What are Other Major Highlights of the Union Budget 2026-26? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are Other Major Highlights of the Union Budget 2026-26?

Medium⏱️ 6 min read

economy

📖 Introduction

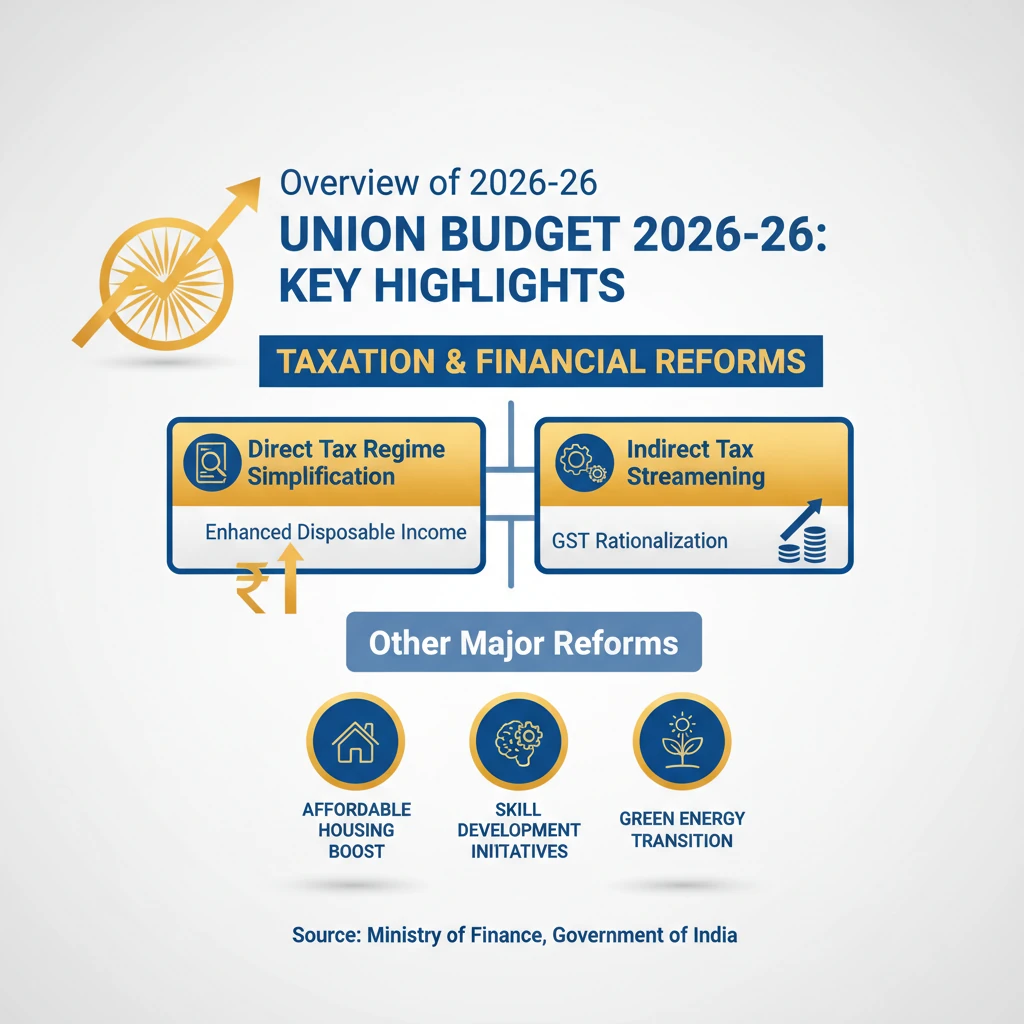

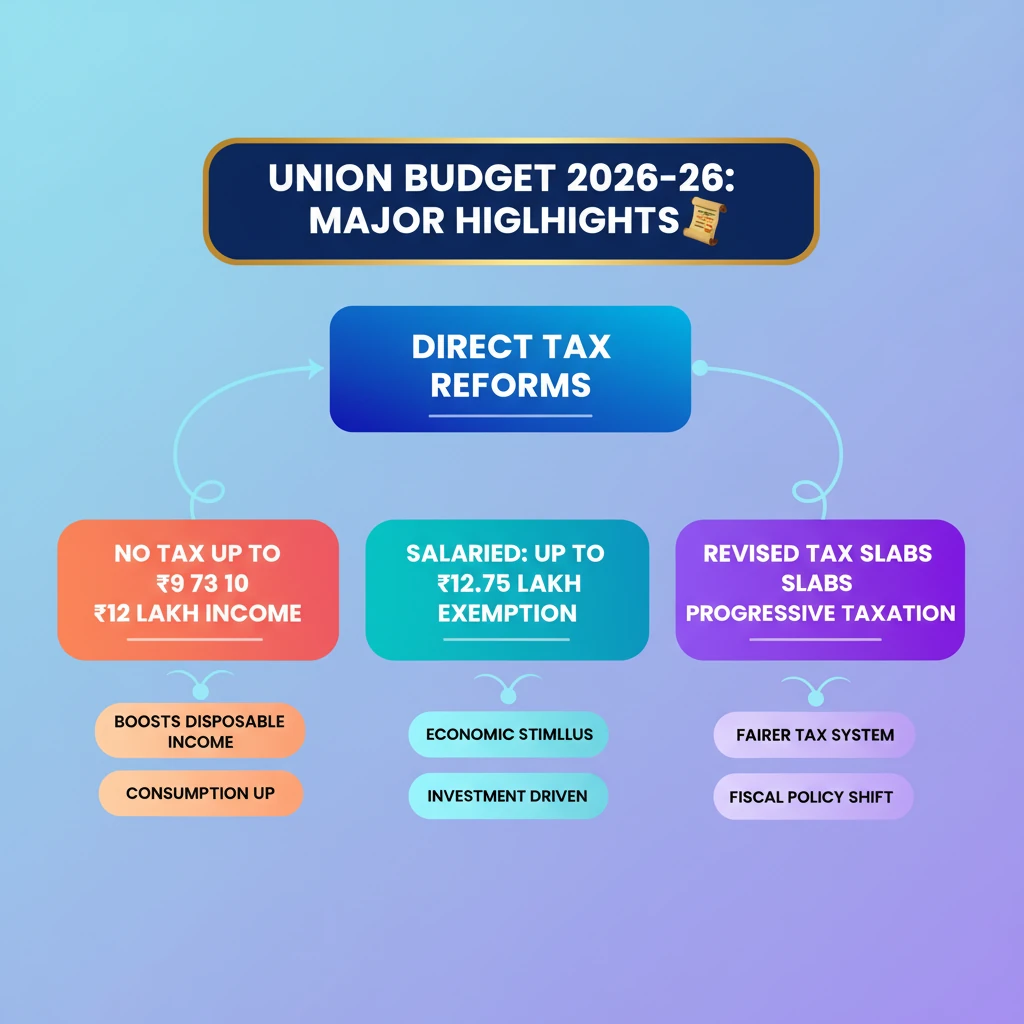

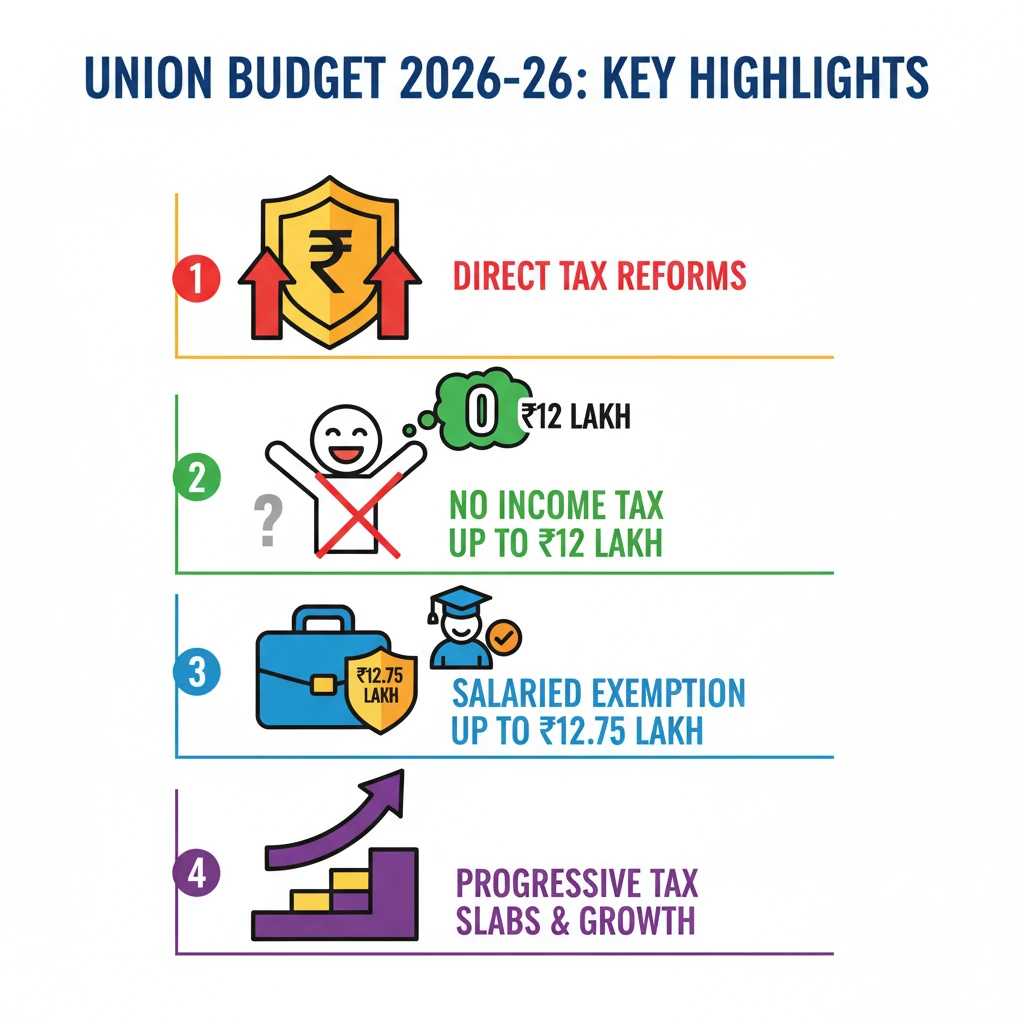

<h4>Overview of Union Budget 2026-26 Highlights</h4><p>The <strong>Union Budget 2026-26</strong> introduced several significant reforms, particularly in the realm of <strong>Taxation and Financial Reforms</strong>. These changes aim to streamline the tax structure and provide relief to various taxpayer categories.</p><div class='key-point-box'><p>A primary focus of the budget was to simplify the <strong>direct tax regime</strong> and enhance disposable income for a large segment of the population.</p></div><h4>Direct Tax Reforms: Income Tax Slabs</h4><p>A major highlight was the revision of <strong>Direct Taxes</strong>, specifically concerning <strong>Income Tax</strong>. The budget proposed significant changes to the tax slabs, offering considerable relief to individuals.</p><div class='info-box'><p>For <strong>annual incomes up to ₹12 lakh</strong>, individuals are now exempt from paying <strong>Income Tax</strong>. This move is designed to boost consumption and savings among the middle-income group.</p></div><p>Furthermore, for <strong>salaried taxpayers</strong> who are eligible for certain <strong>deductions</strong>, this exemption limit has been extended. They can enjoy <strong>no Income Tax</strong> for annual incomes up to <strong>₹12.75 lakh</strong>.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the nuances between general taxpayers and salaried taxpayers with deductions is crucial for Mains answers, especially in <strong>GS Paper 3 (Economy)</strong>.</p></div><h4>Revised Income Tax Slabs (Union Budget 2026-26)</h4><div class='info-box'><table class='info-table'><tr><th>Income (in ₹)</th><th>Tax Rate</th></tr><tr><td><strong>₹0 - ₹4 lakh</strong></td><td><strong>Nil</strong></td></tr><tr><td><strong>₹4 - ₹8 lakh</strong></td><td><strong>5%</strong></td></tr><tr><td><strong>₹8 - ₹12 lakh</strong></td><td><strong>10%</strong></td></tr><tr><td><strong>₹12 - ₹16 lakh</strong></td><td><strong>15%</strong></td></tr><tr><td><strong>₹16 - ₹20 lakh</strong></td><td><strong>20%</strong></td></tr><tr><td><strong>₹20 - ₹24 lakh</strong></td><td><strong>25%</strong></td></tr><tr><td><strong>Above ₹24 lakh</strong></td><td><strong>30%</strong></td></tr></table></div><p>These revised slabs indicate a progressive tax structure, with increasing rates for higher income brackets. The aim is to ensure equitable distribution of the tax burden while stimulating economic activity.</p>

💡 Key Takeaways

- •Union Budget 2026-26 introduced significant Direct Tax reforms.

- •No Income Tax for annual incomes up to ₹12 lakh.

- •Salaried taxpayers with deductions get exemption up to ₹12.75 lakh.

- •Revised tax slabs aim for progressive taxation and economic stimulus.

- •These changes impact disposable income, consumption, and government fiscal policy.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Press Information Bureau (PIB) releases on Budget Highlights

•Economic Survey (relevant sections on taxation and fiscal policy)