Strengthening of Rupee - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Strengthening of Rupee

Medium⏱️ 7 min read

economy

📖 Introduction

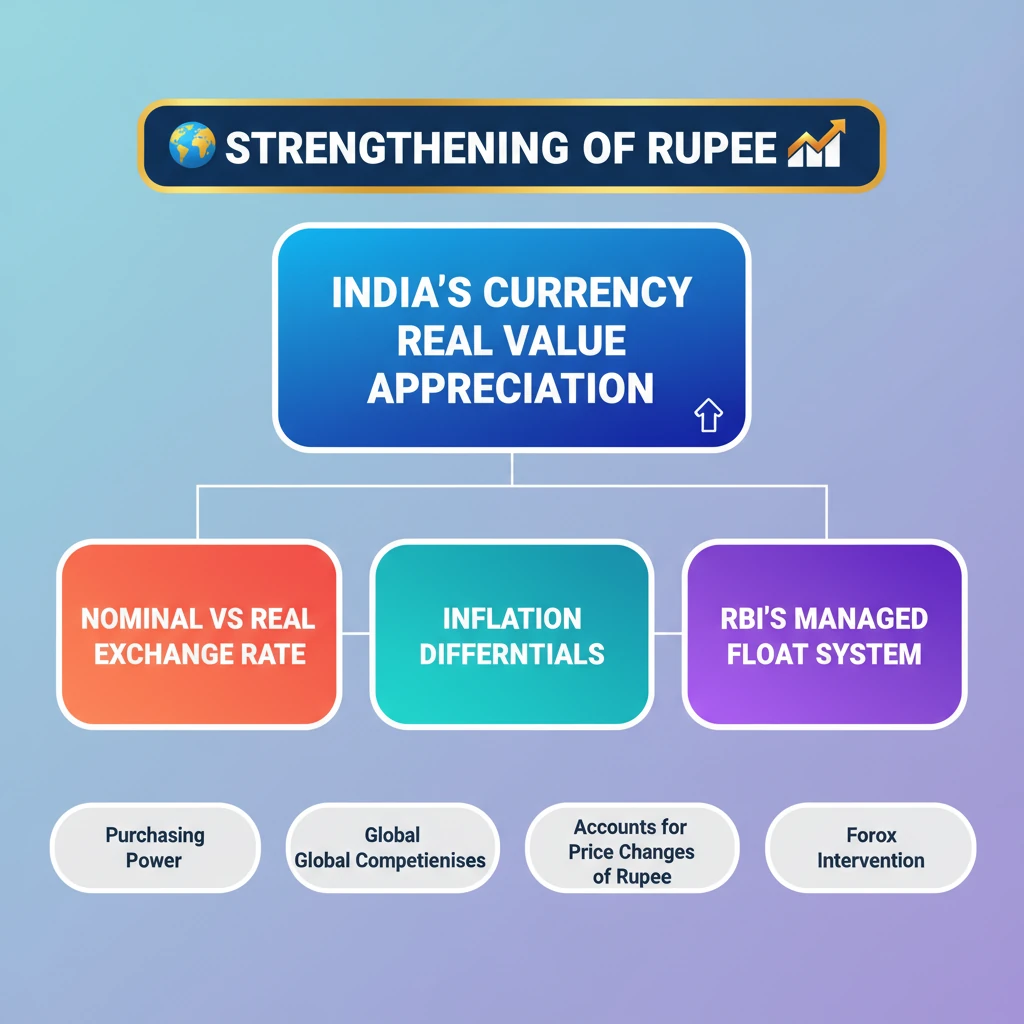

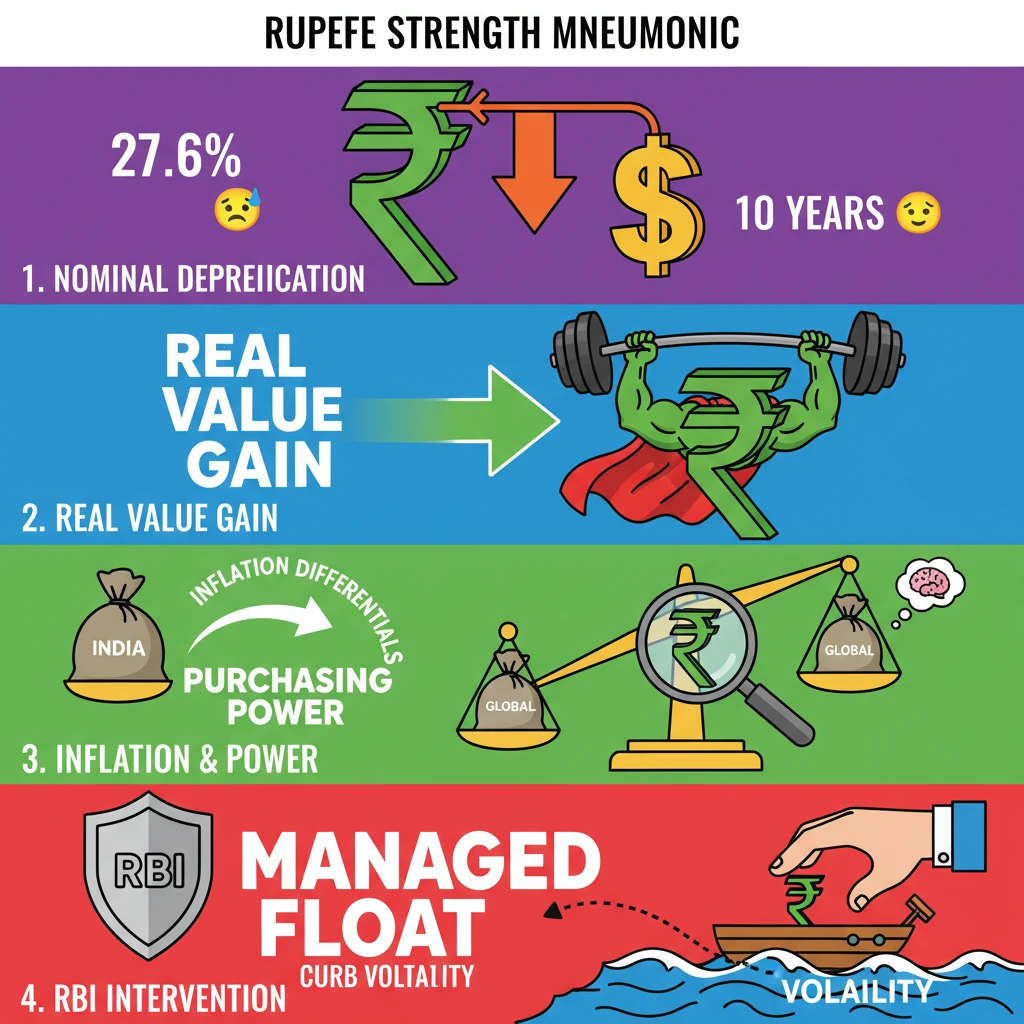

<h4>Understanding Rupee's Exchange Rate Dynamics</h4><p>The <strong>Indian Rupee (INR)</strong> has experienced significant fluctuations in its exchange rate over the past decade. While its value against the <strong>US Dollar (USD)</strong> has seen a nominal decline, its performance against a broader basket of currencies tells a more nuanced story.</p><div class='info-box'><p><strong>Key Data Point:</strong> The <strong>Indian Rupee</strong> depreciated by approximately <strong>27.6%</strong> against the <strong>US Dollar</strong> over the last <strong>10 years</strong>.</p></div><p>This depreciation against the <strong>USD</strong> is a nominal measure. It reflects how many rupees are needed to buy one dollar, indicating a weakening of the rupee in dollar terms.</p><h4>Real Value vs. Nominal Value</h4><p>Despite the nominal depreciation against the <strong>US Dollar</strong>, the <strong>Indian Rupee</strong> has actually gained <strong>real value</strong> when its exchange rate is considered against a broader basket of <strong>major global currencies</strong>.</p><div class='key-point-box'><p><strong>Important Concept:</strong> <strong>Real value</strong> of a currency accounts for inflation differentials between countries. It provides a more accurate picture of a currency's purchasing power and international competitiveness.</p></div><p>This means that while it takes more rupees to buy a dollar, the rupee's purchasing power relative to goods and services in other major economies has improved or remained stable.</p><h4>Factors Influencing Rupee's Strength</h4><p>Several factors contribute to the <strong>Rupee's exchange rate dynamics</strong>, including <strong>inflation differentials</strong>, <strong>interest rate differentials</strong>, <strong>capital flows (FDI, FPI)</strong>, <strong>trade balance</strong>, and <strong>global economic conditions</strong>. The <strong>Reserve Bank of India (RBI)</strong> also plays a crucial role through its interventions in the foreign exchange market.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Understanding the distinction between <strong>nominal</strong> and <strong>real exchange rates</strong> is critical for analyzing India's economic competitiveness and balance of payments. Questions often test the impact of these dynamics on exports, imports, and inflation.</p></div>

💡 Key Takeaways

- •Indian Rupee nominally depreciated against USD by ~27.6% over 10 years.

- •Despite nominal depreciation against USD, Rupee gained real value against major global currencies.

- •Real value accounts for inflation differentials, offering a better measure of purchasing power and competitiveness.

- •India operates a managed float exchange rate system, with RBI intervening to curb volatility.

- •Rupee's value impacts trade, inflation, foreign debt, and capital flows, making it a key macroeconomic indicator.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Reserve Bank of India (RBI) publications on exchange rate management

•Economic Survey of India