What is Legal Status of Cryptocurrency in India? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is Legal Status of Cryptocurrency in India?

Medium⏱️ 8 min read

economy

📖 Introduction

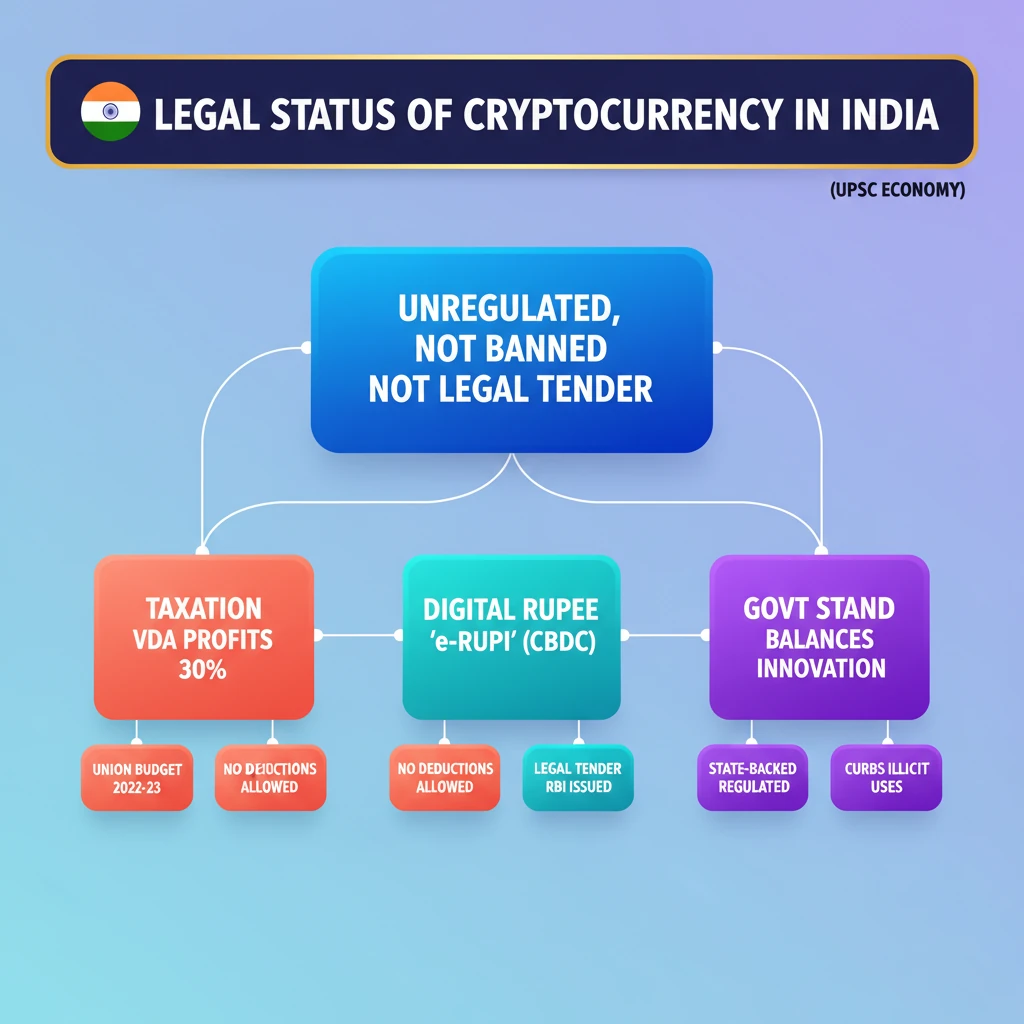

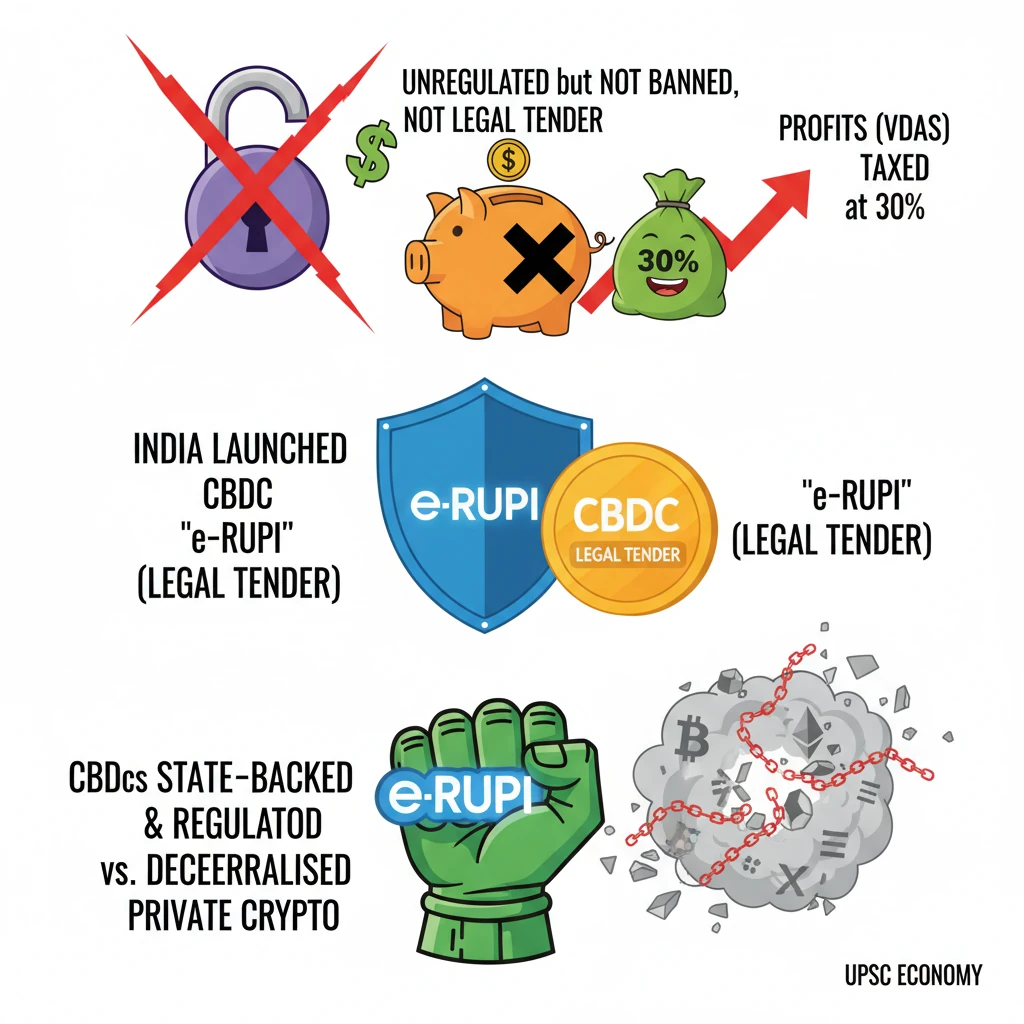

<h4>Current Regulatory Stance on Cryptocurrency in India</h4><p>In India, <strong>cryptocurrencies</strong> are currently <strong>unregulated</strong>. However, it is crucial to note that they are <strong>not specifically banned</strong> by law.</p><p>The <strong>Government of India</strong> does not officially recognise cryptocurrencies as <strong>legal tender</strong>. This means they cannot be used as a standard medium of exchange for goods and services or for settling debts.</p><div class='info-box'><p><strong>Legal Tender:</strong> A medium of payment recognised by law to be valid for meeting a financial obligation. In India, the <strong>Indian Rupee</strong> is the legal tender.</p></div><p>The government intends to address the use of cryptocurrencies in facilitating <strong>illegal activities</strong>, treating them as a payment method for such purposes.</p><h4>Taxation of Virtual Digital Assets (VDA)</h4><p>Despite the unregulated status, the <strong>Government of India</strong> introduced a significant taxation framework for <strong>virtual digital assets (VDA)</strong>, which includes cryptocurrencies, in the <strong>Union Budget 2022-23</strong>.</p><div class='info-box'><p><strong>Union Budget 2022-23:</strong> Announced that the transfer of any <strong>virtual currency/cryptocurrency asset</strong> will be subject to a <strong>30% tax deduction</strong>.</p></div><p>This taxation implies a form of indirect recognition for transaction purposes, even though they lack legal tender status.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> The introduction of taxation without explicit regulation highlights the government's cautious approach – aiming to generate revenue and track transactions while deliberating a comprehensive regulatory framework.</p></div><h4>Introduction of Central Bank Digital Currency (CBDC) - e-RUPI</h4><p>India has launched its own <strong>Central Bank Digital Currency (CBDC)</strong>, known as the <strong>Digital Rupee</strong> or <strong>‘e-RUPI’</strong>. This initiative is a collaborative effort by key financial and health authorities.</p><div class='info-box'><p><strong>Key Collaborators for e-RUPI:</strong></p><ul><li><strong>National Payments Corporation of India (NPCI)</strong></li><li><strong>Department of Financial Services (DFS)</strong></li><li><strong>National Health Authority (NHA)</strong></li><li><strong>Ministry of Health and Family Welfare (MoHFW)</strong></li><li>Partner banks</li></ul></div><p>The <strong>e-RUPI</strong> is a digital form of the paper currency, designed to be transacted using wallets backed by <strong>blockchain technology</strong>.</p><h4>Distinction between CBDC and Cryptocurrencies</h4><p>While the concept of <strong>CBDCs</strong> was inspired by innovations like <strong>Bitcoin</strong>, there are fundamental differences between them and decentralised virtual currencies or crypto assets.</p><div class='key-point-box'><p><strong>Key Differences:</strong></p><ul><li><strong>CBDCs</strong> are <strong>legal tenders</strong>, issued and backed by a <strong>central bank</strong> (like RBI in India).</li><li><strong>Cryptocurrencies</strong> (e.g., Bitcoin, Ethereum) operate in a <strong>regulatory vacuum</strong> and are <strong>not issued by the state</strong>.</li><li><strong>CBDCs</strong> are a digital form of <strong>fiat currency</strong>, enjoying sovereign backing.</li><li><strong>Cryptocurrencies</strong> lack the <strong>‘legal tender’ status</strong> and are decentralised.</li></ul></div><p>This distinction is critical for understanding India's approach, which seeks to leverage digital currency benefits while maintaining monetary control and stability.</p>

💡 Key Takeaways

- •Cryptocurrency in India is unregulated but not banned; it is not legal tender.

- •Profits from Virtual Digital Assets (VDAs) are taxed at 30% since Union Budget 2022-23.

- •India has launched its own Central Bank Digital Currency (CBDC), the 'e-RUPI', which is legal tender.

- •CBDCs are state-backed and regulated, unlike decentralised private cryptocurrencies.

- •The government's approach balances innovation with financial stability and combating illicit uses.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Union Budget 2022-23 documents

•Reserve Bank of India (RBI) publications on Central Bank Digital Currency (CBDC)

•Supreme Court of India rulings on cryptocurrency (2020)