Financial Sector Reforms - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

Financial Sector Reforms

Medium⏱️ 7 min read

economy

📖 Introduction

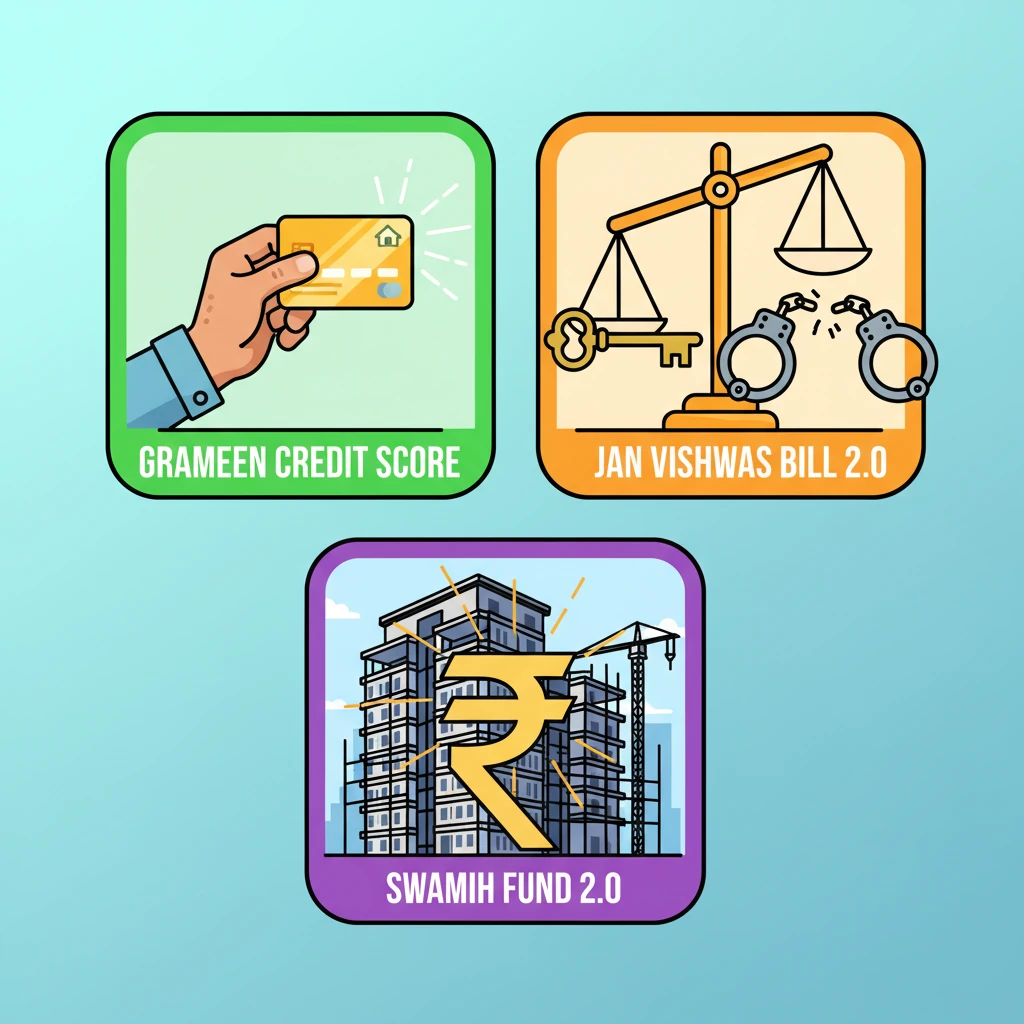

<h4>Understanding Financial Sector Reforms</h4><p><strong>Financial sector reforms</strong> are crucial for enhancing the efficiency, stability, and inclusivity of a nation's financial system. In India, these reforms aim to address existing challenges and foster a more robust economic environment.</p><div class='key-point-box'><p>The primary goal of <strong>financial sector reforms</strong> is to streamline operations, expand access to credit, reduce regulatory burdens, and support key economic sectors like housing and rural development.</p></div><h4>Grameen Credit Score: Empowering Rural Borrowers</h4><p>The <strong>Grameen Credit Score</strong> is an innovative framework designed to improve the creditworthiness assessment of individuals in rural areas. It specifically targets members of <strong>Self-Help Groups (SHGs)</strong> and other rural borrowers.</p><p>This initiative aims to facilitate more efficient access to <strong>formal credit facilities</strong>. By providing a standardized scoring mechanism, it helps financial institutions evaluate risk better and extend loans to a demographic often excluded from mainstream banking.</p><div class='info-box'><p><strong>Purpose:</strong> To enable <strong>SHG members</strong> and rural borrowers to access formal credit facilities more efficiently.</p><p><strong>Mechanism:</strong> A framework for assessing creditworthiness in rural contexts, bridging the information gap for lenders.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> The <strong>Grameen Credit Score</strong> is relevant for <strong>GS-III</strong> (Economy - Financial Inclusion, Rural Development) and <strong>GS-II</strong> (Social Justice - SHGs, Poverty Alleviation). Focus on its role in deepening financial inclusion.</p></div><h4>Jan Vishwas (Amendment of Provisions) Bill 2023: Easing Business Operations</h4><p>The <strong>Jan Vishwas (Amendment of Provisions) Bill 2023</strong> is a significant legislative reform aimed at promoting trust-based governance and improving the ease of doing business in India. It seeks to rationalize and decriminalize minor offenses across various laws.</p><p>This bill proposes to <strong>decriminalize over 100 legal provisions</strong> across 42 Central Acts. By converting imprisonment penalties into monetary fines, it reduces the burden of compliance and the fear of prosecution for minor infractions.</p><div class='info-box'><p><strong>Key Feature:</strong> Decriminalizes <strong>100+ legal provisions</strong> across <strong>42 Central Acts</strong>.</p><p><strong>Objective:</strong> Easing business operations, reducing regulatory compliance burdens, and promoting trust-based governance.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> This bill is crucial for <strong>GS-II</strong> (Governance, Law) and <strong>GS-III</strong> (Economy - Ease of Doing Business, Investment Climate). Understand its impact on entrepreneurship and the judicial system.</p></div><h4>SWAMIH Fund 2.0: Boosting Affordable Housing</h4><p>The <strong>Special Window for Affordable and Mid-Income Housing (SWAMIH) Fund</strong> is a government-backed initiative designed to provide last-mile funding for stalled affordable and mid-income housing projects. <strong>SWAMIH Fund 2.0</strong> represents a continuation and expansion of this critical support.</p><p>The fund aims to complete a significant number of dwelling units, thereby addressing the issue of delayed projects and providing homes to many aspiring homeowners. It operates as an Alternative Investment Fund (AIF).</p><div class='info-box'><p><strong>Fund Size:</strong> <strong>₹15,000 crore</strong> (for SWAMIH Fund 2.0).</p><p><strong>Target:</strong> To complete an additional <strong>1 lakh more dwelling units</strong>.</p><p><strong>Contributors:</strong> Government of India, leading public and private sector banks, financial institutions, and sovereign wealth funds.</p></div><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> Relevant for <strong>GS-III</strong> (Economy - Infrastructure, Housing Sector, Investment) and <strong>GS-I</strong> (Urbanization issues). Focus on its role in stimulating the real estate sector and achieving 'Housing for All'.</p></div>

💡 Key Takeaways

- •<strong>Grameen Credit Score</strong> aims to provide formal credit access to rural borrowers and SHG members.

- •<strong>Jan Vishwas Bill 2.0</strong> decriminalizes over 100 minor offenses to boost ease of doing business and reduce compliance burden.

- •<strong>SWAMIH Fund 2.0</strong> is a ₹15,000 crore fund to complete 1 lakh more stalled affordable and mid-income housing units.

- •These reforms collectively enhance financial inclusion, improve the investment climate, and stabilize critical economic sectors.

- •They reflect India's ongoing commitment to a more efficient, accessible, and trust-based financial and regulatory system.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•Ministry of Finance, Government of India official documents

•The Economic Survey of India

•RBI Annual Reports and policy statements

•Parliamentary proceedings and legislative documents for Jan Vishwas Bill 2.0