RBI’s Framework for Swap Facilities for SAARC - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

RBI’s Framework for Swap Facilities for SAARC

Medium⏱️ 6 min read

economy

📖 Introduction

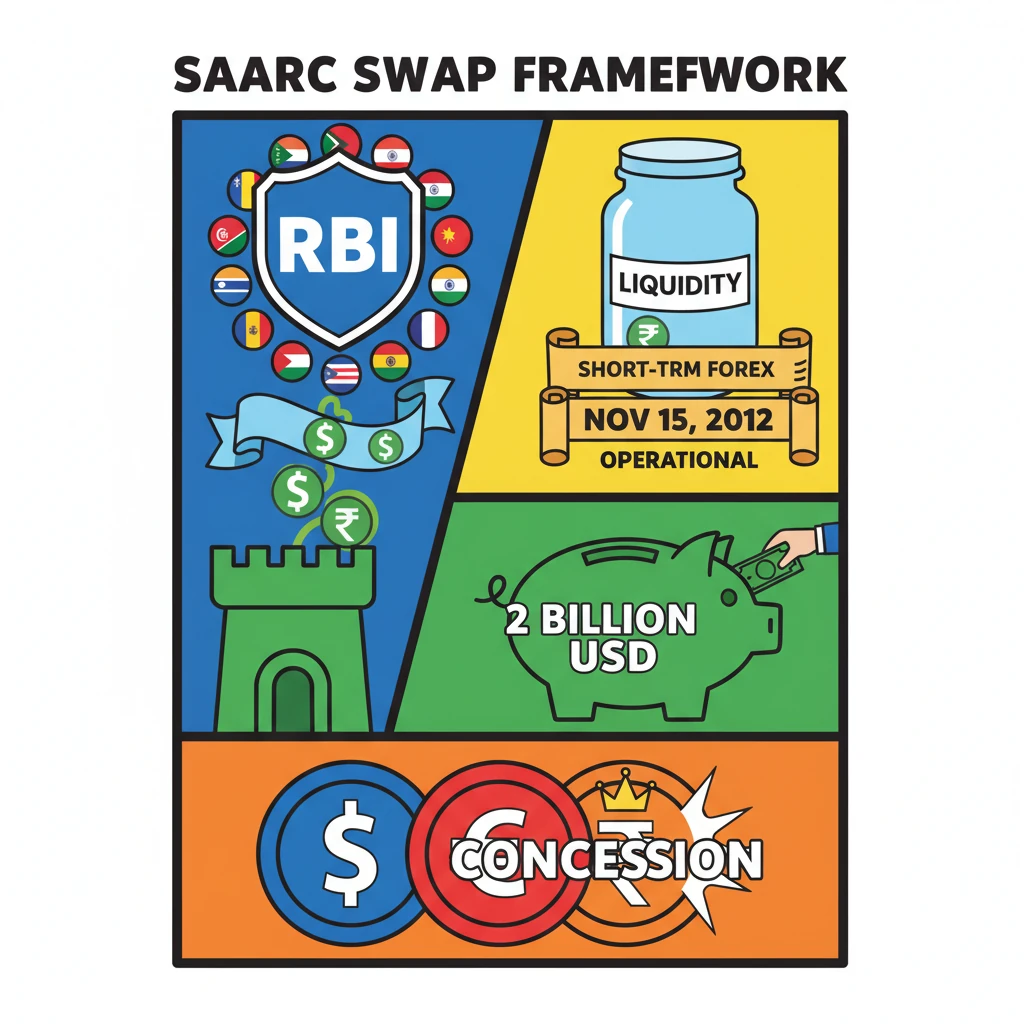

<h4>Introduction to SAARC Currency Swap Facility</h4><p>The <strong>SAARC currency swap facility</strong> was established to provide crucial financial support to member nations. It acts as a vital mechanism for regional economic stability.</p><p>This facility offers a <strong>backstop line of funding</strong> designed to address short-term financial needs. It helps countries facing immediate foreign exchange liquidity requirements.</p><h4>Operational Date and Core Purpose</h4><div class='info-box'><p>The <strong>SAARC currency swap facility</strong> officially commenced operations on <strong>15th November 2012</strong>.</p></div><p>Its primary objective is to assist <strong>SAARC countries</strong> during periods of <strong>balance of payment crises</strong> or acute foreign exchange shortages. It provides a temporary buffer.</p><p>The facility is intended to bridge financial gaps until more sustainable, longer-term arrangements can be put into place by the affected nation.</p><h4>RBI's Role and Financial Corpus</h4><p>The <strong>Reserve Bank of India (RBI)</strong> is the central authority responsible for administering this swap framework. It manages the operational aspects and disbursals.</p><p>The <strong>RBI</strong> has the capacity to offer swap arrangements within a predefined financial limit. This ensures prudent management of the facility's resources.</p><div class='info-box'><p>The overall corpus available for these swap arrangements is capped at <strong>USD 2 billion</strong>.</p></div><h4>Eligible Currencies and Concessions</h4><p>The currency swaps under this framework can be denominated in several major currencies. This flexibility allows for broader utility among member states.</p><p>The eligible currencies for these transactions include the <strong>US Dollar</strong>, the <strong>Euro</strong>, and the <strong>Indian Rupee</strong>.</p><div class='key-point-box'><p>An important feature of the framework is the provision of specific <strong>concessions</strong> for swaps executed in the <strong>Indian Rupee</strong>. This encourages its use in regional trade.</p></div><h4>Eligibility and Bilateral Agreements</h4><p>The <strong>SAARC currency swap facility</strong> is open to all member countries of the <strong>South Asian Association for Regional Cooperation (SAARC)</strong>.</p><p>However, access to this facility is not automatic. Each interested <strong>SAARC member country</strong> must formally agree to the terms.</p><p>To avail the swap facility, participating nations are required to sign specific <strong>bilateral swap agreements</strong> with the <strong>Reserve Bank of India</strong>.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understand the <strong>RBI's role</strong> as a regional financial stabilizer and the strategic importance of the <strong>Indian Rupee</strong> in such frameworks for <strong>GS Paper 2 (International Relations)</strong> and <strong>GS Paper 3 (Economy)</strong>.</p></div>

💡 Key Takeaways

- •SAARC currency swap facility provides short-term foreign exchange liquidity support to SAARC nations.

- •Operational since 15th November 2012, managed by RBI.

- •RBI can offer swaps up to USD 2 billion corpus.

- •Swaps available in US Dollar, Euro, and Indian Rupee, with concessions for INR.

- •All SAARC members eligible upon signing bilateral swap agreements with RBI.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Ministry of Finance, Government of India documents

•SAARC Secretariat official communications