Survey and Budget - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Survey and Budget

Medium⏱️ 10 min read

economy

📖 Introduction

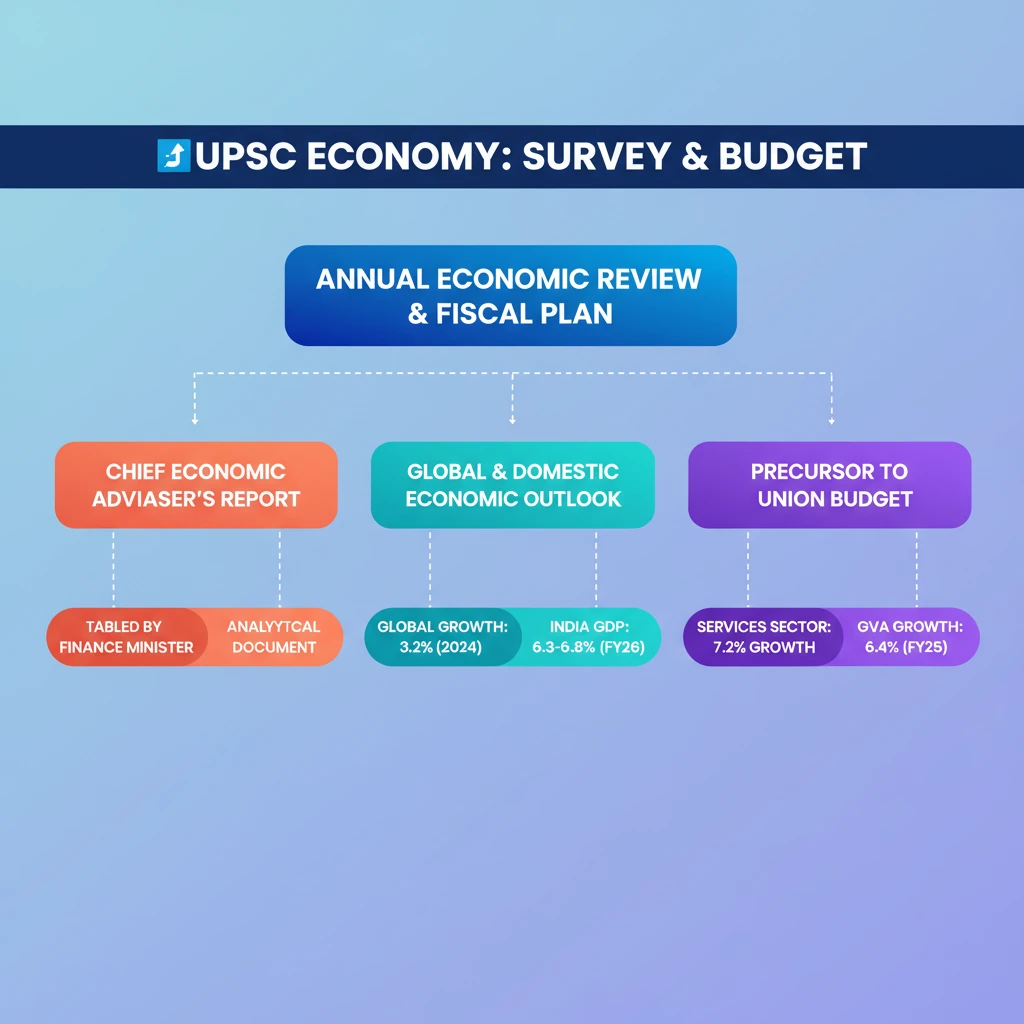

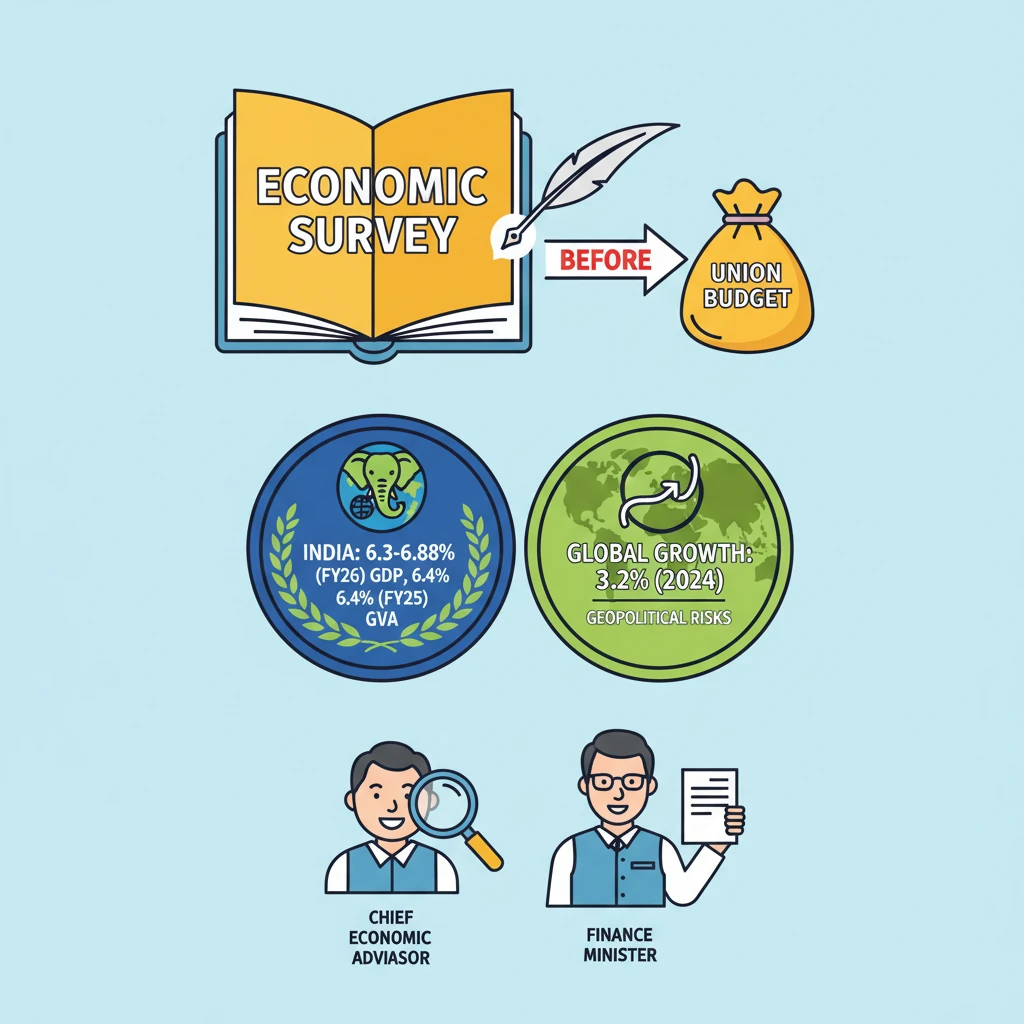

<h4>Introduction to Economic Survey and Union Budget</h4><p>The <strong>Economic Survey</strong> and <strong>Union Budget</strong> are two pivotal documents presented by the Government of India. They provide a comprehensive overview of the nation's economic health and future policy direction.</p><p>The <strong>Finance Minister Nirmala Sitharaman</strong> tabled the <strong>Economic Survey 2024-25</strong> in Parliament. This document serves as a crucial roadmap, outlining reforms and growth strategies that set the foundation for the upcoming <strong>Union Budget 2025</strong>.</p><h4>Understanding the Economic Survey</h4><p>The <strong>Economic Survey</strong> is an annual report that the government presents before the <strong>Union Budget</strong>. Its primary purpose is to assess <strong>India’s economic condition</strong> over the past financial year.</p><div class='info-box'><p><strong>Preparation:</strong> The Survey is prepared by the <strong>Economic Division of the Ministry of Finance</strong>. It operates under the direct supervision of the <strong>Chief Economic Adviser</strong>.</p><p><strong>Presentation:</strong> It is tabled in both houses of <strong>Parliament</strong> by the <strong>Union Finance Minister</strong>.</p></div><p>This comprehensive document evaluates <strong>economic performance</strong>, highlights <strong>sectoral developments</strong>, identifies key <strong>challenges</strong>, and provides an <strong>economic outlook</strong> for the forthcoming year.</p><div class='key-point-box'><p><strong>Historical Context:</strong> The <strong>Economic Survey</strong> was first presented in <strong>1950-51</strong> as an integral part of the budget document. It gained its independence in <strong>1964</strong>, becoming a separate document tabled a day before the <strong>Union Budget</strong>.</p></div><h4>Key Highlights of the Economic Survey 2024-25</h4><h4>Global Economic Outlook</h4><p>The <strong>International Monetary Fund (IMF)</strong> projected a <strong>3.2% global growth</strong> in <strong>2024</strong>, with an anticipated rise to <strong>3.3% in 2025</strong>. This forecast indicates a mixed global economic environment.</p><p>Manufacturing sectors experienced a slowdown, primarily due to persistent <strong>supply chain disruptions</strong>. In contrast, the <strong>services sector</strong> demonstrated robust performance globally.</p><p>While <strong>global inflation</strong> showed signs of easing, <strong>services inflation</strong> remained persistent. This led to a divergence in <strong>monetary policies</strong> adopted by various central banks worldwide.</p><h4>Geopolitical Uncertainties and Their Impact</h4><p>Ongoing geopolitical conflicts, such as the <strong>Russia-Ukraine war</strong> and the <strong>Israel-Hamas conflict</strong>, have significantly impacted global trade, energy security, and inflation dynamics.</p><p>Disruptions in the <strong>Suez Canal</strong> forced many ships to reroute via the <strong>Cape of Good Hope</strong>. This diversion resulted in increased <strong>freight costs</strong> and extended <strong>delivery times</strong> for goods globally.</p><h4>India’s Economic Performance</h4><p><strong>India’s Gross Domestic Product (GDP)</strong> is projected to grow between <strong>6.3-6.8%</strong> in <strong>FY26 (2025-26)</strong>. This robust projection underscores the country's economic resilience.</p><p>The <strong>real Gross Value Added (GVA)</strong> is estimated to achieve a growth rate of <strong>6.4%</strong> in <strong>FY25 (2024-25)</strong>, reflecting healthy underlying economic activity.</p><h4>Sector-Wise Performance in India</h4><ul><li><strong>Agriculture:</strong> This sector recorded a <strong>3.8% growth</strong> in <strong>FY25</strong>. This growth was primarily fueled by record <strong>Kharif production</strong> and strong <strong>rural demand</strong>.</li><li><strong>Industry & Manufacturing:</strong> The sector witnessed a <strong>6.2% growth</strong> in <strong>FY25</strong>. However, manufacturing experienced a slowdown attributed to weak <strong>global demand</strong>.</li><li><strong>Services:</strong> Emerging as the fastest-growing sector, services achieved <strong>7.2% growth</strong> in <strong>FY25</strong>. This growth was significantly led by <strong>Information Technology (IT)</strong>, <strong>finance</strong>, and <strong>hospitality</strong> segments.</li></ul><h4>External Sector Developments</h4><p>Overall exports, encompassing both <strong>merchandise and services</strong>, registered a <strong>5% Year-on-Year (YoY) growth</strong> during the first nine months of <strong>FY25</strong>. The services sector alone contributed significantly with an <strong>11.6% growth</strong> during the same period.</p><p><strong>Merchandise exports</strong> grew by <strong>1.6%</strong>, while <strong>imports</strong> saw a higher rise of <strong>5.2%</strong>. This disparity led to a widening of the <strong>trade deficit</strong>.</p><div class='info-box'><p><strong>Remittances:</strong> <strong>India</strong> maintained its position as the <strong>top global recipient of remittances</strong>. This inflow played a crucial role in helping to contain the <strong>Current Account Deficit (CAD)</strong> at a manageable <strong>1.2% of GDP</strong>.</p></div><h4>Monetary and Financial Sector Developments</h4><p>The <strong>Gross Non-Performing Assets (GNPA)</strong> of <strong>Scheduled Commercial Banks (SCBs)</strong> witnessed a significant decline. They dropped to a <strong>12-year low of 2.6%</strong> in <strong>2024</strong>, with <strong>Net NPAs</strong> further reducing to <strong>0.6%</strong>.</p><p>The <strong>Return on Assets (ROA)</strong> for SCBs improved to <strong>1.4%</strong>, and the <strong>Return on Equity (ROE)</strong> enhanced to <strong>13.1%</strong> by <strong>September 2024</strong>, indicating improved profitability and efficiency.</p><div class='info-box'><p><strong>RBI's Role in Financial Inclusion:</strong> The <strong>Reserve Bank of India (RBI)</strong> reported an increase in the <strong>Financial Inclusion Index</strong> from <strong>53.9 (2021)</strong> to <strong>64.2 (2024)</strong>. This improvement was strongly supported by the operations of <strong>Regional Rural Banks (RRBs)</strong>.</p></div><p>The <strong>RBI</strong> maintained the <strong>repo rate at 6.5%</strong>, reflecting its stance on monetary policy. Concurrently, it reduced the <strong>Cash Reserve Ratio (CRR) to 4%</strong>, injecting a substantial <strong>₹1.16 lakh crore</strong> into the financial system to boost liquidity.</p><p>The <strong>money multiplier</strong> rose to <strong>5.7</strong>, further indicating increased liquidity in the economy. Capital markets mobilized <strong>₹11.1 lakh crore</strong> in primary markets between <strong>April and December 2024</strong>, marking a <strong>5% increase</strong>.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the trends in <strong>GDP, GVA, NPAs, CAD</strong>, and <strong>sectoral growth rates</strong> from the Economic Survey is crucial for both <strong>Prelims (factual questions)</strong> and <strong>Mains (analytical answers)</strong> in <strong>GS Paper 3 (Economy)</strong>. Pay attention to the year-on-year changes and the reasons behind them.</p></div>

💡 Key Takeaways

- •Economic Survey is an annual review of India's economy, presented before the Union Budget.

- •It's prepared by the Chief Economic Adviser and tabled by the Finance Minister.

- •Global growth projected at 3.2% (2024), with geopolitical risks impacting trade.

- •India's GDP projected 6.3-6.8% for FY26; GVA at 6.4% for FY25.

- •Services is the fastest-growing sector (7.2%), while manufacturing faces global demand issues.

- •Banking sector health improved: GNPA at 2.6% (12-year low), Net NPA at 0.6%.

- •RBI maintained repo rate at 6.5% but reduced CRR to 4%, boosting liquidity.

- •India remains top recipient of remittances, helping contain CAD at 1.2% of GDP.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Economic Survey 2024-25 (implied official source for data)