NPS vs. UPS: Features, Lump Sum Payments & Minimum Pension - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

NPS vs. UPS: Features, Lump Sum Payments & Minimum Pension

Medium⏱️ 8 min read

economy

📖 Introduction

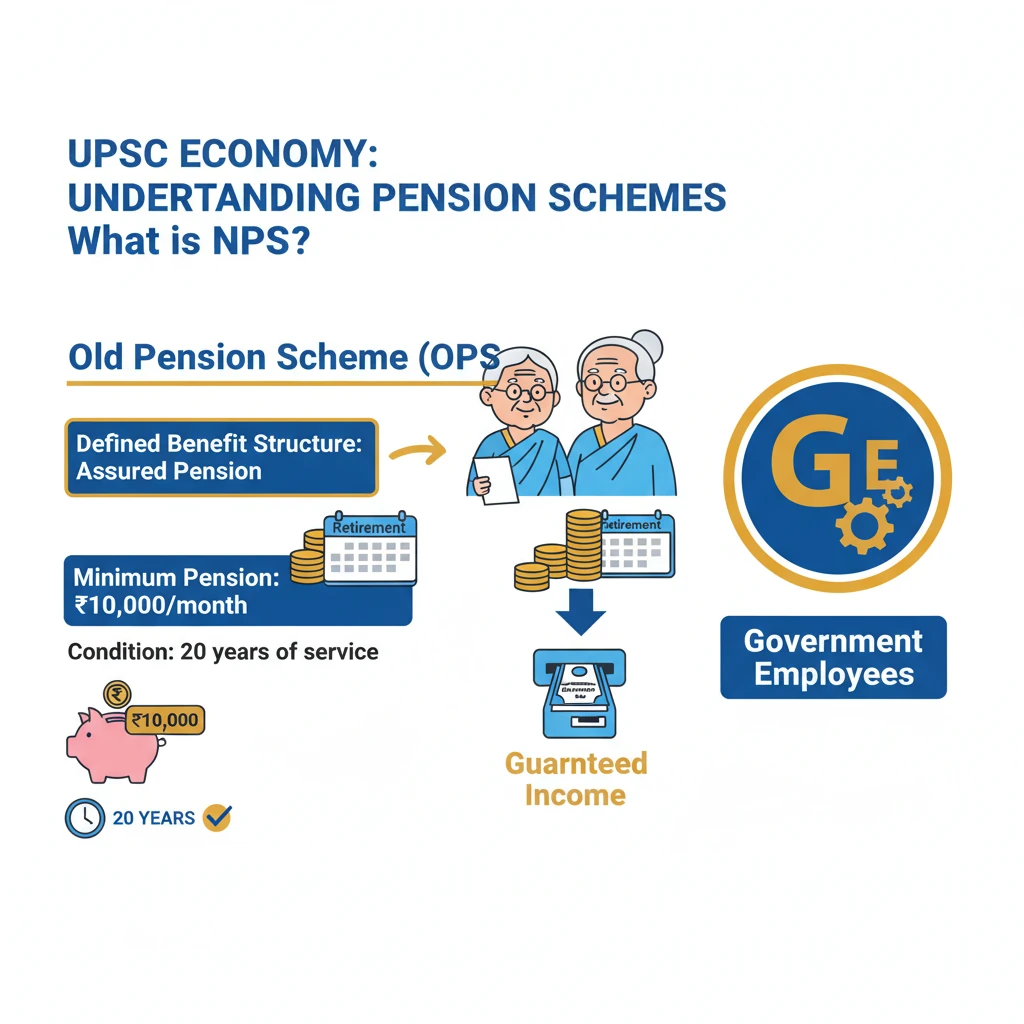

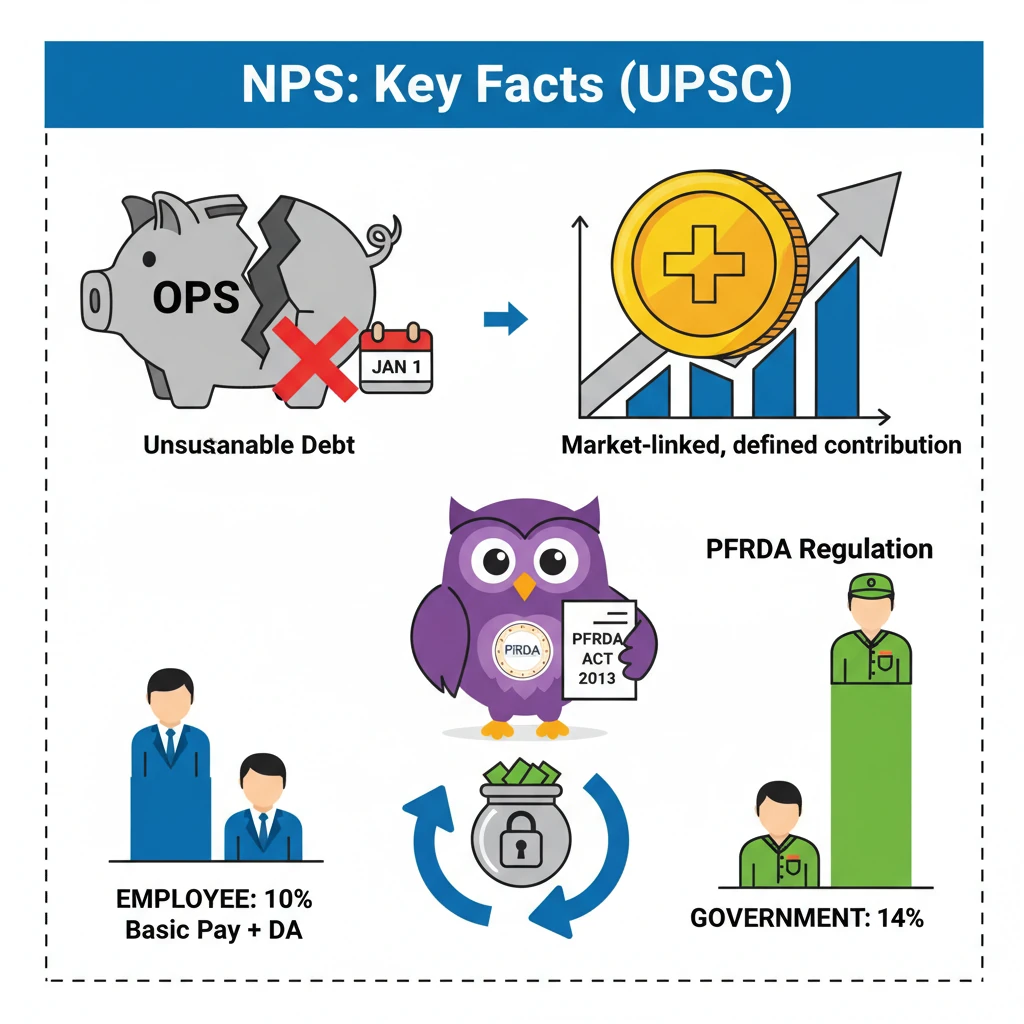

<h4>Understanding the Old Pension Scheme (OPS)</h4><p>The <strong>Old Pension Scheme (OPS)</strong> was a traditional pension system that offered assured benefits to government employees upon retirement. It was characterized by a defined benefit structure, meaning the pension amount was predetermined and guaranteed.</p><div class='info-box'><p>Under the <strong>OPS</strong>, the minimum pension offered per month was <strong>Rs 10,000</strong> at the time of retirement, provided an employee had completed a <strong>10-year minimum service</strong>. Prior to this, the minimum amount was <strong>Rs 9,000</strong> after the same service period.</p></div><p>Another feature of <strong>OPS</strong> was the provision for <strong>lump sum payments</strong>. Employees could commute up to <strong>40%</strong> of their pension into a lump sum, which would, however, reduce their subsequent monthly pension amount.</p><h4>Introduction to the National Pension System (NPS)</h4><p>The <strong>National Pension System (NPS)</strong> is a <strong>market-linked contribution scheme</strong> introduced by the Central Government. Its primary objective is to help individuals secure a regular income in the form of a pension to meet their retirement needs.</p><p>The <strong>NPS</strong> officially replaced the <strong>Old Pension Scheme (OPS)</strong> on <strong>1st January, 2004</strong>. This reform was part of the Central Government's broader efforts to modernize India's pension policies and ensure fiscal sustainability.</p><div class='info-box'><p>The <strong>Pension Fund Regulatory and Development Authority (PFRDA)</strong> is the regulatory body responsible for administering and overseeing the <strong>NPS</strong>. Its powers and functions are defined under the <strong>PFRDA Act, 2013</strong>.</p></div><h4>Need for the National Pension System (NPS)</h4><p>The transition to <strong>NPS</strong> was necessitated by a fundamental problem inherent in the <strong>Old Pension Scheme (OPS)</strong>. The <strong>OPS</strong> was an <strong>unfunded scheme</strong>, meaning there was no dedicated corpus or fund specifically earmarked for pension payments.</p><p>Over time, this lack of a dedicated fund led to a significant increase in the government's pension liability. This escalating liability began to reach fiscally unsustainable levels, posing a substantial burden on public finances.</p><div class='info-box'><p>The pension liabilities of the Central Government witnessed a dramatic increase, jumping from <strong>Rs 3,272 crore</strong> in <strong>1990-91</strong> to a staggering <strong>Rs 1,90,886 crore</strong> in <strong>2020-21</strong>, highlighting the urgent need for reform.</p></div><h4>Working Mechanism of NPS</h4><p>The <strong>National Pension System (NPS)</strong> fundamentally differs from the <strong>Old Pension Scheme (OPS)</strong> in two critical aspects. These differences address the core issues that made <strong>OPS</strong> unsustainable.</p><div class='key-point-box'><ul><li><strong>No Assured Pension:</strong> Unlike <strong>OPS</strong>, <strong>NPS</strong> does away with an assured or defined pension. The final pension amount depends on the market performance of the invested contributions.</li><li><strong>Funded by Contributions:</strong> <strong>NPS</strong> is a <strong>defined contribution scheme</strong>. It is funded by contributions from both the employee and the government, creating a dedicated corpus for retirement.</li></ul></div><p>Under the <strong>NPS</strong>, the employee's contribution is a defined percentage of their basic pay and dearness allowance. The government also makes a matching contribution to the employee's pension account.</p><div class='info-box'><p>The defined contribution structure typically involves <strong>10%</strong> of the <strong>basic pay and dearness allowance</strong> contributed by the employee. The government's contribution is higher, at <strong>14%</strong> of the employee's basic pay and dearness allowance.</p></div><div class='exam-tip-box'><p>Understanding the transition from <strong>OPS to NPS</strong> and its fiscal implications is crucial for <strong>UPSC Mains GS Paper 3 (Economy)</strong>. Focus on the reasons for reform and the structural differences.</p></div>

💡 Key Takeaways

- •NPS is a market-linked, defined contribution pension scheme introduced on January 1, 2004.

- •It replaced the Old Pension Scheme (OPS) to address unsustainable government pension liabilities.

- •NPS is regulated by the Pension Fund Regulatory and Development Authority (PFRDA) under the PFRDA Act, 2013.

- •Employees contribute 10% of basic pay + DA, and the government contributes 14% to NPS.

- •Unlike OPS, NPS does not guarantee a fixed pension; benefits depend on market performance.

- •It aims for fiscal prudence and provides a structured retirement savings avenue.

🧠 Memory Techniques

98% Verified Content