What are Cross-Border Payments? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are Cross-Border Payments?

Medium⏱️ 8 min read

economy

📖 Introduction

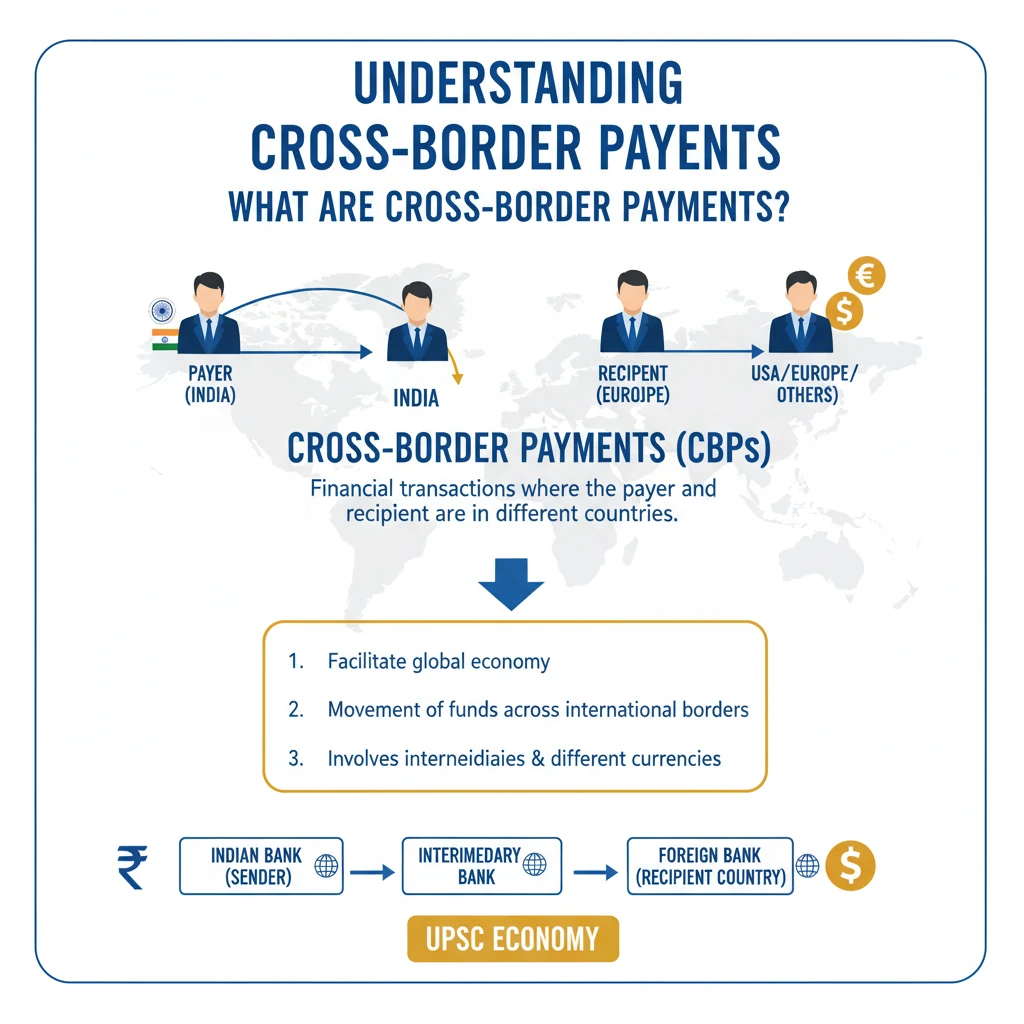

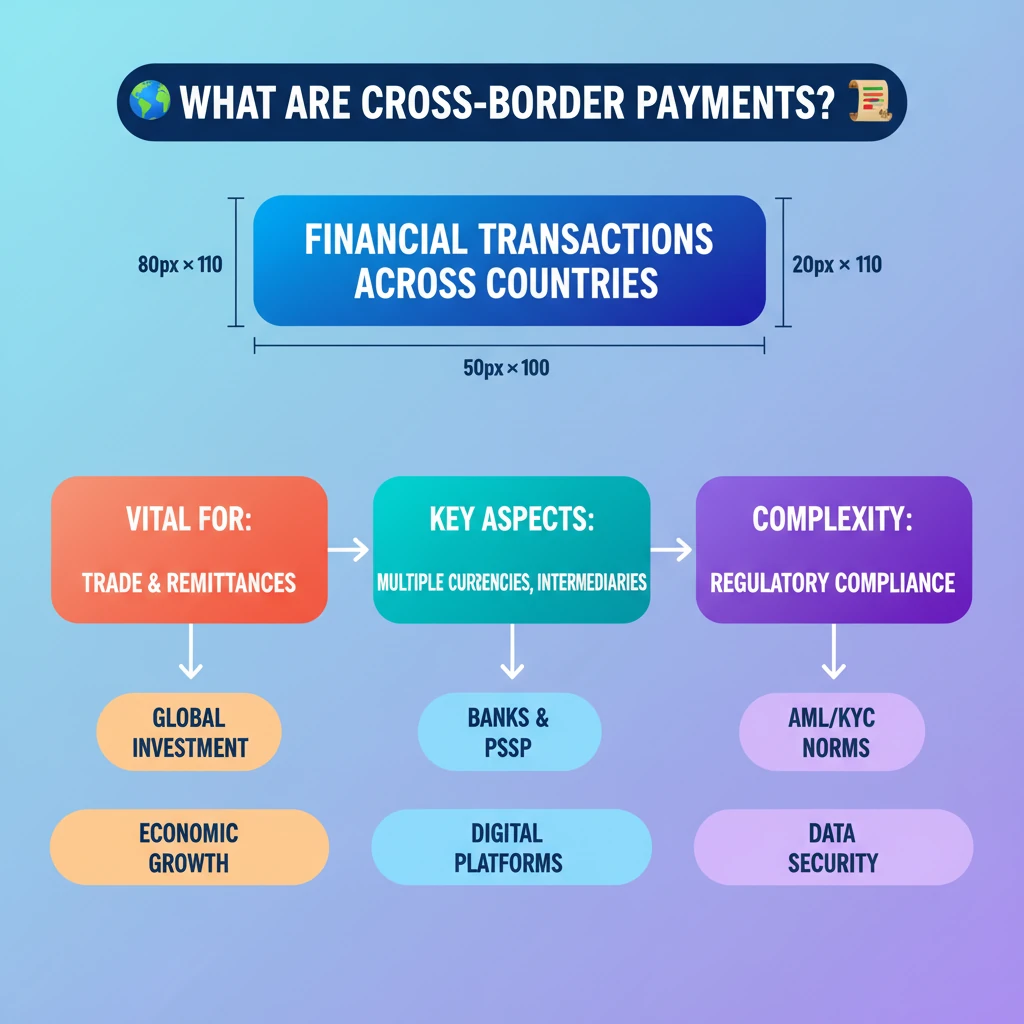

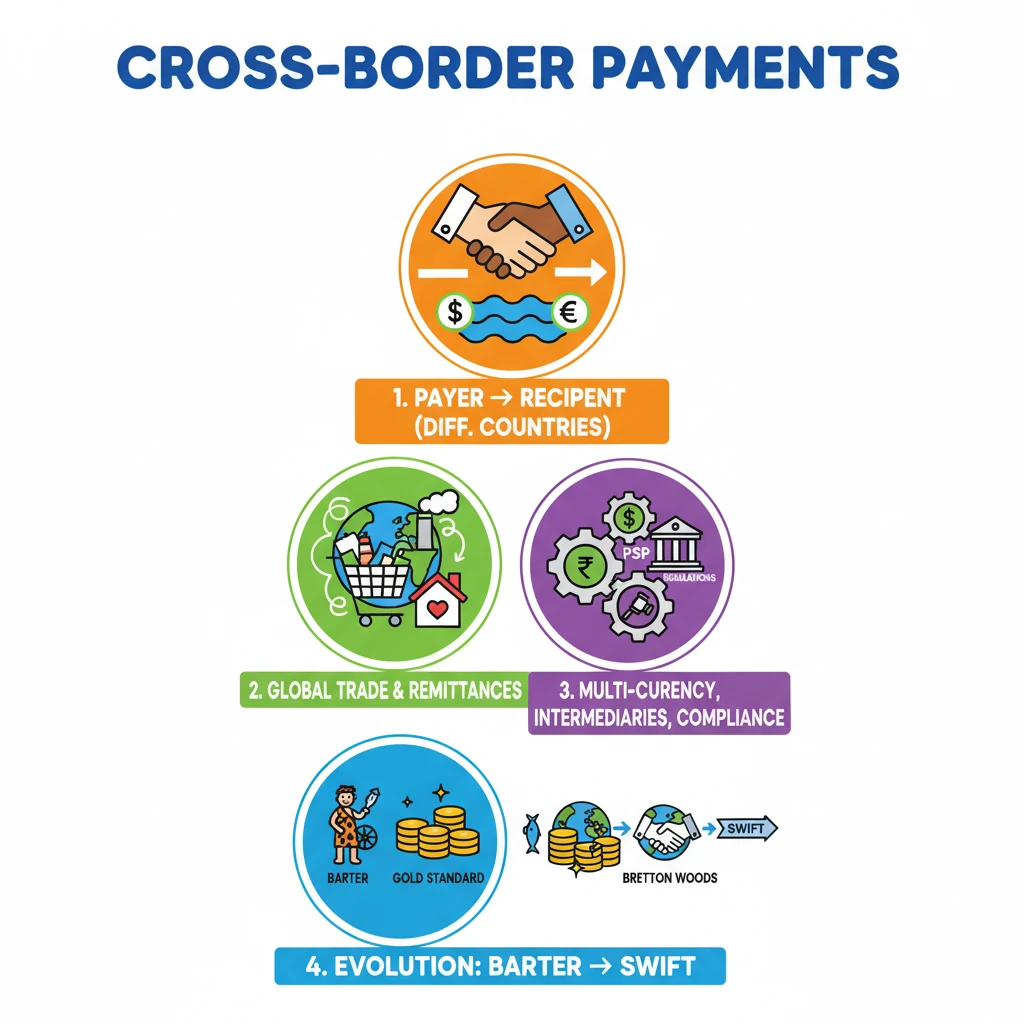

<h4>Understanding Cross-Border Payments</h4><p><strong>Cross-Border Payments (CBPs)</strong> are financial transactions where the <strong>payer</strong> and the <strong>recipient</strong> are located in different countries. These transactions are fundamental to the global economy.</p><p>They facilitate the movement of funds across international borders, enabling various economic activities. The process often involves multiple intermediaries and different currencies.</p><div class='info-box'><p><strong>Definition:</strong> A <strong>Cross-Border Payment</strong> occurs when money is transferred from one country to another, involving distinct national jurisdictions for the sender and receiver.</p></div><h4>Vital Role in Global Economy</h4><p>Cross-Border Payments are absolutely <strong>vital</strong> for several key aspects of the international economic landscape. Their efficient functioning underpins global connectivity.</p><p>They are essential for driving <strong>international trade</strong>, allowing businesses to buy and sell goods and services across borders. This includes everything from raw materials to finished products.</p><p>Furthermore, CBPs are crucial for <strong>investment flows</strong>, facilitating foreign direct investment (FDI) and portfolio investments. This enables capital to move to areas of higher return or need.</p><p>Finally, they are indispensable for <strong>personal transfers</strong>, commonly known as remittances. Migrant workers frequently send money home to support their families, significantly contributing to many national economies.</p><div class='key-point-box'><p><strong>Key Importance:</strong> CBPs underpin <strong>international trade</strong>, facilitate <strong>global investment</strong>, and enable crucial <strong>personal remittances</strong>, making them a backbone of the interconnected world economy.</p></div><h4>Key Characteristics of CBPs</h4><p>Cross-Border Payments involve several unique characteristics that differentiate them from domestic transactions. These factors often contribute to their complexity and cost.</p><ul><li><strong>Multiple Currencies:</strong> Transactions typically involve the conversion of one currency to another (e.g., INR to USD).</li><li><strong>Intermediaries:</strong> Banks, payment service providers (PSPs), and money transfer operators (MTOs) often act as intermediaries.</li><li><strong>Regulatory Compliance:</strong> Each country has its own regulatory framework, including anti-money laundering (AML) and counter-terrorist financing (CTF) laws.</li><li><strong>Time and Cost:</strong> Historically, CBPs have been slower and more expensive than domestic payments due to the involvement of multiple parties and systems.</li></ul><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding <strong>Cross-Border Payments</strong> is crucial for topics like <strong>Balance of Payments</strong>, <strong>International Trade</strong>, <strong>Remittances</strong>, and the role of <strong>Digital Public Infrastructure (DPI)</strong> in India's economy. Be prepared to discuss challenges and solutions.</p></div>

💡 Key Takeaways

- •Cross-Border Payments (CBPs) are financial transactions between a payer and recipient in different countries.

- •They are vital for international trade, global investment, and personal remittances.

- •Key characteristics include multiple currencies, intermediaries (banks, PSPs), and complex regulatory compliance.

- •Historically, CBPs evolved from barter to the gold standard, Bretton Woods, and SWIFT.

- •Modern CBPs are being revolutionized by digital platforms, blockchain, CBDCs, and linkages of fast payment systems (e.g., UPI).

- •Challenges include high costs, slow speeds, and lack of transparency, which global efforts aim to resolve.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Bank for International Settlements (BIS) reports on Cross-Border Payments

•World Bank reports on Remittances and Migration

•NITI Aayog documents on Digital India and Fintech

•SWIFT official documentation and reports