What are the Key Differences between UPS, Old Pension Scheme (OPS) and National Pension Scheme (NPS)? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are the Key Differences between UPS, Old Pension Scheme (OPS) and National Pension Scheme (NPS)?

Medium⏱️ 8 min read

economy

📖 Introduction

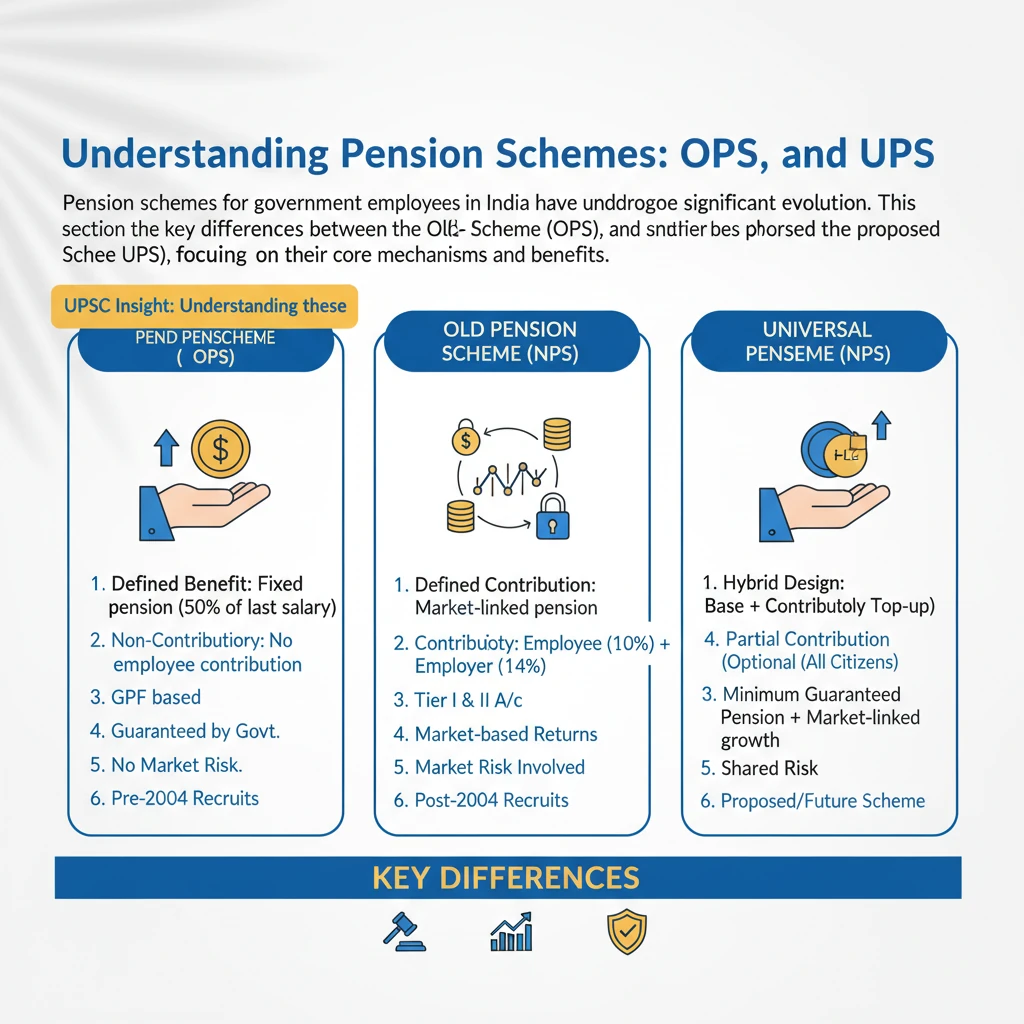

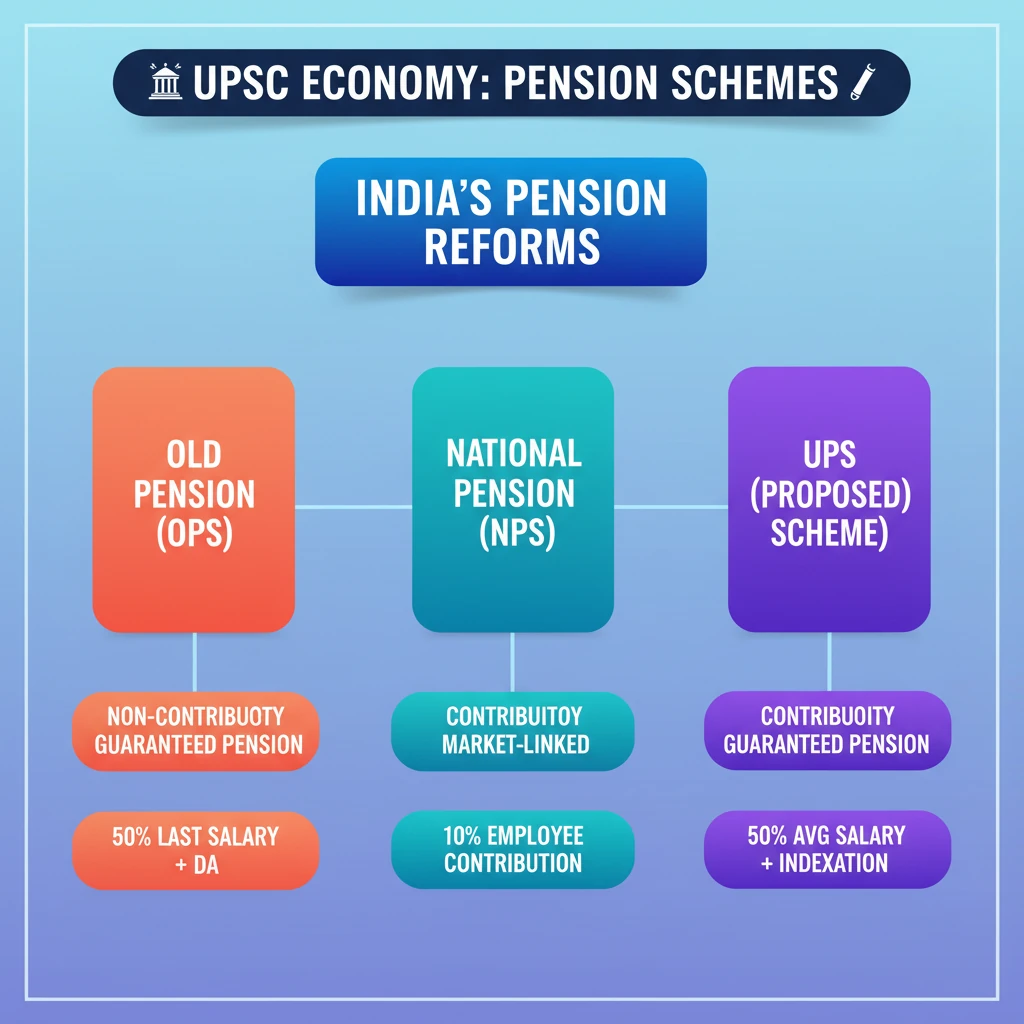

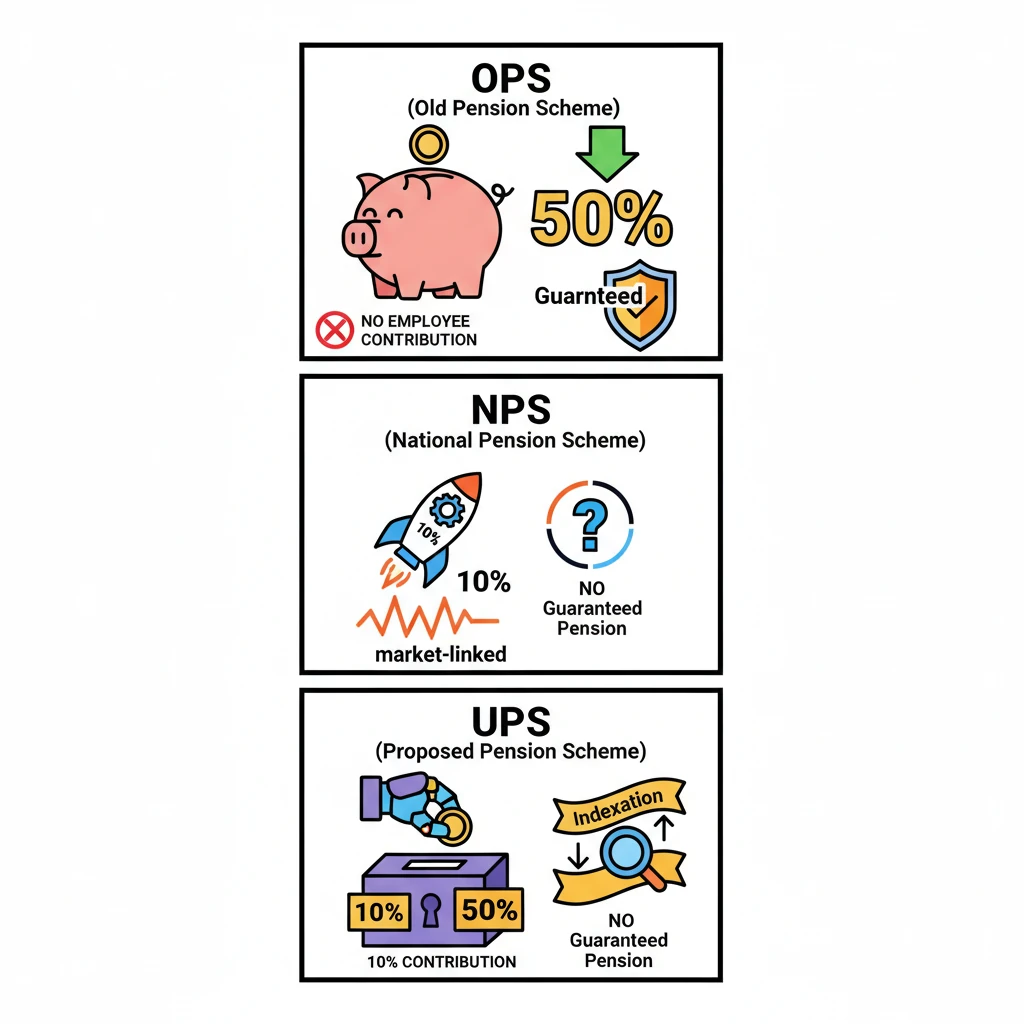

<h4>Understanding Pension Schemes: OPS, NPS, and UPS</h4><p>Pension schemes for government employees in India have undergone significant evolution. This section details the key differences between the <strong>Old Pension Scheme (OPS)</strong>, the <strong>National Pension Scheme (NPS)</strong>, and the proposed <strong>Universal Pension Scheme (UPS)</strong>, focusing on their core mechanisms and benefits.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding these schemes is crucial for <strong>GS Paper 2 (Governance)</strong> and <strong>GS Paper 3 (Indian Economy)</strong>. Questions often revolve around fiscal sustainability, social security, and employee welfare.</p></div><h4>Pension Calculation Method</h4><p>The method used to calculate an employee's pension is a primary differentiator among these schemes.</p><ul><li><p>Under the <strong>Old Pension Scheme (OPS)</strong>, pension was fixed at a generous <strong>50% of the last drawn basic salary plus Dearness Allowance (DA)</strong>. This provided a predictable and often higher retirement income.</p></li><li><p>For the <strong>Universal Pension Scheme (UPS)</strong>, pension is calculated as <strong>50% of the average of the last salary plus DA</strong> drawn in the <strong>last year before retirement</strong>. This adjustment can result in a slightly lower pension if an employee receives a promotion shortly before retiring, as the average might not fully reflect the final higher pay.</p></li><li><p>The <strong>National Pension Scheme (NPS)</strong>, being a <strong>defined contribution scheme</strong>, does not guarantee a fixed pension amount. The pension received depends on the accumulated corpus and market performance of investments.</p></li></ul><h4>Employee Contribution and Government Support</h4><p>The requirement for employee contributions varies significantly across the schemes, impacting both the employee's take-home pay and the government's fiscal burden.</p><ul><li><p>The <strong>Old Pension Scheme (OPS)</strong> required <strong>no employee contribution</strong>. This made it highly attractive to employees, as the entire pension was funded by the government.</p></li><li><p>Under the <strong>Universal Pension Scheme (UPS)</strong>, employees are required to contribute <strong>10% of their basic pay and DA</strong>. The government's contribution is set at <strong>14.85%</strong>.</p></li><li><p>The <strong>National Pension Scheme (NPS)</strong> mandates a <strong>10% contribution from the central government employee’s basic salary</strong>. The government's contribution to NPS is <strong>14%</strong>.</p></li></ul><h4>Tax Benefits</h4><p>Tax implications play a crucial role in the net financial benefit for employees under different pension schemes.</p><ul><li><p>Employees under the <strong>Old Pension Scheme (OPS)</strong> could not avail of any specific tax benefits related to pension contributions, as there were <strong>no employee contributions</strong> required.</p></li><li><p>For the <strong>National Pension Scheme (NPS)</strong>, central government employees are eligible for significant tax benefits. They can deduct the government's <strong>14% contribution under Section 80CCD(2) of the Income Tax Act, 1961</strong>, applicable to both old and new taxation regimes.</p></li><li><p>Regarding the <strong>Universal Pension Scheme (UPS)</strong>, the government has <strong>yet to clarify</strong> whether employee and government contributions will be eligible for any specific tax benefits.</p></li></ul><h4>Lump Sum Payment at Retirement (UPS Specific)</h4><p>The <strong>Universal Pension Scheme (UPS)</strong> introduces a unique provision for a lump sum payment at retirement.</p><div class='info-box'><p>In addition to <strong>gratuity</strong>, UPS employees will receive a <strong>lump sum payment</strong> equivalent to <strong>10% of their monthly emoluments (pay + DA)</strong> as of the retirement date, for every completed six months of service. This payment is designed to provide immediate financial support upon retirement and <strong>will not affect the amount of the assured pension</strong>.</p></div><div class='info-box'><p><strong>Definition: Gratuity</strong> is a one-time amount paid by an employer to its employees for rendering their services, typically upon retirement or resignation after a minimum service period.</p></div><h4>Indexation of Pension (UPS Specific)</h4><p><strong>Indexation</strong> is a key feature of the <strong>Universal Pension Scheme (UPS)</strong>, ensuring that pension benefits keep pace with inflation.</p><div class='info-box'><p>Under UPS, <strong>indexation</strong> will be calculated based on the <strong>All India Consumer Price Index for Industrial Workers (CPI-IW)</strong>. This mechanism helps to protect the purchasing power of the pension over time.</p></div><h4>Employee Choice (UPS Specific)</h4><p>The <strong>Universal Pension Scheme (UPS)</strong> provides a degree of flexibility for existing employees.</p><div class='key-point-box'><p>Employees can still opt to remain under the <strong>National Pension Scheme (NPS)</strong> if they choose. However, this is a one-time option; once an employee opts out of NPS for UPS, or vice versa, the <strong>option cannot be changed</strong>.</p></div>

💡 Key Takeaways

- •OPS is a non-contributory, defined benefit scheme with guaranteed pension (50% of last salary + DA).

- •NPS is a contributory, defined contribution scheme, market-linked, with no guaranteed pension.

- •UPS (proposed) is a contributory scheme aiming for a guaranteed pension (50% of last year's average salary + DA) with indexation.

- •OPS has no employee contribution; UPS and NPS require 10% employee contribution.

- •NPS offers clear tax benefits on government contributions; UPS tax benefits are yet to be clarified.

- •UPS includes a lump sum payment at retirement and pension indexation based on CPI-IW.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reports by the Finance Ministry on NPS and pension reforms

•Economic Survey documents