What is the National Monetisation Pipeline (NMP)? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What is the National Monetisation Pipeline (NMP)?

Medium⏱️ 10 min read

economy

📖 Introduction

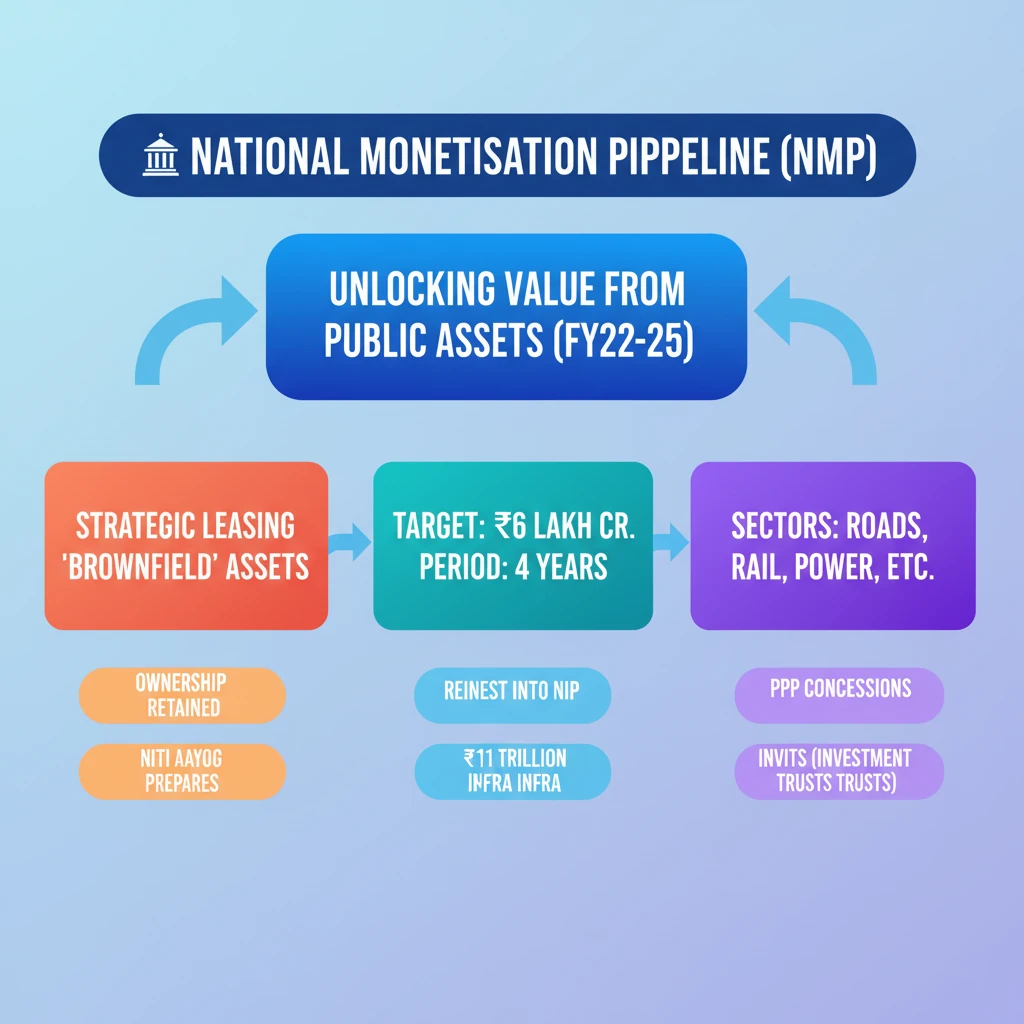

<h4>Understanding Asset Monetisation</h4><p><strong>Monetising</strong> involves using something of value to generate profit or convert it into cash. This process aims to unlock the economic potential of an asset.</p><p>For instance, a government might <strong>monetise its national debt</strong> by acquiring treasury securities, which in turn increases the money supply within the economy.</p><h4>Need for Asset Monetisation</h4><p>The primary need for <strong>asset monetisation</strong> is to unlock the economic value of public assets that are either underutilised or entirely unutilised. This creates new and sustainable revenue streams for governments and public entities.</p><p>Its core objective is to identify and leverage these assets to generate significant financial returns. Importantly, this is achieved without necessarily selling the assets outright, retaining public ownership.</p><h4>Focus on Public Assets and Brownfield Assets</h4><p><strong>Public assets</strong> suitable for monetisation encompass a wide range of properties owned by public bodies. These include critical infrastructure such as <strong>roads</strong>, <strong>airports</strong>, <strong>railways</strong>, <strong>pipelines</strong>, and <strong>mobile towers</strong>.</p><p>The National Monetisation Pipeline (NMP) specifically focuses on <strong>brownfield assets</strong>. These are existing assets that can be improved, upgraded, or put to better, more efficient use to generate value.</p><div class='info-box'><p><strong>Brownfield Assets Defined:</strong> These are existing infrastructure projects or production facilities that a private company or investor purchases or leases to carry out new production activity or enhance existing operations.</p></div><h4>Monetisation vs. Privatisation</h4><p>It is crucial to distinguish between <strong>asset monetisation</strong> and <strong>privatisation</strong>, as they represent different approaches to public asset management.</p><div class='key-point-box'><p><strong>Privatisation</strong> entails the complete transfer of ownership of an asset from the public sector to the private sector. The government relinquishes all control and proprietary rights.</p><p>In contrast, <strong>asset monetisation</strong> involves structured partnerships with private entities. Under this model, public authorities retain primary ownership of the assets while benefiting from private sector efficiency, investment, and operational expertise.</p></div><h4>About the National Monetisation Pipeline (NMP)</h4><p>The <strong>National Monetisation Pipeline (NMP)</strong> is a flagship initiative designed to promote sustainable infrastructure financing. It achieves this through the monetisation of existing, operating public infrastructure assets.</p><p>The NMP envisages an aggregate monetisation potential of <strong>Rs 6 lakh crore</strong>. This substantial amount is targeted through the leasing of core assets belonging to the Central government and various public sector entities.</p><div class='info-box'><p><strong>NMP Target:</strong> An aggregate monetisation potential of <strong>Rs 6 lakh crore</strong> over a four-year period (FY2022 to FY2025).</p></div><h4>Preparation of NMP</h4><p>The comprehensive framework for the NMP has been meticulously prepared by <strong>NITI Aayog</strong>. This was done in close consultation with key infrastructure line ministries, ensuring a holistic and integrated approach.</p><p>These consulting ministries include those responsible for crucial sectors such as <strong>Roads, Transport, Highways, Railways, Power, Civil Aviation, Telecommunications</strong>, among others. Their input ensures practical implementation.</p><p>The NMP specifically targets <strong>brownfield infrastructure assets</strong>. It offers public asset owners a clear roadmap for monetisation and provides the private sector with transparent visibility on upcoming opportunities.</p><h4>Sectors and Asset Classes Covered by NMP</h4><p>The NMP encompasses a wide array of critical sectors and asset classes, reflecting its broad scope and ambition. These include:</p><ul><li><strong>Roads</strong></li><li><strong>Ports</strong></li><li><strong>Airports</strong></li><li><strong>Railways</strong></li><li><strong>Gas & product pipelines</strong></li><li><strong>Power generation and transmission</strong></li><li><strong>Mining</strong></li><li><strong>Telecom</strong></li><li><strong>Warehousing</strong></li><li>And several other strategic infrastructure areas.</li></ul><p>The top five sectors, based on their contribution to the total pipeline value, are:</p><ul><li><strong>Roads</strong> (contributing <strong>27%</strong> of the total pipeline value)</li><li><strong>Railways</strong> (contributing <strong>25%</strong>)</li><li><strong>Power</strong> (contributing <strong>15%</strong>)</li><li><strong>Oil & Gas Pipelines</strong> (contributing <strong>8%</strong>)</li><li><strong>Telecom</strong> (contributing <strong>6%</strong>)</li></ul><h4>NMP's Monetisation Framework</h4><p>The framework for the monetisation of core assets under the NMP is guided by three fundamental mandates, ensuring transparency, stability, and public interest protection:</p><ol><li><strong>Monetisation of ‘Rights’ NOT ‘Ownership’:</strong> The government explicitly retains primary ownership of the assets. Assets are returned to the public authority after the transaction period, ensuring no permanent transfer.</li><li><strong>Stable Revenue:</strong> The framework prioritises selecting de-risked <strong>brownfield assets</strong> that already demonstrate stable and predictable revenue streams, making them attractive to private investors.</li><li><strong>Defined Partnership:</strong> Structured partnerships are established under robust and well-defined contractual frameworks. These agreements include strict <strong>Key Performance Indicators (KPIs)</strong> and clear performance standards to ensure accountability and quality of service.</li></ol><h4>Link with National Infrastructure Pipeline (NIP)</h4><p>The NMP is strategically aligned with the broader <strong>National Infrastructure Pipeline (NIP)</strong>. This alignment ensures synergy between infrastructure development and its financing mechanisms.</p><p>The monetisation period of the NMP is co-terminus with the NIP, which runs through <strong>FY 2022 to FY 2025</strong>. This synchronized timeline facilitates integrated planning and execution.</p><p>The fundamental purpose of the NMP is to generate capital that can be reinvested into the ambitious <strong>Rs 111 trillion National Infrastructure Pipeline</strong>, fueling future infrastructure growth.</p><div class='info-box'><p><strong>National Infrastructure Pipeline (NIP):</strong> A government initiative aiming to attract investments in key greenfield and brownfield projects across all economic and social infrastructure sub-sectors, valued at <strong>Rs 111 trillion</strong>.</p></div><h4>Instruments for Monetisation under NMP</h4><p>The NMP will utilise a diverse set of instruments to facilitate asset monetisation, catering to different asset classes and investor preferences:</p><ul><li><strong>Public-Private Partnership (PPP) concessions:</strong> These involve direct contractual agreements where private entities undertake development, operation, and maintenance responsibilities for a defined period.</li><li><strong>Infrastructure Investment Trusts (InvITs) and other capital market instruments:</strong> InvITs are a key mechanism for attracting broader investor participation.</li></ul><div class='info-box'><p><strong>Infrastructure Investment Trusts (InvITs):</strong> These are collective investment vehicles that enable direct investment of money from individual and institutional investors in infrastructure projects. Investors earn a portion of the income generated by these projects as a return on their investment.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the distinction between <strong>monetisation</strong> and <strong>privatisation</strong>, and the role of <strong>InvITs</strong>, is critical for both Prelims (definitions) and Mains (economic policy analysis in <strong>GS-III Economy</strong>).</p></div>

💡 Key Takeaways

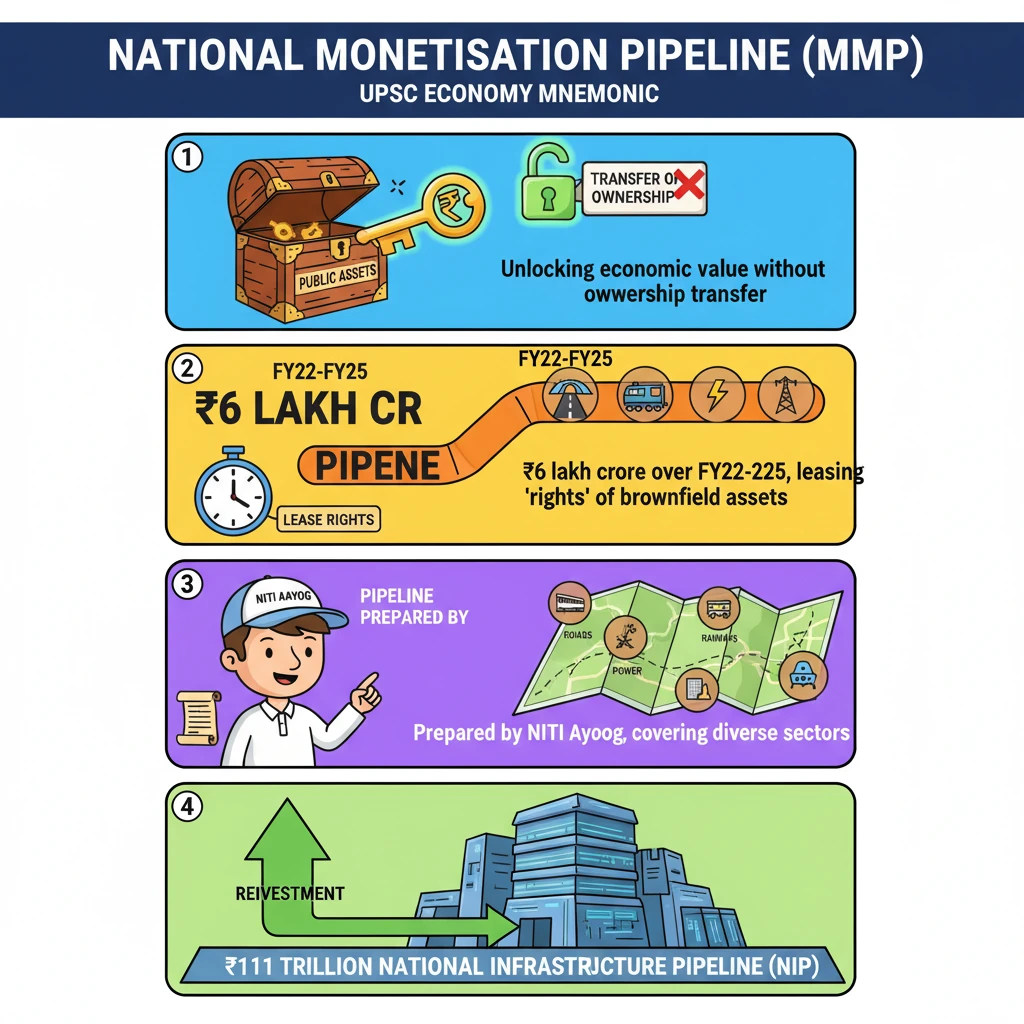

- •NMP aims to unlock economic value from underutilised public assets without transferring ownership.

- •It targets Rs 6 lakh crore over FY22-FY25 by leasing 'rights' of brownfield assets.

- •The pipeline is prepared by NITI Aayog and covers diverse sectors like roads, railways, power.

- •NMP funds are to be reinvested into the Rs 111 trillion National Infrastructure Pipeline (NIP).

- •Key instruments include PPP concessions and Infrastructure Investment Trusts (InvITs).

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•NITI Aayog's National Monetisation Pipeline (NMP) document (implied)

•Ministry of Finance reports on infrastructure financing (implied)