Cross-Border Payments - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Cross-Border Payments

Medium⏱️ 7 min read

economy

📖 Introduction

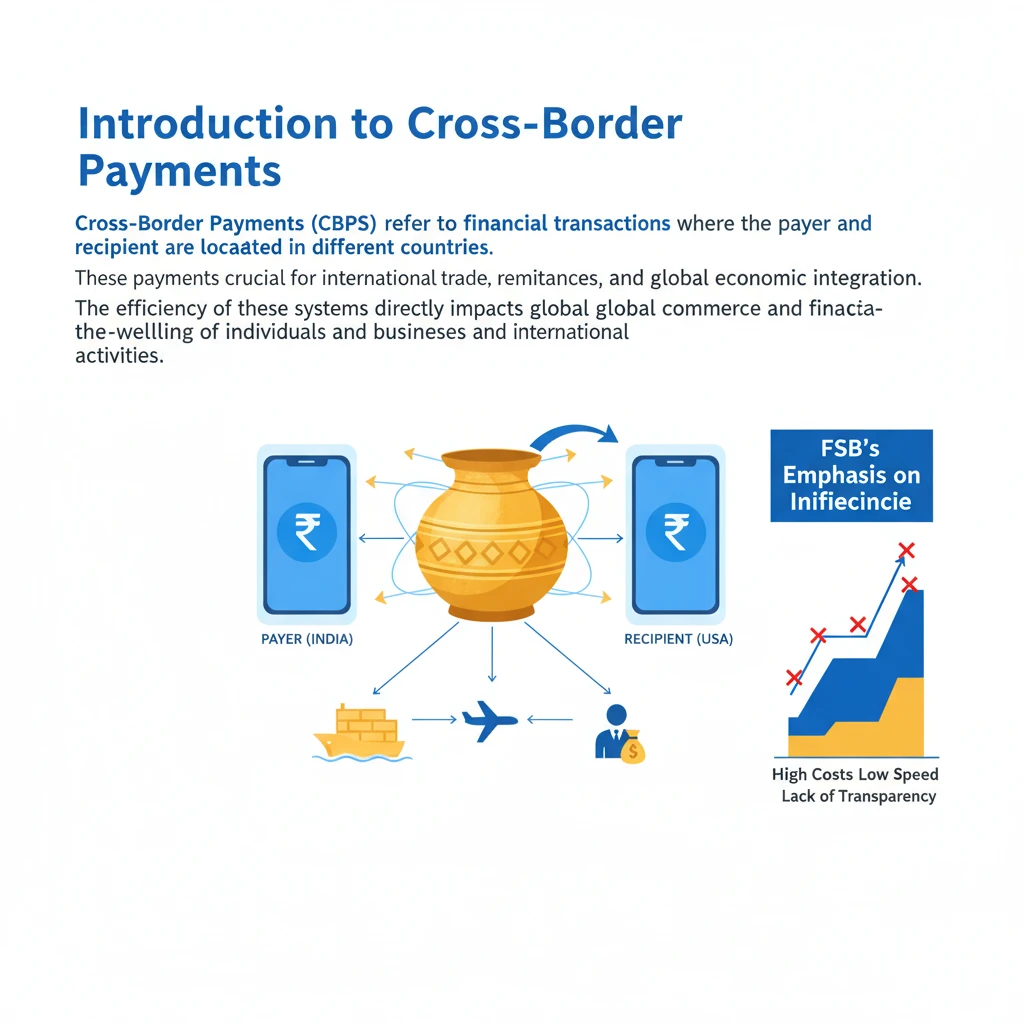

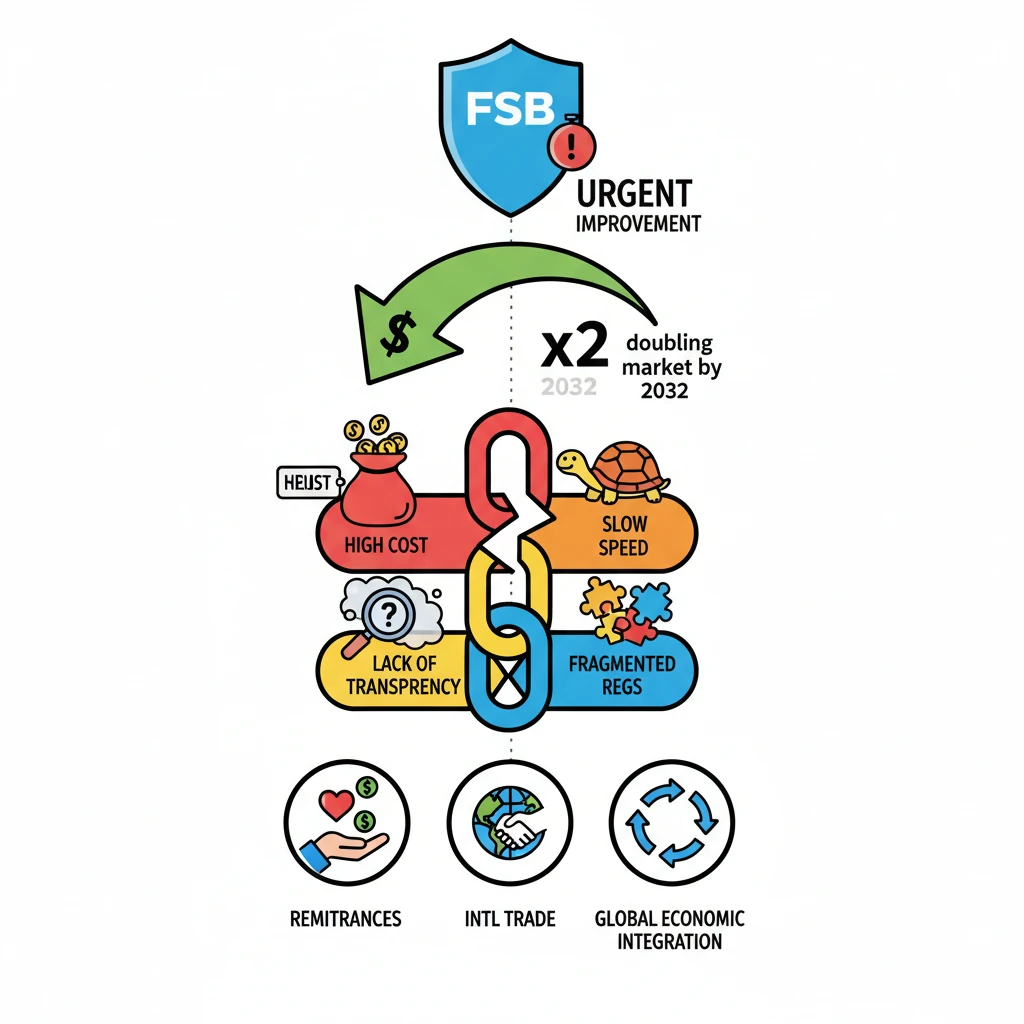

<h4>Introduction to Cross-Border Payments</h4><p><strong>Cross-Border Payments (CBPs)</strong> refer to financial transactions where the payer and the recipient are located in different countries. These payments are crucial for international trade, remittances, and global economic integration.</p><p>The efficiency of these systems directly impacts global commerce and the financial well-being of individuals and businesses engaged in international activities.</p><h4>FSB's Emphasis on Inefficiencies</h4><p>The <strong>Financial Stability Board (FSB)</strong>, an international body that monitors and makes recommendations about the global financial system, has highlighted a pressing concern. The FSB has strongly emphasised the urgent need to address existing <strong>inefficiencies</strong> within current cross-border payment systems.</p><div class='info-box'><p>The <strong>FSB's mandate</strong> is to promote global financial stability by coordinating national financial authorities and international standard-setting bodies.</p></div><h4>Growing Market and Critical Focus</h4><p>The global cross-border payments market is experiencing rapid growth. Projections indicate that this market is set to nearly <strong>double by 2032</strong>, signifying a massive increase in transaction volume and value.</p><div class='key-point-box'><p>This significant growth trajectory makes the improvement of existing cross-border payment systems a <strong>critical focus</strong> for international financial bodies and national governments alike.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Reports and recommendations from bodies like the <strong>FSB</strong> are important for understanding global economic trends and potential policy interventions. They often feature in <strong>GS-III Economy</strong> questions related to financial sector reforms or international economic institutions.</p></div>

💡 Key Takeaways

- •The Financial Stability Board (FSB) stresses the urgent need to improve cross-border payments (CBPs).

- •The global CBP market is projected to nearly double by 2032, making efficiency crucial.

- •Inefficiencies include high costs, slow speeds, lack of transparency, and fragmented regulations.

- •CBPs are vital for remittances, international trade, and global economic integration.

- •International cooperation (e.g., G20 roadmap) and fintech innovations are key to addressing challenges.

- •India's UPI linkages and focus on digital payments reflect a commitment to CBP efficiency.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Financial Stability Board (FSB) official reports and statements

•Reserve Bank of India (RBI) publications on digital payments and international finance

•World Bank reports on remittances and global payment systems

•G20 Communiqués on enhancing cross-border payments