What are the Government Schemes Related to Microfinance? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are the Government Schemes Related to Microfinance?

Medium⏱️ 8 min read

economy

📖 Introduction

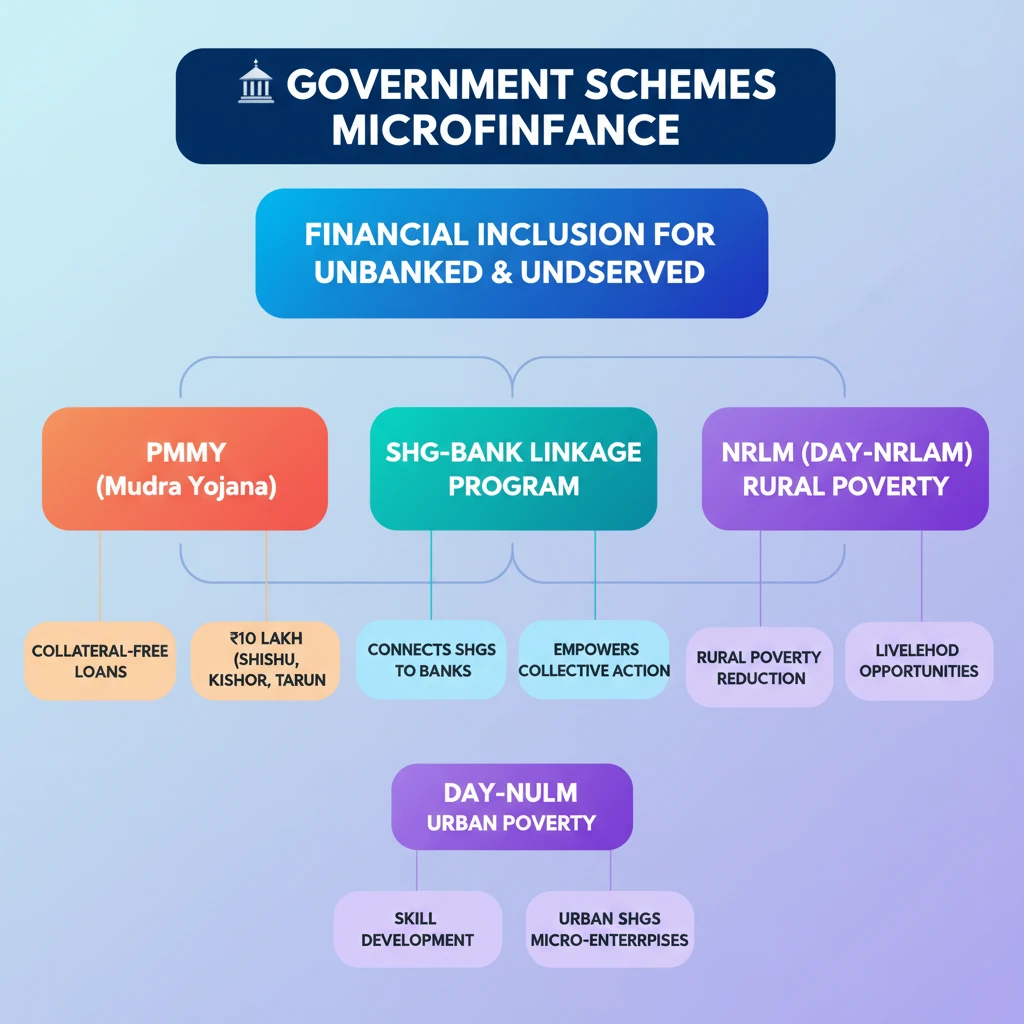

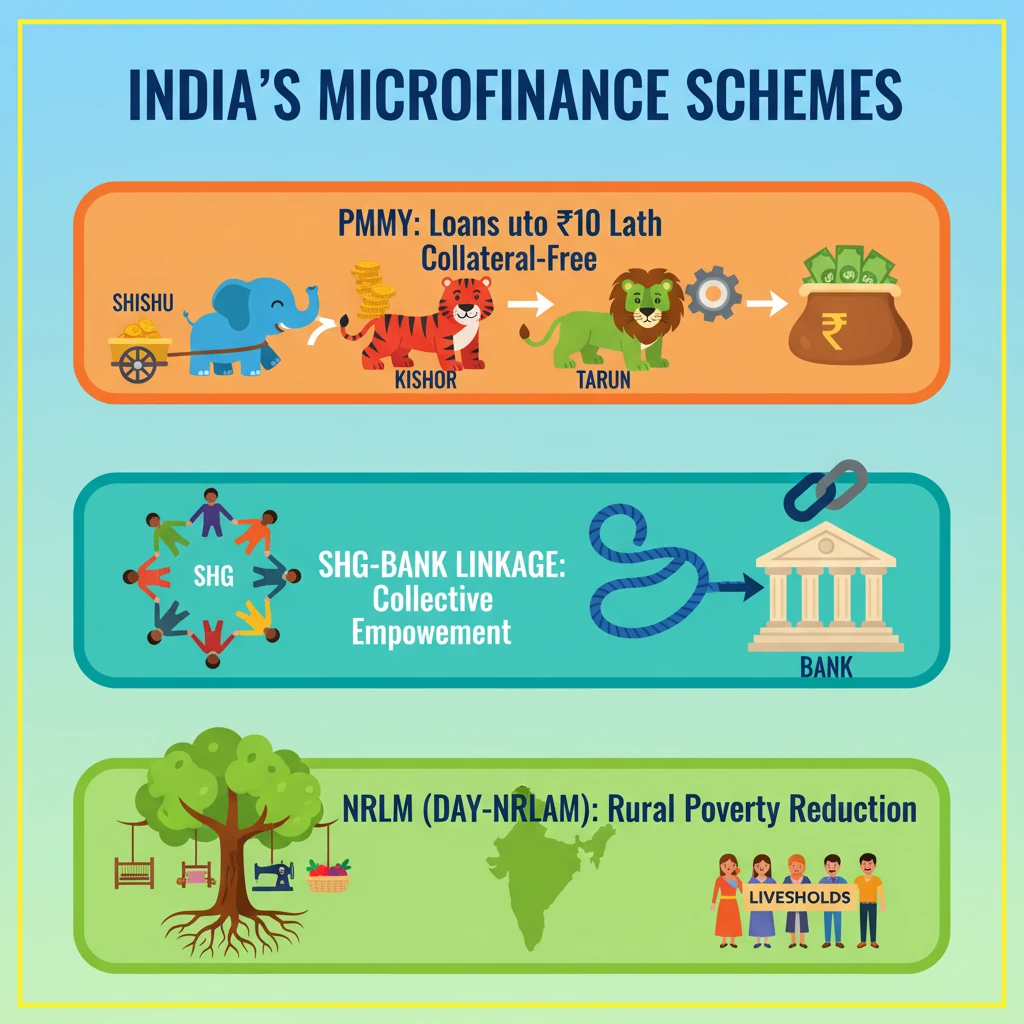

<h4>Introduction to Government Microfinance Schemes</h4><p>The Indian government has launched various initiatives to promote <strong>microfinance</strong>, recognizing its critical role in <strong>financial inclusion</strong> and <strong>poverty alleviation</strong>. These schemes aim to provide accessible credit to the unbanked and underserved populations, particularly in rural and semi-urban areas.</p><p>Microfinance facilitates small loans and other financial services to individuals or groups who typically lack access to conventional banking services. It empowers beneficiaries, often women, to start or expand small businesses and improve their livelihoods.</p><div class='key-point-box'><p><strong>Key Objective:</strong> To extend financial services to the poor and low-income households, enabling them to become self-reliant and integrate into the formal economy.</p></div><h4>Pradhan Mantri Mudra Yojana (PMMY)</h4><p>Launched in <strong>2015</strong>, the <strong>Pradhan Mantri Mudra Yojana (PMMY)</strong> provides loans up to <strong>₹10 lakh</strong> to non-corporate, non-farm small/micro enterprises. These loans are extended by commercial banks, RRBs, Small Finance Banks, MFIs, and NBFCs.</p><div class='info-box'><p><strong>Loan Categories under PMMY:</strong></p><ul><li><strong>Shishu:</strong> Loans up to <strong>₹50,000</strong> (for new businesses)</li><li><strong>Kishor:</strong> Loans above <strong>₹50,000</strong> and up to <strong>₹5 lakh</strong></li><li><strong>Tarun:</strong> Loans above <strong>₹5 lakh</strong> and up to <strong>₹10 lakh</strong></li></ul></div><p>The scheme focuses on funding the 'unfunded' and encourages entrepreneurship among the disadvantaged sections of society, including women and Scheduled Castes/Tribes.</p><h4>Self-Help Group (SHG) - Bank Linkage Program (SBLP)</h4><p>The <strong>SHG-Bank Linkage Program (SBLP)</strong>, initiated by <strong>NABARD</strong> in <strong>1992</strong>, is one of the largest microfinance programs globally. It aims to link <strong>Self-Help Groups (SHGs)</strong> with formal financial institutions.</p><p>SHGs are small, informal groups, predominantly of women, who pool their savings and lend to each other. Once mature, these groups become eligible for credit from banks, leveraging their collective guarantee for loans.</p><div class='info-box'><p><strong>Mechanism:</strong> SHGs act as intermediaries between banks and their members, reducing transaction costs for both, and ensuring better repayment rates due to peer pressure and local knowledge.</p></div><h4>National Rural Livelihoods Mission (NRLM) / Aajeevika</h4><p>The <strong>National Rural Livelihoods Mission (NRLM)</strong>, now known as <strong>Aajeevika - Deendayal Antyodaya Yojana-NRLM (DAY-NRLM)</strong>, was launched in <strong>2011</strong>. It aims to reduce poverty by enabling poor households to access gainful self-employment and skilled wage employment opportunities.</p><p>NRLM promotes institution building of the poor, primarily through <strong>SHGs</strong>, and provides financial support, capacity building, and access to credit and markets. It works towards universal financial inclusion for rural poor households.</p><div class='exam-tip-box'><p><strong>UPSC Insight:</strong> NRLM is crucial for understanding rural development and women's empowerment. Questions often link it to <strong>SHG functionality</strong> and its impact on <strong>poverty reduction</strong>.</p></div><h4>Deen Dayal Upadhyaya Antyodaya Yojana (DAY-NULM)</h4><p>The <strong>Deen Dayal Upadhyaya Antyodaya Yojana (DAY-NULM)</strong> focuses on alleviating urban poverty. Launched in <strong>2013</strong>, it aims to uplift the urban poor by enhancing their livelihood opportunities through skill development and self-employment.</p><p>DAY-NULM supports the formation of <strong>Self-Help Groups (SHGs)</strong> among the urban poor and provides them with financial assistance for setting up micro-enterprises. It also includes components for shelter for the urban homeless and vendor support.</p><div class='info-box'><p><strong>Key Components:</strong> Social Mobilization and Institution Development (SM&ID), Capacity Building and Training (CBT), Employment through Skill Training and Placement (EST&P), Self-Employment Programme (SEP), Support to Urban Street Vendors (SUSV), Scheme for Homeless (SUH).</p></div><h4>Credit Guarantee Fund for Micro and Small Enterprises (CGTMSE)</h4><p>The <strong>Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)</strong> was jointly set up by the <strong>Ministry of MSME</strong> and <strong>SIDBI</strong> in <strong>2000</strong>. Its primary objective is to make collateral-free credit available to the <strong>Micro and Small Enterprise (MSE) sector</strong>.</p><p>This scheme provides a guarantee cover to banks and financial institutions for collateral-free loans extended to eligible MSEs. It mitigates the risk for lenders, thereby encouraging them to lend more to this crucial sector.</p><div class='key-point-box'><p><strong>Benefit:</strong> CGTMSE eliminates the need for collateral or third-party guarantees, which is often a major hurdle for small entrepreneurs seeking finance.</p></div>

💡 Key Takeaways

- •Government microfinance schemes target financial inclusion for the unbanked and underserved.

- •<strong>PMMY</strong> provides collateral-free loans up to ₹10 lakh for micro-enterprises (Shishu, Kishor, Tarun).

- •<strong>SHG-Bank Linkage Program</strong> connects Self-Help Groups with formal banks, empowering collective action.

- •<strong>NRLM (DAY-NRLM)</strong> focuses on rural poverty reduction through SHGs and livelihood opportunities.

- •<strong>DAY-NULM</strong> addresses urban poverty via skill development and micro-enterprise support for urban SHGs.

- •<strong>CGTMSE</strong> offers credit guarantee cover to banks for collateral-free loans to Micro and Small Enterprises (MSEs).

🧠 Memory Techniques

98% Verified Content

📚 Reference Sources

•NABARD (SHG-Bank Linkage Program, NRLM information)

•Ministry of Rural Development, Government of India (NRLM details)

•Ministry of Housing and Urban Affairs, Government of India (DAY-NULM details)

•Reserve Bank of India (RBI) publications on financial inclusion and microfinance