Need of Deposit Insurance - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Need of Deposit Insurance

Medium⏱️ 6 min read

economy

📖 Introduction

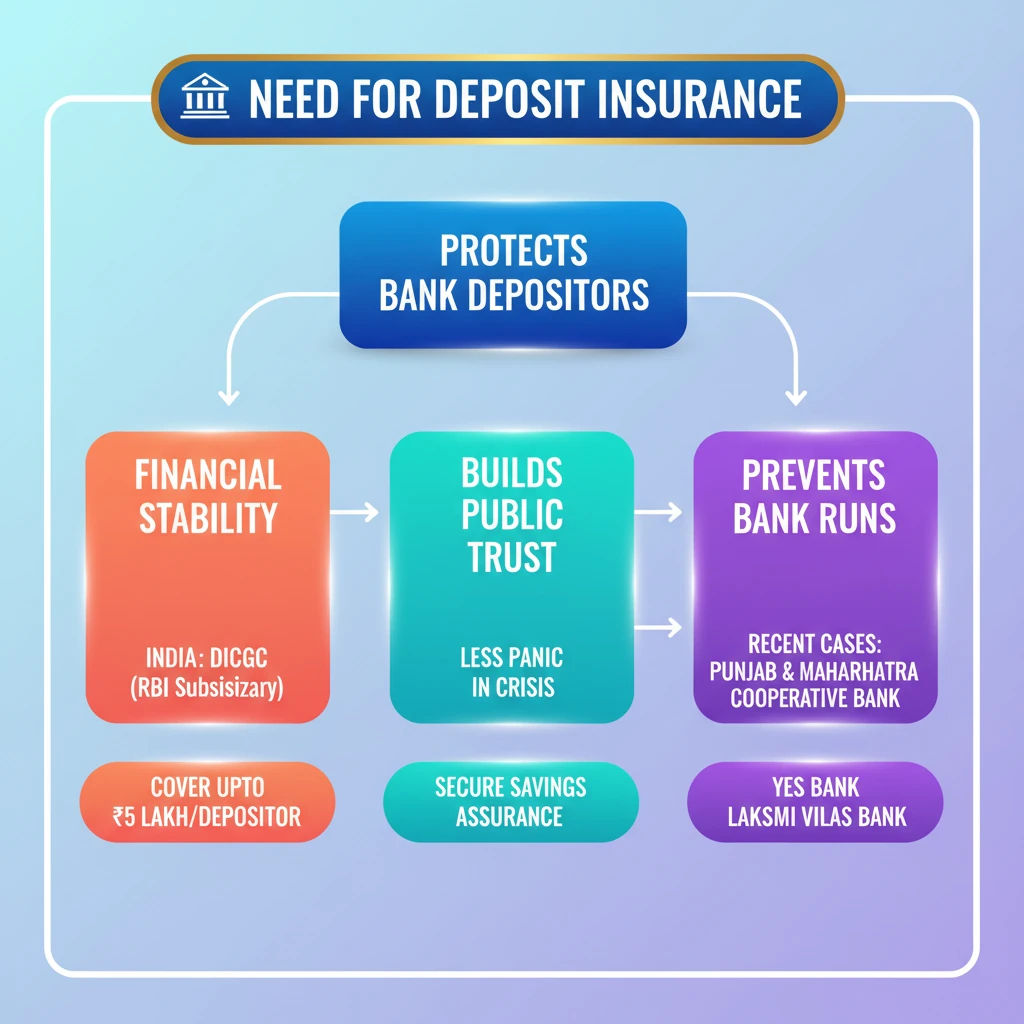

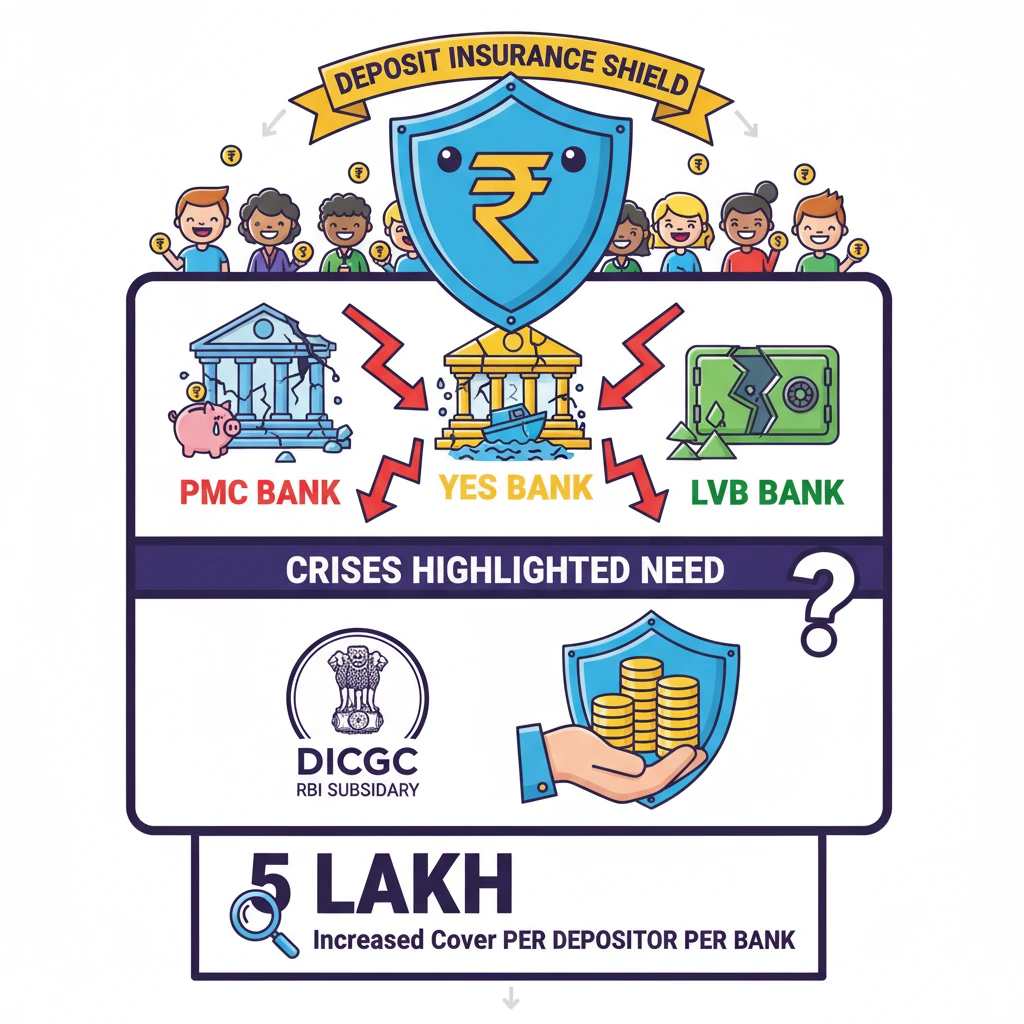

<h4>Understanding the Need for Deposit Insurance</h4><p>The subject of <strong>deposit insurance</strong> gained significant attention following a series of incidents where depositors faced challenges in accessing their funds. These events highlighted the critical importance of a robust safety net for bank customers.</p><p>Recent cases involving prominent financial institutions underscored the vulnerability of depositors. When banks faced distress, customers experienced difficulties in immediately withdrawing their savings, leading to widespread concern and a potential erosion of trust in the banking system.</p><div class='key-point-box'><p>The primary 'need' for <strong>deposit insurance</strong> stems from the imperative to protect small depositors and maintain public confidence in the stability and reliability of the financial sector.</p></div><h4>Impact of Recent Banking Crises</h4><p>Several high-profile banking crises brought the issue of depositor protection into sharp focus. These incidents demonstrated how systemic issues or mismanagement within banks could directly impact the financial well-being of ordinary citizens.</p><ul><li>The collapse of <strong>Punjab & Maharashtra Co-operative (PMC) Bank</strong> left thousands of depositors unable to access their money due to financial irregularities.</li><li>A moratorium was imposed on <strong>Yes Bank</strong>, a major private sector lender, restricting withdrawals and causing panic among its customer base.</li><li><strong>Lakshmi Vilas Bank</strong> also faced severe financial stress, eventually leading to its merger, which again raised questions about depositor safety.</li></ul><div class='exam-tip-box'><p>These cases are crucial for understanding the practical implications of banking regulations and the role of institutions like <strong>DICGC</strong> for <strong>UPSC GS Paper III (Economy)</strong>. Analyzing these events helps in comprehending financial stability measures.</p></div>

💡 Key Takeaways

- •Deposit insurance protects bank depositors from losses if a bank fails.

- •Recent crises (PMC, Yes, LVB) underscored the critical need for robust depositor protection.

- •In India, DICGC provides deposit insurance, a subsidiary of the RBI.

- •The insurance cover was recently increased to ₹5 lakh per depositor per bank.

- •Strong deposit insurance builds public trust and prevents bank runs, ensuring financial stability.

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•Deposit Insurance and Credit Guarantee Corporation (DICGC) website

•The Economic Survey of India

•Press Information Bureau (PIB) releases

•Reputable financial news outlets (e.g., The Hindu, Livemint)