What are the Key Highlights of the FATF Mutual Evaluation Report on India? - Economy | UPSC Learning

Topics

0 topics • 0 completed

🔍

No topics match your search

What are the Key Highlights of the FATF Mutual Evaluation Report on India?

Medium⏱️ 7 min read

economy

📖 Introduction

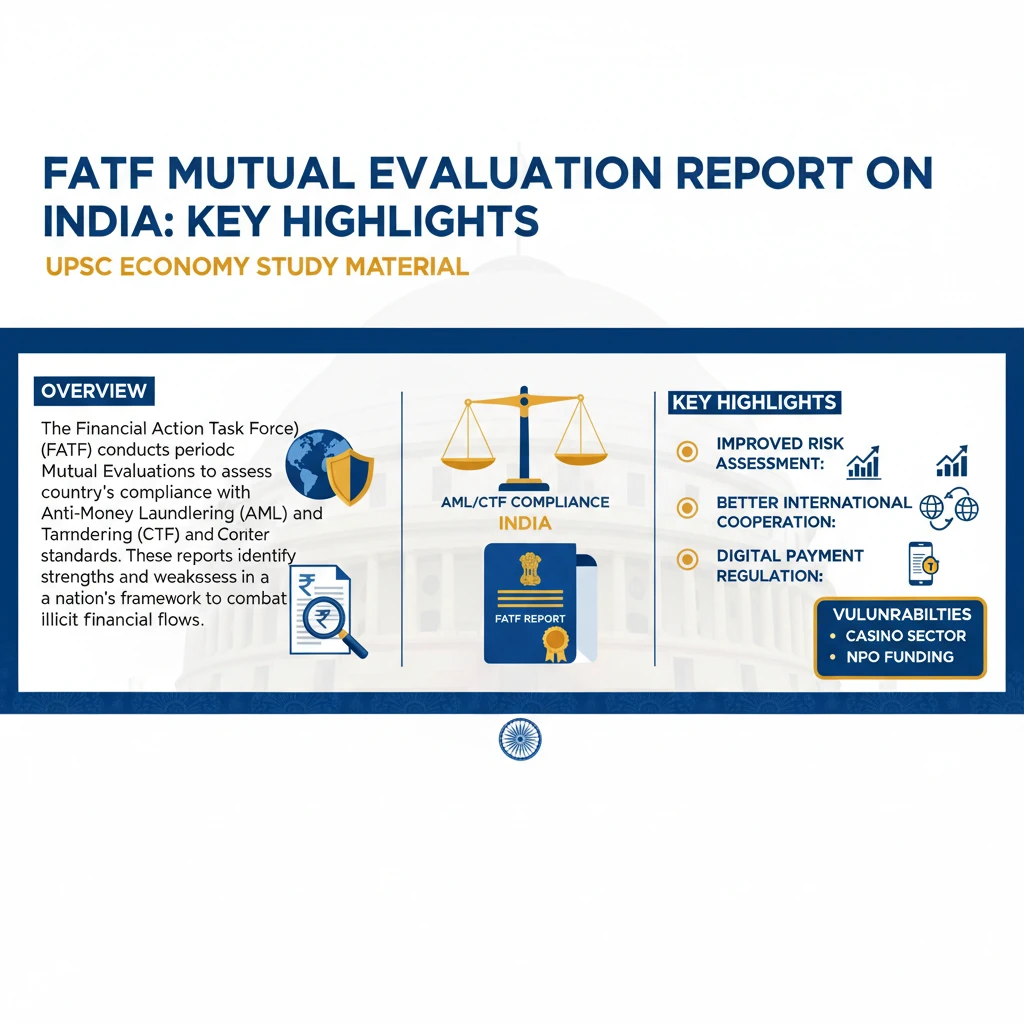

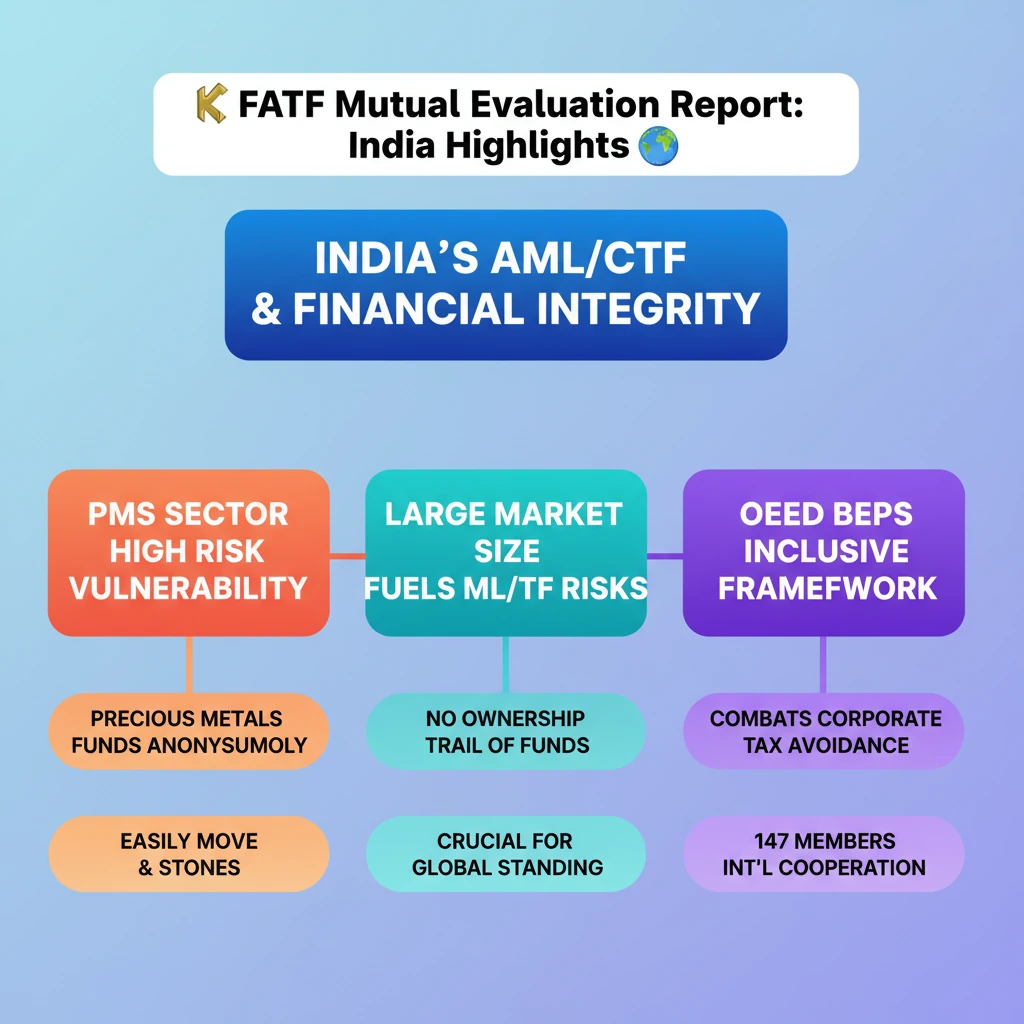

<h4>Overview of FATF Mutual Evaluation on India</h4><p>The <strong>Financial Action Task Force (FATF)</strong> conducts periodic <strong>Mutual Evaluations</strong> to assess a country's compliance with <strong>Anti-Money Laundering (AML)</strong> and <strong>Counter-Terrorist Financing (CTF)</strong> standards.</p><p>These reports identify strengths and weaknesses in a nation's framework to combat illicit financial flows and protect the integrity of the global financial system.</p><h4>Vulnerability of Precious Metals and Stones (PMS) Sector</h4><p>One of the key highlights from the <strong>FATF Mutual Evaluation Report on India</strong> points to the significant vulnerability of the <strong>Precious Metals and Stones (PMS)</strong> sector.</p><div class='info-box'><p><strong>Precious Metals and Stones (PMS)</strong> include items like gold, silver, diamonds, and other valuable gemstones. These assets are highly liquid and can be easily transferred across borders.</p></div><p>The report notes that <strong>PMS</strong> can be exploited to move large amounts of funds without leaving a clear <strong>ownership trail</strong>, making them attractive for illicit activities.</p><div class='key-point-box'><p>India's substantial <strong>PMS market size</strong> significantly contributes to its overall vulnerability to <strong>money laundering</strong> and <strong>terrorist financing</strong> risks, necessitating robust regulatory oversight.</p></div><div class='exam-tip-box'><p>Understanding the specific vulnerabilities identified by <strong>FATF</strong> is crucial for <strong>UPSC Mains GS-III (Internal Security)</strong>, especially regarding financial crimes and their impact on national security and economic stability.</p></div><h4>Base Erosion and Profit Shifting (BEPS) Initiative</h4><p>Separately, the <strong>Organisation for Economic Co-operation and Development (OECD)</strong> has welcomed the commitment of <strong>147 Members</strong> of the <strong>Inclusive Framework on Base Erosion and Profit Shifting</strong>.</p><p>This initiative aims to combat tax avoidance strategies used by multinational enterprises (MNEs) that exploit gaps and mismatches in tax rules to shift profits to low-tax or no-tax locations.</p><div class='info-box'><p>The <strong>Inclusive Framework on BEPS</strong> is a global collaboration involving numerous countries and jurisdictions working together to implement the <strong>BEPS Package</strong> and address tax challenges arising from the digitalization of the economy.</p></div>

💡 Key Takeaways

- •FATF Mutual Evaluations assess a country's Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) compliance.

- •India's Precious Metals and Stones (PMS) sector is identified as highly vulnerable to money laundering and terrorist financing.

- •The large size of India's PMS market contributes significantly to this vulnerability, as PMS can move funds without an ownership trail.

- •The OECD's Base Erosion and Profit Shifting (BEPS) Inclusive Framework, with 147 members, combats multinational corporate tax avoidance.

- •Strong AML/CTF measures and adherence to international tax cooperation frameworks are crucial for India's financial integrity and international standing.

🧠 Memory Techniques

95% Verified Content

📚 Reference Sources

•FATF Official Website (general information on FATF and Mutual Evaluations)

•OECD Official Website (general information on BEPS)