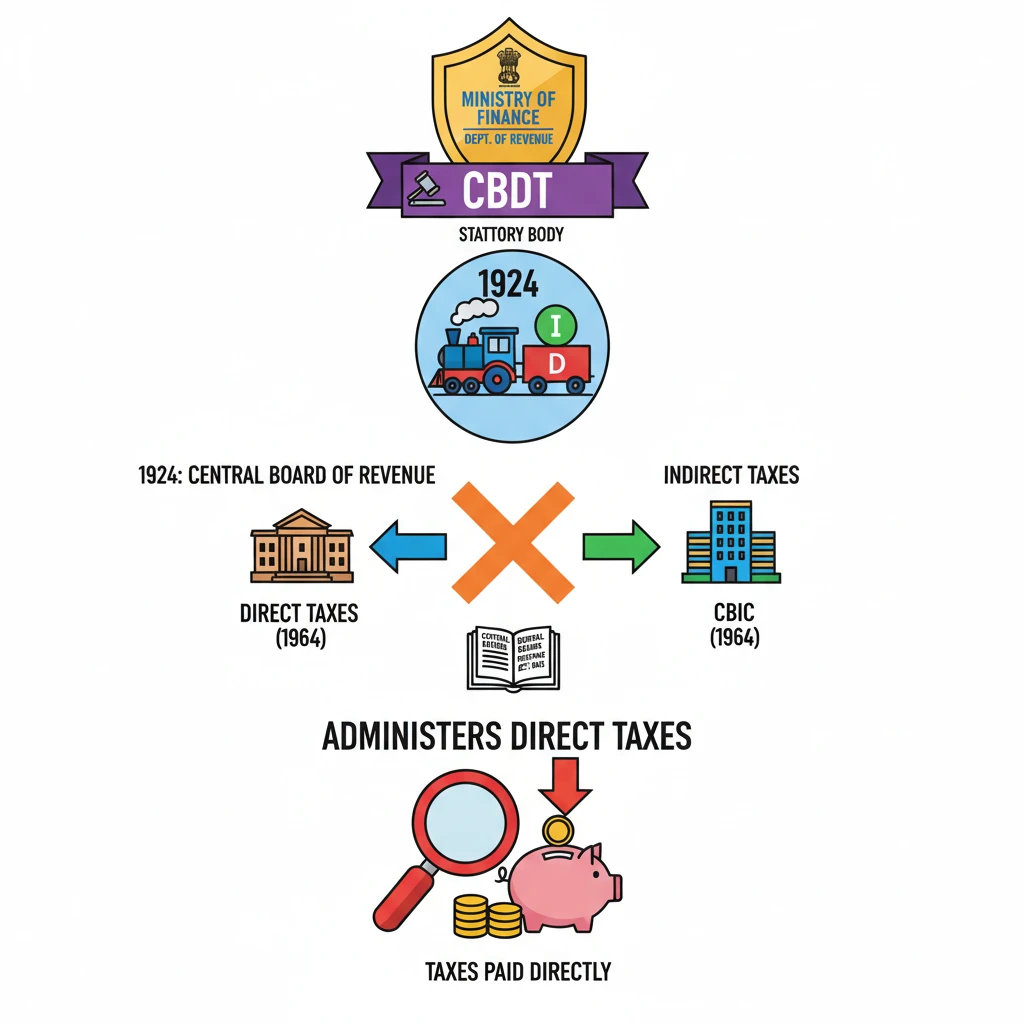

<h4>Introduction to the Central Board of Direct Taxes (CBDT)</h4><p>The <strong>Central Board of Direct Taxes (CBDT)</strong> is a statutory body crucial for India's direct tax administration. It functions under the <strong>Department of Revenue</strong>, which is part of the <strong>Ministry of Finance</strong>.</p><div class='key-point-box'><p>The <strong>CBDT</strong> is responsible for the administration of <strong>direct taxes</strong> in India, playing a pivotal role in the nation's fiscal framework.</p></div><h4>Historical Evolution and Genesis</h4><p>The origins of the <strong>CBDT</strong> can be traced back to the pre-independence era. Initially, a single administrative body managed both direct and indirect taxes.</p><p>This initial body was established under the provisions of the <strong>Central Board of Revenue Act, 1924</strong>. It was known as the <strong>Central Board of Revenue</strong>.</p><div class='info-box'><p>The <strong>Central Board of Revenue Act, 1924</strong>, created the <strong>Central Board of Revenue</strong>, which had jurisdiction over both <strong>direct and indirect taxes</strong>.</p></div><h4>Bifurcation of the Central Board of Revenue</h4><p>Over time, the administrative burden associated with managing both categories of taxes became significant. This led to a recognition of the need for specialized bodies.</p><p>Consequently, in <strong>1964</strong>, the <strong>Central Board of Revenue</strong> was bifurcated. This split aimed to streamline and enhance the efficiency of tax administration.</p><ol><li>The first distinct body formed was the <strong>Central Board of Direct Taxes (CBDT)</strong>, specifically for <strong>direct taxes</strong>.</li><li>The second body was the <strong>Central Board of Excise and Customs</strong>, established for the administration of <strong>indirect taxes</strong>.</li></ol><h4>Formalization and Legal Framework</h4><p>This crucial restructuring was formally institutionalized through the enactment of the <strong>Central Boards of Revenue Act, 1963</strong>. This Act provided the legal basis for the separate functioning of the two boards.</p><div class='info-box'><p>The <strong>Central Boards of Revenue Act, 1963</strong>, legally separated the administration of direct and indirect taxes, creating the <strong>CBDT</strong> and the <strong>Central Board of Excise and Customs</strong>.</p></div><h4>Organizational Structure of CBDT</h4><p>The <strong>CBDT</strong> operates with a clear hierarchical structure to ensure effective governance and policy implementation.</p><p>At its helm, the <strong>CBDT</strong> is led by a <strong>Chairman</strong>. The <strong>Chairman</strong> is responsible for coordinating all the functions and activities of the Board members and departments.</p>

💡 Key Takeaways

- •CBDT is a statutory body under the Ministry of Finance, Department of Revenue, administering direct taxes.

- •It originated from the Central Board of Revenue (1924), which managed both direct and indirect taxes.

- •The Central Board of Revenue was bifurcated in 1964, formalized by the Central Boards of Revenue Act, 1963.

- •This bifurcation created CBDT for direct taxes and the Central Board of Excise and Customs for indirect taxes.

- •Headed by a Chairman, CBDT is crucial for policy formulation, administration, and collection of direct taxes, and for improving taxpayer services.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Central Board of Direct Taxes (CBDT) official website

•Ministry of Finance, Government of India