Decline in 10-Year Bond Yield - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Decline in 10-Year Bond Yield

Medium⏱️ 7 min read

economy

📖 Introduction

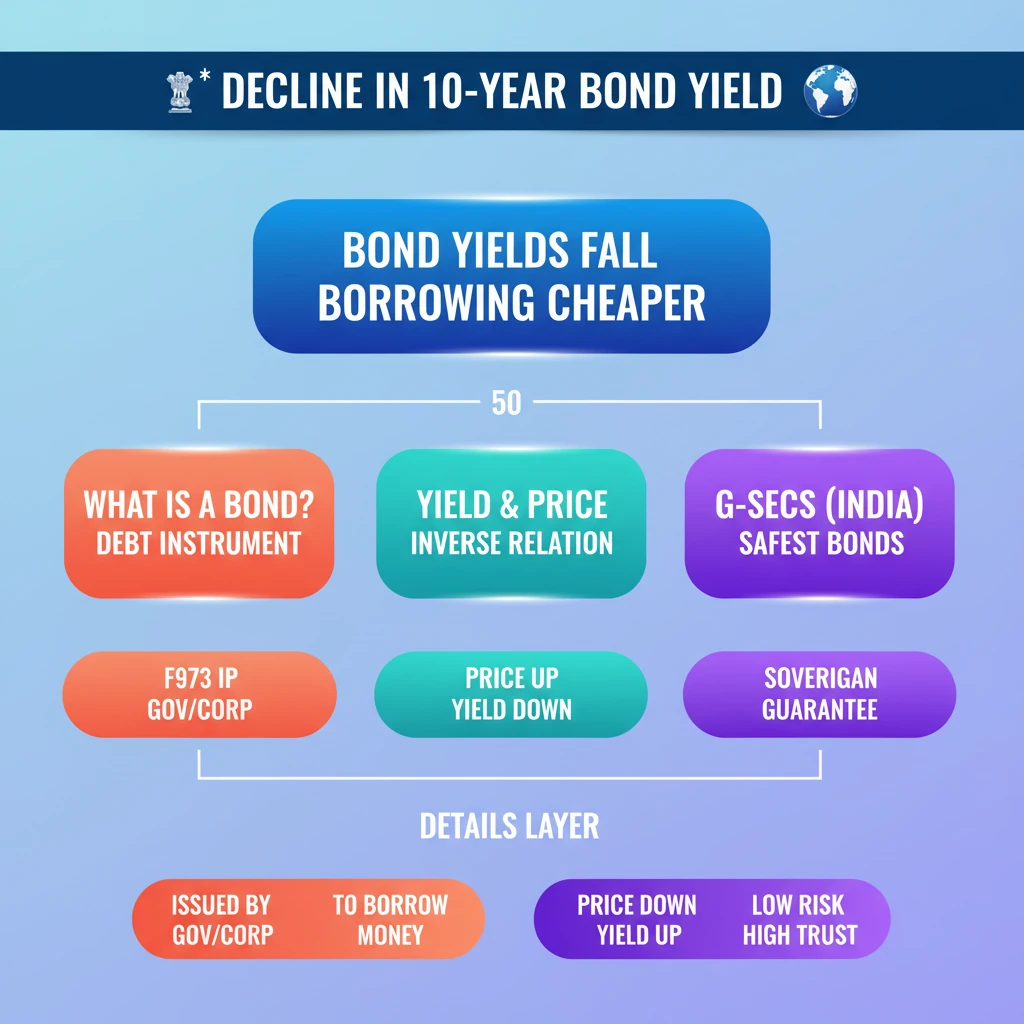

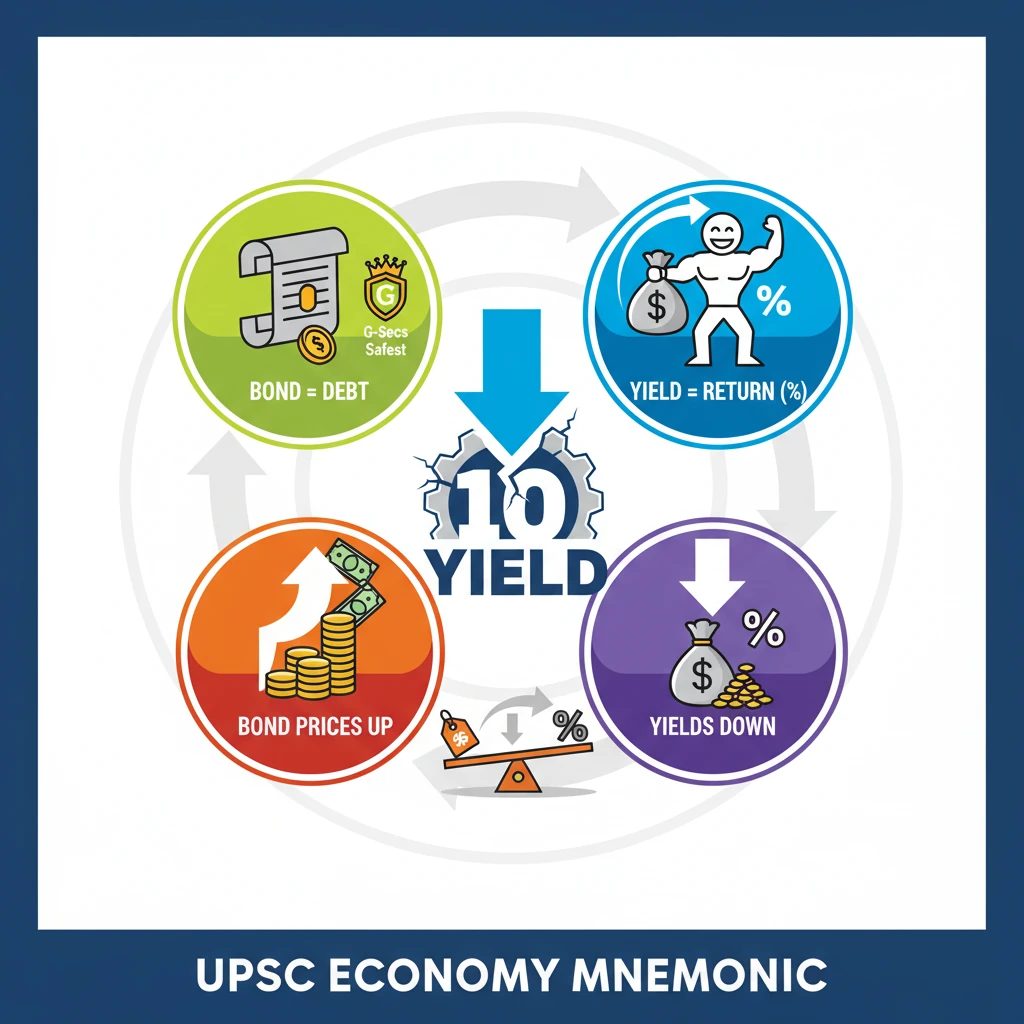

<h4>Recent Trends in Indian Bond Yields</h4><p>Indian <strong>government bond yields</strong> have recently experienced a notable decline. This trend saw the <strong>10-year benchmark yield</strong> fall to its lowest point since <strong>2021</strong>, indicating significant shifts in the financial market.</p><div class='exam-tip-box'><p><strong>UPSC Relevance:</strong> Understanding bond yield movements is crucial for <strong>GS Paper 3 (Economy)</strong>, particularly topics related to financial markets, monetary policy, and government borrowing. Questions often link these to inflation and interest rates.</p></div><h4>Understanding Bonds</h4><p>A <strong>bond</strong> is essentially a debt instrument. It serves as a formal agreement, much like an <strong>IOU (I owe you)</strong>, where an entity borrows money from investors for a specified period at a certain interest rate.</p><p>Bonds can be issued by various entities to raise capital. This includes a country's <strong>government</strong>, aiming to finance its expenditure, or a <strong>company</strong>, seeking funds for expansion or operations.</p><div class='info-box'><p><strong>Key Issuers of Bonds:</strong><ul><li><strong>Governments:</strong> To fund public projects and bridge fiscal deficits.</li><li><strong>Corporations:</strong> To finance business operations, expansion, or refinance existing debt.</li></ul></p></div><h4>Government Bonds and Their Safety</h4><p><strong>Government Bonds</strong> are widely regarded as one of the safest investment options available. This high level of safety stems from the fact that they come with the <strong>sovereign's guarantee</strong>, meaning the issuing government pledges its full faith and credit to repay the debt.</p><div class='key-point-box'><p><strong>Nomenclature of Government Bonds:</strong><ul><li>In <strong>India</strong>, government bonds are known as <strong>G-secs (Government Securities)</strong>.</li><li>In the <strong>United States</strong>, they are referred to as <strong>Treasury</strong> bonds.</li><li>In the <strong>United Kingdom</strong>, they are commonly called <strong>Gilts</strong>.</li></ul></p></div><h4>What is Bond Yield?</h4><p>The <strong>bond yield</strong> represents the total return an investor can expect to receive from a bond. It is typically expressed as a <strong>percentage</strong> of the bond's face value or current market price.</p><p>Yield is a crucial metric for investors as it indicates the profitability of holding a bond. It is dynamically influenced by various market factors, including interest rates and inflation expectations.</p><div class='info-box'><p><strong>Bond Yield Explained:</strong> The yield can be thought of as the effective rate of return an investor gets on a bond, taking into account its coupon payments, market price, and time to maturity.</p></div>

💡 Key Takeaways

- •A bond is a debt instrument issued by governments or companies to borrow money.

- •Government bonds (G-secs in India) are considered safest due to sovereign guarantee.

- •Bond yield is the return an investor expects from a bond, expressed as a percentage.

- •Bond prices and yields generally move inversely: when prices rise, yields fall, and vice versa.

- •A decline in 10-year bond yield signifies lower borrowing costs for the government and potentially for corporations.

- •Yield movements are influenced by RBI policy, inflation expectations, and global economic conditions.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) publications on Government Securities and Monetary Policy

•Ministry of Finance, Government of India reports on public debt management

•NCERT Economics textbooks (for foundational concepts of bonds and markets)