Why are RRBs Facing High Attrition Rates? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Why are RRBs Facing High Attrition Rates?

Medium⏱️ 9 min read

economy

📖 Introduction

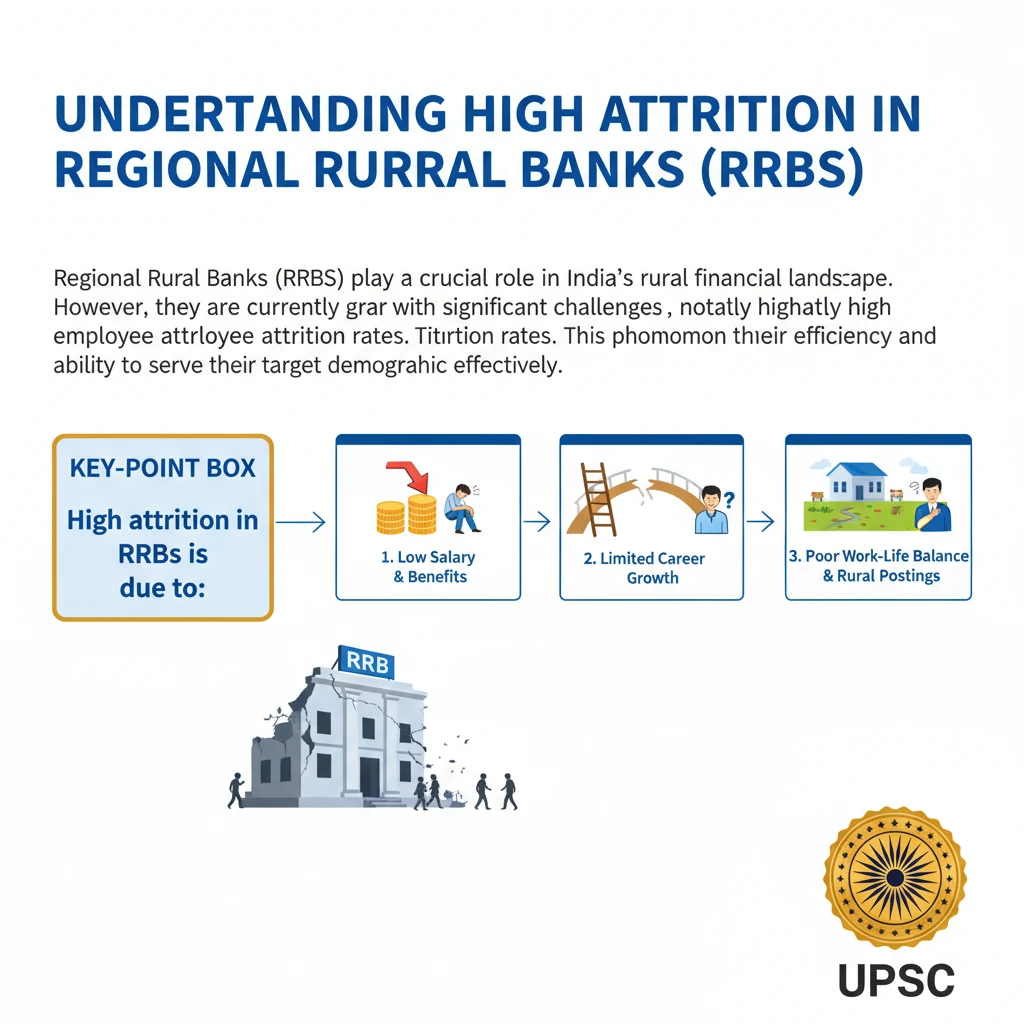

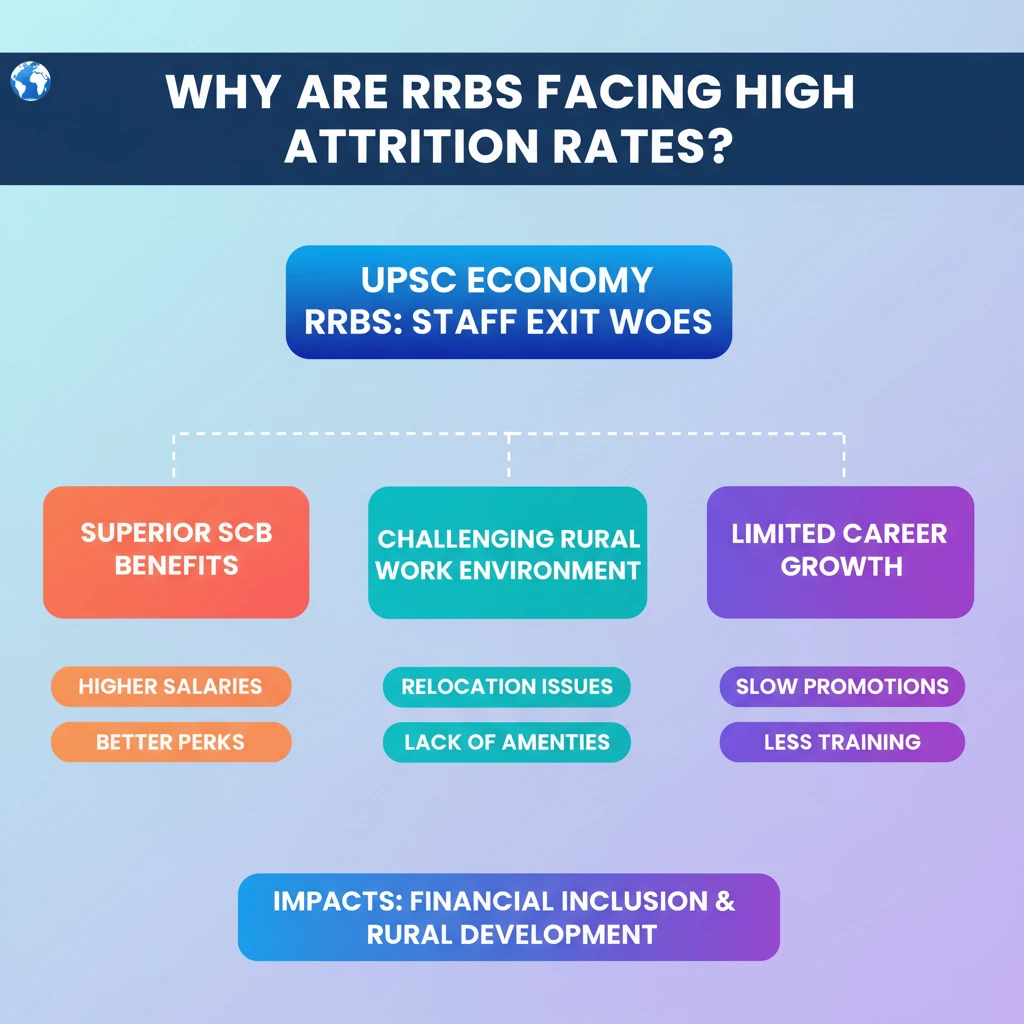

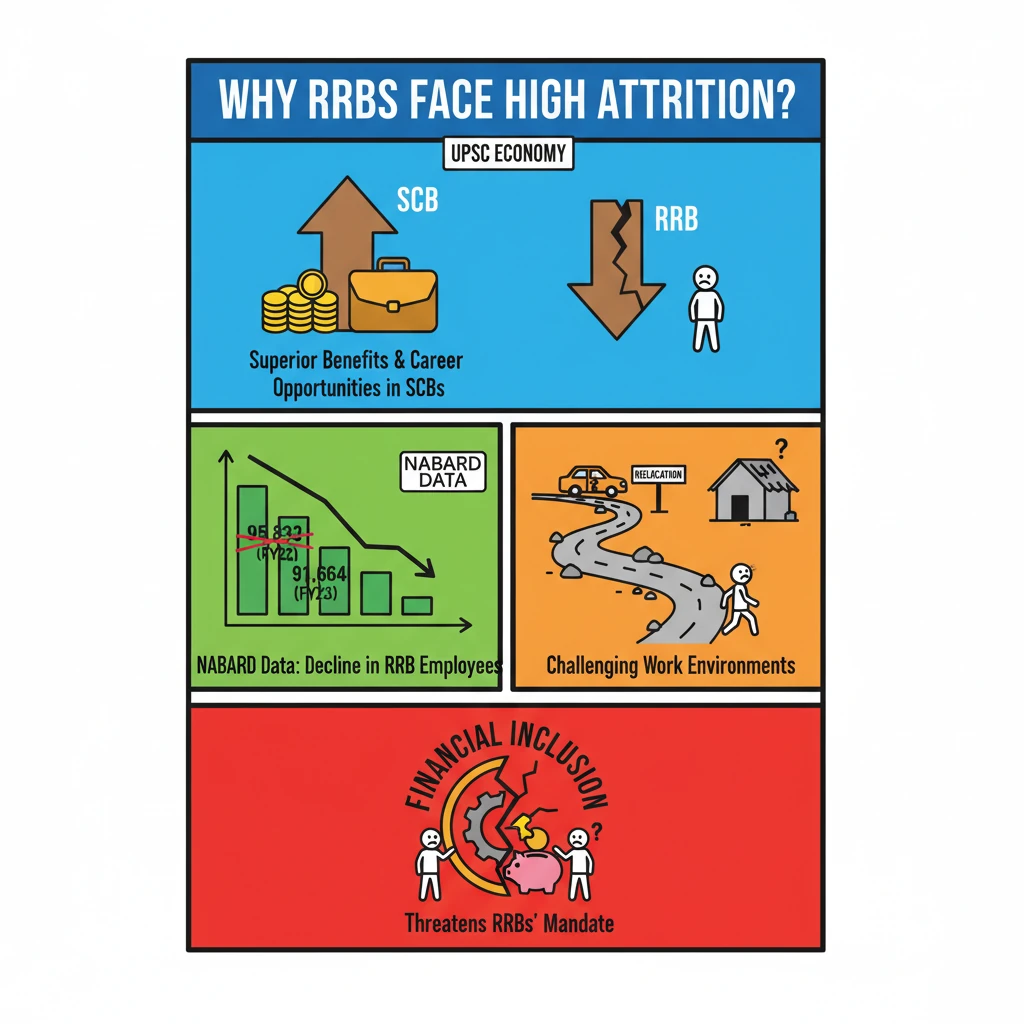

<h4>Understanding High Attrition Rates in Regional Rural Banks (RRBs)</h4><p><strong>Regional Rural Banks (RRBs)</strong> play a crucial role in India's financial inclusion agenda, serving remote and rural areas. However, these institutions are currently grappling with significant challenges, notably high employee attrition rates.</p><p>This trend poses a threat to their operational efficiency and long-term sustainability. Understanding the underlying causes is essential for devising effective retention strategies and strengthening the rural banking sector.</p><h4>Key Data on Employee Decline in RRBs</h4><div class='info-box'><p>According to the <strong>National Bank for Agriculture and Rural Development (NABARD)</strong>, there has been a notable decline in the total number of employees in <strong>Regional Rural Banks (RRBs)</strong>.</p><ul><li>Total employees in <strong>43 RRBs</strong> decreased from <strong>95,833</strong> in <strong>FY 2022</strong> to <strong>91,664</strong> in <strong>FY 2023</strong>.</li><li>Concurrently, the number of <strong>RRB branches</strong> saw a minor increase from <strong>21,892</strong> in <strong>FY 2022</strong> to <strong>21,895</strong> in <strong>FY 2023</strong>.</li></ul><p>This data highlights a growing disparity between increasing branch networks and a shrinking workforce.</p></div><h4>Reason 1: Disparity in Employee Benefits and Facilities</h4><div class='key-point-box'><p>A primary driver of attrition is the perceived lack of superior employee benefits in <strong>RRBs</strong> compared to <strong>Scheduled Commercial Banks (SCBs)</strong>.</p></div><p>While the pay scales might be similar, <strong>SCBs</strong> often offer a wider array of facilities, perquisites, and a more urban work environment.</p><p>These superior offerings in <strong>SCBs</strong> make them more attractive, leading <strong>RRB employees</strong> to seek better opportunities elsewhere.</p><h4>Reason 2: Challenging Rural Work Environment</h4><div class='key-point-box'><p>Many employees, especially those who relocate from other states or urban backgrounds, find it difficult to adapt to the <strong>rural lifestyle</strong> associated with <strong>RRB postings</strong>.</p></div><p>The lack of urban amenities, social infrastructure, and family support systems in remote areas can lead to dissatisfaction.</p><p>This struggle to adjust often prompts employees to look for roles in more urban or semi-urban settings, contributing to the high attrition.</p><h4>Reason 3: Slower Career Growth and Limited Incentives</h4><div class='key-point-box'><p>Compared to their counterparts in <strong>Scheduled Commercial Banks (SCBs)</strong>, employees in <strong>RRBs</strong> often experience slower career progression.</p></div><p>The promotion cycles in <strong>RRBs</strong> can be longer, and the opportunities for upward mobility or diverse roles may be fewer.</p><p>This limited scope for professional advancement and fewer performance-based incentives can lead to significant dissatisfaction among ambitious employees.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the challenges faced by <strong>RRBs</strong> is crucial for topics like <strong>Financial Inclusion</strong>, <strong>Rural Development</strong>, and <strong>Banking Sector Reforms</strong> in <strong>GS Paper III</strong>. Analyze both the socio-economic and human resource aspects.</p></div>

💡 Key Takeaways

- •RRBs face high attrition due to lack of employee benefits, challenging rural work environments, and slower career growth.

- •NABARD data shows a significant decline in RRB employees (95,833 in FY22 to 91,664 in FY23) despite a slight increase in branches.

- •Scheduled Commercial Banks (SCBs) offer superior facilities and better career prospects, attracting RRB talent.

- •Difficulty in adapting to rural life and limited urban amenities contribute significantly to employee dissatisfaction.

- •Slower promotions and fewer incentives in RRBs demotivate employees seeking professional advancement.

- •Addressing RRB attrition is crucial for sustaining financial inclusion and rural development efforts in India.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•National Bank for Agriculture and Rural Development (NABARD) Annual Reports

•Reserve Bank of India (RBI) publications on Regional Rural Banks

•Ministry of Finance, Government of India reports on banking sector