Digital Currency - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Digital Currency

Medium⏱️ 5 min read

economy

📖 Introduction

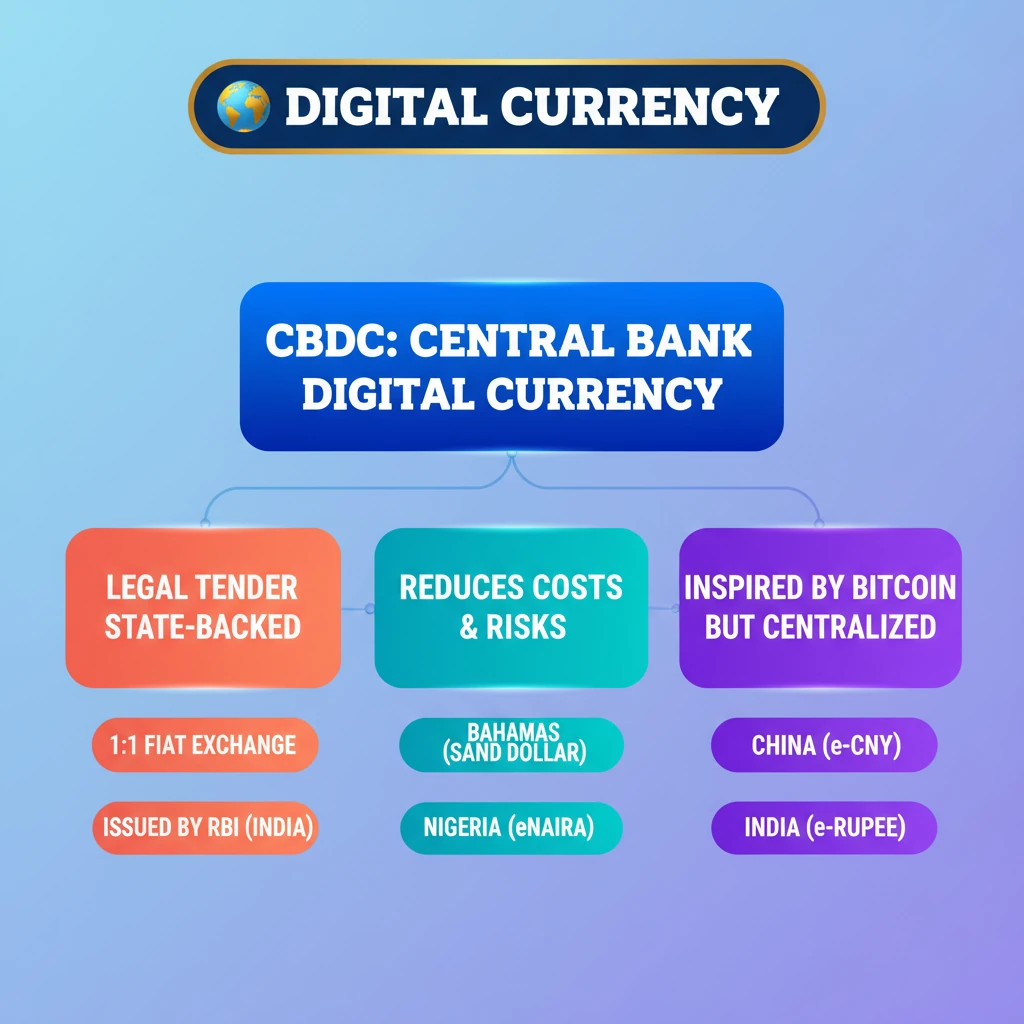

<h4>Introduction to Digital Currency and CBDC</h4><p>The concept of <strong>Digital Currency</strong> has gained significant traction globally. India's central bank, the <strong>Reserve Bank of India (RBI)</strong>, is actively developing its own version, known as the <strong>Central Bank Digital Currency (CBDC)</strong> or <strong>e-rupee</strong>.</p><p>The <strong>Governor of the RBI</strong> has highlighted the innovative features being incorporated into India's <strong>CBDC</strong>, signaling a strategic move towards modernizing the country's financial infrastructure.</p><h4>What is Central Bank Digital Currency (CBDC)?</h4><p>A <strong>CBDC</strong> is essentially a <strong>legal tender</strong> that is issued by a <strong>central bank</strong> in a purely <strong>digital form</strong>. It represents the digital equivalent of a nation's fiat currency.</p><div class='info-box'><p><strong>Definition:</strong> A <strong>Central Bank Digital Currency (CBDC)</strong> is a digital form of a country's fiat currency, issued and backed by its central bank.</p></div><p>Crucially, <strong>CBDCs</strong> are backed directly by the respective <strong>central bank</strong>. This backing provides inherent <strong>stability</strong> and fosters <strong>trust</strong> among users, a characteristic often lacking in private cryptocurrencies.</p><div class='key-point-box'><p><strong>Key Feature:</strong> A <strong>CBDC</strong> is fully exchangeable <strong>one-to-one</strong> with the traditional <strong>fiat currency</strong> of that nation, maintaining its value and purchasing power.</p></div><h4>Understanding Fiat Currency</h4><p>The term <strong>fiat currency</strong> refers to a national currency that is not pegged to the price of a physical commodity. Unlike historical currencies backed by gold or silver, its value is derived from government decree and public trust.</p><div class='info-box'><p><strong>Fiat Currency:</strong> A national currency not backed by a physical commodity like gold or silver. Its value is determined by government declaration and market demand.</p></div><h4>Distinguishing CBDC from Cryptocurrencies</h4><p>While the concept of <strong>CBDCs</strong> was indeed inspired by the emergence of <strong>Bitcoin</strong> and other digital assets, they are fundamentally different. <strong>CBDCs</strong> are distinct from decentralized virtual currencies and crypto assets.</p><p>The primary difference lies in their issuance and legal status. <strong>Private cryptocurrencies</strong> are not issued by the state and therefore lack the crucial status of <strong>'legal tender'</strong>, making them speculative assets rather than official currency.</p><h4>Objectives of CBDC</h4><p>The main objective behind the development and implementation of <strong>CBDCs</strong> is multi-faceted. It aims to enhance efficiency and security within the financial system.</p><div class='key-point-box'><p><strong>Primary Goal:</strong> The core objective of <strong>CBDCs</strong> is to <strong>mitigate risks</strong> associated with and <strong>trim costs</strong> involved in handling physical currency, promoting a more streamlined digital economy.</p></div>

💡 Key Takeaways

- •CBDC is a legal tender digital currency issued and backed by a central bank, unlike private cryptocurrencies.

- •It is exchangeable one-to-one with fiat currency and aims to reduce costs and risks of physical cash.

- •Inspired by Bitcoin, but fundamentally different due to centralized issuance and legal tender status.

- •Bahamas (Sand Dollar), Nigeria (eNaira), and China (e-CNY) are pioneers in CBDC implementation.

- •India's e-rupee is under development, with RBI emphasizing innovative features for a robust digital financial ecosystem.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) official statements and publications on CBDC

•Bank for International Settlements (BIS) reports on CBDCs