Why is the Income Tax Act Being Reviewed? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Why is the Income Tax Act Being Reviewed?

Medium⏱️ 8 min read

economy

📖 Introduction

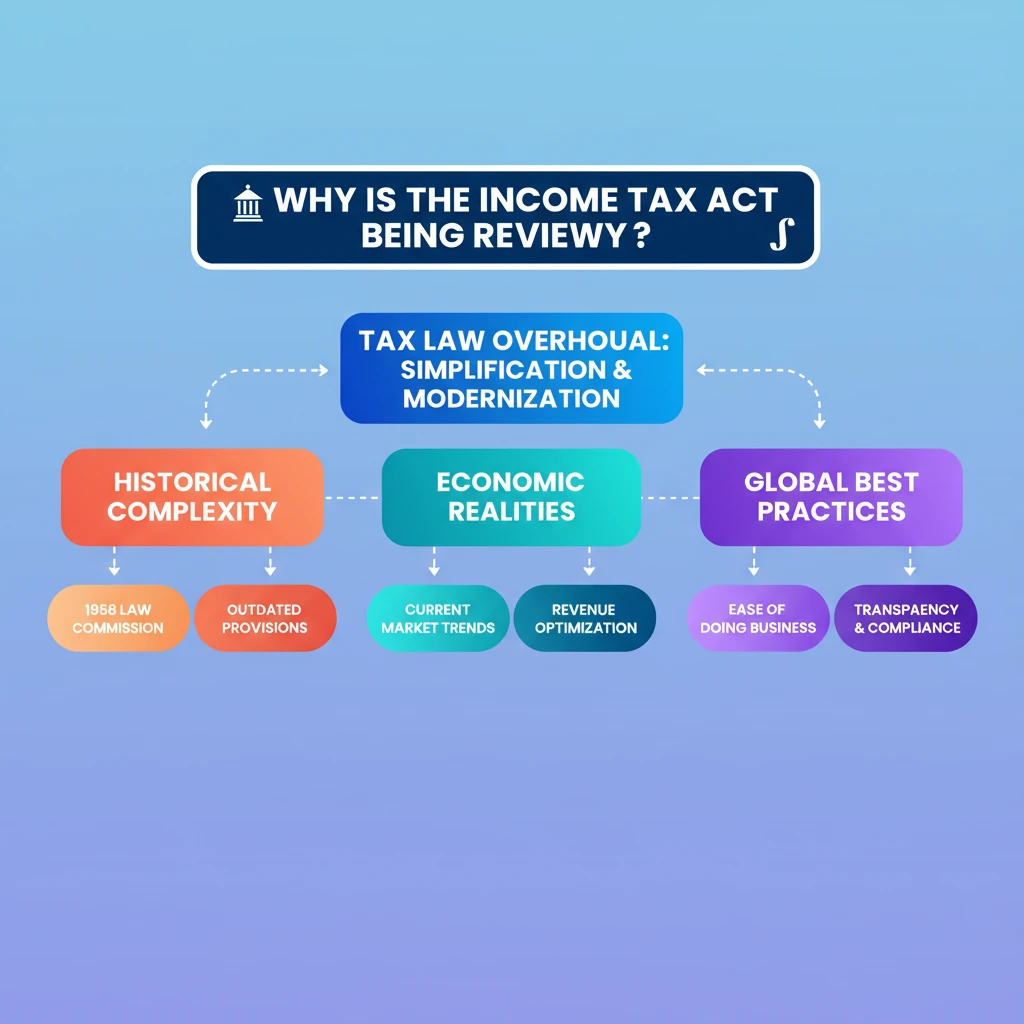

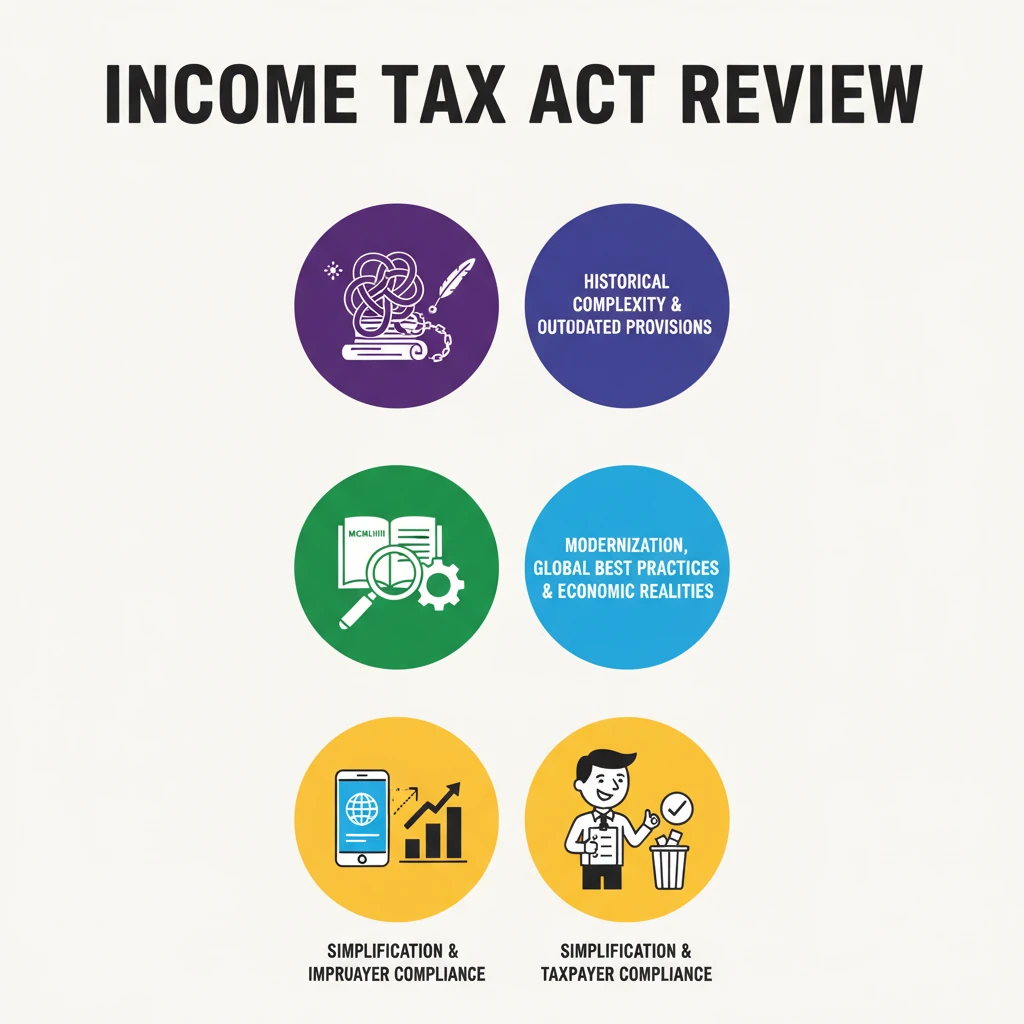

<h4>Introduction to the Income Tax Act Review</h4><p>The <strong>Income Tax Act, 1961</strong>, is currently undergoing a significant review. This initiative aims to address long-standing criticisms regarding its complexity and the outdated nature of many of its provisions.</p><div class='key-point-box'><p>The primary goal of this review is to create a more transparent, efficient, and taxpayer-friendly direct tax regime in India.</p></div><h4>Historical Complexity and Simplification Efforts</h4><p>A major point of contention has been the historical complexity embedded within the <strong>Income Tax Act, 1961</strong>. This complexity has often led to confusion and numerous disputes among taxpayers and authorities alike.</p><div class='info-box'><p>Previous efforts to simplify the tax code date back to the <strong>1958 Law Commission's</strong> work. This commission had highlighted the need for a fundamental overhaul of the entire tax structure, rather than mere superficial changes, when reviewing the erstwhile <strong>Income Tax Act, 1922</strong>.</p></div><p>These past observations underscore that true simplification requires a comprehensive restructuring of the tax framework itself, addressing its foundational elements.</p><h4>Need for Modernization</h4><p>The existing Act's intricate provisions often fail to align with contemporary economic realities. This discrepancy necessitates a modernization drive to ensure the law remains relevant and effective in a rapidly evolving global economy.</p><p>The review seeks to incorporate <strong>global best practices</strong> in taxation. This will help make the Indian tax system more competitive and aligned with international standards, reducing friction for global businesses.</p><div class='key-point-box'><p>A key objective is to enhance the <strong>transparency</strong> and <strong>ease of navigation</strong> within the tax law, making it more accessible for all stakeholders.</p></div><h4>Improving Taxpayer Compliance</h4><p>Simplifying the tax law is directly linked to improving <strong>taxpayer compliance</strong>. When rules are clear and straightforward, taxpayers are more likely to understand and adhere to them.</p><p>The current ambiguities in the law often lead to unintentional errors and disputes. A clearer framework is expected to reduce these issues, making the filing process significantly more straightforward for individuals and businesses.</p><div class='exam-tip-box'><p>This review is part of a broader government strategy to foster a more efficient and globally benchmarked tax system, crucial for India's economic growth and ease of doing business.</p></div>

💡 Key Takeaways

- •The Income Tax Act, 1961, is being reviewed due to historical complexity and outdated provisions.

- •Previous efforts, like the 1958 Law Commission, also emphasized the need for structural overhaul.

- •Modernization aims to align the law with current economic realities and global best practices.

- •Simplification is expected to improve taxpayer compliance by reducing ambiguities.

- •The review is part of a broader strategy to make India's tax system more efficient and transparent.

🧠 Memory Techniques

95% Verified Content