NPS vs. OPS: Opposition, Somanathan Committee & Unified Pension Scheme - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

NPS vs. OPS: Opposition, Somanathan Committee & Unified Pension Scheme

Medium⏱️ 8 min read

economy

📖 Introduction

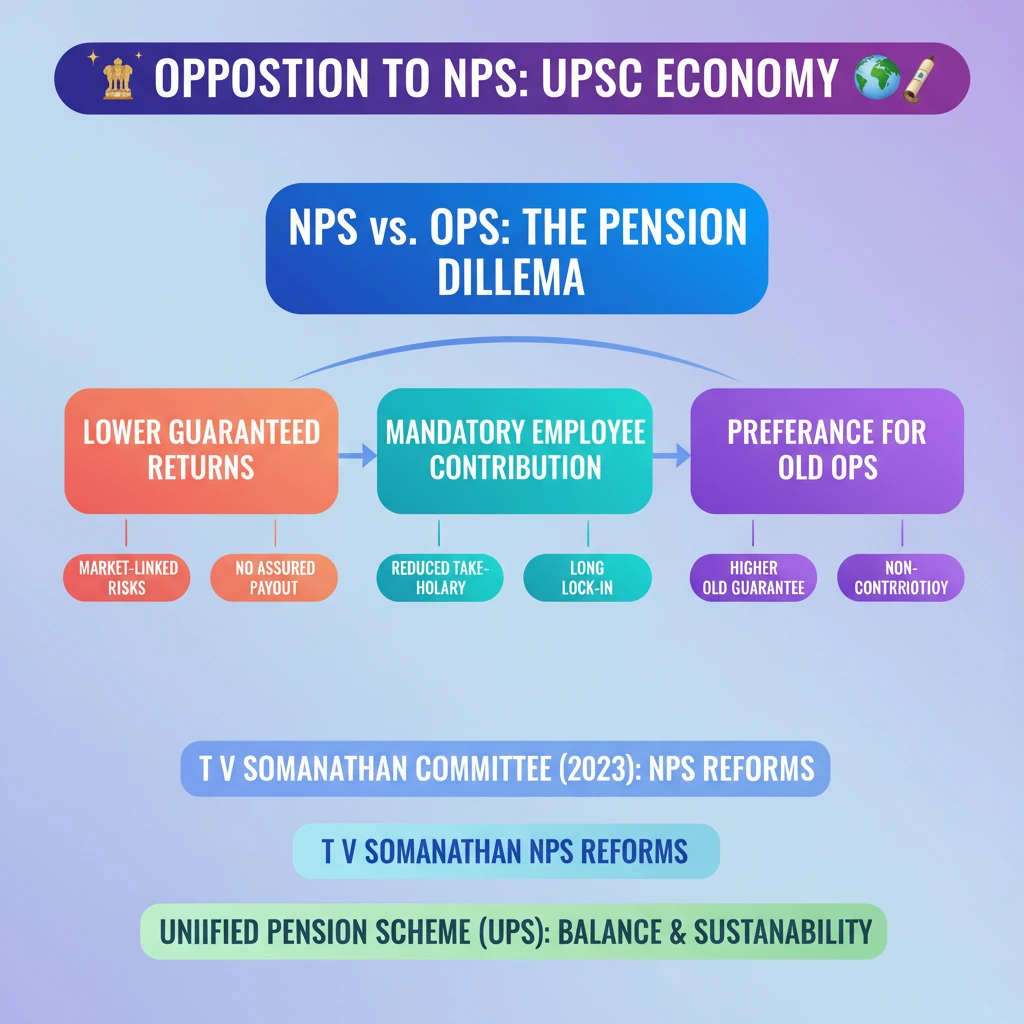

<h4>Introduction to NPS Features</h4><p>The <strong>National Pension System (NPS)</strong> offers individuals flexibility in managing their retirement savings. Subscribers can choose from a range of <strong>schemes</strong> and <strong>pension fund managers</strong>.</p><p>This includes the option to invest through various <strong>private companies</strong>, allowing for diversified portfolio management tailored to individual risk appetites.</p><div class='info-box'><p><strong>NPS Flexibility:</strong> Allows subscribers to select their investment patterns and fund managers, providing a market-linked approach to pension accumulation.</p></div><h4>Core Reasons for Opposition to NPS</h4><p>Significant opposition to the <strong>NPS</strong> arose primarily from <strong>government employees</strong>. Their concerns stemmed from a comparison with the older <strong>Old Pension Scheme (OPS)</strong>.</p><div class='key-point-box'><p>Under <strong>NPS</strong>, employees faced <strong>lower guaranteed returns</strong> compared to <strong>OPS</strong>. Additionally, they were required to <strong>contribute a portion of their salary</strong> towards their pension.</p></div><p>In contrast, the <strong>OPS</strong> provided <strong>higher guaranteed returns</strong> and did not require any <strong>employee contributions</strong>, making it a more attractive option for many.</p><h4>Government's Response and New Scheme</h4><p>Amid widespread calls for a return to the <strong>OPS</strong>, the <strong>Union Government</strong> took action. In <strong>2023</strong>, a committee was established to review the pension system.</p><div class='info-box'><p>The committee was led by <strong>T V Somanathan</strong>, the Finance Secretary, tasked with finding a sustainable solution to address employee concerns while maintaining fiscal prudence.</p></div><p>The recommendations of the <strong>T V Somanathan Committee</strong> have since led to the introduction of the <strong>new Unified Pension Scheme (UPS)</strong>, aiming to balance employee welfare with financial sustainability.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the differences between <strong>OPS</strong>, <strong>NPS</strong>, and the proposed <strong>UPS</strong> is crucial for questions on social security, fiscal policy, and public administration (GS2, GS3).</p></div>

💡 Key Takeaways

- •NPS allows employee contribution and market-linked returns, offering flexibility in investment choices.

- •Opposition to NPS stems from lower guaranteed returns and mandatory employee contributions compared to OPS.

- •OPS offered higher guaranteed returns and no employee contribution, making it preferred by many.

- •The T V Somanathan Committee (2023) was formed to address NPS concerns and recommend reforms.

- •The new Unified Pension Scheme (UPS) is introduced as a response, aiming to balance employee security with fiscal sustainability.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Press Information Bureau (PIB) releases regarding T V Somanathan Committee (2023)

•Ministry of Finance, Department of Financial Services (DFS) official communications on NPS and pension reforms

•Reports and analysis by economic think tanks on India's pension system